A new generation of ‘unintentional’ risk-takers?

A new generation of ‘unintentional’ risk-takers?

Research indicates that taking substantial investment risk is inversely correlated with age. Advisors can play a valuable role in educating younger prospective clients on the merits of a risk-managed investment approach.

The financial markets have been focused in April and May on two themes: 1. Assessing the highly uneven, though generally positive, results of Q1 2024 earnings reports. 2. Consumer price index (CPI), gross domestic product (GDP), and ISM manufacturing and services data—and what that means for the economy and Federal Reserve policy moving forward.

Perhaps the laser focus of most market participants and analysts has been on the forecast for interest-rate cuts for the remainder of 2024—against a backdrop of stubborn inflation, slowing economic growth, and the upcoming November elections.

The Fed held rates steady and did not commit to future rate hikes or specify rate cuts in its latest announcement and Chair Powell’s comments.

CBS News reported on the May 1 announcement,

“Federal Reserve officials said they are leaving their benchmark rate untouched, noting that progress in taming U.S. inflation has stalled. …

“Powell demurred when asked if the Fed continues to cut rates three times in 2024, as it had indicated earlier this year. Instead, he responded that Fed officials need to feel more confident before they move to ease borrowing costs.”

I recently caught an interview on Fox Business with the colorful commodities floor trader Scott Shellady, which was conducted before the latest Fed meeting. Shellady thinks there may be no interest-rate cuts this year, which he says will not be well received by traders and fund managers.

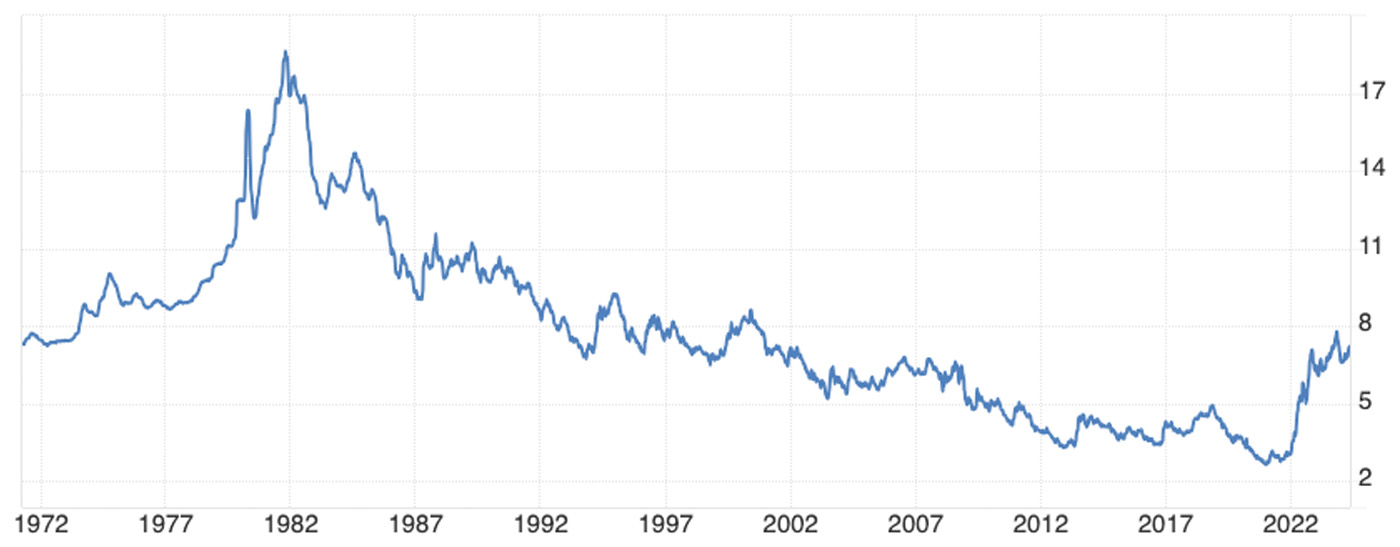

He said, “We got addicted to the sugar water of zero percent interest rates for almost 15 years. And now those folks are in their mid-30s, managing a lot of money, and they think 5.25% to 5.5% is too high. … The average fed funds rate over the last 50 years is around about 5.42%. We’re right there. So all you hear is people talking about ‘higher for longer.’ I want to rename it ‘normal for longer.’”

I spoke to a friend—a 40-year market veteran—about the new generation of Wall Street investment managers. He agreed with Shellady about the general lack of historical perspective on interest rates for those under 35. He recalled, “When home mortgage rates finally dropped to 6% in the early 2000s after years of higher rates, everyone rushed out to buy a home or refinance. Younger portfolio managers also seem to ignore the fact that markets can thrive—or crash—in just about any interest-rate environment.”

FIGURE 1: HISTORICAL VIEW OF 30-YEAR MORTGAGE RATE IN THE U.S.

Sources: Freddie Mac; Trading Economics

He also raised the point that many on Wall Street who are managing serious money have never experienced a true bear market—let alone a secular (longer-term) bear market—in their professional lives. While they may be highly trained CFAs, he said, their primary goal in running the passive lifestyle or target-date funds used in many retirement plans is beating a benchmark, not risk management. He added, “They will be facing some unfamiliar and unsettling challenges with little means of portfolio defense when the next sustained bear market comes around.”

While my friend was referring to fairly senior portfolio managers and strategists who joined the financial industry following the Great Recession—and may even have 10-plus years of experience—the issue is certainly more acute for recent industry hires.

In a 2022 interview, Paul Shotton, a former quantitative trader and now chair and CEO of White Diamond Risk Advisory, said,

“A lot of junior people in risk management are coming into their roles straight out of college or business school with quantitative training. That’s great. But what they really miss is the trading background. You can’t replace the experience of having positions at risk and the fear of losing money. They don’t teach that in school.”

What about younger retail investors?

I took a look at two reports issued in recent years by the Financial Industry Regulatory Authority (FINRA), with one focused on Gen Z investors (ages 18–25) and the other on post-pandemic investing attitudes and behavior across all demographic groups.

Overall, the reports confirmed the premise that younger investors—those under the age of 35—are bigger risk-takers than those in older age cohorts.

A few of the findings stand out in supporting this theme (the first three findings are from the Gen Z report, and the rest are from FINRA’s broader study):

- Younger investors (especially Gen Z) are more likely to invest in cryptocurrencies, “meme” stocks, options, and non-fungible tokens (NFTs)—as well as trading on margin. They are also more likely to trade individual stocks—as opposed to mutual funds or exchange-traded funds (ETFs)—using popular self-directed platforms such as Robinhood.

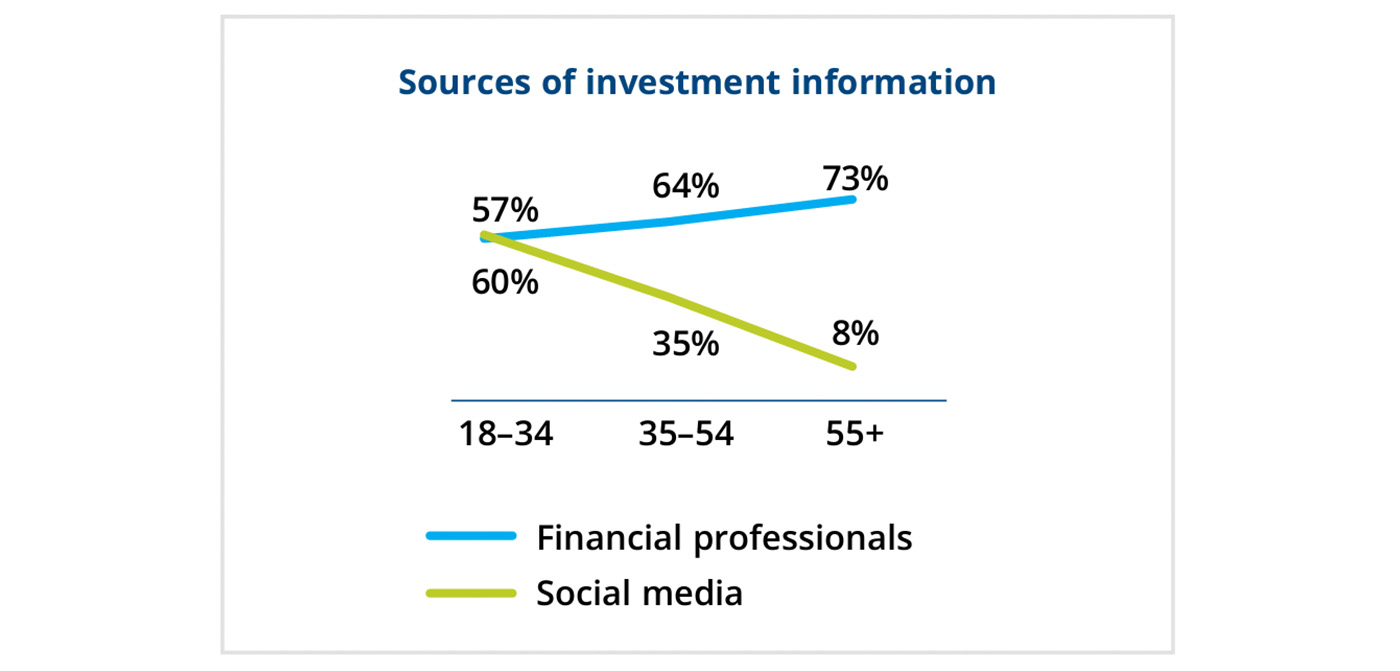

- Gen Z investors cite social media (48%) as their top resource for investment information, favoring YouTube, Instagram, TikTok, X (formerly Twitter), Reddit, and Facebook in that order.

FIGURE 2: SOURCES OF INVESTMENT INFORMATION BY AGE GROUP

Source: FINRA Foundation’s 2021 National Financial Capability Study (NFCS)

- “Almost half (46 percent) of Gen Z investors are willing to take substantial or above-average financial risks. Half (50 percent) say they have made an investment driven by their fear of missing out (FOMO).”

- “Willingness to take substantial financial risks was inversely correlated with age. Similarly, investors with less than 10 years’ experience were more willing to take risks than those with 10 or more years’ experience.”

- “Men, younger respondents, and newer investors were more likely to believe they would outperform the market.”

- Across all age groups, “Investor knowledge is low. On the ten-question investing quiz, the average number answered correctly is 4.7. More than two in five respondents (44 percent) think that the past performance of an investment is a good indicator of future results.” Knowledge levels decreased among “investors under 35 and those with less than two years’ experience.”

Addressing poor investor knowledge and a lack of regard for investment risk

A 2023 Financial Planning Magazine article addressed the challenges, and opportunities, for financial advisers among the Gen Z and millennial population:

“‘… The 70 million-strong cohort [Gen Z] stands to inherit at least tens of billions of dollars and assets from their parents and grandparents in coming decades. Yet 1 in 3 members may get their financial advice not from professional wealth planners, but from TikTok and YouTube, platforms permeated with myths, misperceptions and outright falsehoods dispensed by so-called experts.

“The cohort, along with millennials (what Fidelity Investments calls ‘Gen Y’), comprised nearly half, or 47%, of the U.S. population in 2021, but only 14% of all advisory clients, Fidelity’s 2022 Investor Insights Study shows.”

I think it is naive to believe that many of the trends cited in the preceding section can be easily overcome. Younger people have grown up in a world where instant gratification is the norm, whether via social media or digital commerce. This mindset often translates to the world of investing, where many younger investors are looking for quick gains without giving much thought to the substantial risks involved.

However, in conducting in-depth interviews with hundreds of advisers for Proactive Advisor Magazine, we have found that astute advisers are taking many steps to cultivate this new generation of investors. These include recruiting younger, tech-savvy advisers who are adept at social media; employing more interactive financial-planning and CRM platforms; finding ways to make client communications faster and more effective; implementing digital marketing plans that focus on education; and striving to include children of older clients in multi-generational planning sessions.

Many independent studies have suggested that working with a financial adviser, particularly if that relationship starts well before the actual retirement date, could mean anywhere from 20% to 50% in increased retirement assets over the course of a long-term adviser-client relationship (some estimates are considerably higher). That value is delivered in many ways, including through sound asset allocation and strategic guidance, avoidance of common investing mistakes, tax-efficient planning strategies, and expertise across a wide range of pragmatic retirement-planning categories. The challenge is finding ways to communicate this value to younger investors.

For advisors who adhere to an investment philosophy that includes active management, communicating the benefits of active, risk-managed strategies during each stage of the prospecting cycle can enhance the chances that younger people will turn into clients.

One advisor based in Oregon said in an interview with Proactive Advisor Magazine,

“I grow my client base in two essential ways: through referrals from current clients and by expanding the services that current clients and their families use. In both cases, my practice’s use of active investment strategies through third-party managers is an important part of my presentations and a differentiator for my practice. … The story of active investment strategies, and its emphasis on risk management, has therefore become a major part of how I position our firm’s services and investment philosophy.”

Another advisor, located in California, says that he believes all prospects are open to active management. “People just need to understand what it is, and some people don’t. … That is why we need to explain.”

He also believes that risk management is paramount in investment planning, and he says he usually recommends to clients that “some portion of their portfolio be allocated to tactical or actively managed strategies”:

“I tend to be very conservative in my investment approach, perhaps more conservative than many of my clients. I want to place an emphasis on risk management. The hard lessons of the two market crashes of this century must always be kept in mind. I also always ask myself, ‘Can a client’s objectives be met with an investment plan that is even more efficient or sensitive to risk than what we now have in place?’ In other words, can the client achieve returns that will meet their needs while taking on less risk or less tax exposure?”

He adds,

“If I take the extra time to explain more to clients, they come to understand that I really care about their learning and understanding and being able to make a smart financial decision. They appreciate that, and I think that helps me turn more prospects into clients. … The most important point is that I constantly seek to add value for clients. This means developing an investment approach that is not cookie-cutter and works hard to meet the specific investment goals within their overall financial plan.”

Based on numerous advisor interviews, I believe members of any generation, with the proper education, should be open to considering sensible propositions around risk management in their investment planning—whether for their workplace retirement plans or a good portion of their other investable assets.

The opinions expressed in this article are those of the author and the sources cited and do not necessarily represent the views of Proactive Advisor Magazine. This material is presented for educational purposes only.

David Wismer is editor of Proactive Advisor Magazine. Mr. Wismer has deep experience in the communications field and content/editorial development. He has worked across many financial-services categories, including asset management, banking, insurance, financial media, exchange-traded products, and wealth management.

David Wismer is editor of Proactive Advisor Magazine. Mr. Wismer has deep experience in the communications field and content/editorial development. He has worked across many financial-services categories, including asset management, banking, insurance, financial media, exchange-traded products, and wealth management.

RECENT POSTS