May Day? Pushing out rate cut expectations

May Day? Pushing out rate cut expectations

Rate hikes are in the rearview mirror—now the issue is when the Federal Reserve starts to cut.

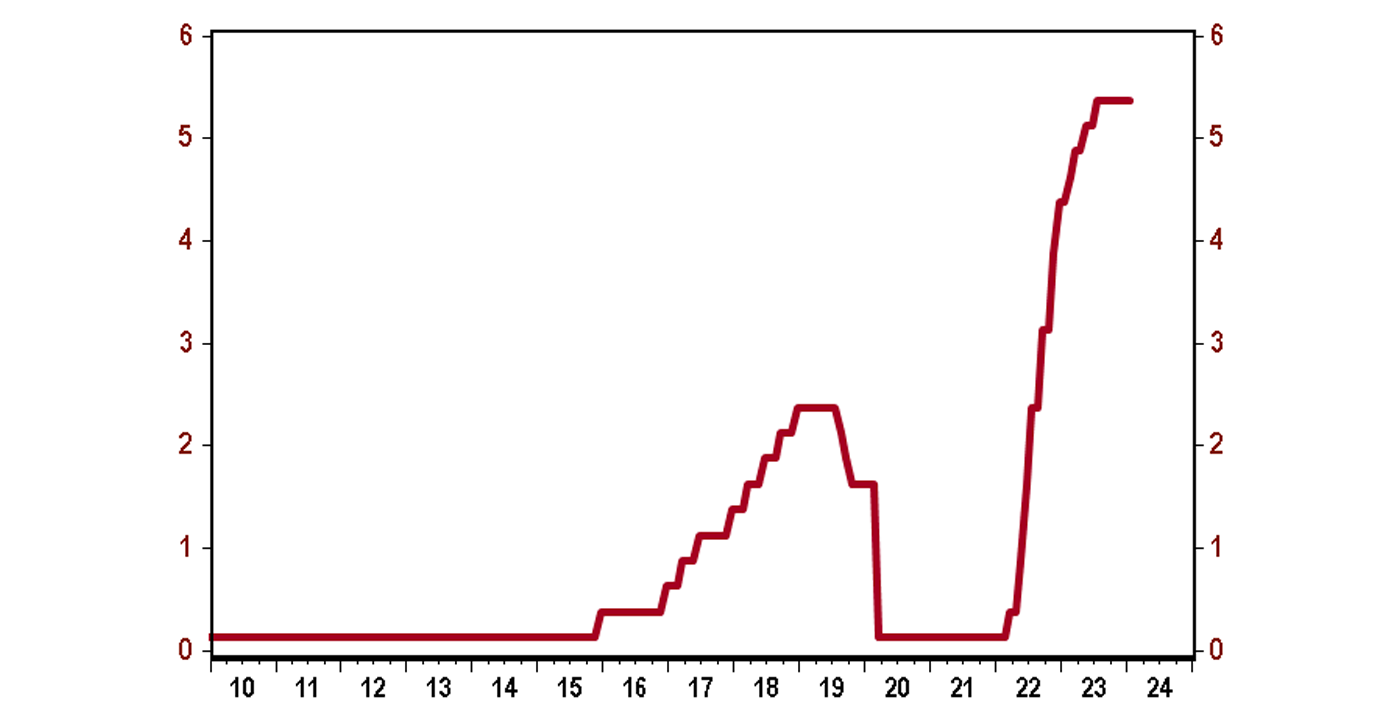

The Fed didn’t change short-term interest rates today [Jan. 31], nor did it alter the pace of quantitative tightening, but it did use both the statement and Chair Powell’s press conference to guide expectations for the path of normalization in the year ahead.

The Fed’s latest statement included some changes from its December announcement. It no longer talked about how tight financial and credit conditions could slow down economic activity. It also added the following: “Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent.” And while inflation remains the central focus, the Fed highlighted that “the risks to achieving its employment and inflation goals are moving into better balance.”

FIGURE 1: FED FUNDS TARGET RATE (%)

Sources: Federal Reserve Board, Haver Analytics

This is understandable, given that inflation is trending down. The consumer price index (CPI) rose 3.4% in 2023, versus a 6.5% rise in 2022, while unemployment has slowly crept higher. But much of the improvement in last year’s inflation readings was due to energy prices, which fell 2.0% in the past 12 months. However, the core CPI is still up a worrisome 3.9% from a year ago, compared to 5.7% in 2022. And we believe the Fed is likely to have more trouble getting broad measures of inflation, like the CPI, through the final stretch than it has in bringing inflation down over the past year.

That said, Powell’s comments during the recent press conference sang a more confident tune. He stated that incoming data has been in line with what the Fed wants to see to start the rate cut process. He added that the Fed doesn’t have reason to expect the positive progression of inflation data will shift in the months ahead. The Fed’s reason for remaining on pause is that it simply wants to see the trend continue for a longer period to build “greater confidence” that it will hit—and sustain—its 2.0% inflation target. When asked if that confidence could come by the next meeting in March, Powell responded that he doesn’t think the committee will have broad confidence that soon, suggesting May is very likely to be the start of the cut cycle.

We believe the Fed should be cautious about cutting interest rates too aggressively or prematurely. Doing so could reignite the inflation problem, similar to what happened on multiple occasions in the 1970s under Chairman Arthur Burns. The economy is still growing, but we think it will fall into a recession before the year is out and that real GDP growth will significantly lag the predictions of the FOMC members. Given that the Fed has now signaled 75 bps in rate cuts even in an environment of moderate growth, if we are right about slower growth, it will be very difficult for the Fed to resist generating higher inflation in 2025 and beyond.

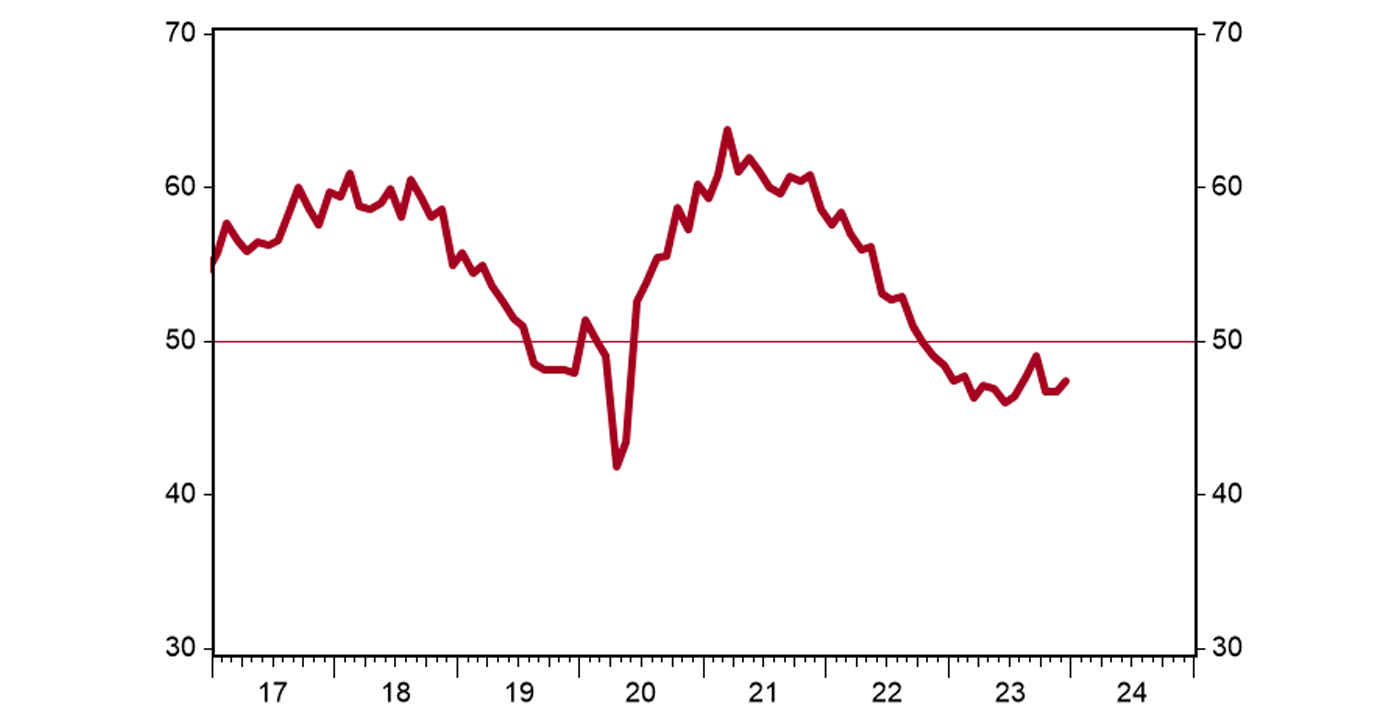

FIGURE 2: ISM MANUFACTURING INDEX

January 2024 sees an uptick—but amid 15 months of contraction

Sources: Institute for Supply Management, Haver Analytics

Editor’s note: Brian Wesbury is chief economist at First Trust Advisors LP. He and his team prepare a weekly market commentary titled “Monday Morning Outlook,” as well as frequent research reports. Proactive Advisor Magazine thanks First Trust for permission to republish an edited version of this commentary, which was first published on Jan. 31, 2024. Figure 2 is from commentary published on Feb. 1, 2024.

The opinions expressed in this article are those of the author and the sources cited and do not necessarily represent the views of Proactive Advisor Magazine. This material is presented for educational purposes only.

First Trust Portfolios LP and its affiliate First Trust Advisors LP (collectively “First Trust”) were established in 1991 with a mission to offer trusted investment products and advisory services. The firms provide a variety of financial solutions, including UITs, ETFs, CEFs, SMAs, and portfolios for variable annuities and mutual funds. www.ftportfolios.com

RECENT POSTS