When interest rates rise, bonds decrease in value. Again, when interest rates rise, bonds decrease in value.

But, do they really decrease in value?

I’ve been to my share of conferences and have seen enough talking heads on various financial networks to recognize how pervasive this belief is, and how much fear it inspires within institutional and retail investors.

Right now the Fed chief is being pressured to hold off on increasing interest rates—or even to begin a process of decreasing interest rates in an economy that is doing very well. That seems contradictory, but, as always, future conditions will dictate which direction rates will go.

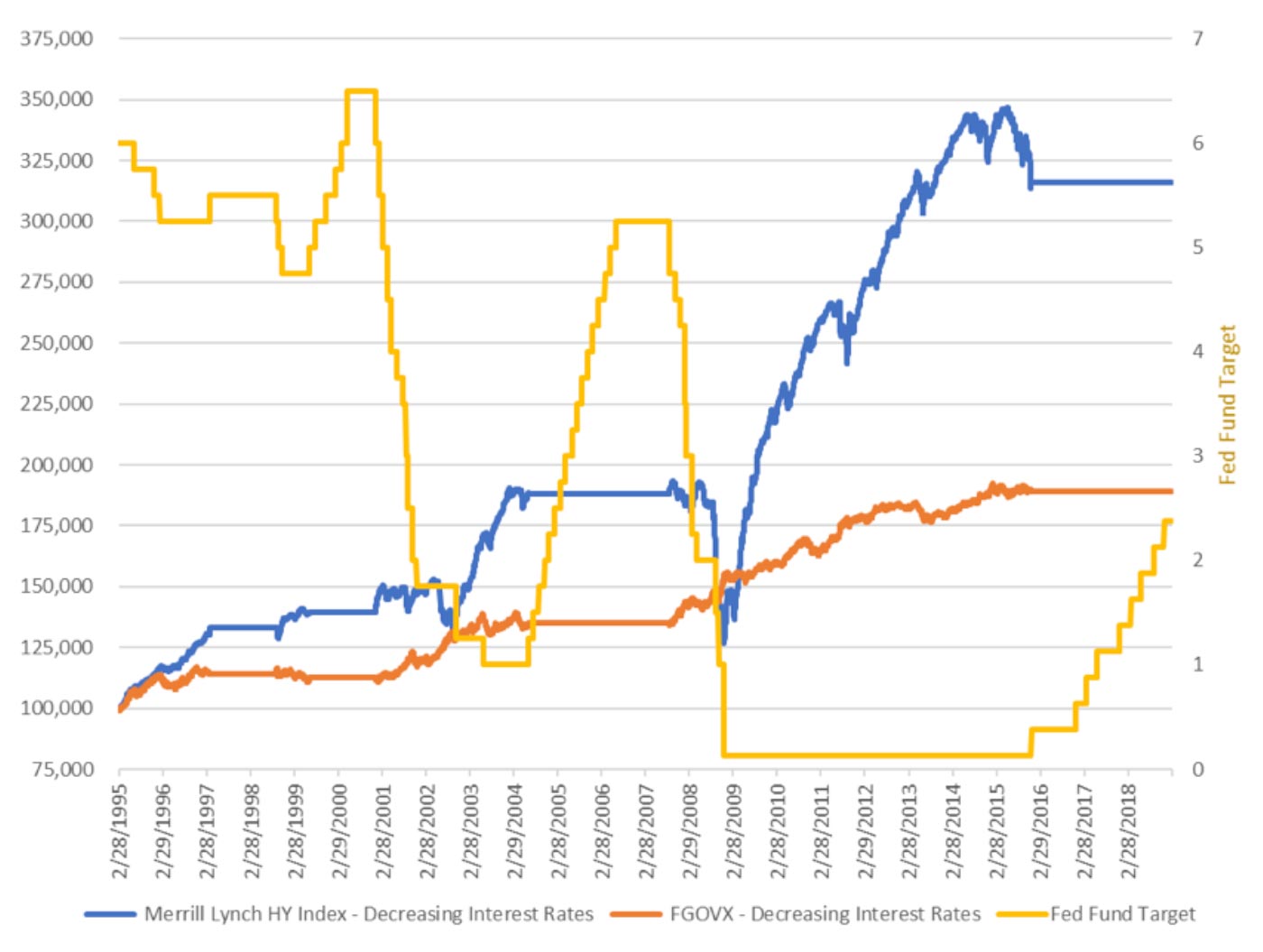

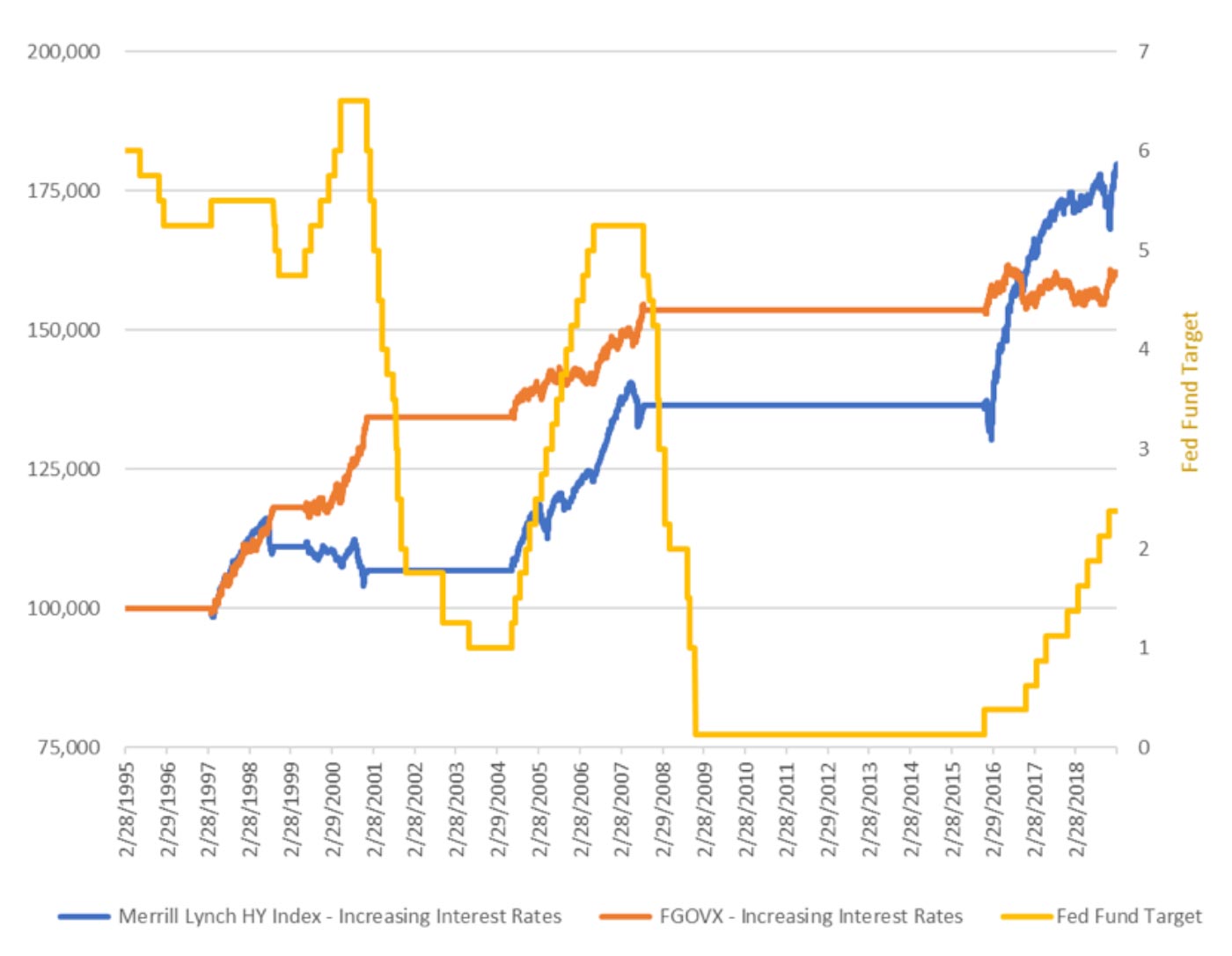

In the meantime, I’ve heard many advisors claim that bonds have run their course. So, I decided to trace the changes to the fed fund target rate going back to 1995 via the St. Louis Fed data portal. I then pulled the historical total return data of the Merrill Lynch High Yield Master 2 Index (as an alternative to the larger and older high-yield ETFs that entered the market in 2007/2008) and also of the Fidelity Government Income Fund, which closely represents the behavior of U.S. government intermediate bonds.

Because the mantra “when interest rates rise, bonds decrease in value” has been so ingrained in me, I expected a real mess of an equity curve with U.S. government bonds and a little less with high-yield bonds.

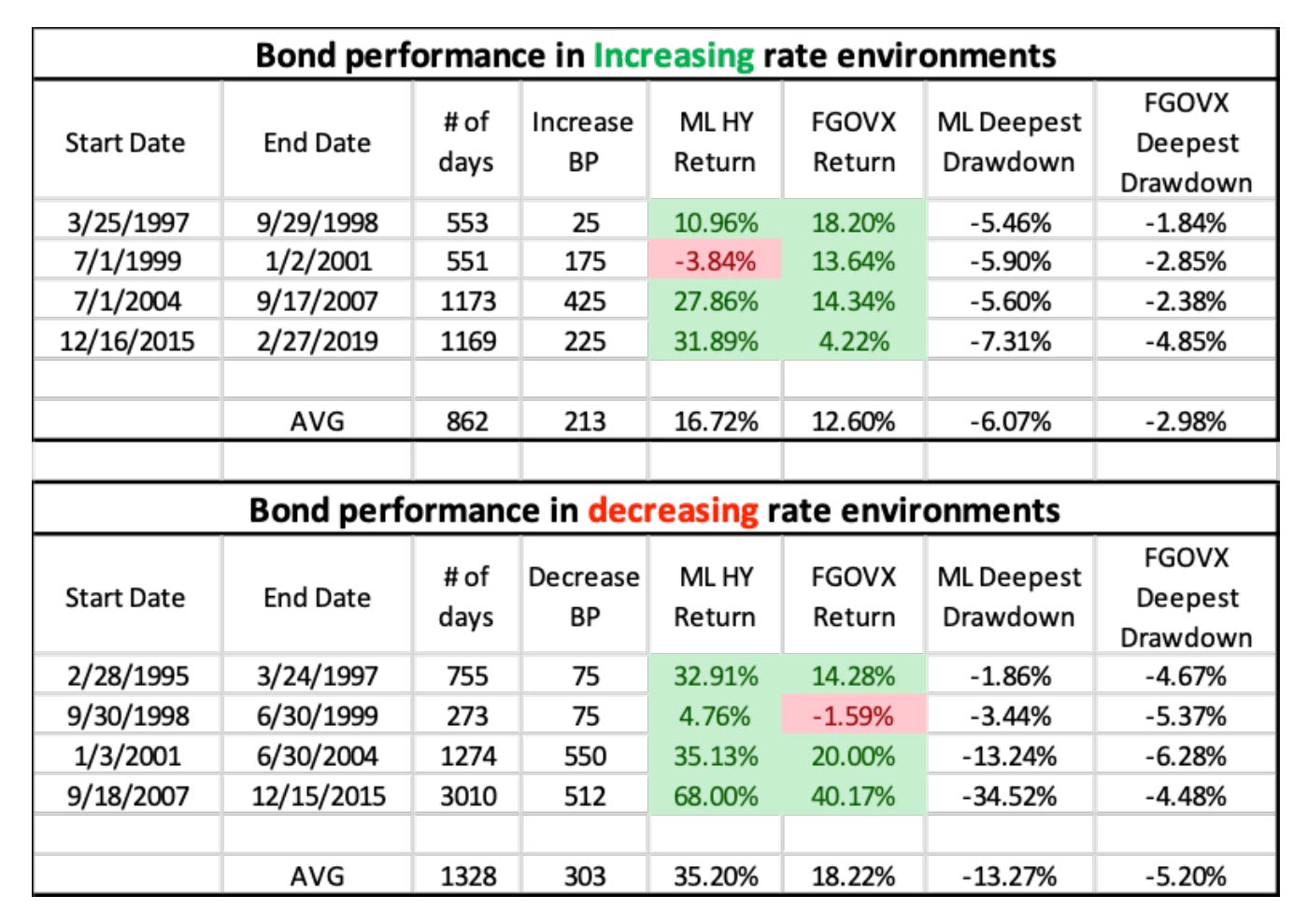

To my surprise, I found that during four recent periods of increasing interest rates, intermediate U.S. government bonds increased (yes, increased) in value 100% of the time.

In addition, the drawdown statistics were surprisingly low. Intermediate U.S. government bonds averaged 12.6% return with an average 3% maximum drawdown in those periods. High-yield bonds increased (yep) in value 75% of the time. The rising rate period between July 1, 1999, and Jan. 2, 2001, handed high-yield bonds their only shallow loss. This makes sense due to the high correlation of equities and high-yield bonds during the bear market period of 2000–2002. High-yield bonds averaged 16.7% return with an average 6.1% maximum drawdown.

“When interest rates decrease, bonds increase in value” is close to a home-run assumption, except for some painful periods.

In the four decreasing-rate environments studied, intermediate U.S. government bonds increased in value 75% of the time—the one exception being a very shallow loss in the period from Sept. 30, 1998, to June 30, 1999. However, the deepest drawdowns were worse in the decreasing-rate environments than the increasing-rate environments. Intermediate U.S. government bonds averaged 18.2% return with an average 5.2% maximum drawdown. High-yield bonds were profitable in all four decreasing-rate environments, but their deepest drawdowns in the periods from Jan. 3, 2001, to June 30, 2004, and from Sept. 18, 2007, to Dec. 15, 2015, were extremely painful. High-yield bonds, because of their high correlation to equities, got walloped during the steep 2008 bear market. High-yield bonds averaged 16.7% with an average 13.3% deepest drawdown.

So, the mantras of what happens to bond behavior during different interest-rate environments really should be re-examined (at least based on the behavior for the past 24-plus years). However, active management techniques of curtailing risk are definitely needed in times of excess volatility and/or market distress. Most financial advisors I know are relatively comfortable understanding the inevitable cycles of equities, but understanding bond behavior can be more challenging. While outsourcing investment strategies to professional managers makes sense for both asset classes, this is especially true for bond exposure. Whatever the case, bonds are needed in portfolios and shouldn’t be feared.

Note: ML HY refers to Merrill Lynch High Yield Master 2 Index and FGOVX refers to Fidelity Government Income Fund. BP refers to basis points.

Source: Ian Naismith, kensingtonanalytics.com

Source: Ian Naismith, kensingtonanalytics.com

Source: Ian Naismith, kensingtonanalytics.com

Ian Naismith is a partner and the index designer of Smooth Sailing Indexes Inc., which is a leader in tactical “risk-on/risk-off” index development. Mr. Naismith has been analyzing and trading the markets since the early 1990s. He is a member of the National Association of Active Investment Managers (NAAIM) and has also served as board member and president. www.smoothsailingindexes.com

Ian Naismith is a partner and the index designer of Smooth Sailing Indexes Inc., which is a leader in tactical “risk-on/risk-off” index development. Mr. Naismith has been analyzing and trading the markets since the early 1990s. He is a member of the National Association of Active Investment Managers (NAAIM) and has also served as board member and president. www.smoothsailingindexes.com