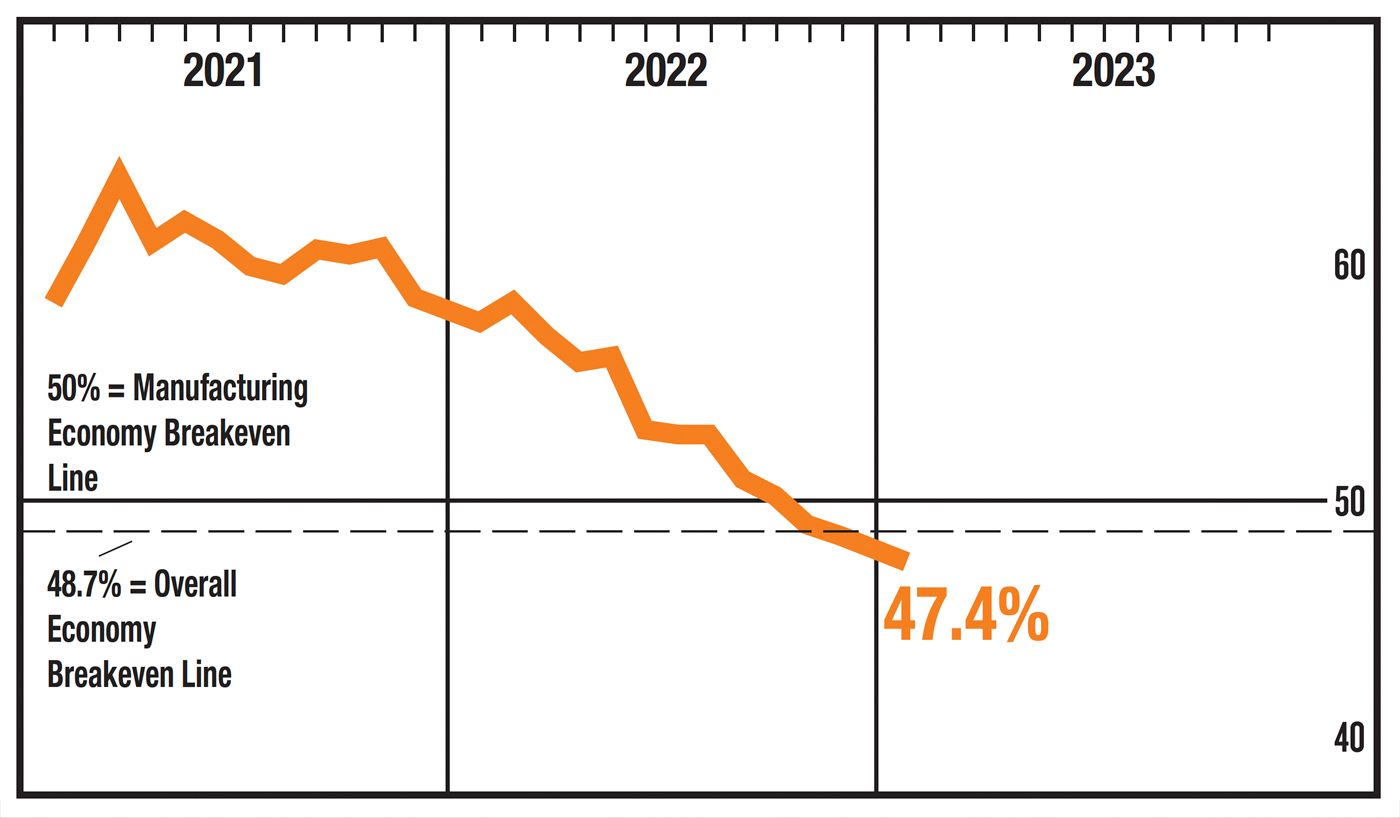

Both sides of the bull and bear argument were reinforced on Feb. 1. The Institute for Supply Management (ISM) manufacturing data continues to point to recession (Figure 1), while the market reaction to the Federal Reserve press conference continued the ramp higher for equities.

FIGURE 1: ISM MANUFACTURING PMI—JANUARY 2023 REPORT

Source: Institute for Supply Management Report on Business

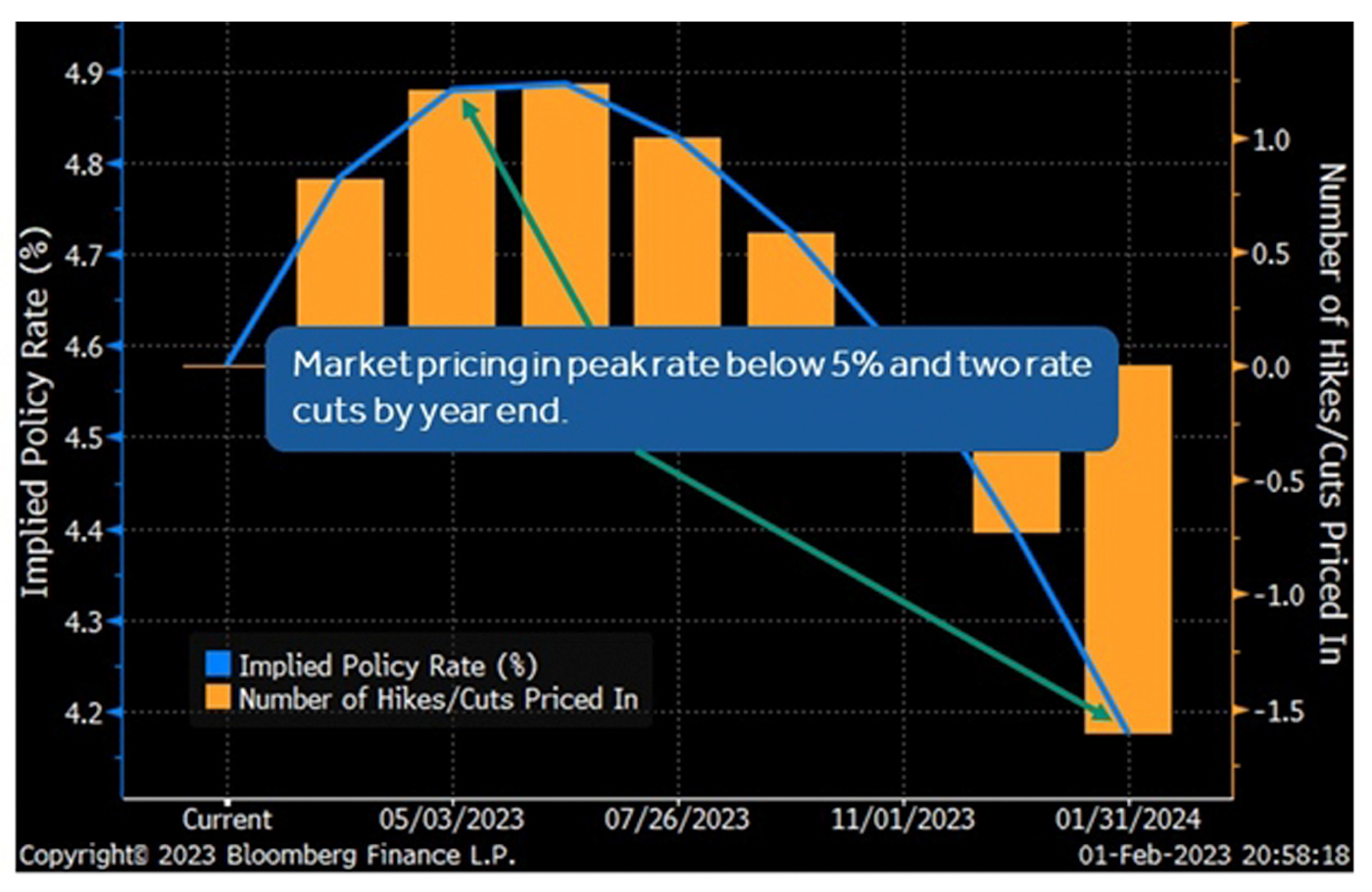

The Fed raised interest rates 25 basis points to 4.5%–4.75%, but the market saw the Fed’s commentary as “dovish” and is now pricing in peak rates below 5% and two cuts by the end of the year (Figure 2).

FIGURE 2: THE MARKET IS PRICING IN ONE MORE HIKE AND TWO CUTS THIS YEAR

Sources: Bloomberg, Canaccord Genuity

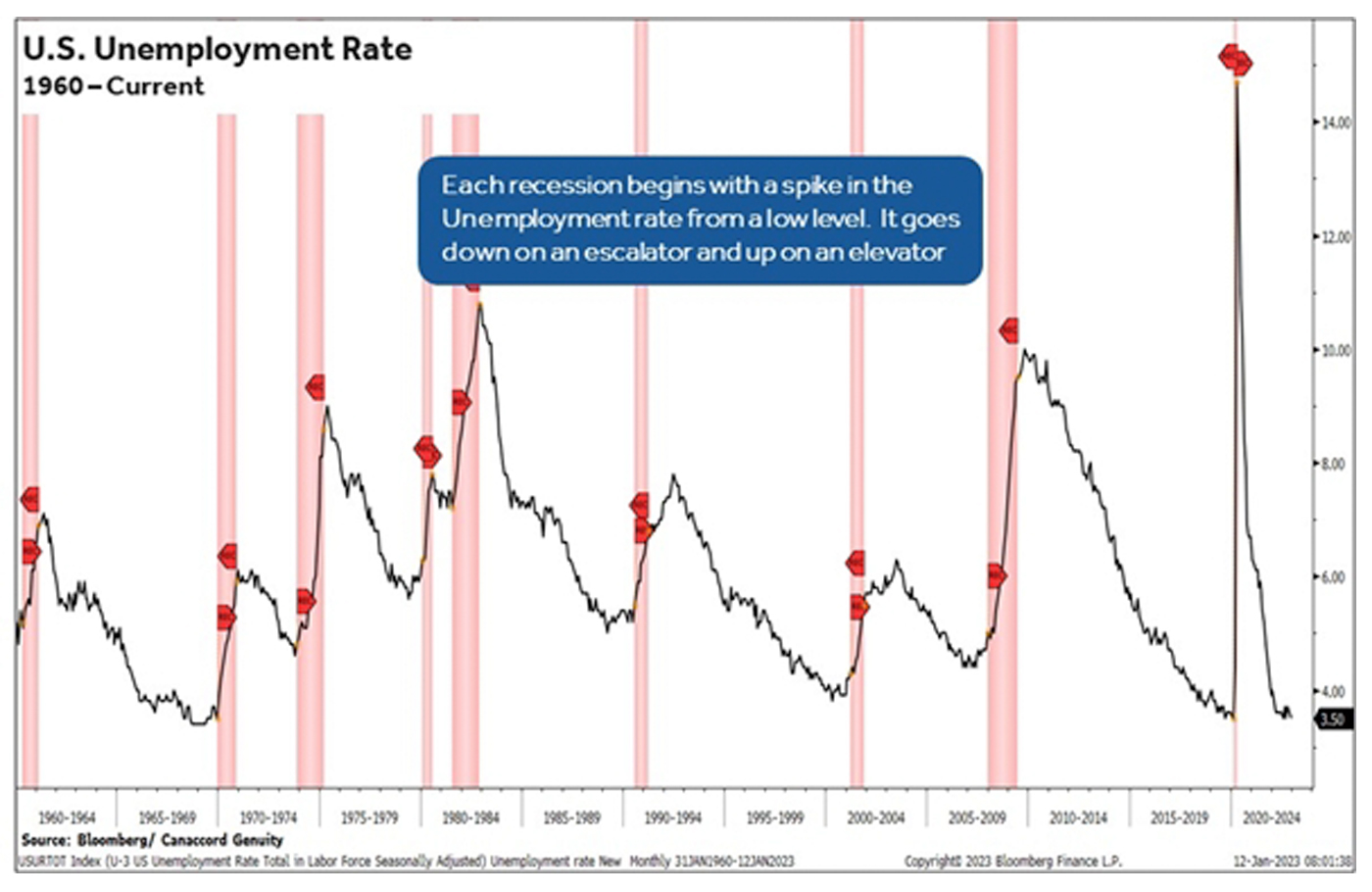

The problem investors have is that both the recession and market arguments are looking for an immediate answer when only more time and evidence will tell. If the economy does enter a recession, we are due to make a new low. So, if that is the measure, how will we know if/when the economy does enter an economic downturn, and when might the market make that low? The answer lies in a spike in the employment data (Figure 3).

FIGURE 3: THE UNEMPLOYMENT RATE IS KEY TO IDENTIFYING A RECESSION

Sources: Bloomberg, Canaccord Genuity

How to detect the start of a recession …

Historically, an excellent guidepost for an economic downturn is the Sahm rule highlighted by the St. Louis Fed. The Sahm rule identifies signals related to the start of a recession when the three-month moving average of the national unemployment rate (U3) rises by 0.50 percentage points or more relative to its low during the previous 12 months. This means that if the unemployment rate over the next three months averages 4.0% (up from 3.5%), then we are in a recession.

… and what it means to the market

Taking this a step further to see market impact, the median duration between the start of a recession to the low in the S&P 500 (SPX) is 23.5 weeks, with the shortest lead time of three weeks in 2020. Before that, it was eight weeks in 1957 and 1980. This means that if the National Bureau of Economic Research (NBER) ultimately says the beginning of the recession is now (unlikely), then the market low should happen anytime over the next six months.

Our base case remains a recession in 2023 and a market low in the first half–followed by a second-half surge that ends with a positive year

It is going to take at least three more months to qualify the start of a recession, which means there should be a lot of volatility associated with the uncertainty. As we have seen in December and January, that volatility can be outsized in both directions. The downside in December was driven by megacaps and information technology, and so is this year’s upside. Despite the ramp in the market this year based on the hopes for a soft landing and cyclically driven value areas, the Industrial, Energy, and Financial sectors have underperformed the market and have given back their relative outperformance since early November.

Both methods work, but the pot roast is better with a slow cooker

There is no question that there has been a broad and powerful move to start the year for equities. But to believe the rally is sustainable we must disprove the prospect of a recession, and that will take more time. I would rather have a quality pot roast dinner that is prepared in a slow cooker than one made in the microwave.

Again, the market has had a very healthy move that has turned around many indicators. But the SPX is already up over 7% this year, optimism is on the rise, and the gains have generated an intermediate-term overbought condition, suggesting now may be a good moment to see how much time is left on the slow cooker.

The opinions expressed in this article are those of the author and do not necessarily represent the views of Proactive Advisor Magazine. These opinions are presented for educational purposes only.

This is an edited version of an article first published by Canaccord Genuity U.S. Equity Research on Feb. 2, 2023.

New this week:

Tony Dwyer is the head of the U.S. Macro Group and chief market strategist at Canaccord Genuity. He also sits on the firm’s U.S. operating committee. Mr. Dwyer joined Canaccord Genuity in 2012 and is known for the practical application of macroeconomic and tactical market indicators. Mr. Dwyer was previously equity strategist and director of research at Collins Stewart and a member of the firm's executive committee. Mr. Dwyer is a frequent guest on many financial news networks. canaccordgenuity.com

Tony Dwyer is the head of the U.S. Macro Group and chief market strategist at Canaccord Genuity. He also sits on the firm’s U.S. operating committee. Mr. Dwyer joined Canaccord Genuity in 2012 and is known for the practical application of macroeconomic and tactical market indicators. Mr. Dwyer was previously equity strategist and director of research at Collins Stewart and a member of the firm's executive committee. Mr. Dwyer is a frequent guest on many financial news networks. canaccordgenuity.com