How advisors address the uncertainties of retirement-income planning

How advisors address the uncertainties of retirement-income planning

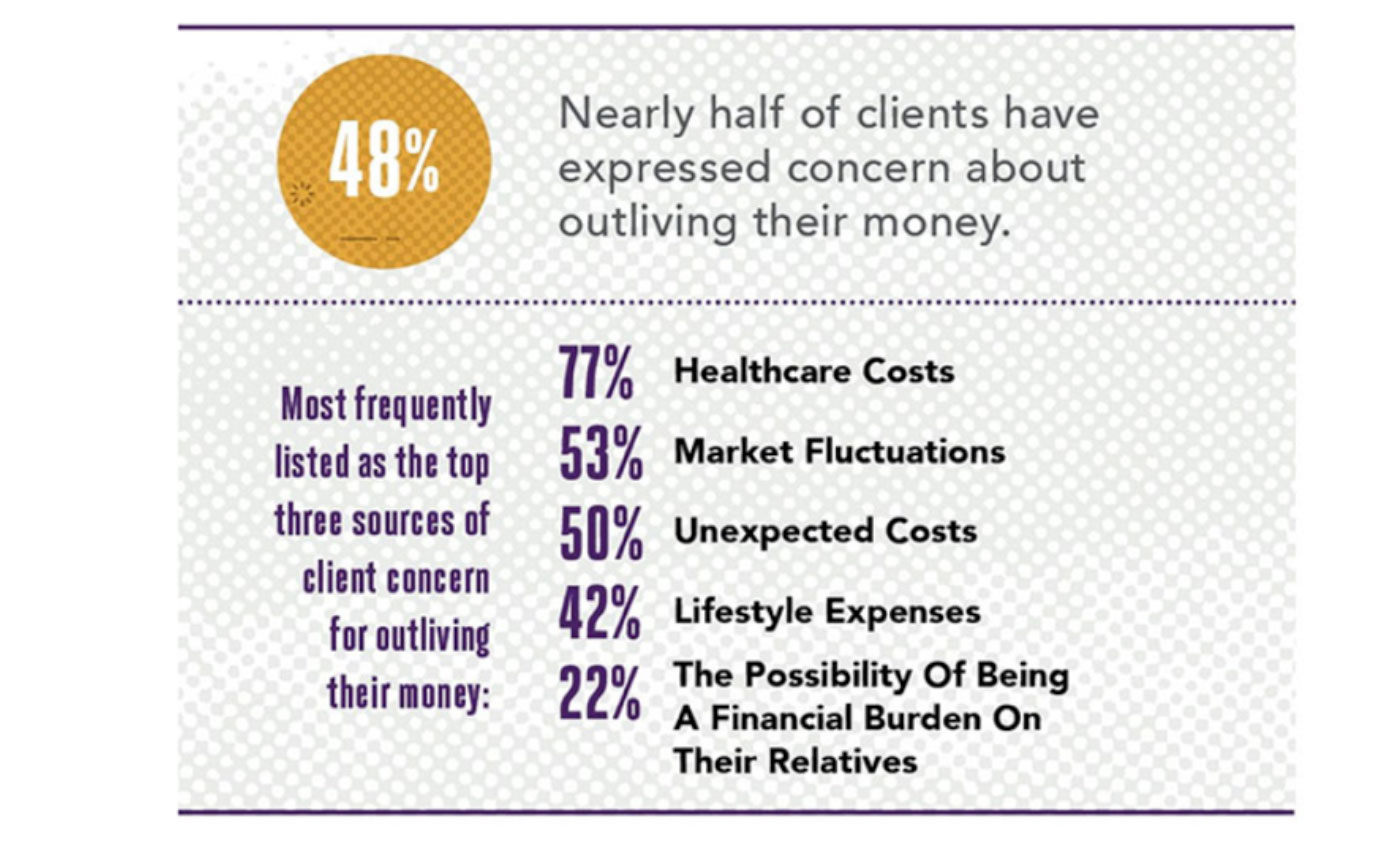

Our article, “‘Going broke’ is still chief retirement concern,” asked the question, “How can retirees reconcile their practical need for capital appreciation with their strong emotional desire for capital preservation?”

We cited findings from a study by the American Institute of CPAs (AICPA), which said that, “Of all the concerns impacting Americans’ retirement today, running out of money, maintaining their lifestyle, and rising healthcare expenses continue to top the list.”

Source: American Institute of CPAs (AICPA), 2018 Personal Financial Planning Trends Survey

We also noted,

“The two market crashes of the 21st century have had a profound effect on investor behavior. According to Betterment, 65% of investors say their risk tolerance has changed since the Great Recession—and 59% say their finances have not recovered fully from that period. A 2017 Gallup Survey found that stock ownership in the U.S. has dropped significantly since 2008.

“These issues are particularly important for individuals or couples on the cusp of retirement, or those already in it. It’s uncertain how long today’s retirees might live, but the one thing they want to know is that their money will not run out during their lifetime. Answering this question in a positive fashion requires combining capital preservation with the opportunity for capital appreciation.”

How, indeed, do financial advisors and wealth managers help their clients answer this question?

For most advisors we have interviewed for Proactive Advisor Magazine, the approach is founded in client education, followed by commitment to a thorough financial-planning process.

Flowing from an understanding of each client or client couple’s life goals, financial objectives, risk tolerance, time horizon, and legacy desires, advisors help build an investment, insurance, and income plan that will see their clients through a lengthy retirement.

On this theme, a recent 2020 report from AICPA, reflecting the impact of the unprecedented events of this year, says,

“As the COVID-19 pandemic has strained the U.S. economy and put millions out of work, Americans have experienced the biggest drop in their personal financial satisfaction in more than a decade. … We’re hearing from CPA financial planners across the country that now more than ever their clients are relying on their guidance to navigate these extraordinary times. …

“From giving clients peace of mind that principles of financial planning haven’t changed, to proactive planning with tax-efficient portfolio moves, and small business loans, CPAs have been working tirelessly to secure their clients’ financial future and to help them realize their life goals.”

For this issue, we looked at how several advisors apply their own unique philosophies and tools to address the following question:

Clyde Cleveland • Fort Lauderdale, FL

Clyde Cleveland • Fort Lauderdale, FL

Read full article

“Our primary goal is to help our clients identify misdirected assets and reallocate those assets in a plan that seeks growth and increases after-tax retirement income. We have developed a process called the ‘Zero Tax Roadmap’—a plan using specialized tools and customized use of investment vehicles to provide as much tax-free income in retirement as possible.

“We find that in many cases a properly chosen fixed index annuity or life insurance retirement plan (LIRP), properly matched to the specific needs of the client, can help maximize retirement income while reducing the risk from exposure to market downturns. However, we have many tools and strategies that may be appropriate for any given client. We provide access to asset management services through an affiliated RIA, IWG Investment Advisors LLC (IWGIA).

“For many of our clients, IWGIA utilizes the services of an experienced third-party investment manager. This manager’s many strategies strive to provide investors with competitive returns while working to reduce risk through the use of diversified investment products and cutting-edge technology. They focus on preserving and growing capital through a robust active management approach, combined with investment risk management.”

Mary Lyons • Dallas, TX

Mary Lyons • Dallas, TX

Read full article

“We help people view their retirement-planning options in a whole new light. The name of our firm, Personal Economics Group, says a lot: How can people construct a viable financial plan that can react effectively to a changing economic landscape, and how can they apply sound economic principles to their own financial-planning situation?

“I believe people work hard throughout their lives to establish a certain lifestyle. When they retire, they should not necessarily view that as a time of retrenchment. Instead, we want to help them have their assets work as hard as possible for them over a long time frame and to seek wealth protection via various strategies—so they may pursue their desired lifestyle. Our ultimate goal is to help clients get to a place where they can do the things they are most passionate about. …

“We believe financial strategies need to be integrated throughout a client’s life. No financial product can provide a perfect solution, but the probabilities for success can be dramatically improved. Insurance and investments are both important parts of an overall plan—and when our clients understand these tools, they can learn how to use them in ways that most advisors don’t talk about.

“Another issue relates to how advisors have viewed retirement planning. The key variables that are most often looked at for clients are rates of return and net worth, with the industry sometimes calling this a ‘magic number.’ Those are important, but more often than not, assumed rates of return do not reflect market realities. And absolute net worth is less important than building an efficient accumulation and distribution plan that can weather different economic and market conditions. An individual with an efficient, risk-managed plan and $500,000 in assets could generate more lifetime income and a larger legacy than an individual with $1,000,000 and an inefficient, non-risk-managed plan. By virtue of building strategies to help optimize a client’s income potential, the by-products of the process should be more liquidity and more opportunities to provide a legacy.”

Ken Lubkowski • Seattle, WA

Ken Lubkowski • Seattle, WA

Read full article

“For many of our clients who are nearing or already in retirement, we want to help them develop a comprehensive financial road map that will address several common areas of concern that they often tell us:

- “Will we have enough savings and investments to support our current lifestyle when we retire, and how long will they last? How can we better understand the different investment and income options available to us? How should our investments be allocated? How can we protect our family’s investments if the market drops again?

- “Do we have adequate insurance coverages in place, especially for long-term care? Are we maximizing the effectiveness of our benefits planning, including Social Security, Medicare, and retirement-plan rollovers? Are we being smart from a tax-efficiency perspective, and how can we effectively leave assets to our beneficiaries? …

“Our goal is to provide clients with guidance that can help them understand and better define and meet their financial objectives. While each situation is different, of course, we employ a repeatable process with each client or client couple and customize it as needed. … We often recommend the use of professional third-party money managers who can provide actively managed strategies. These managers are experienced and skilled at identifying trends, recognizing changes in the macro environment, and using leading indicators to guide adjustments to their strategies. I believe this is a valuable resource for many clients in helping to mitigate downside risk for their portfolios.”

Diana Avery • Atlanta, GA

Diana Avery • Atlanta, GA

Read full article

“Our firm’s bull’s-eye segment consists of people who are looking to retire in five years or less or who have retired within the last five years. I work with them to identify financial-planning solutions to allow them to be self-sufficient going into the next phases of their lives—freeing them up to do whatever it is that they desire to do. … Quality of life is something we focus on, so our relationship with clients involves knowing quite a bit about their life goals and what they hold most important. …

“First, the fact that we conduct a rigorous financial-planning process means that their investment strategies should be a natural outgrowth of their goals and objectives. Second, as a firm that is independent and follows the fiduciary standard, we have the flexibility to look at investment products and strategies from numerous resources and provide solutions that work in the client’s best interests. Third, our business model incorporates the use of managed accounts, and we seek out experienced third-party investment managers who can provide portfolio strategies that we think are appropriate for our clients.

“I believe the managers that we work with provide several benefits for our firm and our clients. They can provide sophisticated, rules-based investment strategies based on their proprietary models. In building client portfolios, we are looking for strong diversification and risk management. I do not believe that most of our clients, especially those near or in retirement, should be simply invested in passive mutual funds that are fully exposed to market risk.”

Ed Gay and Jim Hoogasian • Worcester, MA

Ed Gay and Jim Hoogasian • Worcester, MA

Read full article

Jim: “When we work with clients, most of whom are either retirement or pre-retirement age, the number one concern on everybody’s mind is that they have enough money to live in retirement. Many people do not have a realistic plan in place to allow them to live the way they want to in retirement. Our job is to help them allocate their resources in a way that allows them to progress toward their lifetime income needs.

“Our firm, Integrated Financial Partners, has a proprietary planning methodology called The Lifetime Income Model that strives to provide a reliable stream of income throughout the course of an individual’s or couple’s retirement years. We are looking to help clients strike the appropriate balance between risk and reward with a plan that provides tax efficiency and values the preservation of assets. The methodology uses a time-based approach, employing five-year tranches of differing investment approaches. The methodology is formulated with the goal to provide steady income and several layers of risk management.”

Ed: “Retirement for some people can be 35 years or longer, so one of the most important things we are focused on is longevity risk: How can we help clients manage their assets and resources throughout that kind of lengthy retirement period? If, for example, a client couple’s income need is estimated at $10,000 a month in retirement, our job begins with a thorough analysis of their current financial situation, assets and liabilities, current insurance coverages, retirement-plan assets, and many other factors. For clients whose finances have several layers of complexity, we have excellent case-management resources at IFP that can assist us in the final development of a financial and retirement-income plan.

“The Lifetime Income Model allows us to examine various assumptions and scenarios, ultimately arriving at a financial plan that seeks to deliver the highest probability of success. As independent financial planners, we are not required to use any specific financial products. We have a wide universe of financial products and strategies that can be used to address clients’ needs. … Our model employs risk management through the nature of its planning construct and how the assumption of risk can vary over different time periods in a retirement plan. We also have access to our firm’s proprietary portfolio strategies and those of select third-party money managers that can employ tactical investment approaches, dialing up or down market exposure based on the current market environment.”

The opinions expressed in this article are those of the author and do not necessarily represent the views of Proactive Advisor Magazine. These opinions are presented for educational purposes only.

This article first published in Proactive Advisor Magazine on May 16, 2019, Volume 22, Issue 6.

David Wismer is editor of Proactive Advisor Magazine. Mr. Wismer has deep experience in the communications field and content/editorial development. He has worked across many financial-services categories, including asset management, banking, insurance, financial media, exchange-traded products, and wealth management.

David Wismer is editor of Proactive Advisor Magazine. Mr. Wismer has deep experience in the communications field and content/editorial development. He has worked across many financial-services categories, including asset management, banking, insurance, financial media, exchange-traded products, and wealth management.