The unseen rise of regulation

The unseen rise of regulation

While most people are acutely aware of the money they pay to the federal government in the form of income taxes, they may not know they indirectly pay for a whole host of other federal initiatives in the form of regulations.

This is because the cost of complying with regulations by businesses is not captured in the federal budget, which only counts its tax revenues, mandatory spending on entitlements like Social Security, and direct spending appropriated by Congress.

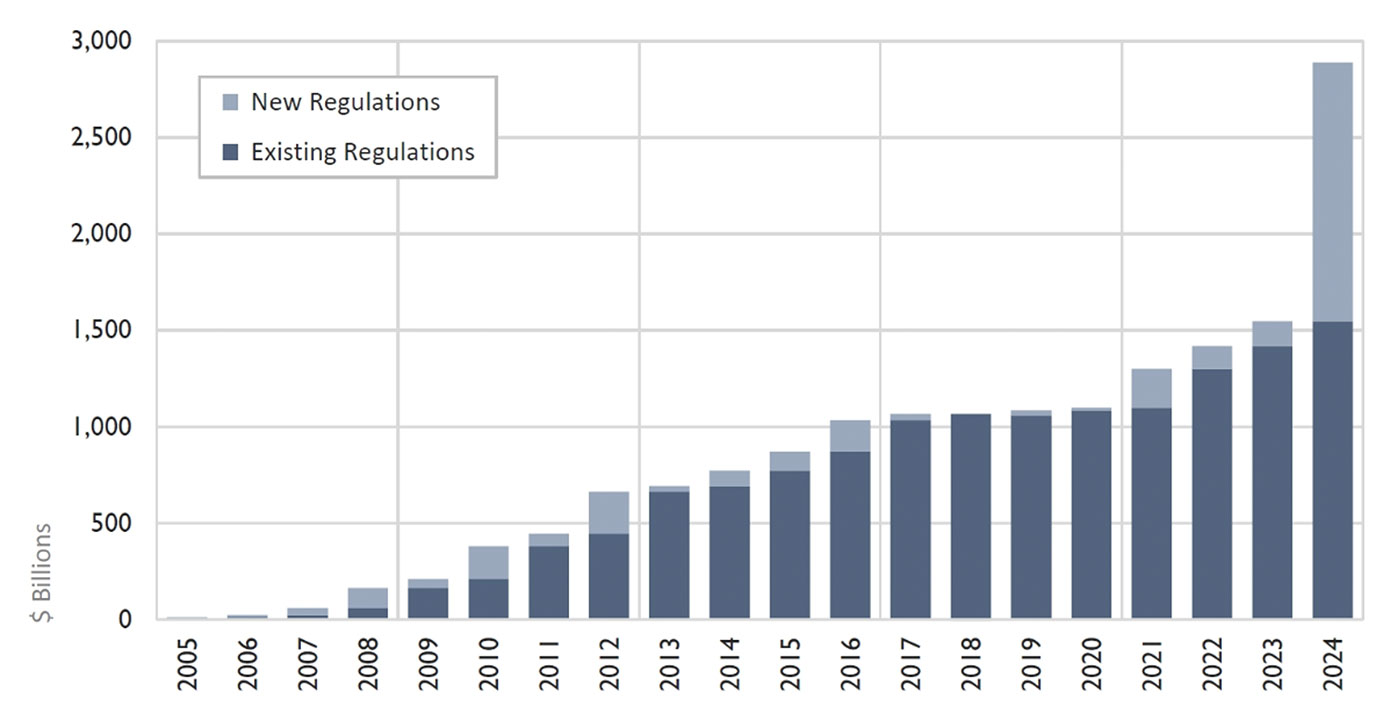

U.S. FEDERAL REGULATORY COSTS BY YEAR (2005–2024, FINALIZED)

Sources: Regulation Rodeo, U.S. Federal Register

Executive departments, like the Department of Defense, and independent agencies, like the Federal Communications Commission, have the power to propose, adopt, and enforce rules and regulations on businesses, as well as on state and local governments.

The chart above displays the total lifetime economic cost of finalized regulations, as estimated by the agency that wrote the regulation. But only about 10% of the finalized regulations written into the Federal Register each year contain such estimates—so the nearly $3 trillion in costs displayed above may be a gross understatement of reality.

From an investment perspective, higher levels of regulation tend to favor either the largest companies, for which compliance costs make up a smaller portion of operating expenses, or smaller companies that may be exempt from certain regulations due to size limits written into them.

By some estimates, federal regulation costs households $15,000 per year—nearly equal to their income tax cost. While regulations are necessary, overregulation can drive up consumer prices, eliminate productive jobs, and undermine the innovation that drives future economic growth—the bedrock of investment growth.

Because regulatory costs are ultimately passed on to consumers, they function like inflation or taxes in a practical sense. This highlights the importance of investing in equities over the long run to maintain purchasing power.

From the behavioral viewpoint

What is going on?

- WYSIATI—“What you see is all there is”: Daniel Kahneman introduced this cognitive bias to describe the human tendency to make decisions or judgments based solely on the information readily available to them, without accounting for what they don’t know or haven’t considered. Analyzing the impact of the federal government without considering regulations is an example of this.

- Availability bias: We give more weight to information that is readily available or recent, even if it’s not the most relevant or accurate. It is much easier for us to see and analyze income taxes and government spending than the more nuanced but still important effects of regulation.

- Framing effect: We make decisions based on how information is presented. For example, a federal agency might present only how a regulation protects consumers without disclosing its cost to them.

What can investors do?

- Gain confidence by asking yourself and your financial advisor if there are important investing topics not apparent at the headline level that might be worth exploring.

- Develop a needs-based financial plan as a road map to illustrate the value of long-term investing. Make contributions whenever possible. Be realistic, and review and update the plan regularly as life circumstances change.

- Collaborate with a financial advisor, who can provide valuable perspective and guidance to help achieve your goals.

This is an edited version of an article that was first published by AthenaInvest on Dec. 5, 2024.

The opinions expressed in this article are those of the author and the sources cited and do not necessarily represent the views of Proactive Advisor Magazine. This material is presented for educational purposes only.

C. Thomas Howard, Ph.D., is the founder, CEO, and chief investment officer at AthenaInvest Inc. Dr. Howard is a professor emeritus in the Reiman School of Finance, Daniels College of Business at the University of Denver. Dr. Howard is the author of the book “Behavioral Portfolio Management” and co-author of “Return of the Active Manager.” AthenaInvest applies behavioral finance principles to investment management and also provides advisor coaching and educational resources.

C. Thomas Howard, Ph.D., is the founder, CEO, and chief investment officer at AthenaInvest Inc. Dr. Howard is a professor emeritus in the Reiman School of Finance, Daniels College of Business at the University of Denver. Dr. Howard is the author of the book “Behavioral Portfolio Management” and co-author of “Return of the Active Manager.” AthenaInvest applies behavioral finance principles to investment management and also provides advisor coaching and educational resources.

RECENT POSTS