Although our positive fundamental core thesis remains positive, we expect 2022 to be a volatile trading range environment.

We believe our macro indicators are where they should be at this point in the cycle, which means (1) monetary, health, policy, and global growth uncertainty should limit the upside, while (2) decelerating inflation expectations, easing supply-chain constraints, a stable credit backdrop, and positive economic and EPS (earnings per share) growth should buffer the downside. Truly, we expect 2022 to be a year to buy the significant whooshes and neutralize on excessive ramps—without a lot of progress in either direction.

This framework would not be dissimilar to 2005 and 2011 following historic excess liquidity emerging from recession, which would favor violent sector rotation that requires a more tactical investment plan.

Let’s review our fundamental core thesis given the current market focus on inflation, growth, margins, and valuation:

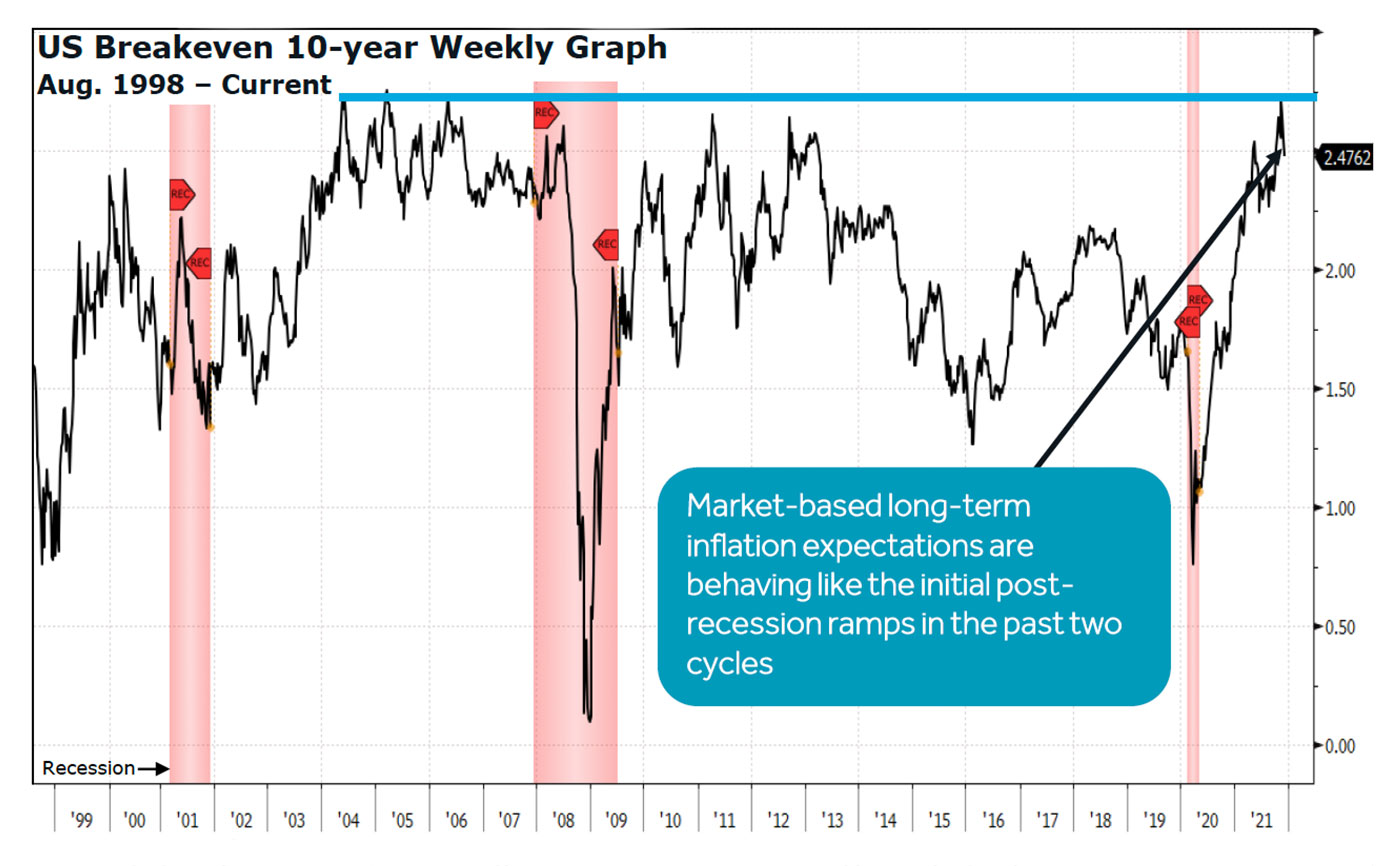

- Expect a better inflation trend in 2022. Although core inflation has surged, long-term inflation expectations are acting like prior early recoveries and have stabilized following the more hawkish tone coming from the Federal Reserve. While we believe higher-than-anticipated current inflation and near full employment may keep the Fed’s attention, we expect that historically high inventories, far less stimulus, and easing supply-chain constraints should help inflation trend closer to the Fed goal as we move through 2022.

Sources: Bloomberg, Canaccord Genuity

- The Fed may taper more quickly but raise rates more slowly than markets expect. The Fed has clearly taken a more hawkish tone given the stubbornly high level of inflation. This has put significant downward pressure on long-term inflation breakevens and interest rates. While we do expect the Fed to accelerate the tapering of asset purchases, we believe market expectations for a liftoff from zero interest rate policy in the spring or early summer are too soon. The credit market should guide us on the likelihood of a policy mistake.

- Slower growth favoring services as the economy normalizes. 2022 should be an economic digestion year that remains positive but is driven by a transition from goods to services. Clearly, variants of COVID, lingering supply-chain issues, and less monetary support will continue to negatively impact expectations and the global growth outlook. Helping to offset these challenges are loose financial conditions, solid income growth, signs of improvement in nonresidential construction, high manufacturing optimism, and a (choppy) global expansion.

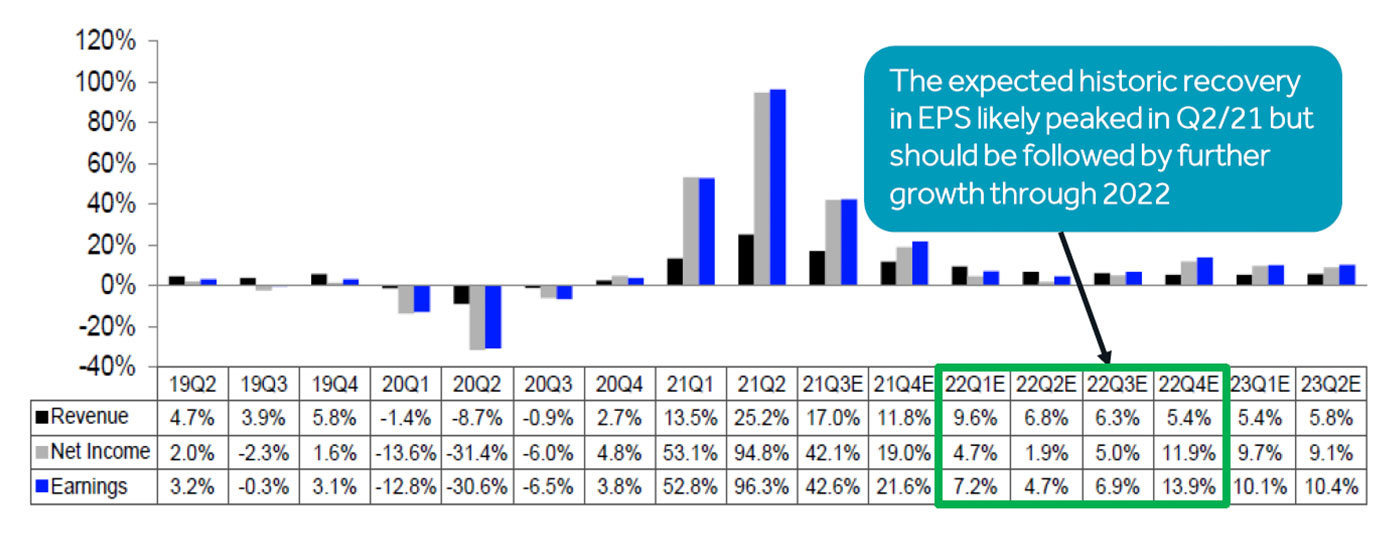

- Raising our EPS estimate to reflect more normal growth off a higher 2021 base. The market correlates with the direction of EPS, which should remain positive over coming quarters, albeit at a much more normal pace. We are raising our 2022 S&P 500 (SPX) Operating EPS estimate to a range of $220–$225 per share to reflect a more normal 5%–7% growth rate off a likely year-end 2021 EPS of roughly $210. Our estimate assumes no major moves in margins or taxes. History shows margins only peak at the end of an economic cycle surrounding full employment, and tax hikes from the Biden stimulus package are highly uncertain heading into an election year.

Sources: Canaccord Genuity, I/B/E/S data from Refinitiv

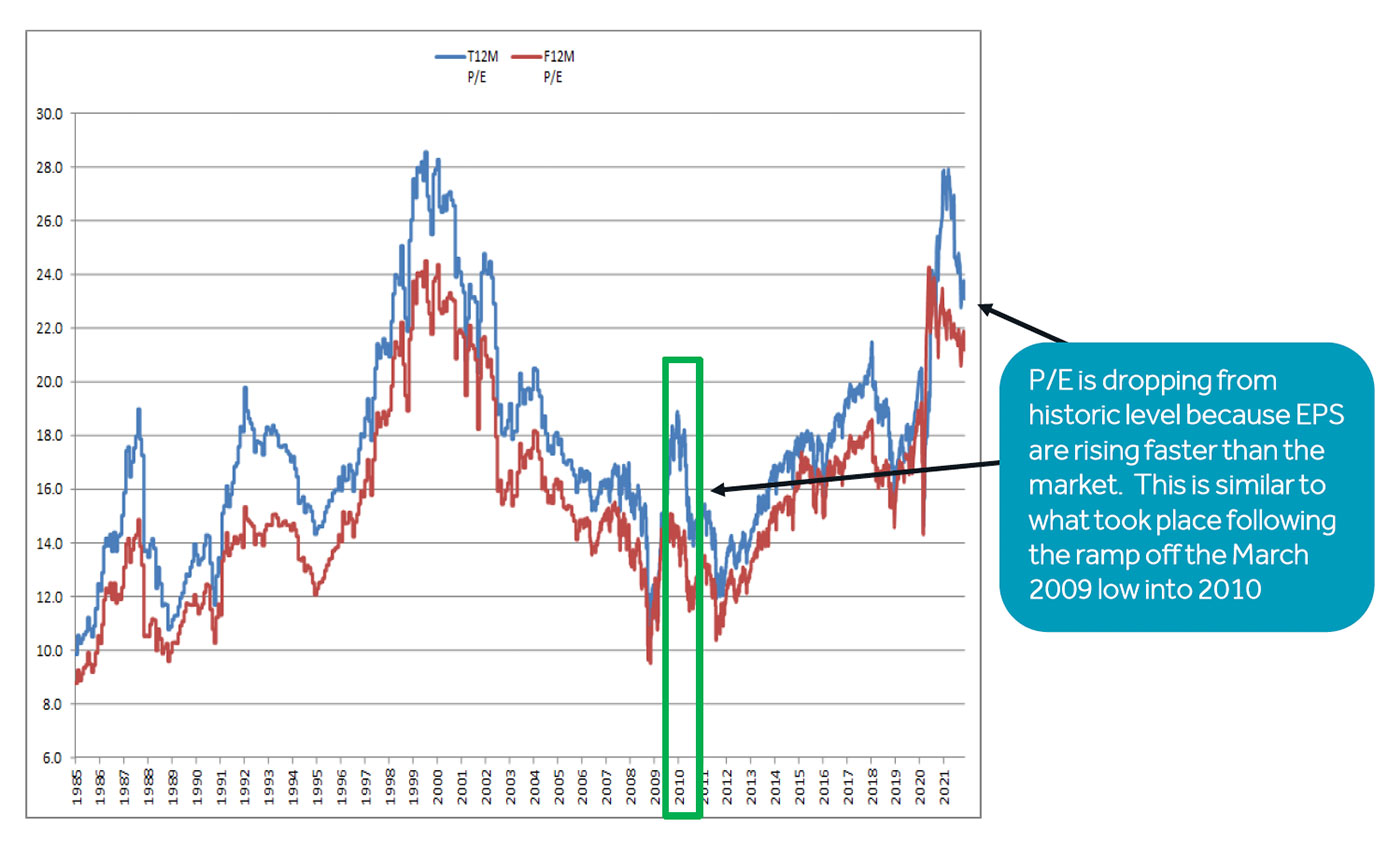

- Valuations are fair if our inflation view is correct. The market valuation has come down as the historic growth in EPS is outpacing the strong gains in the major market indexes. We believe the credit markets are strongly suggesting core inflation should move back toward the Fed’s target range as we progress through 2022, which means the average multiple of 19X–20X in years with core inflation between 1%–3% should hold.

Sources: Canaccord Genuity, I/B/E/S data from Refinitiv

We continue to believe the recent market volatility driven by fear surrounding the new omicron variant and the hawkish Powell pivot created one of the most near-term oversold market conditions since the 2020 low and offers the opportunity for a tactical push higher for risk assets and cyclical sectors into year-end.

We would characterize 2022 as a move back to a more “normal” economic environment like 2005 and 2011 when the markets had to digest what monetary policy and global growth would look like following a historic coordinated easing cycle by the global central banks.

The U.S. Treasury market and long-term inflation breakevens suggest the Fed’s new hawkish tone might be enough to prevent sustained inflation, but uncertainty surrounding the Fed, global growth, and policy should help keep market enthusiasm at bay as we move through the new year.

Tony Dwyer is the head of the U.S. Macro Group and chief market strategist at Canaccord Genuity. He also sits on the firm’s U.S. operating committee. Mr. Dwyer joined Canaccord Genuity in 2012 and is known for the practical application of macroeconomic and tactical market indicators. Mr. Dwyer was previously equity strategist and director of research at Collins Stewart and a member of the firm's executive committee. Mr. Dwyer is a frequent guest on many financial news networks. canaccordgenuity.com

Tony Dwyer is the head of the U.S. Macro Group and chief market strategist at Canaccord Genuity. He also sits on the firm’s U.S. operating committee. Mr. Dwyer joined Canaccord Genuity in 2012 and is known for the practical application of macroeconomic and tactical market indicators. Mr. Dwyer was previously equity strategist and director of research at Collins Stewart and a member of the firm's executive committee. Mr. Dwyer is a frequent guest on many financial news networks. canaccordgenuity.com