Are your clients ‘half’ versus ‘fully’ financially planned?

Are your clients ‘half’ versus ‘fully’ financially planned?

While investment risk management is extremely important for clients, so is active financial planning that minimizes the impact of “black swan” events in all areas of their lives.

For those of us in the financial-planning world, when we think of active investment management, we commonly think of resources such as rules-based strategies, technical and fundamental analysis, hedging strategies, stop-losses, seasonality trends, and the tactical management of market and business cycles.

All of these can be wonderful tools, and I commend advisors who assume an investment role for clients that goes far beyond recommendations for passive investing, traditional asset allocation, and buy-and-hold strategies. Independent financial advisors who advocate for goals-based investment strategies—using multiple asset classes, noncorrelated investment strategies, and strong risk management—should have a leg up on peers who do not.

With the advent of virtual advisor models and the growth of online brokerages, many financial advisors have sought further ways to differentiate their practices. They have positioned financial planning to prospects as a value-added service and a way to distinguish themselves from the online “advisor” or advisors who are primarily “asset-gatherers” that fail to establish a deep personal understanding and relationship with the client.

Financial planning is marketed as being complex and sophisticated. It seems the goal is to elevate the perceived professional acumen of the investment advisor in the eyes of the client with a skill set that cannot easily be duplicated. Typically, the investment advisor gathers enough financial data from the client to satisfy the input required by financial software. As we all know, output is only as good as its input. The input is based on many assumptions beyond that of the client’s own financial situation, including inflation rates, future performance of markets, future interest rates, and time horizons. These inputs are “guesstimates” at best. If just one of the major inputs turns out to be significantly incorrect, it obviously diminishes the value of the output.

“Black swans” are known to occur with some regularity in markets and the economic and geopolitical landscape. Despite the best intentions of an advisor’s Monte Carlo simulations, a single black swan can disrupt financial-planning projections for 20 or more years. The point is that financial planning that uses the most up-to-date software and graphics can appear flawless and scientific. However, because it is grounded in so many assumptions, it is in all practicality merely a guidepost to provide context and benchmarking. Yes, financial planning has significant value, especially when conditions are within statistical norms. But its credibility becomes suspect when markets collide in an unforeseen manner.

As active investment and financial managers, we must constantly scrutinize data and determine when trends and sentiments become extreme. We have to objectively evaluate investment theses and consider their flaws, where they are skewed, and what could go wrong. I am a lawyer by training. As such, it is in my DNA, and enhanced by my education, to always ask what could go wrong with a thesis or a model.

For these reasons, I have reservations about relying solely on financial planning that attempts to model and project long-term investment performance. Yet, most investment and financial advisors depend heavily on such modeling and focus much of their attention on investment projections, while only lightly touching on other relevant aspects of financial planning, namely vulnerabilities that cannot be avoided, but whose impact can often be minimized with various forms of insurance.

A strong level of scrutiny and questioning is a vital component of what I consider active and comprehensive financial planning.

As active investment managers, we incorporate tactical investment strategies that are designed through risk mitigation to grow and preserve capital through both up and down market cycles. Equally as important as investment risk management and minimizing the impact of black-swan market events is active financial planning that adequately addresses the financial implications of dying prematurely or becoming disabled.

We all know plenty of people who have died at a young age or who need assistance resulting from long-term health care, yet I see few new clients with life, disability, or long-term-care insurance that is even remotely adequate. Somewhat ironically, the insurance industry and its agents of 20 years ago have morphed into financial planners. Today, everyone is providing almost identical financial plans that are centered too much around financial and investment modeling and not enough on the protection and security that can only be realized with adequate insurance.

For example, according to the 2018 Life Insurance Needs Survey from Allianz Life Insurance Company of North America, “fewer than half of those with a financial professional have permanent life insurance.” They note, “There is a tremendous opportunity for financial professionals to bridge this education gap about permanent life insurance, particularly for financial professionals who are just beginning to embrace a holistic planning model that addresses all aspects of their client’s financial life.”

Even when the insurance need is presented in the financial plan, it is not emphasized enough for fear of alienating the client. This is because people generally don’t want to buy insurance, except when they need it and it’s too late. Proof of this fact is evidenced by life insurance plans that are marketed as lower-risk investment vehicles or “private pension plans.”

Clients much prefer to talk about ways to achieve stellar investment returns than what will happen to them if they become sick, injured, or die prematurely. I get it. And I get the fact that too often insurance is presented in the plan more as a box to be checked than with the necessary conviction to emphasize its necessity and perhaps the need for a client to adjust financially to afford it.

To truly add value and be a proactive financial advisor requires us to step out of our comfort zone and insist on having conversations that people avoid. I speak from experience. I have always considered life, disability, and long-term-care insurance the cornerstones of a financial plan. To the extent to which these are lacking, the entire financial plan can become invalidated.

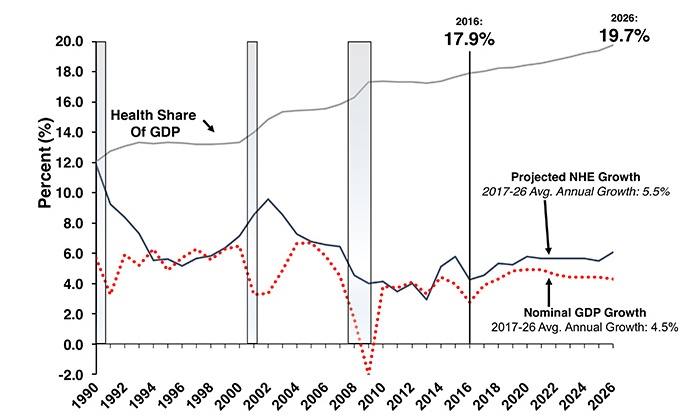

The issue of the affordability of health care is not going away any time soon in the United States, despite the ongoing efforts at health-care reform. Time says a recent study published in The Journal of the American Medical Association (JAMA) found that “Health care spending in the U.S. is roughly twice that of other high-income nations—but all that extra money isn’t leading to better health.”

Note: Shaded boxes indicate 1990–1991, 2001, and 2007–2009 recessionary periods as identified by the National Bureau of Economic Research.

Sources: Centers for Medicare and Medicaid Services, Office of the Actuary, National Health Statistics Group

Advisors need to advocate for ‘black swan’ protection in all areas of clients’ lives

I have served as a financial advisor for myself and my family for more than 30 years. I have committed to treating myself as a client. By this, I mean I follow the same investment, risk management, and financial-planning strategies that I recommend for other clients. I try to own the same financial products in my accounts. Despite the fact that I have always been the primary wage earner in our household, I have maintained life insurance protection on myself and my wife and children, knowing that a loss of any of them would be personally devastating to me—and, speaking frankly, create an emotional hardship with ramifications that could affect my business and productivity for a lengthy period of time.

In addition, at age 40, I acquired long-term-care insurance protection for me and my wife. Many financial commentators would challenge my decision to have these insurance protections. I have read their advice, and I can hear them saying that one should acquire long-term-care insurance at least a decade or more beyond the age we did. They would fit me in a box based on statistics. They would assume that neither of us would experience any black-swan health events prior to age 60. Their financial plans and advice would be rote.

I am grateful that I did not succumb to such mainstream advice. I am grateful that I ignored the assumptions inherent in their input. I say this because at age 54 my wife was diagnosed with a rare neurological illness that currently requires home health care that our policy is covering. Not only is the policy covering the cost of the required personal assistance, but it has also covered much of the costs necessary for physical modifications to our home, making it handicap-accessible. In addition, for the last 15 years since the policy was taken, the benefit has substantially increased. Now that she is collecting, her premiums are waived.

I am grateful that I did not succumb to such mainstream advice. I am grateful that I ignored the assumptions inherent in their input. I say this because at age 54 my wife was diagnosed with a rare neurological illness that currently requires home health care that our policy is covering. Not only is the policy covering the cost of the required personal assistance, but it has also covered much of the costs necessary for physical modifications to our home, making it handicap-accessible. In addition, for the last 15 years since the policy was taken, the benefit has substantially increased. Now that she is collecting, her premiums are waived.

If I had based my financial plan strictly on investment models and forecasts, irrespective of how reasonable they might be, and if I had only considered insuring what some guidelines indicate as reasonable and likely risks, my financial security would feel very insecure today at a time when having such security means everything to me in light of so much health and life insecurities.

I become quite frustrated when clients tell me that they can’t afford proper insurance coverage because, without being insensitive, I realize that it is a values- and priorities-based decision. The same person who claims he or she can’t afford insurance spends plenty of discretionary income on frivolous and unnecessary items, and rarely do any advisors call them on it.

Things happen to “other people.” The problem is that there are just so many other people. Inevitably, things happen to ourselves or family members or clients that are only supposed to happen to other people. Health-care expenses in the United States represent the single greatest reason for declaring bankruptcy. Clients may convince themselves that they are invincible. They may cite genetic odds in their favor, notwithstanding the fact that siblings from the same gene pool experience very different health conditions.

We want to believe that we will live until age 110, without ever experiencing a health disruption, as a defense mechanism because it is too difficult to consider anything else. But this is unrealistic and way outside the norm. What good is the financial plan, even with the most sophisticated financial modeling and investment risk management, if it leaves the client or his or her family vulnerable due to premature death or health-care issues that are beyond anyone’s control?

Active financial management certainly includes forecasting interest rates and internal rates of returns as well as backtesting against various economic models, but it also needs to provide protection and security against real-life risks. We must relentlessly, but in a professional, friendly, and concerned manner, convince clients to make this a priority and demonstrate how and from where premiums can be procured. If we fail to make a conscious, determined effort to provide both of these aspects of financial planning with equal attention and priority, then we are leaving our clients only “half planned.” Our ultimate goal, of course, is to make sure that all of our clients, as well as our own families, are “fully planned.”

The opinions expressed in this article are those of the author and do not necessarily represent the views of Proactive Advisor Magazine. These opinions are presented for educational purposes only.

Securities and advisory services offered through LPL Financial, a registered investment advisor. Member FINRA/SIPC.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. Insurance policies contain exclusions, limitations, reductions of benefits, and terms for keeping them in force. Your financial professional can provide you with costs and complete details. All policy guarantees are based upon the claims paying ability of the issuer. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing.

Gregory Gann has been an independent financial advisor since 1989. He is president of Gann Partnership LLC, based in Baltimore, Maryland. Gann Partnership provides objective, unbiased financial planning and active investment management for individuals, families, and businesses. (Securities offered through LPL Financial, a registered investment advisor. Member FINRA/SIPC.) Mr. Gann also serves clients as a certified divorce financial analyst. gannpartnership.com

Gregory Gann has been an independent financial advisor since 1989. He is president of Gann Partnership LLC, based in Baltimore, Maryland. Gann Partnership provides objective, unbiased financial planning and active investment management for individuals, families, and businesses. (Securities offered through LPL Financial, a registered investment advisor. Member FINRA/SIPC.) Mr. Gann also serves clients as a certified divorce financial analyst. gannpartnership.com