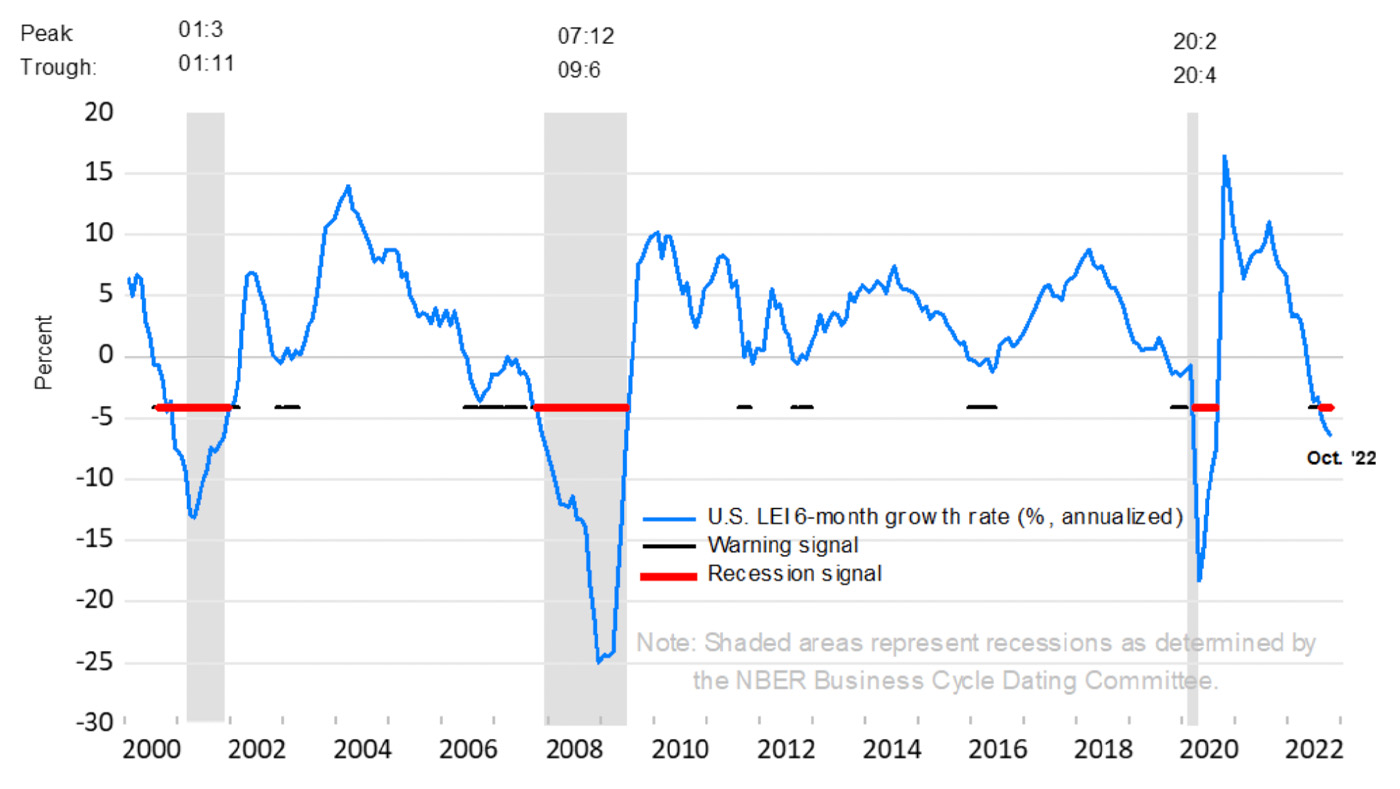

The Conference Board’s most recent report on the Leading Economic Index (LEI) showed a decline for October, down 0.8% from the previous month. According to Fox Business, that follows a 0.5% decline in September.

The Conference Board’s press release noted,

“The LEI is now down 3.2 percent over the six-month period between April and October 2022, a reversal from its 0.5 percent growth over the previous six months.

“‘The US LEI fell for an eighth consecutive month, suggesting the economy is possibly in a recession,’ said Ataman Ozyildirim, Senior Director, Economics, at The Conference Board. ‘The downturn in the LEI reflects consumers’ worsening outlook amid high inflation and rising interest rates, as well as declining prospects for housing construction and manufacturing. The Conference Board forecasts real GDP growth will be 1.8 percent year-over-year in 2022, and a recession is likely to start around yearend and last through mid-2023.’”

FIGURE 1: THE LEI DIFFUSION INDEX SHOWS A STRONG RECESSION SIGNAL

Source: The Conference Board

Recession prospects and corporate earnings

On the possibilities for a recession, Canaccord Genuity’s Tony Dwyer said in a Dec. 5 research note,

“The current level of possible yield curve inversions (82.2%) has historically led to a recession each time. It can happen well before an economic downturn, but is a sign that one is coming. There was no mid-cycle slow down or ‘soft landing’ associated with a reading over 55%. … Whenever the year-to-year change in the Conference Board Leading Economic Indicators hits the current level (-2.7), the economy is either in or very close to a recession. There were no soft landings associated with similar readings. …

“Investor focus heading into 2023 should turn to the challenge for economic growth rather than the risk of inflation and higher rates that are beginning to show up in an economic recession and weaker corporate data. We are lowering our 2023 EPS estimate to $210/share to reflect the lower expectation for year-end 2022. … We would enter 2023 with a more defensive posture, with an eye on adding risk as the market begins to more fully reflect the likelihood of recession.”

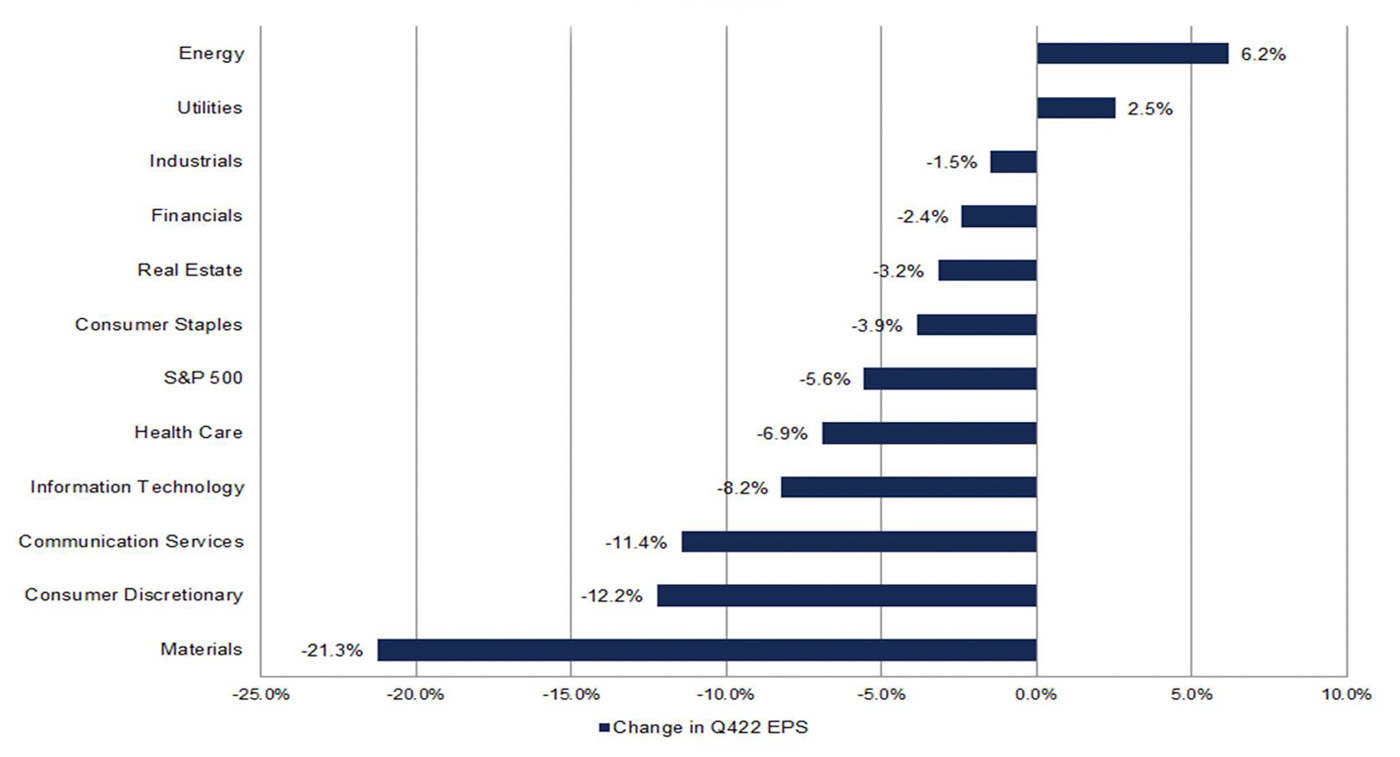

FactSet says of recent cuts in earnings forecasts,

“Given continuing concerns in the market about a possible recession, are analysts lowering EPS estimates more than normal for S&P 500 companies for the fourth quarter?

“The answer is yes. During the months of October and November, analysts lowered EPS estimates for S&P 500 companies for the fourth quarter by a larger margin than average. The Q4 bottom-up EPS estimate (which is an aggregation of the median EPS estimates for Q4 for all the companies in the index) decreased by 5.6% (to $54.58 from $57.79) from September 30 to November 30.”

The impact of these lower earnings forecasts can be seen in a sector analysis by FactSet for Q4 2022, where all sectors except Energy and Utilities have seen declining earnings projections.

FIGURE 2: S&P 500—SECTOR-LEVEL CHANGE IN Q4 2022 EPS ESTIMATES (9/30–11/30)

Source: FactSet

New this week: