As stocks impressively recovered from April’s pullback and the major indexes reached record highs, so-called meme stocks reappeared last week in serious fashion for the first time since 2021.

MarketWatch reported,

“Shares of GameStop Corp. and AMC Entertainment Holdings Inc. soared this week after trader Keith Gill, also known as ‘Roaring Kitty,’ made his eye-catching return to social media after a three-year hiatus.

“Gill was an influential figure in the meme-stock frenzy in 2021, and his flurry of posts on X—known as Twitter when Roaring Kitty burst into the stock-market spotlight—thrust GameStop and AMC to center stage once again. …

“‘It felt as though the market briefly took a trip back to 2021 this week after GameStop shares traded up as high as 119% on Monday morning, based on a single tweet posted by Keith Gill (a.k.a. Roaring Kitty), the infamous central figure of the 2021 meme-stock frenzy,’ CIBC Capital Markets analyst Stephanie Price wrote in a note published Thursday. ‘Rising interest rates had cooled the meme-stock craze over the last two years, and until now, Mr. Gill’s Twitter account had been silent since his 2021 testimony to Congress.’

“‘The moves this week have left many wondering if Roaring Kitty’s return to social media is a signal that retail traders are eyeing struggling companies and heavily shorted stocks once again,’ she added.”

What exactly are meme stocks?

Forbes notes that they are usually “unconventional, often-struggling companies that garnered a cult-like following among retail traders” in 2021.

MarketWatch observed that in addition to GameStop (GME) and AMC Entertainment Holdings (AMC), several of the most common names in the meme category include SunPower Corp. (SPWR), Maxeon Solar Technologies Ltd. (MAXN), MicroCloud Hologram Inc. (HOLO), Children’s Place Inc. (PLCE), Beyond Meat Inc. (BYND), Spirit Airlines Inc. (SAVE), Plug Power Inc. (PLUG), Koss Corp. (KOSS), BlackBerry Ltd. (BB), and Faraday Future Intelligent Electric Inc. (FFIE).

Forbes adds,

“Fueled by online communities and social media platforms, a collective of rogue retail traders banded together to drive up the share prices of these companies, defying conventional market wisdom. By leveraging platforms like Reddit’s WallStreetBets forum, traders shared investment strategies, rallied support, and executed a coordinated buying spree that sent shockwaves through Wall Street. …

“Has anything changed with their respective businesses? No, not really. They may have even further deteriorated, despite having plenty of cash as they take advantage of their nonsensical share prices to issue more shares.”

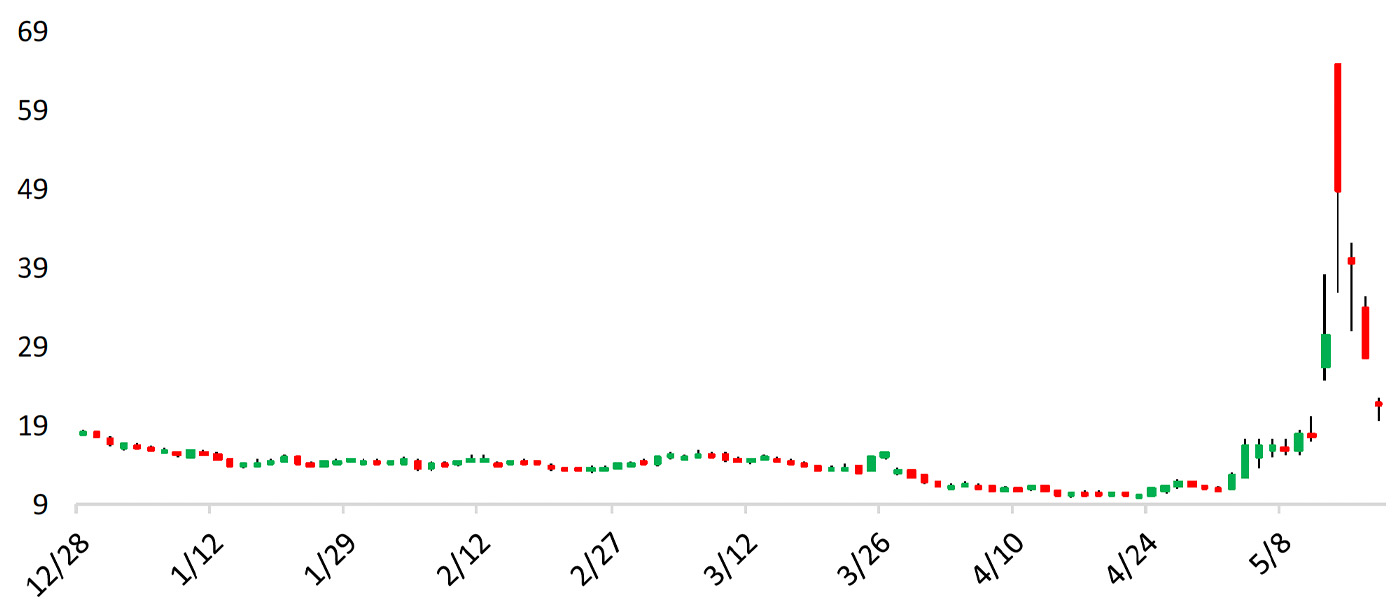

Interestingly, but not surprisingly, the extreme rallies for GameStop and AMC came to an end, at least temporarily, as both stocks gave back much—but not all—of their gains later last week. For example, GameStop rose from $17.46 at the close on May 10 to $64.83 on May 14, then dropped to $22.21 by the close on May 17.

FIGURE 1: GAMESTOP CORP. (GME)—RAPID RISE AND FALL LAST WEEK

Source: Bespoke Investment Group

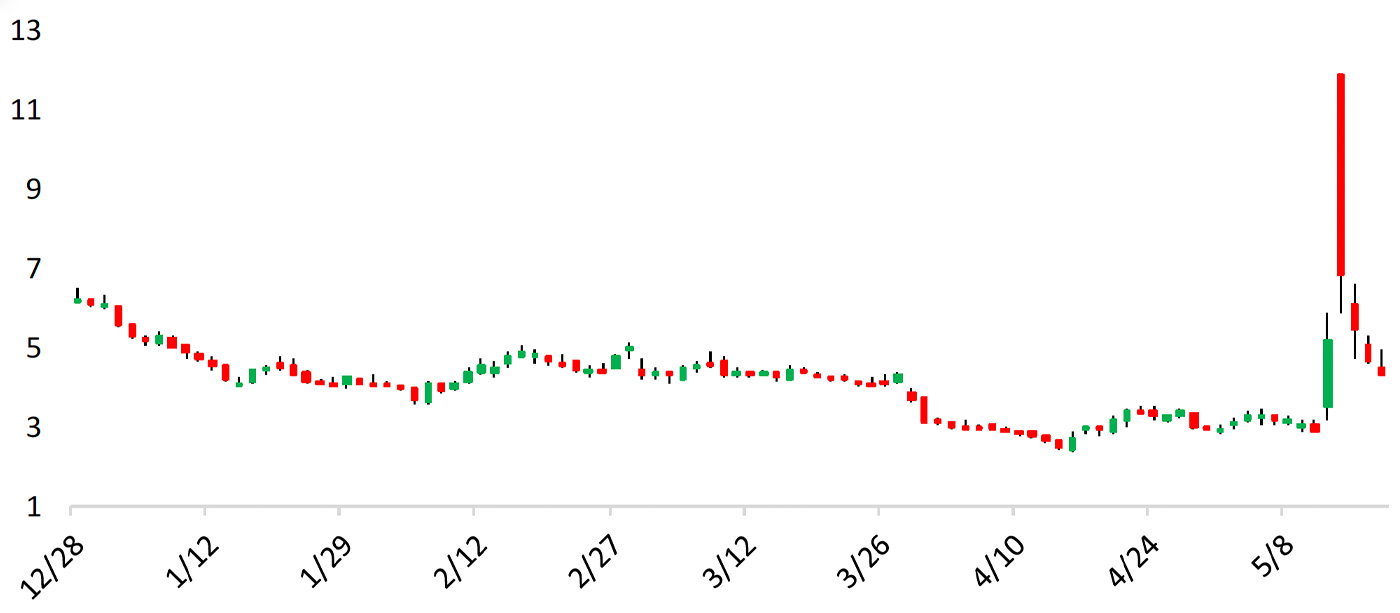

FIGURE 2: AMC ENTERTAINMENT HOLDINGS INC. (AMC)—3 DAYS OF LOSSES AFTER SHARP RALLY

Source: Bespoke Investment Group

Last week’s meme action generated a lot of diverse commentary throughout the financial press.

Meme stocks vs. fundamentals

Strategist Michael Gayed wrote the following about the meme craze in general:

“If you have a copy of Benjamin Graham’s ‘The Intelligent Investor’ on your bookshelf or religiously follow Berkshire Hathaway’s annual shareholder meetings, you might want to sit down.

“That’s because all notion of fundamental investing is being thrown out the window as we speak.

“Gone, apparently, is the need to examine balance sheets or cash flow statements or competitive advantages or, you know, anything that has to do with the actual health of a business. …

“In reality, this environment isn’t new. It really started during the COVID pandemic when people stuck at home who were bored, had nothing to do and were sitting on thousands of dollars of stimulus cash decided to turn the stock market into their own personal casino. Looking for a target to take their frustrations out on, they settled on ultra-wealthy hedge fund operators, who were clearly having a much easier time making it through the pandemic than they were (financially speaking at least).

“So they coordinated on a Reddit message board and identified the companies with the largest short positions out there. The plan: buy as much of these stocks as they could, drive the share price higher and inflict millions of dollars of damage on these funds, if not bankrupt them altogether.

“And it worked for a little while, but by the end of 2021, the biggest meme stocks, including GameStop and AMC, were down more than 60% from their peaks. The bear market of 2022 took care of destroying most of what was left of their remaining value and meme stock mania quietly fizzled out.

“Up until the past week.”

A behavioral perspective on meme stocks

MarketWatch interviewed a behavioral finance expert to gain perspective on whether last week’s meme stock action represented a larger trend for the markets:

“Victor Ricciardi, a visiting finance professor at Ursinus College and co-author of the book ‘Advanced Introduction to Behavioral Finance,’ told MarketWatch that he was fascinated by this week’s events, if not surprised. ‘Human behavior has a tendency to repeat itself,’ he said.

“But Ricciardi added that the scope of this week’s meme-stock rally should not be overestimated. ‘It’s not a real economic event for the average investor—that’s why I would hate to call it a bubble,’ he explained. ‘It’s not a bubble affecting the overall market; it’s more of an overreaction or an outlier event that’s concentrated on a small group of investors.’”

Ricciardi provided further behavioral commentary in another article:

“‘Somebody who has millions or hundreds of thousands [of followers] is going to create that herd mentality,’ Ricciardi said, noting that herd mentality can also lead to group polarization. ‘Members of the group make riskier decisions than they would as individuals,’ he said. ‘That group dynamic really affects them—people don’t want to miss out on something.’”

Was buying in GameStop and AMC limited to retail investors?

It is interesting to discover that a prominent investment firm held significant stakes in both GameStop and AMC before last week’s action.

Bloomberg wrote,

“Renaissance Technologies LLC, the quantitative fund founded by the late Jim Simons, loaded up on shares of meme-stock darlings AMC Entertainment Holdings Inc. and GameStop Corp. ahead of the latest rally.

“The hedge fund bought 3.82 million shares of AMC in the first quarter of 2024, adding to its position in the movie theater chain, according to regulatory filings. At the same time, Renaissance also snapped up 1 million shares of GameStop, revealing a new position during the three months ending March 31, filings show.”

While it is difficult to say what triggered those share purchases, Bloomberg’s article provides an interesting insight:

“‘Quant/hedge funds are much better equipped to handle these situations nowadays,’ wrote Vanda Research’s Marco Iachini in a note to clients this week.

“‘If anything, we believe the chances that they participate along with retail in the [short] squeeze but also lean against and then exit these trades ahead of retail traders are high.’”

How GameStop and AMC took advantage of rising stock prices

Bespoke Investment Group provided the following analysis of how both companies found something of a windfall in the trading action last week:

“On the meme stock front, surges in the names once popular with retail traders (but since marked for constant selloffs) more than tripled based on the highest after-hours prints mid-week. But high prices for both GME and AMC weren’t sustainable. Management teams rushed in to take advantage of the very low cost of capital; in GME’s case, that meant management filing a mixed securities shelf registration on Friday that would allow issuance of as many as 45mm shares. AMC converted subordinated debt into shares earlier in the week, using retail trader enthusiasm to shore up their balance sheet.

“In both cases, the companies clearly learned lessons of the meme stock craze from a few years ago, including that when the market hands you a gift, it’s important to take advantage and think long-term rather than getting greedy suddenly finding yourself buying in to the hype that your company really may be able to break the laws of financial gravity.”

RECENT POSTS