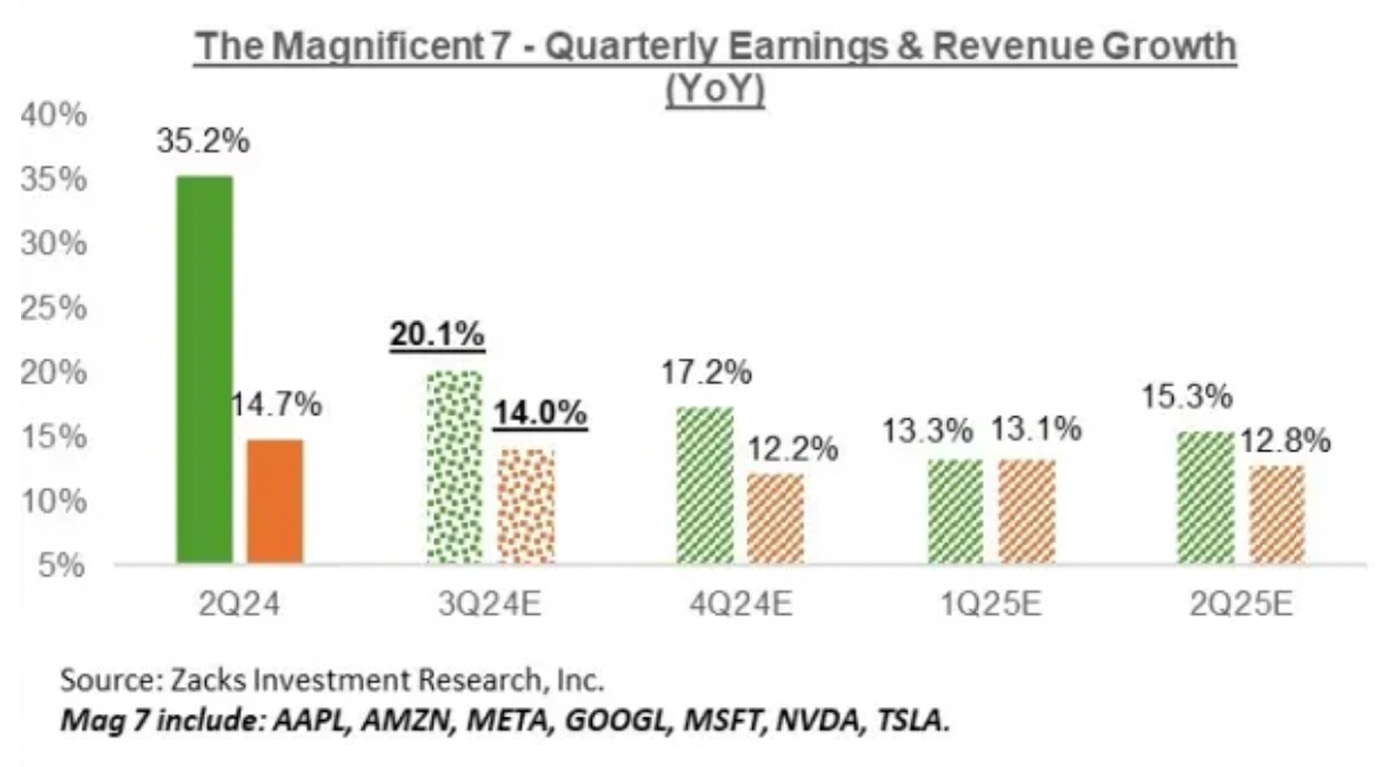

According to Zacks Investment Research, a modest outlook for Q3 2024 earnings growth is being overshadowed by the fifth consecutive quarter of impressive results for the tech sector, especially for the mega-caps known as the “Magnificent Seven.”

Zacks noted the following on Yahoo Finance last week:

- “Looking at Q3 as a whole, combining the actual results from the 258 index members that have reported with estimates for the still-to-come companies, total S&P 500 earnings are currently expected to be up +4.4% from the same period last year on +5.2% higher revenues. …

- “Q3 earnings for the ‘Magnificent 7’ companies are expected to be up +20.1% from the same period last year on +14.0% higher revenues. This would follow the +35.2% earnings growth on +14.7% higher revenues in Q2. Excluding the ‘Mag 7’, Q3 earnings growth for the rest of the index would be up +0.7% (vs. +4.4% otherwise). …

“The market’s current issues with the Mag 7 stocks notwithstanding, there is no escaping the fact that these mega-cap operators are enjoying sustainable profitability growth. These seven companies collectively are on track to bring in $116.1 billion in earnings in Q3 on $488.7 billion in revenues.”

FIGURE 1: FORWARD OUTLOOK FOR MAGNIFICENT SEVEN EARNINGS/REVENUE GROWTH

Source: Zacks Investment Research

Highlights for Q3 earnings to date: S&P 500 companies

FactSet offered the following commentary about the Q3 2024 earnings season in its Nov. 1 earnings season blog update:

“At this stage of the Q3 earnings season, the S&P 500 is continuing to report mixed results. Overall, the index is now reporting higher earnings for Q3 relative to the end of last week and relative to the end of the quarter. On a year-over-year basis, the index is reporting earnings growth for the fifth-straight quarter.

“Overall, 70% of the companies in the S&P 500 have reported actual results for Q3 2024 to date. Of these companies, 75% have reported actual EPS above estimates, which is below the 5-year average of 77% but equal to the 10-year average of 75%. In aggregate, companies are reporting earnings that are 4.6% above estimates, which is below the 5-year average of 8.5% and below the 10-year average of 6.8%. …”

“In terms of revenues, 60% of S&P 500 companies have reported actual revenues above estimates, which is below the 5-year average of 69% and below the 10-year average of 64%. In aggregate, companies are reporting revenues that are 1.1% above the estimates, which is below the 5-year average of 2.0% and below the 10-year average of 1.4%. …”

![]() Related Article: The yield curve’s 15-month lag

Related Article: The yield curve’s 15-month lag

FactSet’s Earnings Insight highlighted the following key metrics for Q3 2024:

- “Earnings Scorecard: For Q3 2024 (with 70% of S&P 500 companies reporting actual results), 75% of S&P 500 companies have reported a positive EPS surprise and 60% of S&P 500 companies have reported a positive revenue surprise.

- “Earnings Growth: For Q3 2024, the blended (year-over-year) earnings growth rate for the S&P 500 is 5.1%. If 5.1% is the actual growth rate for the quarter, it will mark the 5th straight quarter of year-over-year earnings growth for the index.

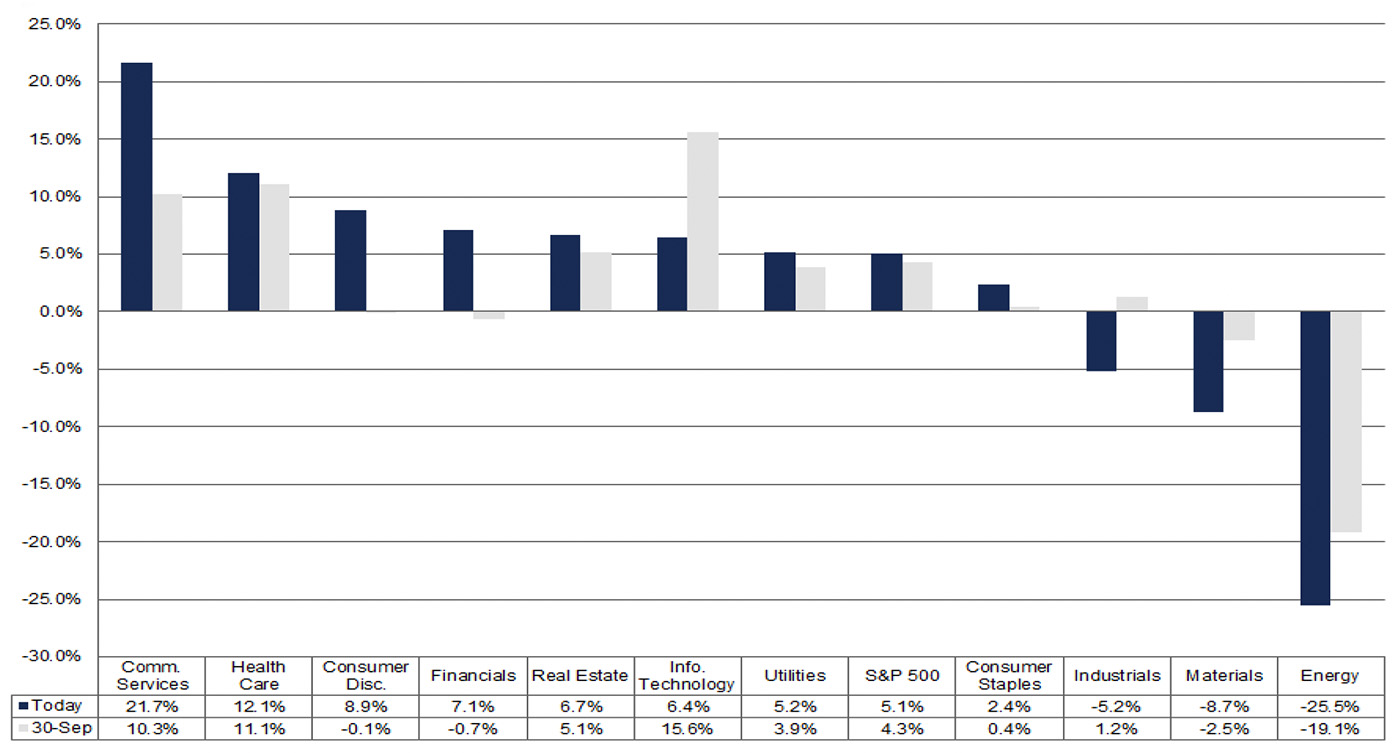

- “Earnings Revisions: On September 30, the estimated (year-over-year) earnings growth rate for the S&P 500 for Q3 2024 was 4.3%. Seven sectors are reporting higher earnings today (compared to September 30) due to positive EPS surprises.

- “Earnings Guidance: For Q4 2024, 37 S&P 500 companies have issued negative EPS guidance and 18 S&P 500 companies have issued positive EPS guidance.

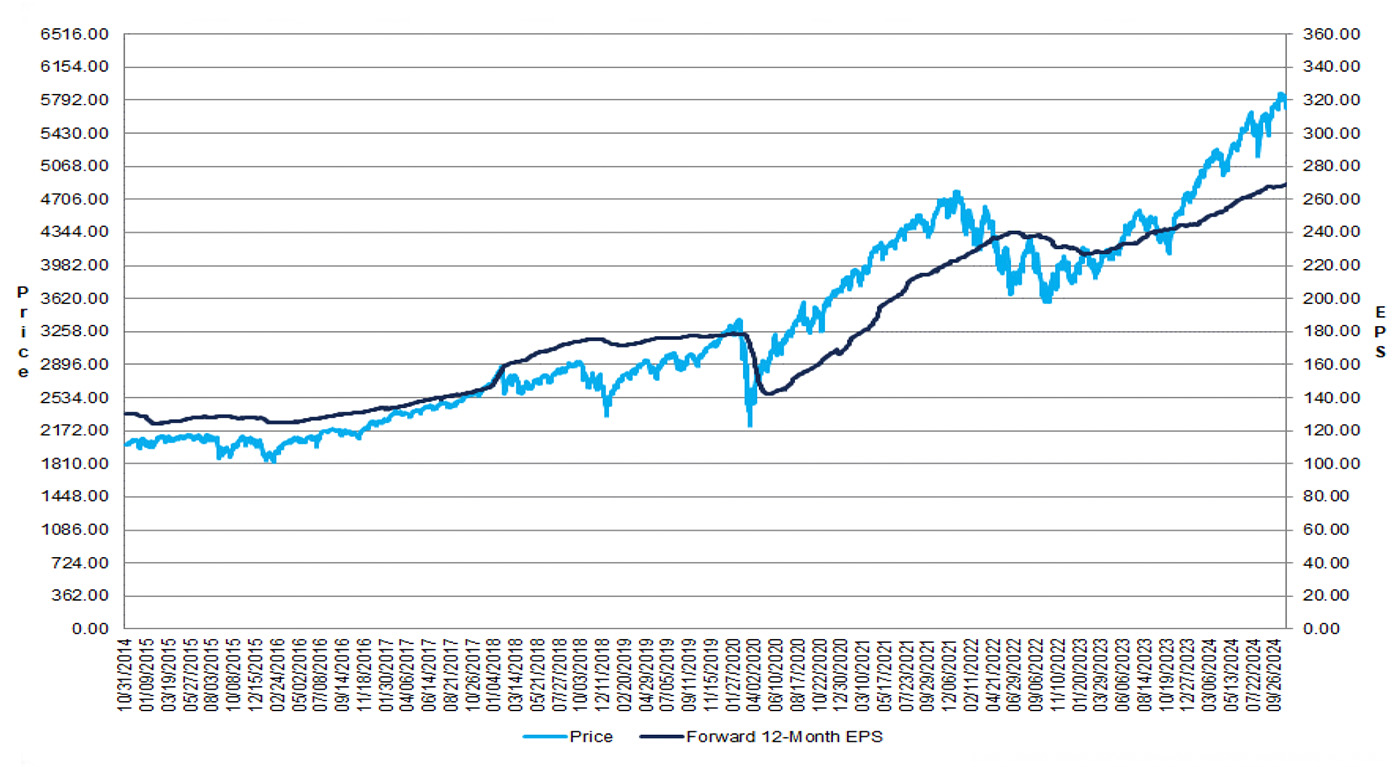

- “Valuation: The forward 12-month P/E ratio for the S&P 500 is 21.3. This P/E ratio is above the 5-year average (19.6) and above the 10-year average (18.1).”

FIGURE 2: S&P 500 CHANGE IN FORWARD 12-MONTH EPS VS. CHANGE IN PRICE—10 YRS.

Source: FactSet

FactSet indicates that eight of the 11 S&P 500 sectors are reporting year-over-year earnings growth, led by Communication Services and Health Care. Three sectors are expected to report year-over-year declines in earnings, with the Energy sector seeing the largest drop.

FIGURE 3: S&P 500 EARNINGS GROWTH BY SECTOR (Y/Y)—Q3 2024

Source: FactSet

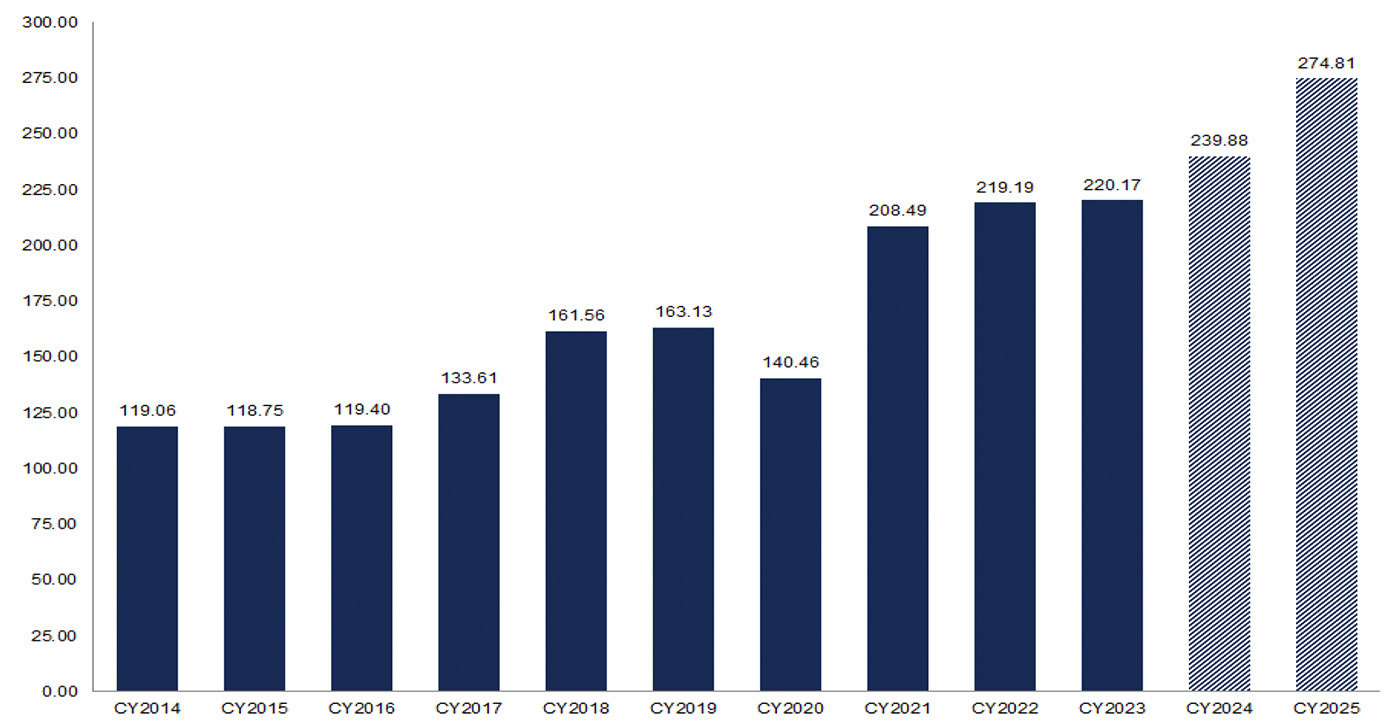

S&P 500 expected to report earnings growth of 9% for CY 2024

FactSet reports the following estimates for earnings and revenue growth through 2024 and into 2025:

“For the third quarter, S&P 500 companies are reporting year-over-year growth in earnings of 5.1% and year-over-year growth in revenues of 5.2%.

“For Q4 2024, analysts are projecting earnings growth of 12.7% and revenue growth of 4.8%.

“For CY 2024, analysts are projecting earnings growth of 9.3% and revenue growth of 5.0%.

“For Q1 2025, analysts are projecting earnings growth of 13.0% and revenue growth of 5.3%.

“For Q2 2025, analysts are projecting earnings growth of 12.2% and revenue growth of 5.5%.

“For CY 2025, analysts are projecting earnings growth of 15.1% and revenue growth of 5.7%.”

FIGURE 4: S&P 500 CALENDAR YEAR BOTTOM-UP EPS ACTUALS AND ESTIMATES

Source: FactSet

RECENT POSTS