Over the last few months, bond investors have been hit with the worst combination of rate moves.

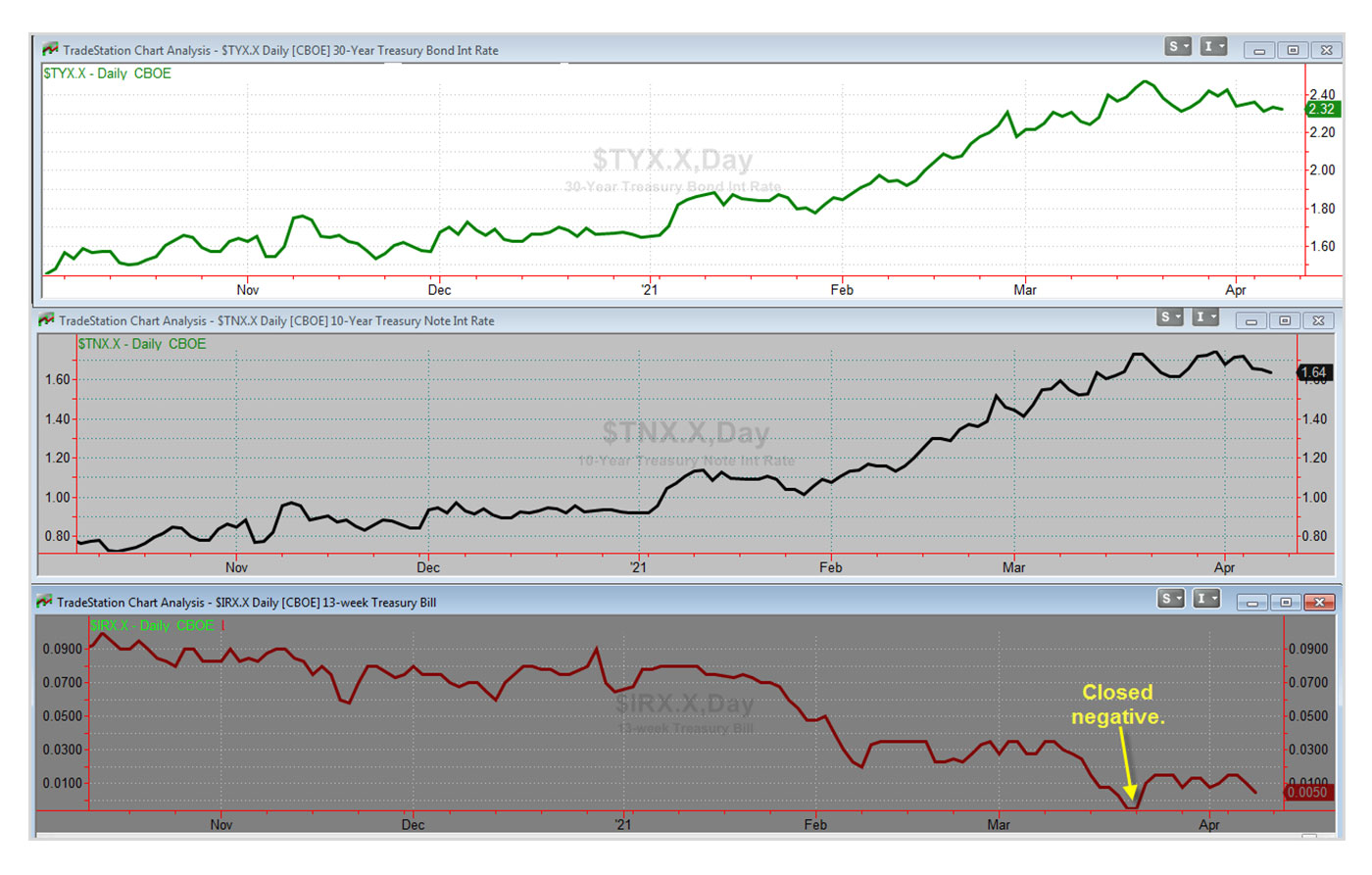

Rates for intermediate- and long-duration bonds have been rising rapidly, while very short-term rates have continued to decline. This can be seen in Figure 1, which shows the 30-year Treasury rate (top), 10-year Treasury rate (middle), and the 13-week Treasury rate (bottom).

Source: Quantifiable Edges. Charts created in TradeStation.

The rise in long-term rates has caused TLT (the iShares 20-year Treasury bond ETF) to lose more than 20% from its closing high on Aug. 4, 2020, to its March 2021 low—that includes dividends paid over this time. A decline that large can be tough to make back when the current yield is just 2.3%.

But the drop in rates on the short end has also been painful.

The 13-week Treasury rate actually closed negative on March 19 and 22! Yes, we had negative rates in the U.S. a few weeks ago, and they could get there again.

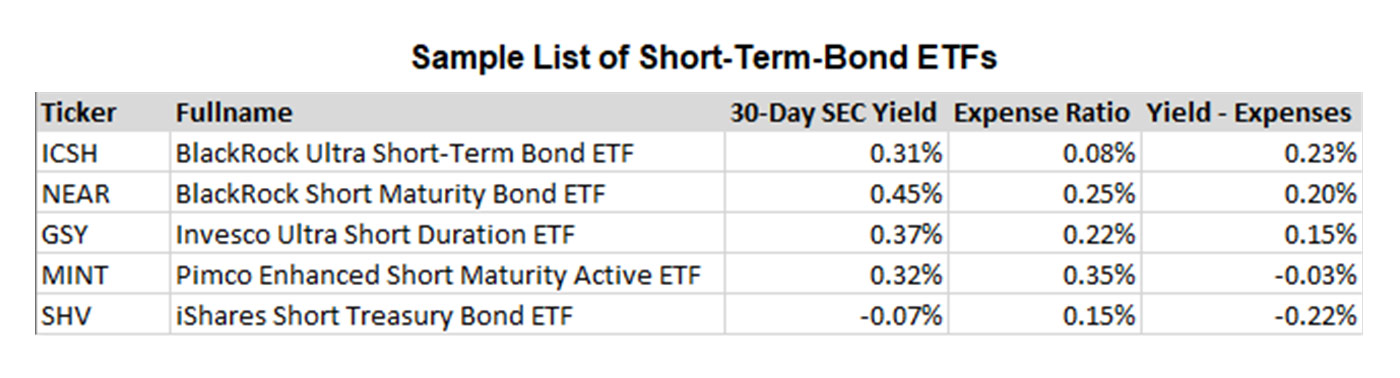

Even with slightly positive rates, many short-term-bond ETFs are struggling to keep their yield above their expense ratio. And the only way some are managing to do so is with a big chunk of their bond holdings in BBB or lower-rated securities. Of course, yields below expense ratios over an extended period means a negative return in those assets. Table 1 provides a list of some of the more popular short-term-bond ETFs along with their stated 30-day SEC yield and expense ratios. (Data was taken from their respective websites on April 8, 2021.)

TABLE 1: COMPARISON OF SHORT-TERM-BOND ETF YIELDS AND EXPENSE RATIOS

Source: Quantifiable Edges

The Federal Reserve is not likely to remove pressure on short-term rates anytime soon. But recently that has meant bond investors have been losing on the long end, and also struggling to break even on the short end.

This is leaving many bond investors looking for ways to diversify into potential replacement strategies. This could include short-term trading or fixed-income rotation strategies with long/short capability—along with other strategies.

I have long been a believer that using active/tactical strategies and applying a risk-managed approach to portfolios are perhaps the best ways to adapt to ever-changing market conditions.

A primary focus of mine at Capital Advisors 360 is developing and instituting alternative strategies with low correlation to both stocks and bonds. “Buy and hold” for fixed income has generally worked for generations as rates slowly declined, but recent action in the bond market has emphasized the need for other options. I don’t see that changing in the foreseeable future.

Rob Hanna has worked in the investment industry since 2001. He is the founder and publisher of Quantifiable Edges, a quant-based website where he also publishes a newsletter. After managing a private investment fund through Hanna Capital Management LLC from 2001 to 2019, Rob joined Capital Advisors 360, where he now serves as a registered investment advisor and focuses on short-term and quantitative strategies. quantifiableedges.com

Rob Hanna has worked in the investment industry since 2001. He is the founder and publisher of Quantifiable Edges, a quant-based website where he also publishes a newsletter. After managing a private investment fund through Hanna Capital Management LLC from 2001 to 2019, Rob joined Capital Advisors 360, where he now serves as a registered investment advisor and focuses on short-term and quantitative strategies. quantifiableedges.com