As recently as late September, our publication was commenting on “Crude oil’s relentless march higher.”

About a week after that article was published, prices for front-month futures for WTI crude oil started a notable descent from its 2023 high of over $90 per barrel.

For much of October, crude oil markets struggled to assess the impact of the turmoil in the Middle East, trading in volatile spurts but remaining in the $80–$90 range.

November then saw a steady decline in prices to the current level in the low $70s.

FIGURE 1: WTI CRUDE OIL NEAR-MONTH FUTURES PRICE TREND FOR 2023

Source: MarketWatch

Along with the falling price of oil, U.S. consumers are experiencing a welcome reduction in the retail price of gasoline at the pump.

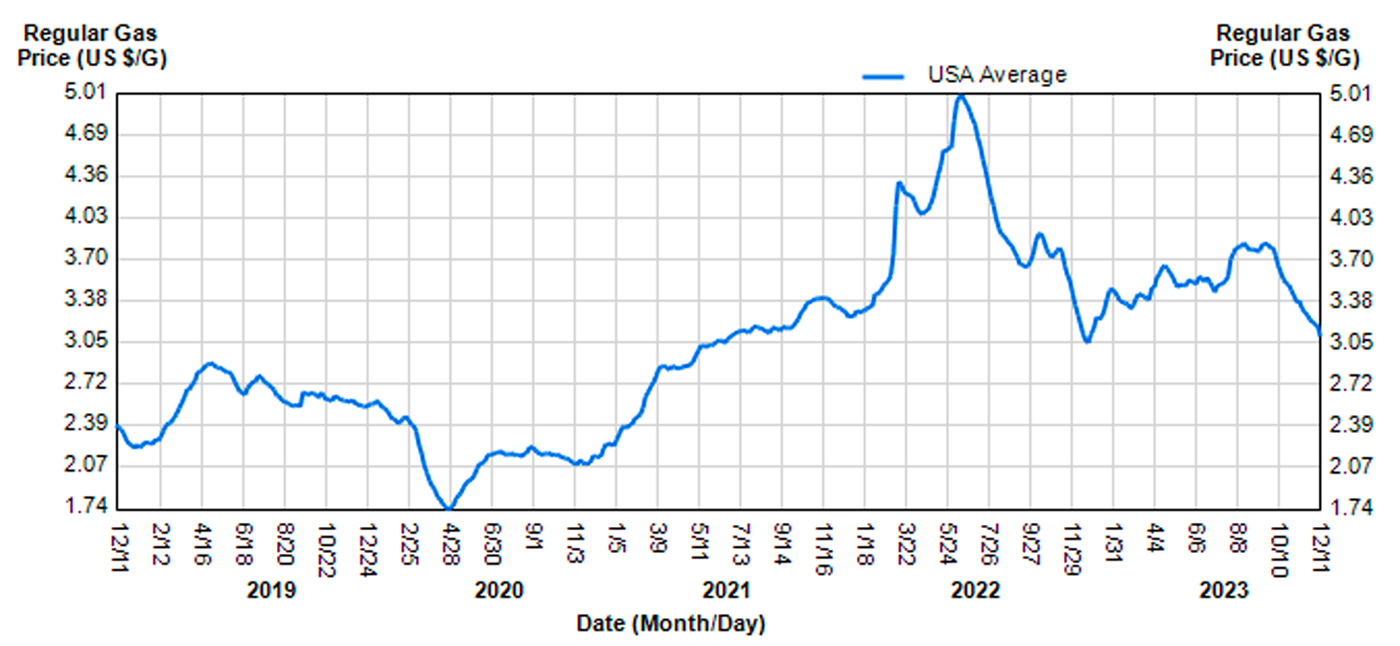

FIGURE 2: RETAIL GASOLINE PRICE TREND PER GALLON OF REGULAR (2018–2023)

Source: GasBuddy.com

What has been driving the decline in crude oil and gas prices?

With heightened tensions in the Middle East and the ongoing Ukraine-Russia conflict, the significant decrease in crude oil prices and gasoline seems counterintuitive on the surface.

Trading Economics provided this analysis for the week ending Dec. 8:

“WTI crude futures rose above $71 per barrel on Friday in likely technical-related buying, but were still set to lose more than 5% this week amid signs of increasing global supplies and weakening demand. Data released earlier in the week showed that US gasoline inventories jumped by 5.4 million barrels last week, the biggest increase in nine weeks and much higher than forecasts of 1 million barrels, indicating weaker demand. Adding to bearish sentiment, BEA data showed that US crude exports were near a record 6 million barrels a day in October, with flows to Europe and Asia showing a steady increase. Heightened economic uncertainties in top crude importer China also weighed on the market, with Moody’s cutting its outlook on China’s government credit rating from stable to negative. Meanwhile, OPEC+ members announced additional cuts of 2.2 million bpd last week, but more than 1.3 million were extensions of voluntary reductions by Saudi Arabia and Russia.”

Reuters reported over the weekend on further issues regarding economic conditions in China, which is facing a deflationary environment and sagging demand among consumers in many areas. This adds to the pressure on global demand for crude oil:

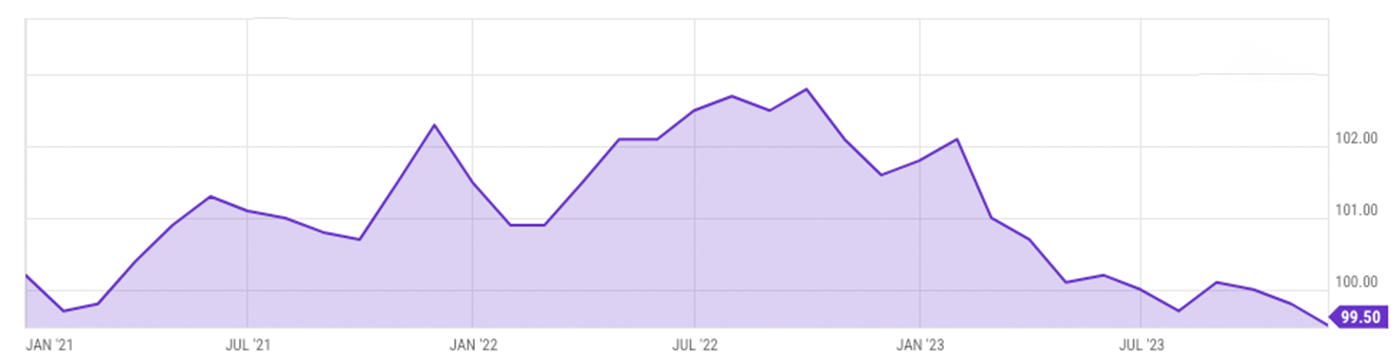

“China’s consumer prices fell the fastest in three years in November while factory-gate deflation deepened, indicating rising deflationary pressures as weak domestic demand casts doubt over the economic recovery. …

“The numbers add to recent mixed trade data and manufacturing surveys that have kept alive calls for further policy support to shore up growth.

“Xu Tianchen, senior economist at the Economist Intelligence Unit, said the data would be alarming for policymakers and cited three main factors behind it: falling global energy prices, the fading of the winter travel boom and a chronic supply glut.

“‘Downward pressure will continue to rise in 2024 as developers and local governments continue to deleverage and as global growth is expected to slow,’ Xu said.”

FIGURE 3: CHINA’S DEFLATION CHALLENGE—CONSUMER PRICE INDEX

Sources: National Bureau of Statistics of China, YCharts

Industry experts review the backdrop for falling oil prices

CNN recently interviewed Jim Mitchell and Corey Stewart, oil analysts at LSEG, looking to “better understand the dynamics pushing down the price of oil.”

In the lengthy interview, several comments were highly relevant to current oil pricing:

“Stewart: ‘You’ve seen where we were maybe a bit undersupplied on the crude oil for a while, supporting higher prices. And as we moved out of the traditional driving season when we’d see more crude runs, it was only natural for prices to come down a little bit. A fall towards the end of the year is not necessarily surprising, as we move probably from an undersupply to a slight oversupply in the crude oil market here in the near term. It looks dramatic, and it is, but I think you can see how this will play out based on seasonality. …’

“Mitchell: ‘Prices were creeping past $90 a barrel just a few months ago, and so there was a lot of incentive for other countries, including the US, to start producing more energy.

“‘Now we’re seeing record production in some parts of the US, so it’s going to be more difficult for OPEC to implement some of the tactics that it’s used before to limit supply and bring prices back up. It’s not going to work.

“‘There are other issues. OPEC is not talking about Libya, for example. Libya doesn’t have a quota and is now producing about 1.1 million barrels of oil per day. Iran is producing 3.2 million, and the oil minister said he wants to get to 3.6 million by the end of the first quarter next year. So they’re ramping up and at the same time, Saudi Arabia is still making cuts. …’

“Stewart: ‘I do see the first part of the year [2024] starting out a little lower. If we see a weakening economy, it will impact demand and send prices lower. But by and large, if you just look at history we have seen petroleum demand growth nearly every single year.’”

The opinions expressed in this article are those of the author and the sources cited and do not necessarily represent the views of Proactive Advisor Magazine. This material is presented for educational purposes only.

RECENT POSTS