Why financial advisors should be building teams

Why financial advisors should be building teams

While expanding the team of an advisory practice is not without its challenges, industry professionals and hands-on financial advisors say team building offers significant practice benefits and growth opportunities.

One of the biggest growth-driving practices at successful advisory firms is the adoption of the “team model.”

The teams can be as simple and informal as two advisors with their own separate firms (and locations) assisting each other in ways such as holding joint educational prospecting events, covering for each other during vacations or illness, sharing best practices, or cross-referring potential clients if they think one advisor represents a better fit.

Or, they can be as robust as those found now at “elite” financial advisory firms handling high-net-worth clients and billions in assets under management.

As Barron’s describes it, these top advisory teams have the following characteristics:

- They have an average of 17 members.

- They have a balance of client-facing advisors, experts in financial planning and investing, and client-service professionals.

- They increasingly resemble law and accounting practices, with clear career paths leading from entry-level to intermediate advisor to senior advisor and on to partner.

- They facilitate the transfer of clients from a primary relationship manager who is approaching retirement to another advisor on the team.

- They have about double the business growth of single practitioners.

In the case of Merrill Lynch, Barron’s notes, “77% of the firm’s nearly 15,000 advisors have now joined forces with others,” and they are supported by “a corps of specialists around the country who help advisors establish and manage teams, and institute best practices.”

Most advisory practice teams are likely somewhere in the middle of these two extremes.

While interviewing independent advisors across the country who are generally focused on mass-affluent and retirement-planning clients, we have seen advisory practice teams that range from those composed of one or two senior advisors, a junior advisor, a customer-service specialist, and an operations or administrative professional to firms with a dozen or more advisors with varying experience levels and a large support staff. Some may also have an in-house tax professional or close working relationships with outside CPAs, estate attorneys, P&C insurance specialists, and other third-party professionals. They may also have access to specialized services offered through their broker-dealers.

One of the advisors we have interviewed, Jon McArdle of Summit Financial Group of Indiana, spoke to us about the impact of team building on his firm’s growth,

“I have been either a partner or principal owner of Summit Financial Group of Indiana since 2002. Over the last 10 years, our team has been able to grow assets under management over 70% per year on average. I attribute that growth to a remarkable team effort, a business model that works exceptionally well for our target segments, and a collective mindset driven by the pursuit of excellence.”

Mike Zimmerman, founder of Regal Wealth Advisors in Stevens, Pennsylvania, continues to expand the team at his practice while maintaining a close working relationship with another advisory firm in his area. He says,

“An integral part of my career philosophy is that it is important to always seek to grow and improve oneself. … I [also] believe that it is important to ‘pay it forward’ and truly enjoy working with and helping to train financial advisors who are relatively new to our industry. We are always stronger in our business as a cohesive and well-educated team.”

Ray Sclafani, founder of ClientWise, a premier coaching company exclusively serving the financial-services industry, has been passionate about the issue of both team building and succession planning, especially for solo practitioners. He says research shows the inadequacy of succession planning, with 60% of advisors within five years of retirement having no plan. His firm has developed a focused program to address this issue, called “Success in Succession.” He says of this effort, “[It’s] honestly the most meaningful and noble work I’ve ever done—because it speaks to legacy and a better future not just for our clients but for the industry as a whole.”

But his firm also strongly believes in the team concept for reasons beyond succession planning. In a ClientWise article, Sclafani writes,

“Bigger really is better! What many advisors don’t realize is that in the vast majority of cases, productivity actually goes UP as your organization gets bigger. In part, this is because you are hiring more staff around you who are also productive. It’s the essence of the interdependent team concept we passionately advocate for—together you can do more and achieve more than any one individual can do on his or her own.

“The other driver of this phenomenon is your clients. As you get bigger, you invariably expand your expertise, capabilities and service offering. Not only does this assist in attracting larger clients with more complex wealth management needs, it compels you to be more disciplined in going after higher value clients. …

“It takes a lot of time and effort to effectively manage a large team. But the benefit of rising productivity, coupled with revenue per advisor increasing as the number of clients per advisor is decreasing (thanks to higher value clients) means that you can spend more time with fewer clients and make the same amount of money. An optimal outcome for both you and your clients.”

Financial Planning Magazine has also made the case for team building:

“More than half of financial planners now operate with others. And the big teams—those with over $500 million in client assets—hold nearly two-thirds of all managed assets, despite making up a fraction (11%) of the entire industry, according to the Cerulli Associates 2018 Advisor Metrics Study.

“Larger clients prefer working with a group, he says, because they gain access to specialists. More advisors mean a broader scope of knowledge and information. ‘The larger the client, the more they favor the team-based model,’ Palaveev says.

“There are other benefits, too. Teams can integrate next-gen advisors and support one another’s client relationships, according to the Cerulli report. In addition, bigger teams are attractive distribution opportunities for asset managers, as they usually have more sophisticated portfolio management and clients.”

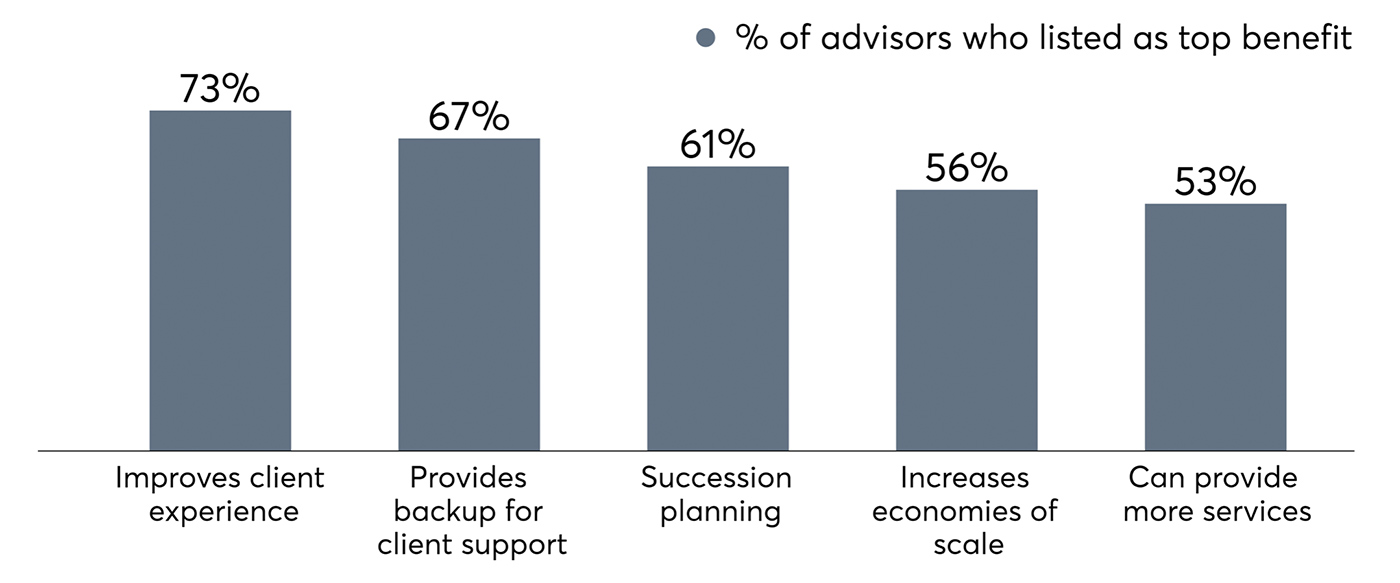

Source: U.S. Advisor Metrics 2018, Cerulli Associates

Research and data analytics firm PriceMetrix says the following in its study “Teams in Retail Wealth Management”:

“Team-based wealth advice has clearly become an important part of the wealth management landscape. The concept of working in a team environment appeals to advisors in many, and often different ways: The ability to leverage different strengths and skill sets to better take care of clients and grow the business; the discipline that working together brings in terms of setting and achieving goals; and the benefits of a built-in succession plan, where the relationships with clients are more likely to stand the test of time.”

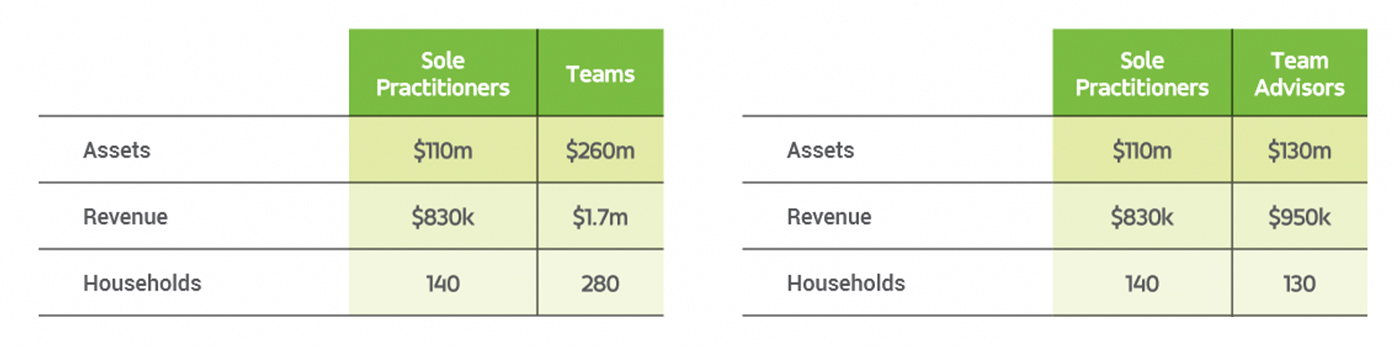

Not surprisingly, says PriceMetrix, teams manage more assets, generate more revenue, and maintain more client relationships than sole practitioners.

The firm has analyzed its data in two ways: (1) looking at the practices of sole practitioners versus the average advisor team in their database, and (2) looking at sole practitioners versus individual advisors who work as part of a team.

Their overall findings?

“Perhaps the most important conclusion of our research is why teams are successful.

- Teams grow faster than sole practitioners, not evidently through the magic of ‘synergy’ or through division of labor. They grow because they are more likely to do the things that drive growth—the fundamentals.

- Teams are more likely to be the primary advice provider to their clients.

- Their clients have more invested and stay longer.

- Teams are more likely to work with couples, create deeper relationships, and focus on a narrower set of relationships.

“Because all of these behaviors lead to growth, it should come as little or no surprise that teams grow faster.”

Source: PriceMetrix Insights

While PriceMetrix says it is very clear that “teams outperform sole practitioners,” they also note that,

“Managing your practice as a team does not guarantee success. Looking at the top and bottom quartile performance of teams for a series of performance metrics reveals some dramatic differences:

- The top quartile of teams averaged 20% of small household relationships, while the bottom quartile averaged 58%. (Households with less than $250k invested.)

- The top quartile of teams averaged 72% fee-based assets while the bottom quartile averaged 13%.

- The top quartile of teams averaged 96% client retention ($250k+) while the bottom averaged 87%.

- And perhaps most importantly, forming a team is not an automatic path to breakthrough growth. Over the last two years, the top quartile of teams grew by, on average 22% while the bottom shrank by 3%. Clearly, there is more to making a team successful than just joining one. …

“Not all teams will be successful, but our data is conclusive—advisors who choose to work in teams are more likely to be part of something bigger.”

The opinions expressed in this article are those of the author and do not necessarily represent the views of Proactive Advisor Magazine. These opinions are presented for educational purposes only.

This article first published in Proactive Advisor Magazine on March 19, 2020, Volume 25, Issue 11.

David Wismer is editor of Proactive Advisor Magazine. Mr. Wismer has deep experience in the communications field and content/editorial development. He has worked across many financial-services categories, including asset management, banking, insurance, financial media, exchange-traded products, and wealth management.

David Wismer is editor of Proactive Advisor Magazine. Mr. Wismer has deep experience in the communications field and content/editorial development. He has worked across many financial-services categories, including asset management, banking, insurance, financial media, exchange-traded products, and wealth management.