February CPI and PPI not encouraging in inflation fight

February CPI and PPI not encouraging in inflation fight

Consumer price index (CPI) rose 0.4% in February

- The consumer price index (CPI) rose 0.4% in February, matching consensus expectations. The CPI is up 3.2% from a year ago.

- Energy prices rose 2.3% in February, while food prices were unchanged. The “core” CPI, which excludes food and energy, rose 0.4% in February, above consensus expectations of more than 0.3%. Core prices are up 3.8% versus a year ago.

- Real average hourly earnings—the cash earnings of all workers, adjusted for inflation—declined 0.4% in February but are up 1.1% in the past year. Real average weekly earnings are up 0.5% in the past year.

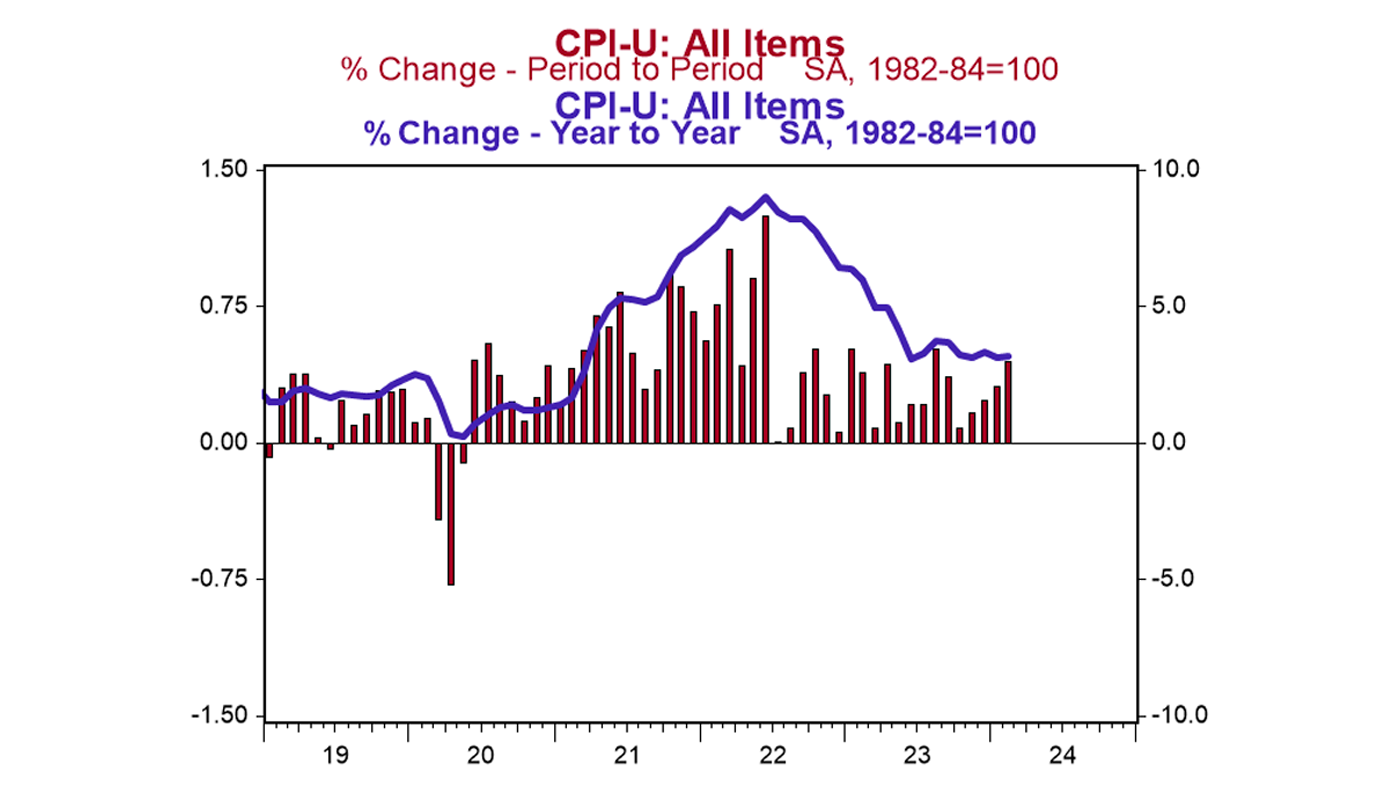

FIGURE 1: U.S. CONSUMER PRICE INDEX TREND

Sources: Bureau of Labor Statistics, Haver Analytics

Inflation accelerated in February, showing the battle against inflation is not over and the last mile of getting it back down to 2.0% will be the toughest.

Looking at the headline, consumer prices rose 0.4% in January, the most in six months, while the 12-month comparison ticked up to 3.2%. For those wondering, this marks the 36th straight month the year-to-year change is above the Fed’s 2.0% long-term inflation target.

Looking at the details, inflation was boosted by energy prices in February, which rose 2.3% on the back of higher gasoline prices. However, it’s important to point out that energy has not been the culprit for stubbornly high inflation over the last year; energy prices are down 1.9% in the same time frame.

Stripping out the energy component and its often-volatile counterpart (food prices) to get “core” prices does not make the inflation picture look any better. That measure rose 0.4% in February for the second consecutive month, meaning January’s core jump was not a one-off anomaly.

Rental inflation—both for actual tenants and the imputed rental value of owner-occupied homes—continued to defy predictions of imminent reversal, rising 0.4% for the month and running at or above a 5% annualized rate over three-, six-, and 12-month time frames.

Housing rents have been a key driver of inflation over the last year (this month it was responsible for over a third of the rise in the overall index). We expect it to continue to do so, as it makes up a third of the weighting in the overall index and still hasn’t caught up with the rise in home prices in the past four years.

But the most troublesome piece of today’s report for the Federal Reserve came from movement in a subset category of prices that the Fed is watching closely—known as the “Super Core.” This subcategory excludes food, energy, other goods, and housing rents, and is a useful gauge of inflation in the services sector. After jumping 0.8% in January, that measure followed up with a 0.5% increase in February, driven by higher prices for airfare (+3.6%) and motor vehicle insurance (+0.9%). In the last 12 months, this measure is up 4.3% and has been accelerating as of late. The annualized rate is up 6.9% and 5.9% in the last three and six months, respectively.

And while inflation remains stubbornly high, workers are no longer being compensated for it. Case in point, real average hourly earnings declined 0.4% in February. These earnings are up 1.1% in the past year, while real average weekly earnings are up just 0.5%, underpinning brewing weakness in the labor market.

Putting this all together, the Fed has little reason at this point to start cutting rates soon. How they respond to the incoming economic data in the months ahead could determine whether we repeat the inflationary 1970s.

Producer price index (PPI) rose 0.6% in February

- The producer price index (PPI) rose 0.6% in February, coming in well above consensus expectations of more than 0.3%. Producer prices are up 1.6% versus a year ago.

- Energy prices rose 4.4% in February, while food prices increased 1.0%. Producer prices excluding food and energy rose 0.3% in February and are up 2.0% versus a year ago.

- In the past year, prices for goods have risen 0.3%, while prices for services have increased 2.3%. Private capital equipment prices declined 0.1% in February but are up 0.9% in the past year.

- Prices for intermediate processed goods increased 1.6% in February but are down 1.8% versus a year ago. Prices for intermediate unprocessed goods rose 1.2% in February but are down 8.3% versus a year ago.

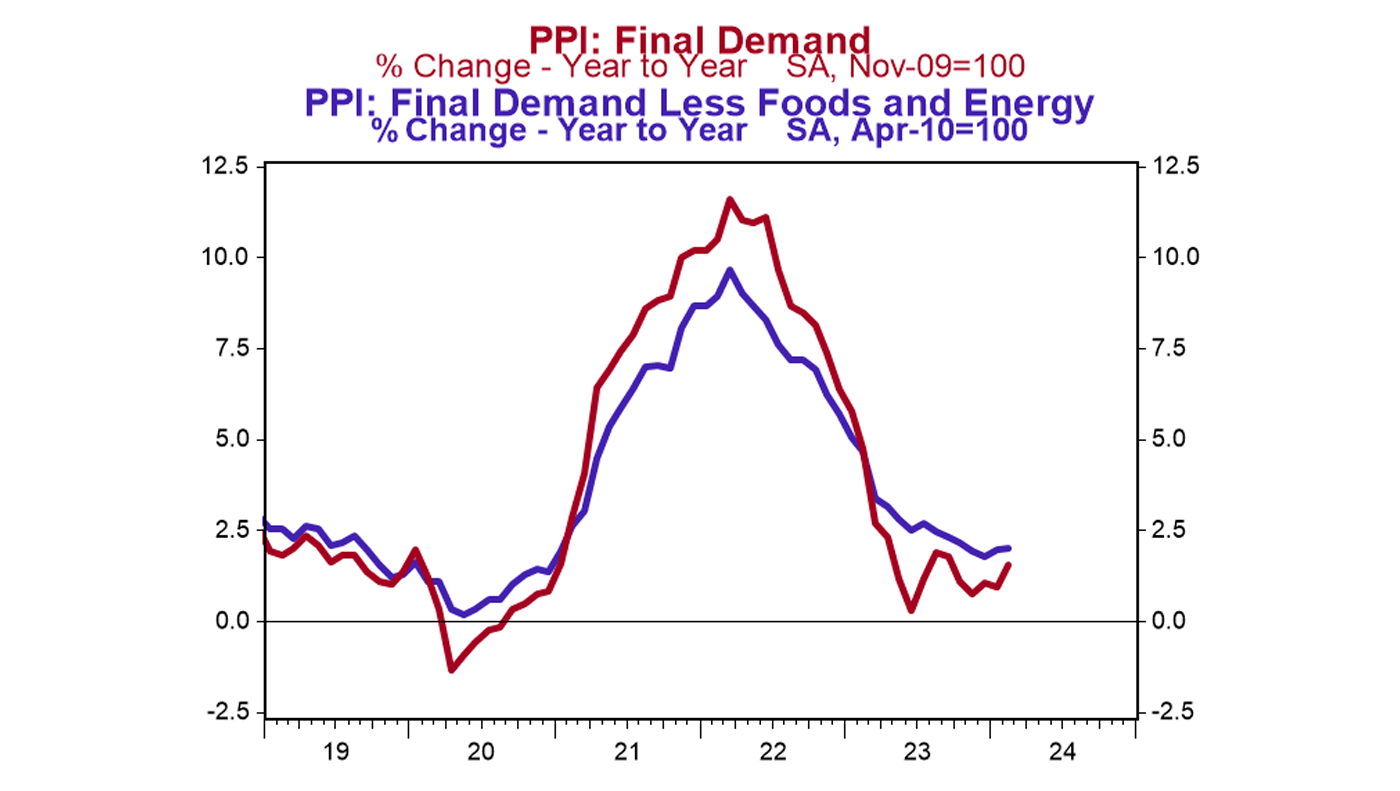

FIGURE 2: U.S. PRODUCER PRICE INDEX TREND

Sources: Bureau of Labor Statistics, Haver Analytics

When Chairman Powell said the FOMC is looking for greater confidence that inflation is trending lower before they begin cutting rates, this is not what he had in mind. While consumer prices continue to run, producer prices further back in the supply chain jumped 0.6% in February, easily outpacing consensus expectations.

February inflation was led by a 4.4% rise in energy prices, a category which had shown steady decline over the prior four months and is down 3.8% from a year ago. Food prices—the other typically volatile category—rose 1.0% in February and are up 0.3% in the past 12 months.

Stripping out these two components shows “core” prices rose 0.3% in February, following an outsized 0.5% increase in January. The Fed can take solace in noting the 12-month rise in core prices has eased since peaking at 9.7% back in March 2022. It is now up a moderate 2.0% from a year ago, but the trend of late has turned back higher, with core prices up 2.9% at an annualized rate over the past three months.

Diving into the details of today’s PPI report shows core inflation was spread between goods and services, with prices for nondurable consumer goods, transportation and warehousing, and outpatient care leading the charge. Further back in the pipeline, processed goods prices rose 1.6% in February but remained down 1.8% in the past year. Meanwhile, unprocessed goods prices rose 1.2% in February but were down 8.3% in the past year.

Further easing in inflation appears on the way should the Fed have the patience to let a tighter monetary policy do its work. But inflation risks rearing its ugly head once again should the Fed falter and cut rates too quickly. The markets—and the Fed itself—seem unsure how soon or how quickly rate cuts will come. Patience is a virtue.

Editor’s note: Brian Wesbury is chief economist at First Trust Advisors LP. He and his team prepare a weekly market commentary titled “Monday Morning Outlook,” as well as frequent research reports. Proactive Advisor Magazine thanks First Trust for permission to republish edited versions of these commentaries, which were first published on March 12 and March 14, 2024.

The opinions expressed in this article are those of the author and the sources cited and do not necessarily represent the views of Proactive Advisor Magazine. This material is presented for educational purposes only.

First Trust Portfolios LP and its affiliate First Trust Advisors LP (collectively “First Trust”) were established in 1991 with a mission to offer trusted investment products and advisory services. The firms provide a variety of financial solutions, including UITs, ETFs, CEFs, SMAs, and portfolios for variable annuities and mutual funds. www.ftportfolios.com

RECENT POSTS