What factors contribute to the growth of financial advisors?

What factors contribute to the growth of financial advisors?

Research findings from the PriceMetrix study “The State of Retail Wealth Management 2018” identify key trends and success factors for “high-growth financial advisors.”

Independent financial advisors faced several distinct challenges in 2018:

- A turbulent market environment, ending with one of the worst fourth quarters in modern history.

- The unknowns of U.S. trade policies and their impact on the economy and companies’ earnings.

- Uncertainty around the Federal Reserve’s path for interest rates in 2019, especially important in an aging equity bull market and lengthy economic expansion.

- The impact of changing demographics for both the advisor community and its client base.

- Increased competition from digital companies, including automated “robo-advisors,” and from “mega” advisory firms and national financial-services brands.

Within this environment, independent financial advisors needed to effectively communicate their firm’s value proposition for prospective clients and drive their firm’s growth.

Many did just that, very successfully. Others struggled in dealing with 2018’s changing environment.

Proactive Advisor Magazine thanks PriceMetrix, a leading research, data, and consulting firm focusing on the financial advisor segment, for their permission to highlight some of the key findings from their comprehensive study, “The State of Retail Wealth Management 2018.”

The April 2019 PriceMetrix study, which includes data through December 2018, is based on information from North American wealth-management firms with $6 trillion in assets under management (representing over 12 million retail investors).

The study presented five major findings:

- Advisor revenues reached record highs in 2018, despite a market-driven drop in assets.

- The number of new client relationships established per advisor increased.

- The proportion of fee-based revenues and assets for financial advisors experienced another annual increase, with further growth in discretionary accounts.

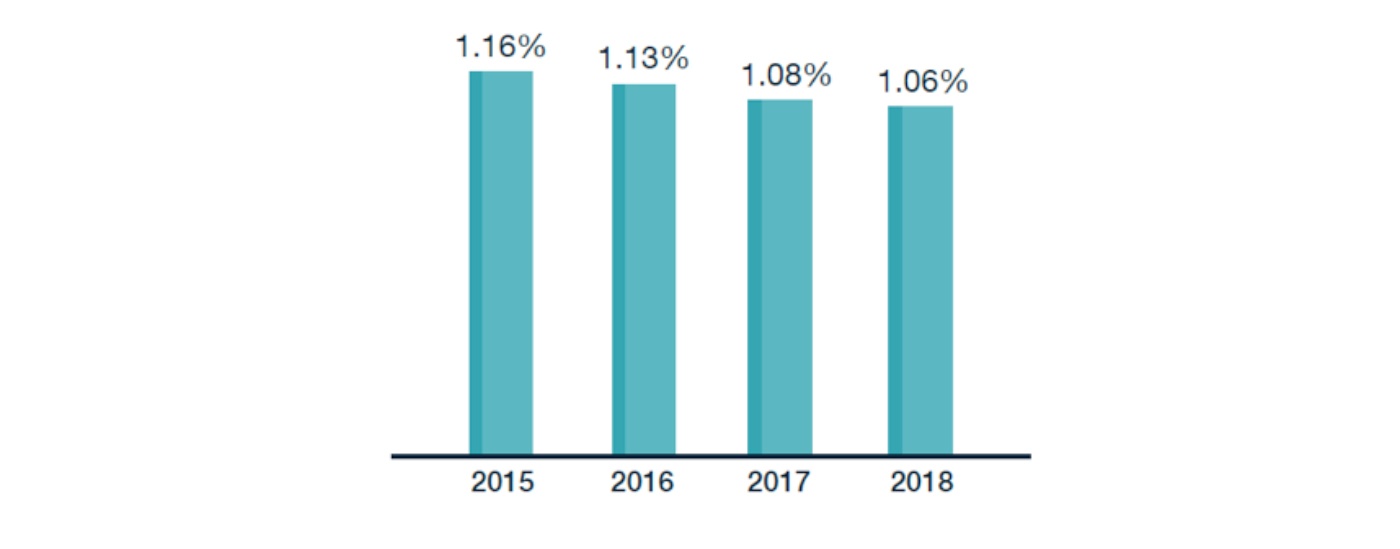

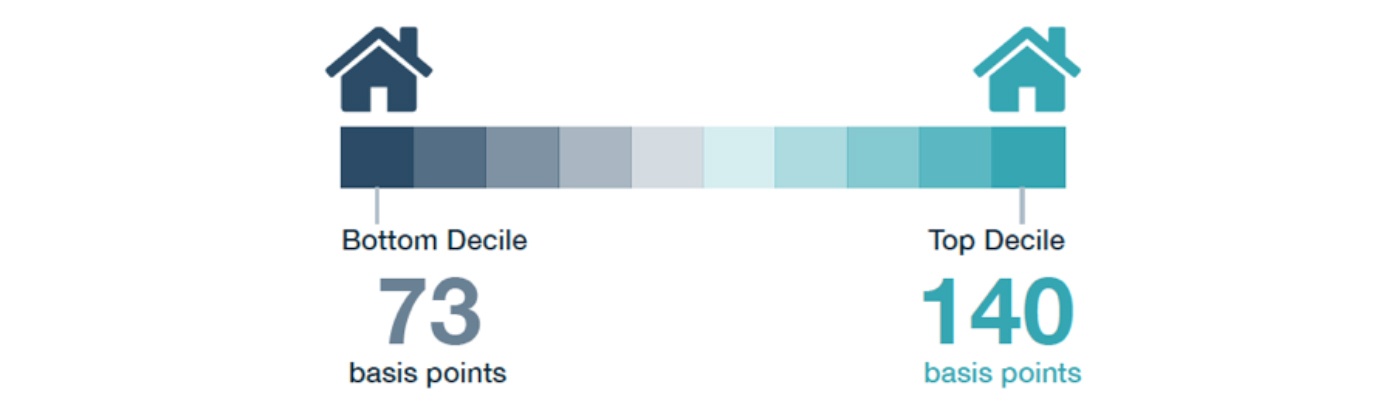

- The drop in fee pricing appears to have found some stabilization, though significant variations exist in aggregate between the highest and lowest fee levels.

- Further inroads were made in developing “next-generation clients,” and there are signs that development of younger financial advisors has turned a corner.

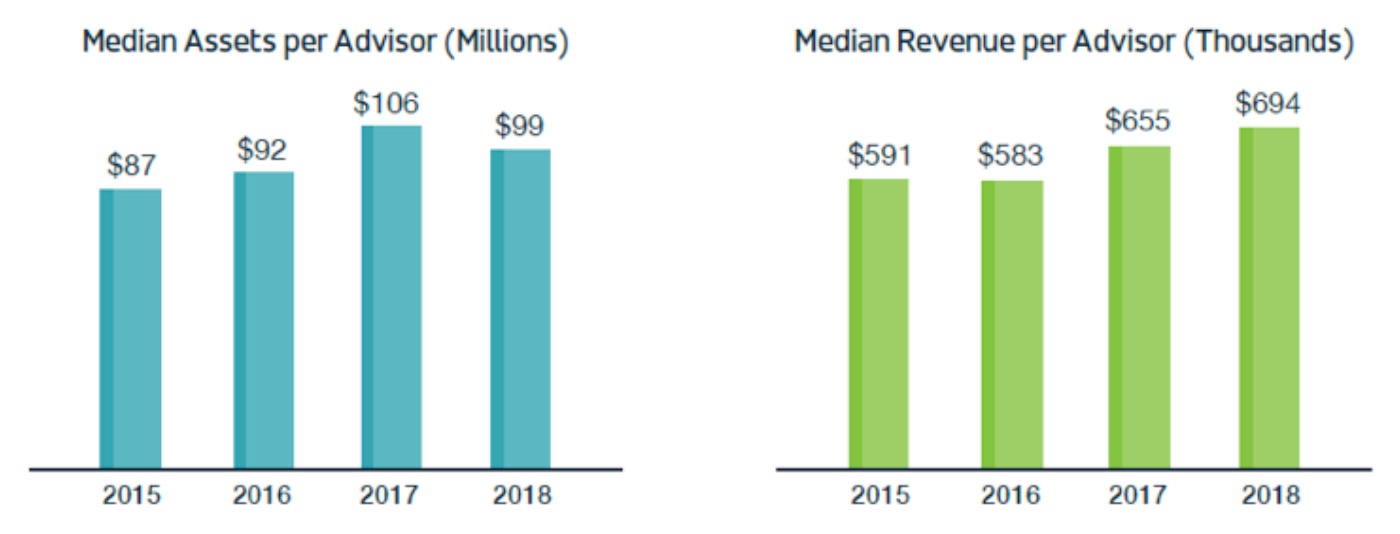

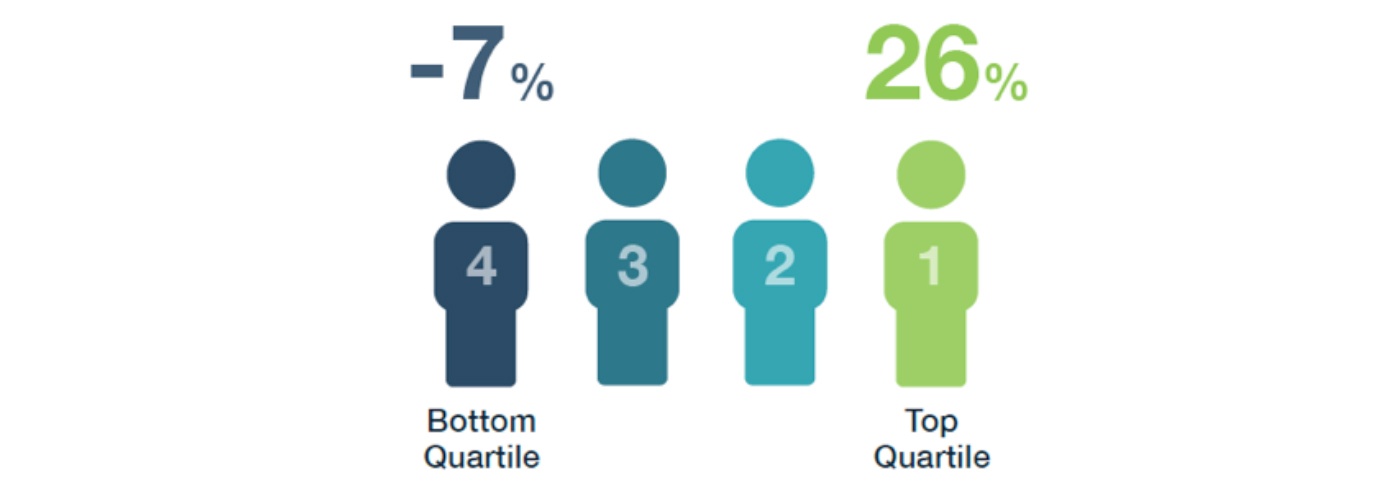

According to PriceMetrix, median revenues per advisor grew by 6% to a record $694,000 in 2018. Yet median assets managed per advisor declined 7%, primarily due to market conditions, says PriceMetrix.

FIGURE 1: 2018 MEDIAN ASSET AND REVENUE PERFORMANCE PER ADVISOR

Source: PriceMetrix, “The State of Retail Wealth Management 2018,” April 2019

Source: PriceMetrix, “The State of Retail Wealth Management 2018,” April 2019

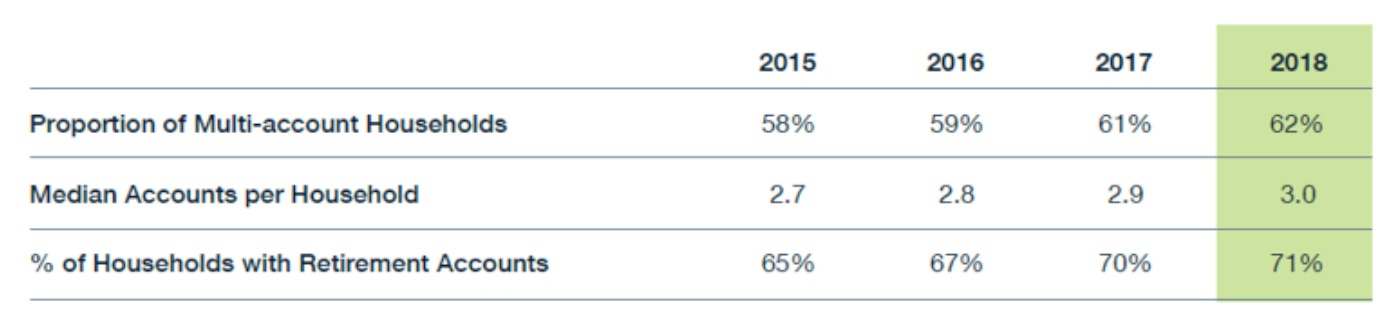

In addition to adding more new client relationships, says PriceMetrix, advisors continued a recent trend of deepening existing relationships:

Source: PriceMetrix, “The State of Retail Wealth Management 2018,” April 2019

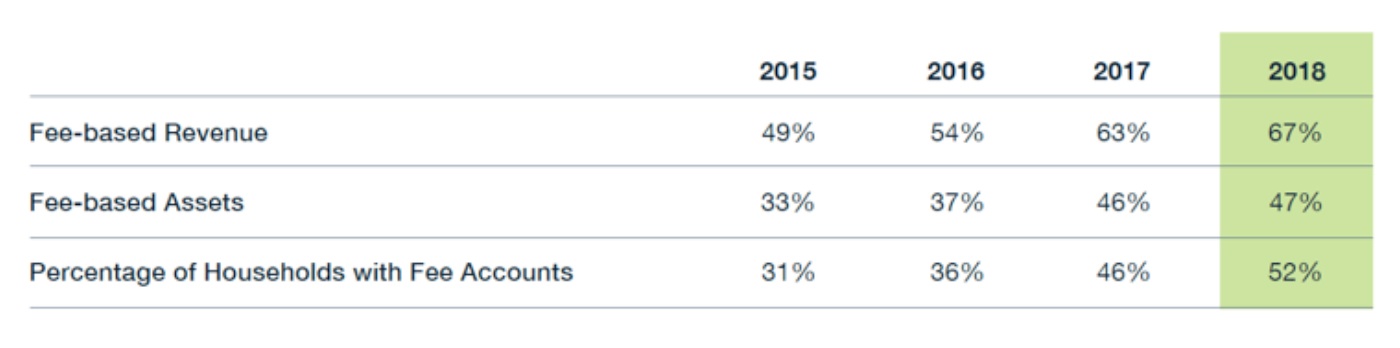

PriceMetrix says that another key driver of advisor revenue growth was “the continued proliferation of fee-based accounts.” Revenues from fee accounts grew by 17% in 2018 over 2017.

PriceMetrix reports,

Source: PriceMetrix, “The State of Retail Wealth Management 2018,” April 2019

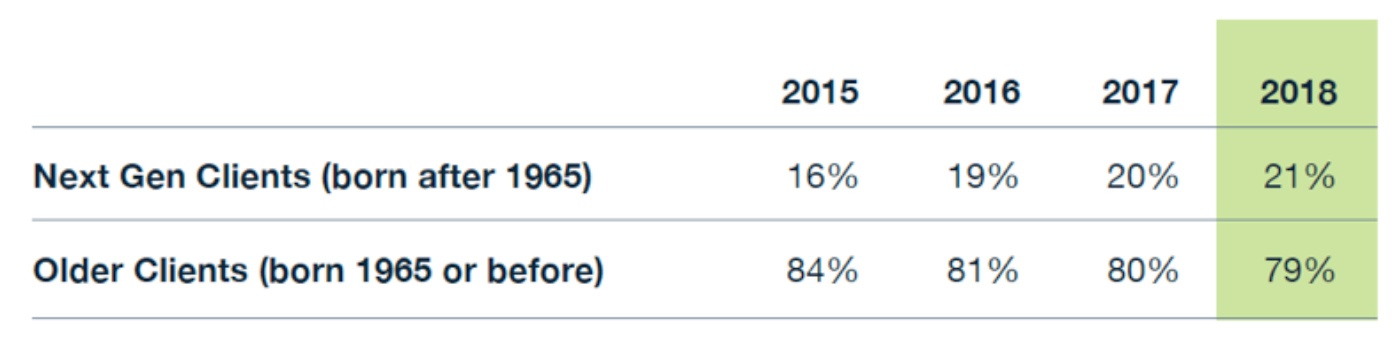

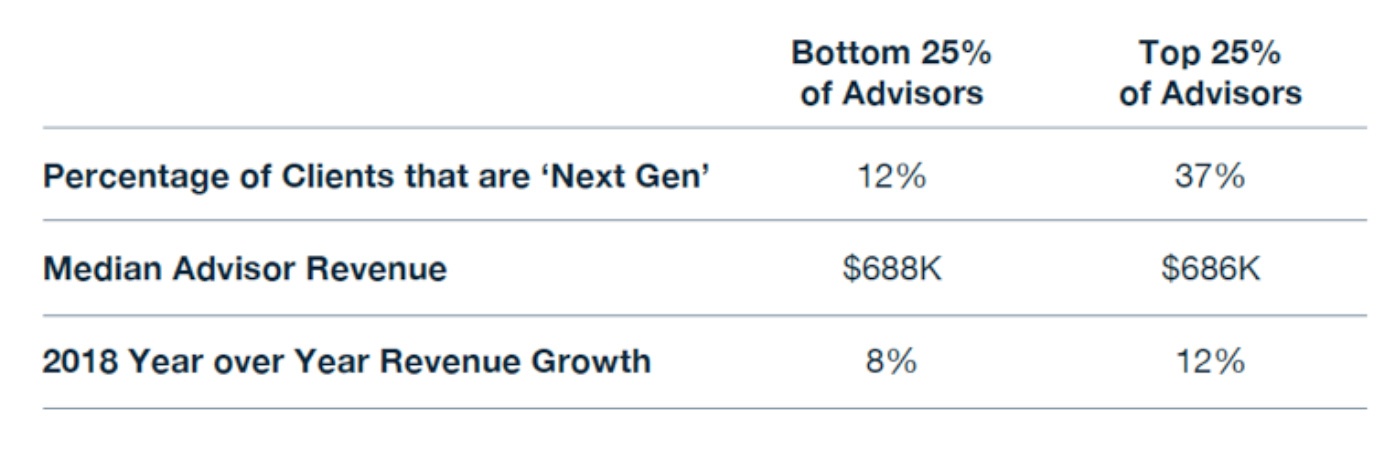

PriceMetrix sees a quantifiable opportunity for advisors who are actively seeking to add younger individuals and families as clients of their firms. The study notes that assets for next-generation clients (those born after 1965) have grown by 6.1% since 2015, compared to 3.5% asset growth over the same period for older clients.

Source: PriceMetrix, “The State of Retail Wealth Management 2018,” April 2019

FIGURE 2: FEE RATES FOR HOUSEHOLDS WITH MANAGED ASSETS OF

$1 MILLION–$1.5 MILLION

Source: PriceMetrix, “The State of Retail Wealth Management 2018,” April 2019

Source: PriceMetrix, “The State of Retail Wealth Management 2018,” April 2019

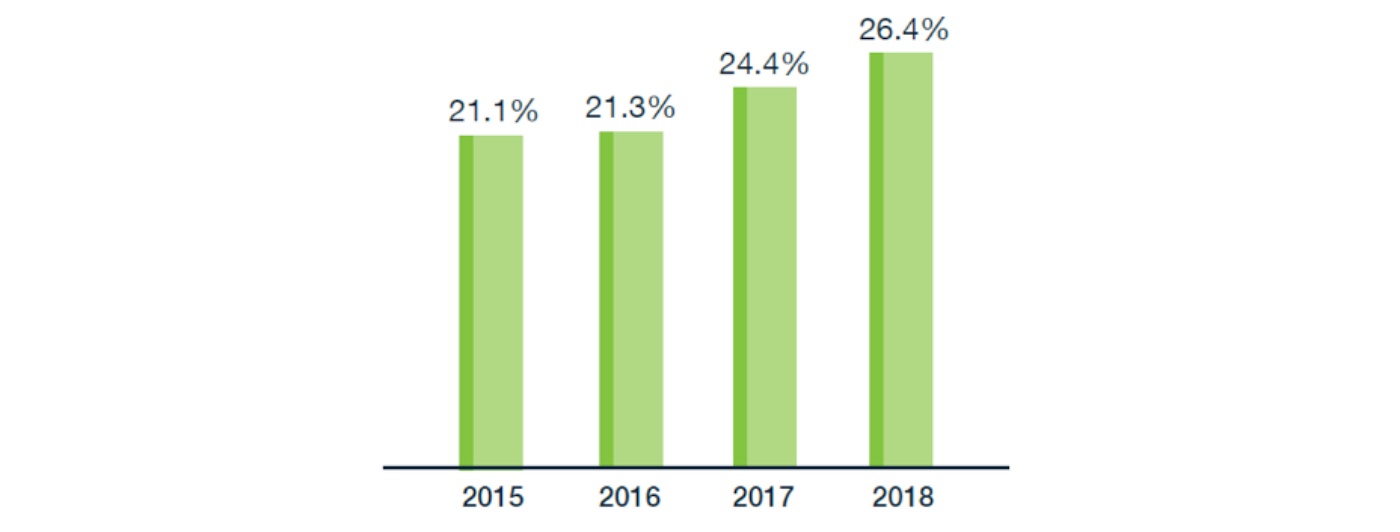

“One of the results of more advisors finding the right growth formula is that the industry is seeing more ‘big producers.’ The percentage of FAs who gross more than $2 million in production has grown from 6.1% in 2015 to 8.4% in 2018, and the assets controlled by these top producers have increased from 21.1% to 26.4% in that same time period.

“However, with more big producers than ever before, firms are more exposed to one of the biggest threats to growth—the size of advisors themselves. When advisors achieve a certain size, many choose to stop growing—in essence, they achieve ‘enough.’ If not managed, this inertia can have a dramatic impact on the performance of wealth management firms overall.”

Source: PriceMetrix, “The State of Retail Wealth Management 2018,” April 2019

Source: PriceMetrix, “The State of Retail Wealth Management 2018,” April 2019

Source: PriceMetrix, “The State of Retail Wealth Management 2018,” April 2019

PriceMetrix believes that the trends identified in 2018 have direct implications for advisory firms and individual financial advisors seeking improved revenue growth moving forward. Their findings include the following:

- “Wealth management leaders will need to deeply understand the product and service preferences of next generation clients, to adapt and ensure they can continue to attract these important clients in the years to come. Advisors with younger books are growing at a faster rate than those with older books, reinforcing the impact that next generation clients can have on growth.”

- “The most common way for new advisors to enter the wealth management industry is by joining an established team: 68% of advisors under 40 years of age work as part of a team. Working as part of an established team allows new advisors to build experience and expertise. And the team benefits as well: teams with next generation advisors grow at a faster rate, add more clients, and lose fewer clients than their counterparts.”

- “Clearly, advice in wealth management is not a commodity. Even today, when pricing is more transparent than ever, some clients are just as satisfied paying double what others pay. Premium propositions, with premium price tags, resonate just as well as cheaper ones. The challenge for advisors (and the firms they work for) is to ensure that the value they deliver aligns with the price they charge.”

- “Advisors who are large, and who continue to grow, have a higher proportion of revenues from fees, service larger clients, and charge higher rates. Even at these very large book sizes, advisors can make decisions that will lead to continued growth. Perhaps the bigger challenge for firm executives is managing the desire for continued growth amongst their top producers.”

- “The reward for firms that help their advisors make informed choices about pricing and demographics is worth a substantial investment. Firms can impact their revenue growth rate by 3 to 5% by encouraging advisors to pursue new next generation client relationships. Programs that help advisors price with confidence can add 5 to 7% in additional revenues.”

The study concludes, in part,

David Wismer is editor of Proactive Advisor Magazine. Mr. Wismer has deep experience in the communications field and content/editorial development. He has worked across many financial-services categories, including asset management, banking, insurance, financial media, exchange-traded products, and wealth management.

David Wismer is editor of Proactive Advisor Magazine. Mr. Wismer has deep experience in the communications field and content/editorial development. He has worked across many financial-services categories, including asset management, banking, insurance, financial media, exchange-traded products, and wealth management.