Adapt and thrive: 8 trends that will impact advisors in 2025 and beyond

Adapt and thrive: 8 trends that will impact advisors in 2025 and beyond

A changing financial environment, shifting client expectations, and new technologies are compelling successful advisors to adapt and innovate continuously. Here are eight notable trends to watch this year.

One could argue that the pace of change in the advisory world is accelerating faster than at any time since the dawn of the internet era. Disruptive uses of artificial intelligence (AI), increasing demand for non-traded alternative investments, and the transfer of trillions of dollars of wealth from baby boomers to their Gen X children and millennial and Gen Z grandchildren will create client acquisition and retention challenges for advisors who aren’t willing to move with the times.

While no one can predict how the economy or the markets will perform in the coming years, certain trends are likely to shape the future of the industry. Many will require advisors to change the way they do business.

1. Expanded tax cuts—and possible strategies to pay for them

It’s too early to tell how President Trump’s attempt to reshape the federal government and deal with nations whose policies he doesn’t agree with will impact the economy and the markets over the long term.

However, with Republicans firmly in charge of all three branches of government, we can expect a flurry of legislative initiatives that could impact many clients, especially wealthier ones.

Congress is highly likely to extend and possibly expand the scope of income and estate tax cuts enacted in the 2017 Tax Cuts and Job Act, with some critics complaining that corporations and wealthier Americans stand to benefit the most. Other ideas being discussed include eliminating taxes on tips, overtime, and Social Security benefits; allowing deductions for auto loan interest for vehicles manufactured in the U.S.; taxing all college scholarships and fellowship income; and increasing the $10,000 state and local tax deduction (SALT).

Deficit hawks in Congress have expressed concerns that these tax cuts have added between $1 trillion to $2 trillion to the national debt and that extending them could increase the federal deficit by as much as $4.6 trillion over the next 10 years.

To replace this lost tax revenue, some pundits have suggested the further “Rothification” of retirement savings vehicles. Ideas range from eliminating pre-tax contributions to employer retirement plans entirely to requiring that all matching contributions for higher-income employees be made as after-tax Roth contributions. Others suggest eliminating the income limits that prevent wealthier Americans from contributing directly to Roth IRAs. This would end the need for the so-called backdoor Roth IRA conversions.

Financial advisors will need to stay current on changes to the tax code and work more closely than ever with their clients’ tax professionals, if that expertise does not reside within their advisory firm.

2. AI will continue to disrupt and transform

Love it or loathe it, AI is here to stay. According to research from Ernst & Young, 99% of executives at financial-services firms are using AI in some capacity, and 77% believe it will transform the industry over the next decade.

More than half said they felt confident about using AI in their organizations, with nearly 90% stating that they believe that the best use of generative AI tools will be to improve the quality of client experiences.

Investors are embracing AI, too. One prognosticator estimates that $6 trillion in assets will be managed by AI platforms by 2027.

Younger investors in particular believe that AI will provide better financial advice than humans. According to a Nationwide Retirement Institute survey, nearly a third of respondents—including 37% of Gen Xers and 43% of millennials—expect that within the next five years AI will deliver better financial advice than investment professionals.

And while financial advisors will need to compete with AI to win the hearts and minds of younger investors, they, too, are embracing AI for their own practices.

And they’re not just using ChatGPT to write blog posts and client letters. A new generation of AI tools will improve back-office efficiency by automating workflows and delivering investment and client insights that can help advisors make better decisions and deliver more personalized client service.

Bob Veres, owner and publisher of Inside Information, believes that AI is particularly useful in documenting client interactions and recommending follow-up actions.

“For example, AI-driven intelligent recap tools can transcribe recorded client meetings and later summarize tasks that were discussed in the meeting and, if desired, assign follow-ups for the advisor or staff members. Other tools can also review notes from past client meetings recorded in their CRM records and synthesize them for use in future meetings,” he says.

Ivan Illan, founder and chief investment officer of Aligne Wealth Advisors Investment Management, is looking forward to the development of AI technologies that streamline the often-cumbersome process of collecting and processing requested data and information from clients.

But the key is making these applications accessible.

“For these data collection applications to be fully embraced by clients, they’ll need user-friendly interfaces that make the process both simple to work with and incorporate AI conversation capabilities that make working with them as comfortable as meeting with a human advisor. My guess is that we’re a good decade away from this,” says Illan.

3. Aging investors will increasingly ask for lifetime income solutions

As more investors are expected to live well into their 90s, they’re concerned that their retirement savings will run out before they pass on. This is driving increased interest in lifetime income solutions, such as annuities.

David Blanchett, managing director and head of retirement research for PGIM DC Solutions, believes this demand will convince many investment advisors to help their clients find appropriate longevity solutions.

“Many clients are concerned that their retirement portfolios may not be enough to provide lifetime income, especially if they anticipate major health-care expenses at some point,” Blanchett says. “To address these concerns, many advisors who were traditionally resistant to discussing annuities with their clients will start doing so. I expect the industry will respond to this interest by rolling out a new generation of fee-based lifetime income annuity options that can address different longevity scenarios at lower costs and with fewer administrative restrictions.”

Demand for longevity solutions is increasing in the 401(k) world as well. Older participants are asking plan sponsors to provide lifetime income solutions in their lineups, and asset managers and annuity companies are eager to get their products into the mix.

The biggest challenge for plan sponsors is the lack of Morningstar-style tools to conduct ERISA-quality due diligence on available lifetime income options.

This may leave plan sponsors with the difficult decision to forego offering retirement-income solutions in their plans and instead encourage participants to take in-service withdrawals from their accounts and work with their own advisors to select appropriate lifetime income options.

Another possibility is that some investment advisors struggling to grow their 401(k) advisory business may leave their comfort zone to become retirement-income experts who can help plan sponsors evaluate and select appropriate longevity options for their plans.

4. TAMPs: Higher usage, more consolidation

While the appetite for annuities may increase, many advisors will continue to build retirement-income solutions that seek a combination of growth-oriented assets and guaranteed income products.

To this point, the use of turnkey asset management platforms (TAMPs) has continued to increase in recent years. According to Cerulli, the TAMP industry more than doubled its assets from 2017 to the end of 2022.

More recent research from 2024 reports that 60% of advisors who outsourced management for at least 20% of their clients’ assets used TAMPs, compared to 44% in 2021. Today, nearly one-third of advisors use a TAMP as their primary outsourcing provider.

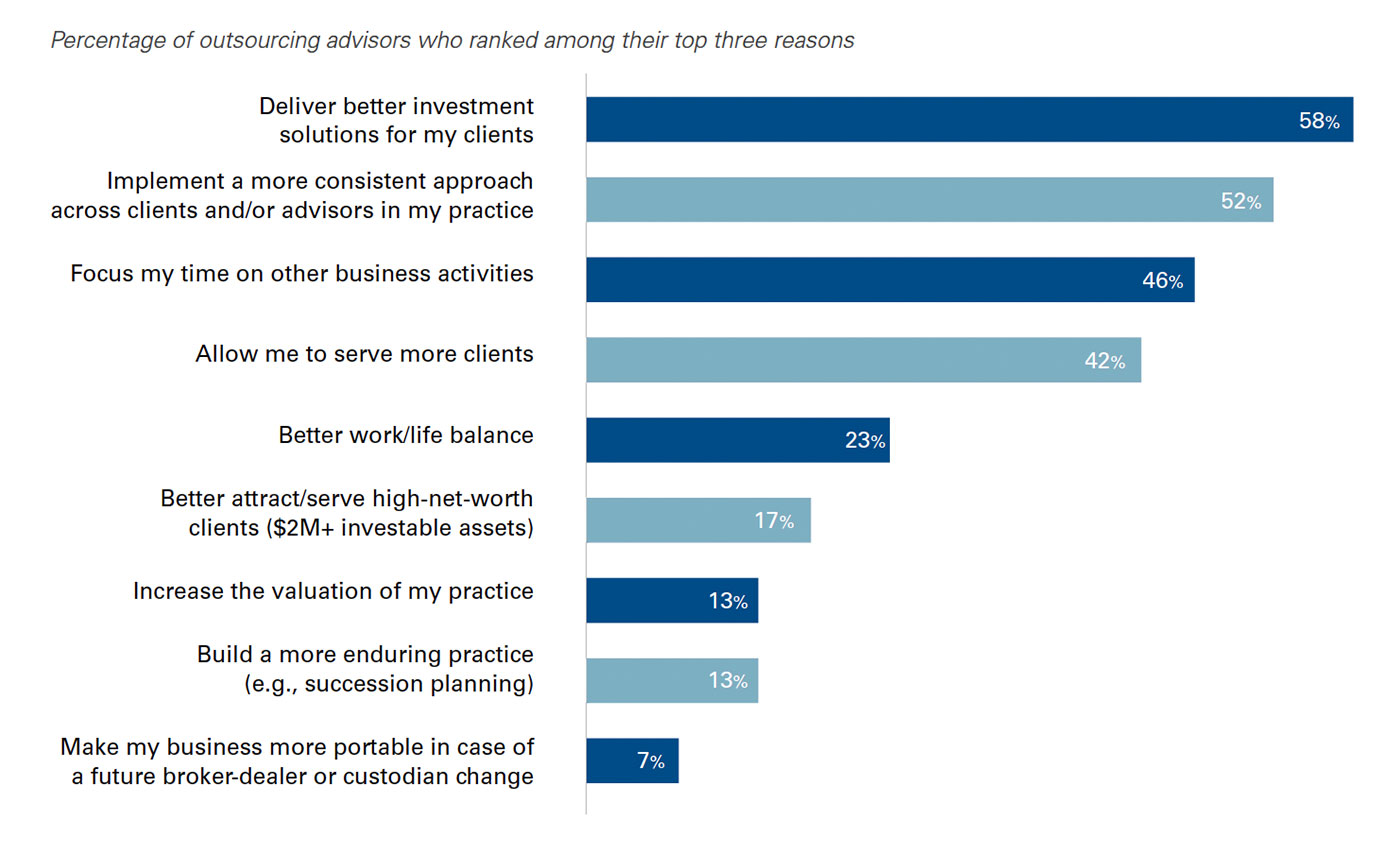

Advisors who outsource save more than nine hours per week, most of which is devoted to building and strengthening client relationships. While saving time is an important benefit of investment outsourcing, it is just one of many reasons advisors choose to do so. According to the 2024 study, 98% of financial advisors surveyed report that they are delivering better investment solutions to their clients since they began outsourcing.

FIGURE 1: TOP-RANKED REASONS FOR OUTSOURCING INVESTMENT MANAGEMENT

Source: The 2024 Impact of Outsourcing study, conducted by independent research firm 8 Acre Perspective on behalf of AssetMark

But, like other segments of the financial-services industry, the TAMP industry is undergoing major changes.

For cost reasons, some TAMPs are shifting away from SMAs to employing a wider variety of ETF-based strategic models on their platforms.

In recent years, consolidation among TAMPs has increased and is likely to continue. Larger platforms like AssetMark and Orion have acquired smaller TAMPs like Adhesion Wealth and Brinker.

Private equity firms are also getting in on the act. In 2024, AssetMark itself was acquired by GTCR, which took the company private.

5. Younger investors will demand more innovative service models

According to a 2024 InspereX survey, 59% of advisors’ clients are in their 60s or older, while only 18% are under 50.

When clients pass on, their children are most likely to take their inheritances elsewhere.

Sixty-one percent of advisors said the death of their clients is the main reason they lose assets under management (AUM). Another survey said 41% of advisors believe that the tsunami of inheritances that will take place over the next decade can threaten their existence as a firm.

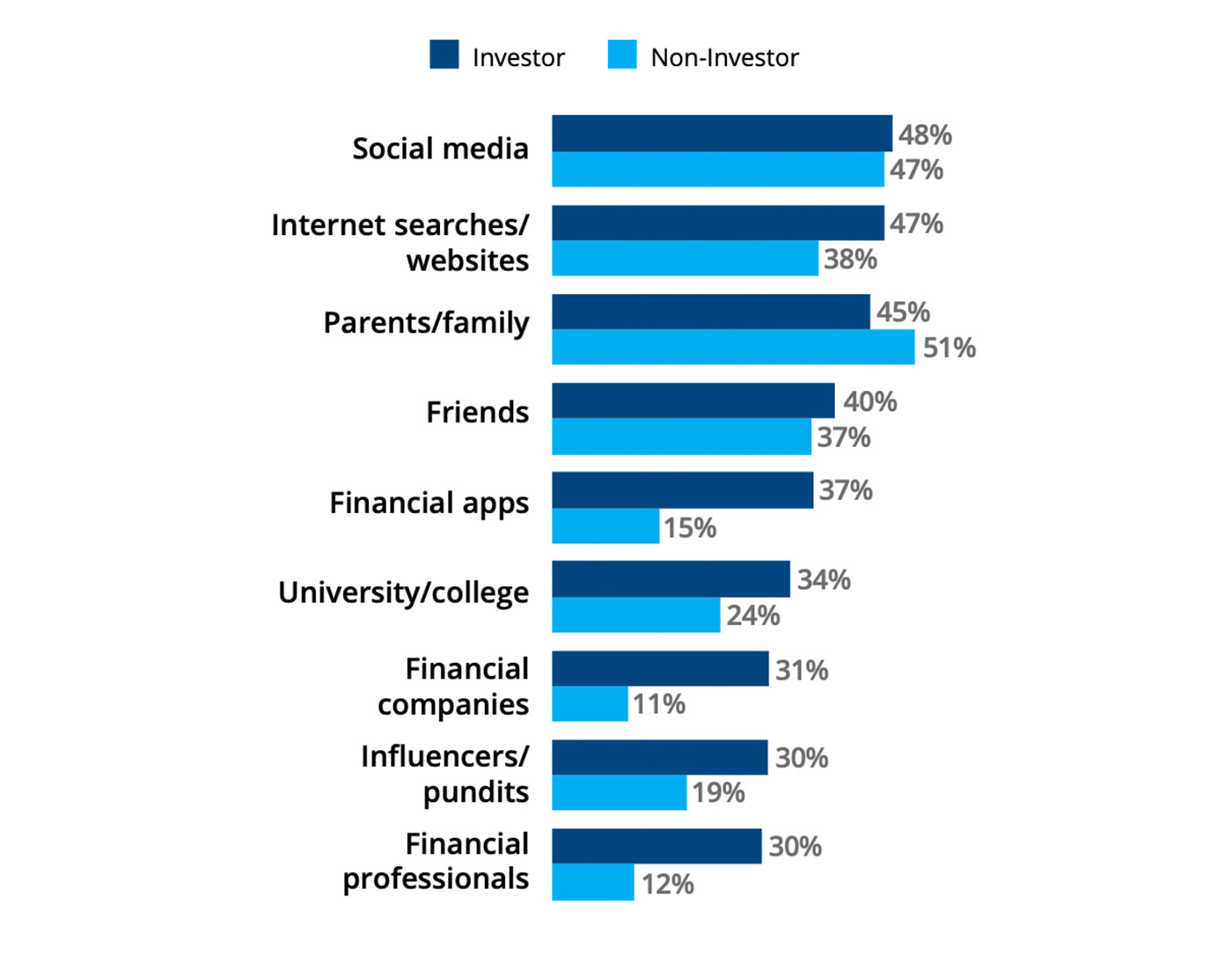

A different survey of young investors conducted by the CFA Institute found that Gen Zers are far more likely to rely on digital sources and social media to inform their investment decisions and less likely to use a financial advisor.

FIGURE 2: SOURCES OF FINANCIAL AND INVESTING INFORMATION FOR GEN Z

They want digital access to their accounts at all times and primarily want to communicate via texts and virtual meetings, rather than the traditional in-person meetings that are the bread and butter of most advisors’ client-cultivation stock and trade.

Younger clients also want fine-tuned personalized advice that reflects who they are, what they do, and what their specific challenges are at any given point in time.

To woo these clients, an increasing number of advisors are focusing on serving specific niches.

For example, some advisors specialize in working with physicians or dentists, gaining a deep understanding of the business management, tax planning, and logistical challenges these affluent practitioners wrestle with all the time. This specialization should help as they attempt to cultivate younger professionals in those fields.

6. Advisors will need to offer more flexible fee arrangements

Millennials and Gen Zers are also demanding greater flexibility in the way they pay for the advisory services they receive.

According to Pam Krueger, creator and co-host of “MoneyTrack” on PBS and CEO of Wealthramp, an online platform that matches investors with fee-only fiduciary advisors, younger clients aren’t willing to settle for the traditional AUM-based fee model, particularly if they’re asking their advisor primarily to provide financial-planning services.

“Two-thirds of all prospects who look for fee-only advisors on Wealthramp are rejecting the traditional service models and fee structures. They’re looking for specific advice and solutions that address their unique financial challenges at a quantifiable price. To win these clients, advisors are increasingly willing to work with them on an hourly, project-based, retainer, or flat-fee arrangement, based on the scope of work,” she says.

7. Automation will continue to enable the transition of back-office personnel

According to Bob Veres, the evolution of fintech platforms over the past decade has allowed back offices to automate many tasks that used to be conducted manually.

“With this extra free time, many operations personnel will be encouraged to transition into client-facing roles, where they’ll handle the 80% of client requests that don’t require the direct involvement of a senior financial advisor,” says Veres.

“Many will also be given the chance to attend client meetings and handle various follow-up activities. This increased collaboration between the front and back office will enable advisors to focus on their most important tasks while giving people who traditionally worked behind the scenes the opportunity to work directly with clients they formerly only knew on paper or on screen.”

Other firms, seeking to cut costs, may choose to reduce back-office headcount entirely and outsource non-core functions such as marketing, operations, and compliance. According to Statista, the global outsourcing market may reach nearly $400 billion in 2025.

8. Access to alternative investments will move down market

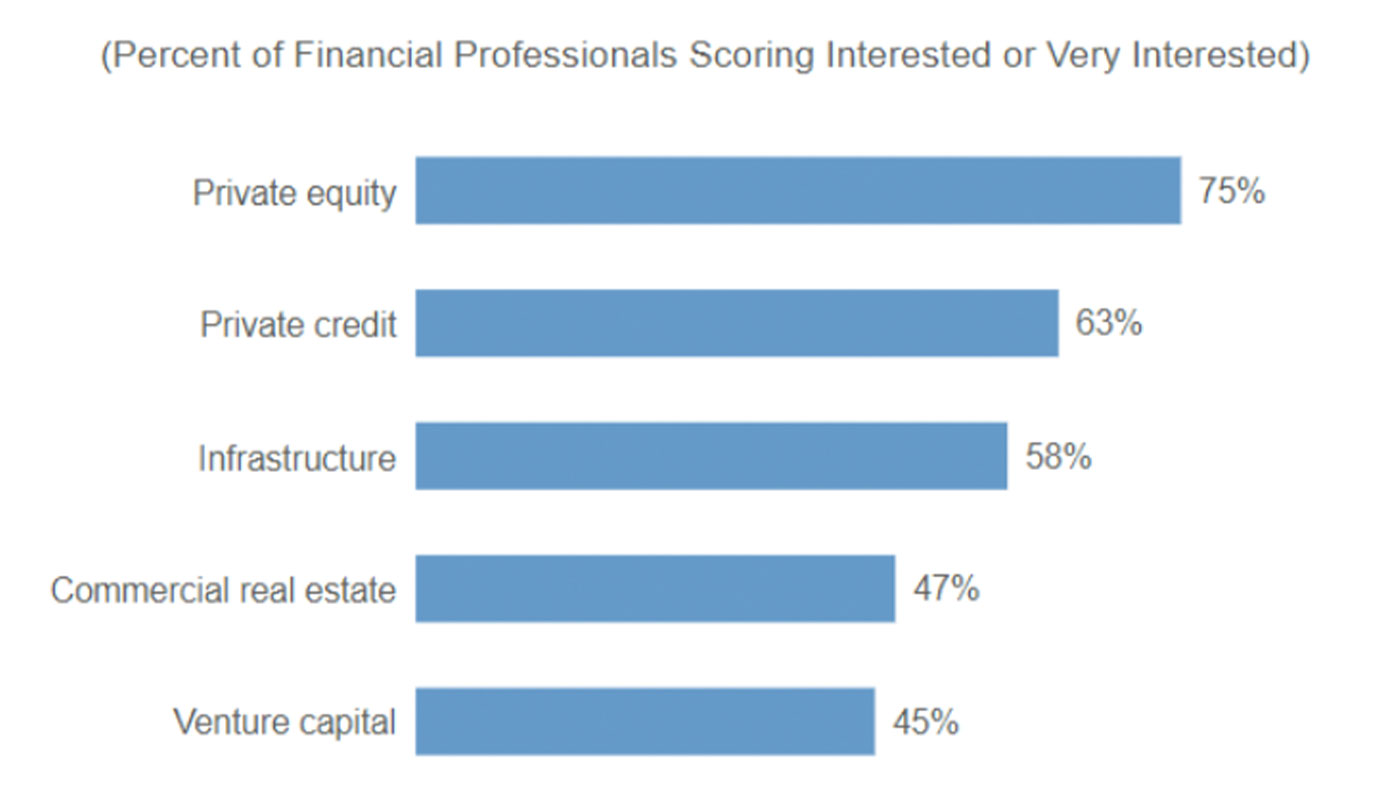

Demand for alternative investments is likely to rise over the next decade. According to a 2024 survey by CNL Securities, 55% of financial advisors were likely to recommend non-traded alternatives to their clients, compared to 25% in 2020.

FIGURE 3: RANKING OF ALTERNATIVE ASSETS BY FINANCIAL PROFESSIONALS (SUITABILITY FOR CLIENTS)

Advisors were most interested in offering private equity and private credit solutions, but only if a particular strategy had delivered strong performance and was easy to explain to clients.

One of the biggest barriers preventing retail investors from participating in alternative investments are regulatory restrictions, according to research from the Apex Group.

However, President Trump’s enthusiasm for cryptocurrency and nontraditional asset classes may end up pressuring the SEC to ease rules that prevent nonaccredited investors from investing directly in unregulated hedge funds and private equity and credit funds.

This may create opportunities for advisors to offer access to these alternative asset classes to their less-than-high-net-worth clients, especially if the expansion of tax cuts puts more money in their pockets.

Many asset managers have been more than willing to creatively skirt accredited investor rules by establishing closed-ended interval funds that invest in the private equity and private credit markets with initial minimums as low as $2,500.

Editor’s note: Financial advisors are navigating a number of transformative trends that are reshaping their industry. These trends are not only influencing how advisors manage client portfolios but also how they engage with clients and deliver personalized advice.

Please check out other recent articles from Proactive Advisor Magazine that provide perspective on important trends relevant to the current advisory environment:

How to enhance client services and practice growth through integrated banking solutions

Could crypto be an effective on-ramp for advisors cultivating younger clients?

Exploring the current landscape of the ‘AI revolution’

Will 20th-century investment strategies meet 21st-century longevity needs?

How advisors are addressing the FIRE movement

Correcting five common misconceptions about TAMPs

5 proven client acquisition strategies for advisors and RIAs

The opinions expressed in this article are those of the author and the sources cited and do not necessarily represent the views of Proactive Advisor Magazine. This material is presented for educational purposes only.

Jeffrey Briskin is a marketing director with a Boston-area financial-planning firm. He is also principal of Briskin Consulting, which provides strategic marketing and financial content development services to asset managers, TAMPs, and fintech firms. Mr. Briskin has more than 25 years’ experience serving as a marketing executive and financial writer for some of America’s largest mutual fund companies, DC plan record keepers, and wealth-management firms. His articles have appeared in Pensions & Investments, Advisor Perspectives, The Wealth Advisor, Rethinking65, Kiplinger’s Adviser Angle, and Alts.co.

Jeffrey Briskin is a marketing director with a Boston-area financial-planning firm. He is also principal of Briskin Consulting, which provides strategic marketing and financial content development services to asset managers, TAMPs, and fintech firms. Mr. Briskin has more than 25 years’ experience serving as a marketing executive and financial writer for some of America’s largest mutual fund companies, DC plan record keepers, and wealth-management firms. His articles have appeared in Pensions & Investments, Advisor Perspectives, The Wealth Advisor, Rethinking65, Kiplinger’s Adviser Angle, and Alts.co.

RECENT POSTS