The hidden cost of fleeing from equities to CDs and fixed-rate annuities

The hidden cost of fleeing from equities to CDs and fixed-rate annuities

High-yield fixed-investment vehicles, whether CDs or fixed-rate annuities, can be alluring for retail investors. History tells us these investments often carry a substantial hidden cost.

The temptation of high short-term yields

What’s catching the eyes of investors today are some of the highest short-term yields in decades. One-year Treasurys have now climbed over 5%. This is all due to Federal Reserve tightening that has resulted in one of the fastest gains in yields in history.

FIGURE 1: 1-YEAR U.S. TREASURY YIELD

Source: StockCharts.com, data as of 8/31/2023

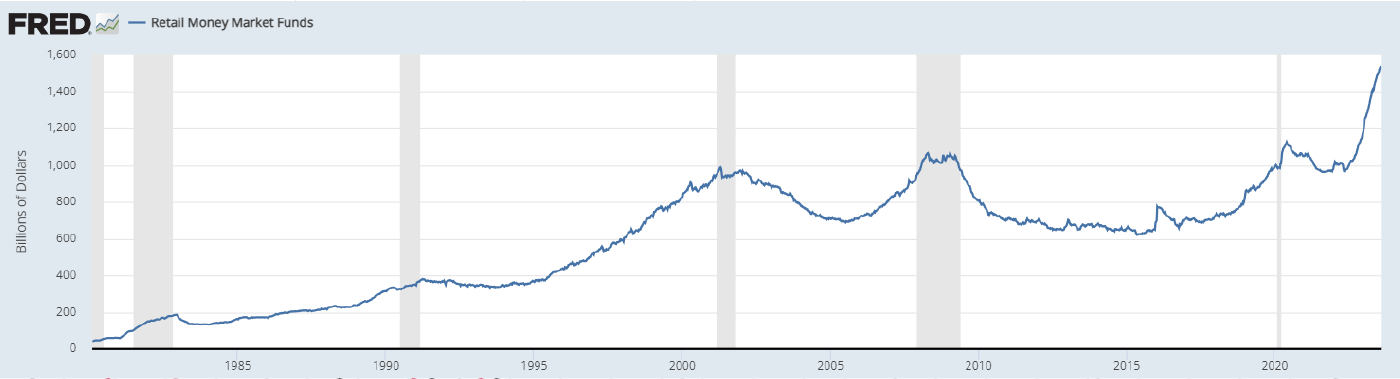

The rising yields have not gone unnoticed by investors. As Treasury yields have soared, so have the amount of assets deposited in money-market funds. They have quickly reached the highest level in history—over $1.5 trillion!

FIGURE 2: GROWTH OF RETAIL MONEY-MARKET FUNDS

Source: Board of Governors of the Federal Reserve System (U.S.)

Investors’ phones have been ringing off the hook in 2023. Insurance salespeople are seeking to tie investor dollars up in fixed-rate annuities. Not to be outdone, the local banks have signs plastered on their walls touting their high CD rates. And, of course, the internet somehow finds a way to thrust ads for both types of investment into investors’ faces—they keep mysteriously popping up on our screens.

Sales of fixed-rate annuities have also soared as investors, frightened by stock market volatility, seek an asset class that offers more certainty of a positive return. The annuity trade association LIMRA reported that U.S. annuity sales hit record highs in 2022 and in the first quarter of 2023.

According to LIMRA, “Fixed-rate deferred (FRD) annuity sales were $40.9 billion in the first quarter [of 2023], 157% higher than the first quarter of 2022. For the fourth consecutive quarter, FRD sales have marked record sales and now represent 44% of the total annuity market. To put this into perspective, FRD annuity sales represented just 18% of the total U.S. annuity market in the first quarter of 2020.”

Given the losses many investors experienced in their stock and bond portfolios in 2022, it is understandable that they would find sales pitches and advertisements for high-interest CDs and fixed-rate annuities enticing. But these investments come at a tremendous cost.

The true cost of today’s higher yields

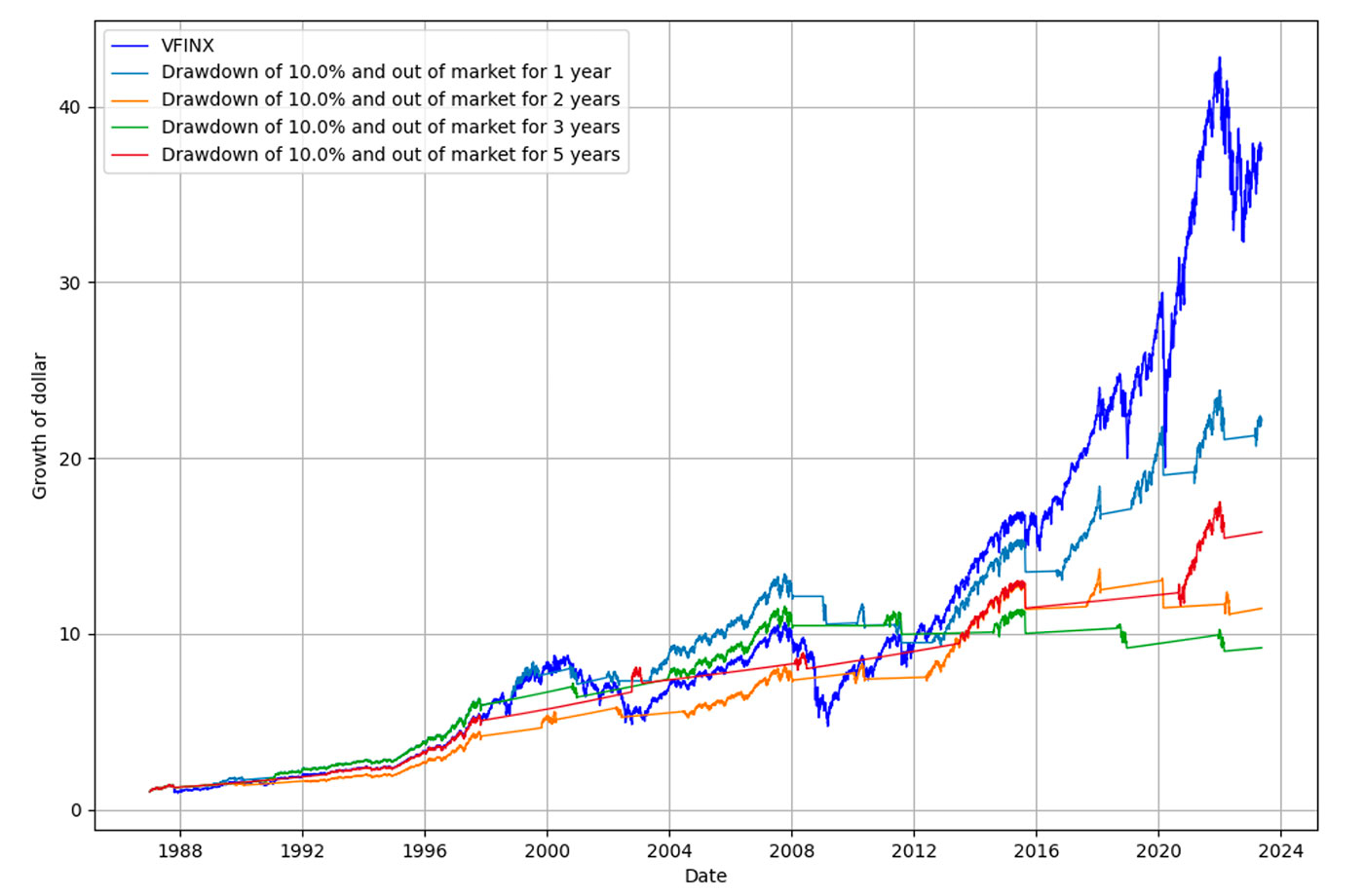

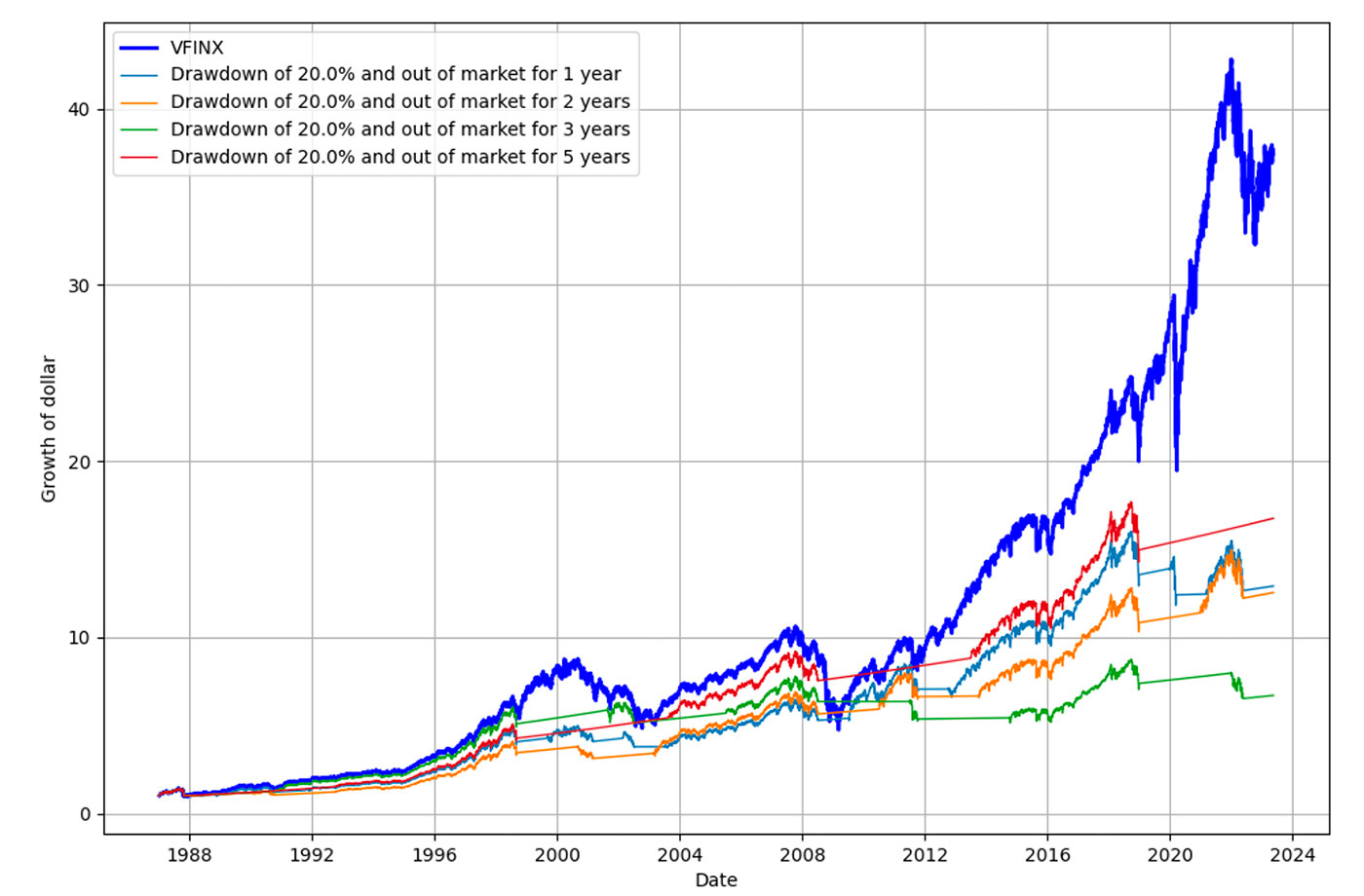

We dove deep into the record books and constructed a series of graphs to illustrate the true cost of overindulging in the recent higher yields.

Investors usually aren’t frightened out of their equity investments, or don’t seek other alternatives, until the equity market has fallen. So we wondered what the investment results would have been if an investor had bought a CD of various terms after a market fall of 10% or 20%.

We looked back over the period from Jan. 1, 1987, to May 17, 2023. We started in 1987 because it was the first full year when banks had no restrictions on the interest rates that they could pay on deposits. In comparing returns, we used the Vanguard 500 Index Fund (VFINX) to represent the equity investment because it has a long history and is an investable asset. For illustration purposes, and because of the limited historical data on CD and fixed-rate annuity rates, we have substituted the yields of Treasury bonds of various lengths for CD rates.

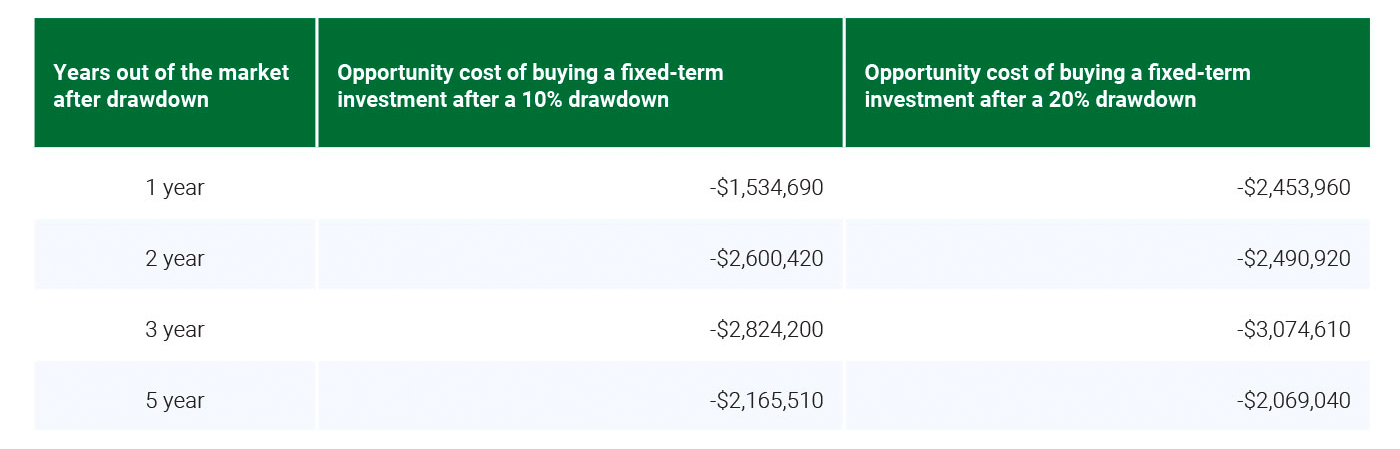

FIGURE 3: OPPORTUNITY COST OF BUYING A FIXED-TERM INVESTMENT AFTER A DRAWDOWN

What happens when you leave the market after a 10% drawdown

What happens when you leave the market after a 20% drawdown

Comparison of opportunity cost in dollars

(Initial investment of $100,000)

Source: Flexible Plan Investments Research

As the graphs and table in Figure 3 make abundantly clear, the opportunity cost of high-yielding investments with a fixed duration is substantial.

Of course, many investors seem to have especially bad timing. Considering this, we also prepared graphs comparing the purchase of CDs at the bottom of a bear market after a 10%-plus decline and after a 20%-plus decline (Figure 4). If last October proves to be the latest bear market low, the information for the 20% drawdown might be the most applicable now.

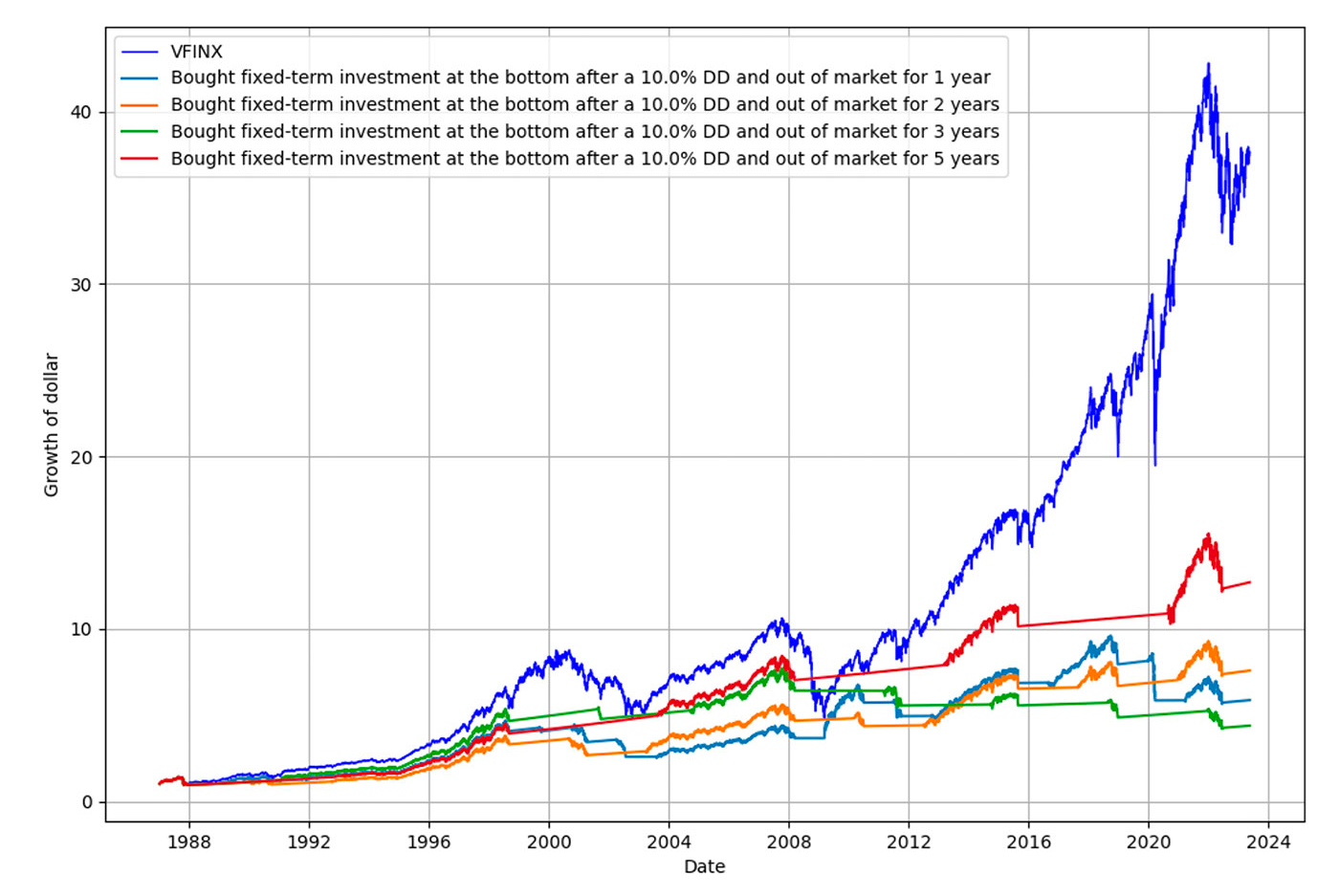

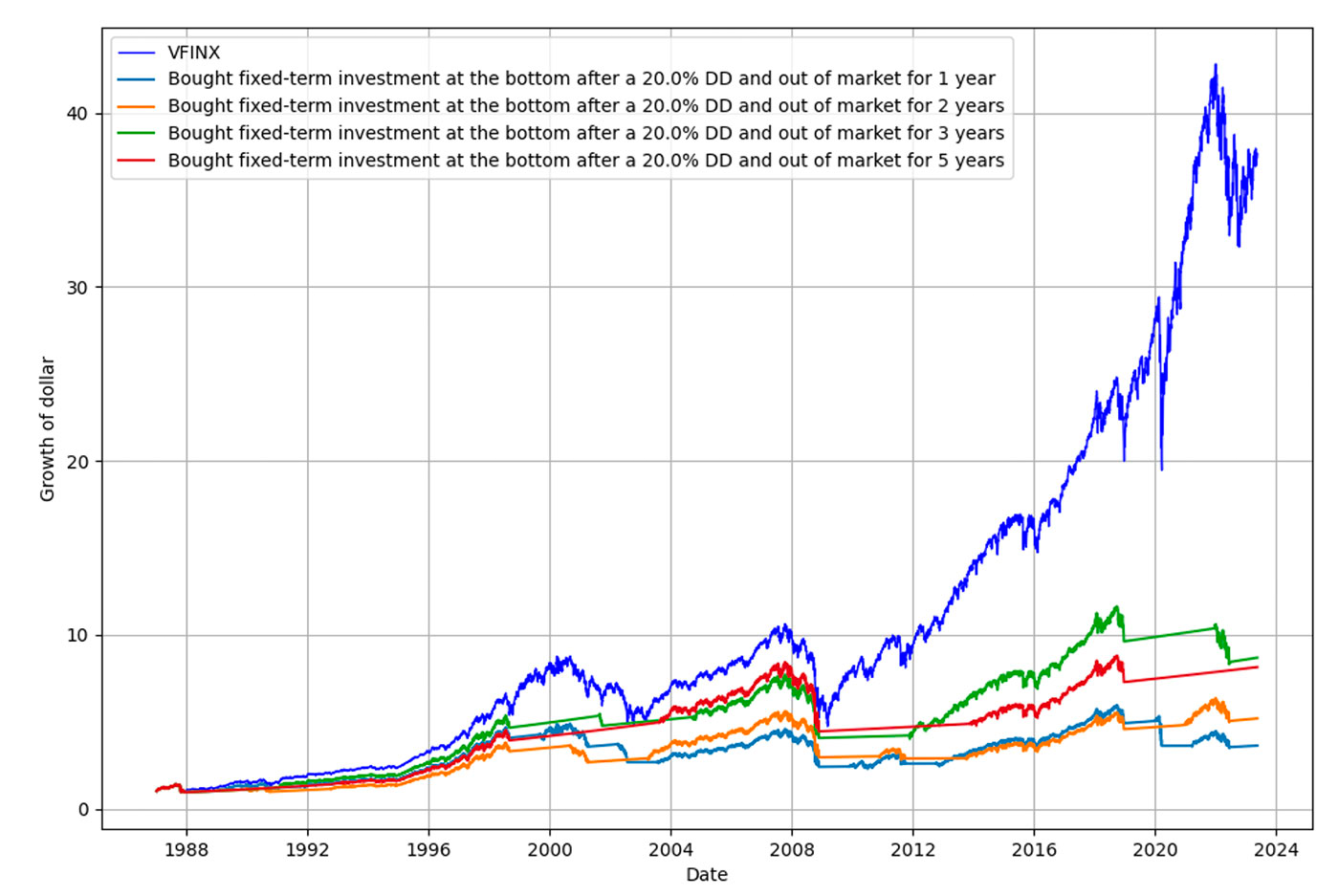

FIGURE 4: OPPORTUNITY COST OF BUYING A FIXED-TERM INVESTMENT AT THE MARKET BOTTOM AFTER A DRAWDOWN

What happens when you leave the market at the bottom after a 10% drawdown

What happens when you leave the market at the bottom after a 20% drawdown

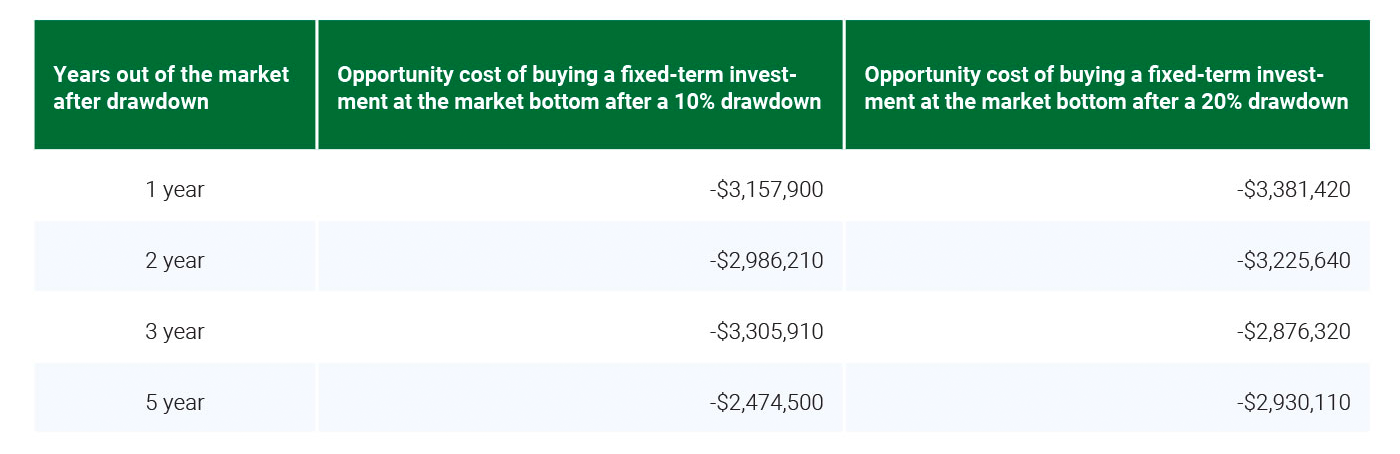

Comparison of opportunity cost in dollars

(Initial investment of $100,000)

Source: Flexible Plan Investments Research

Again, the conclusion is obvious: These investments are very costly at the present time.

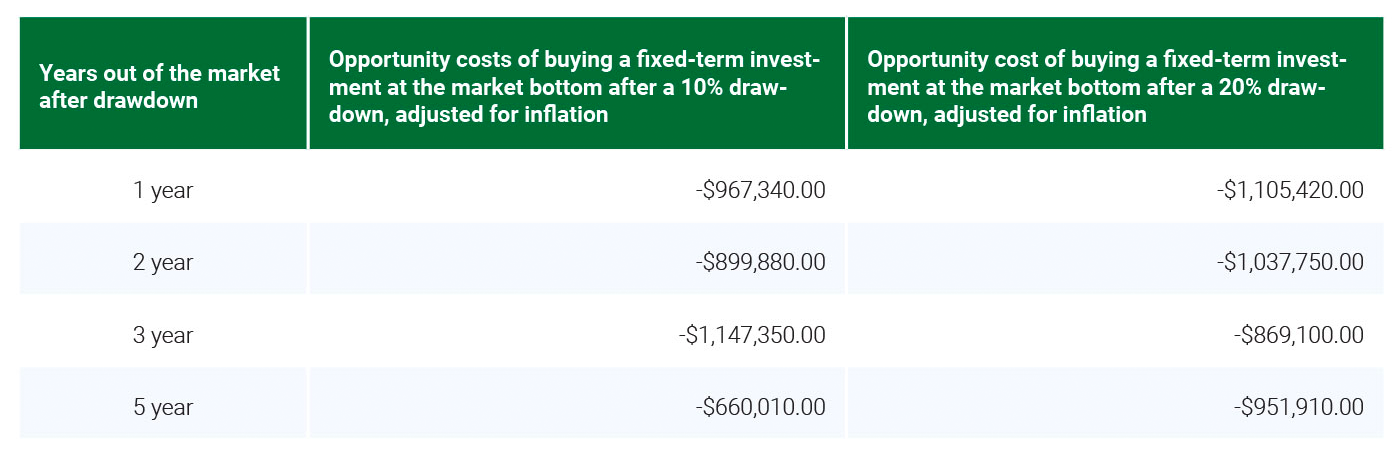

Of course, this is the conclusion for CD/fixed-rate annuities compared to stock market investments generally. This time around we are also trying to cope with high inflation rates. Adjusting our comparison for the purchasing power of the dollar after deducting the cost of living, as reflected by the consumer price index, the opportunity cost differential is even larger. Tying money up in a fixed-duration fixed-yield investment is especially costly in inflationary times. Inflation protection is one of the hallmarks of stock market investing.

FIGURE 5: COMPARISON OF OPPORTUNITY COSTS AFTER INFLATION

Source: Flexible Plan Investments Research

Finally, although I would never recommend using a single indicator for a market-timing strategy, by one measure, now is not a good time to avoid equities.

Except for 2008, history suggests that the times when investors have rushed into money markets can be a good time to buy stocks. Even in 2008, that held for the first three months following a 20% increase in money-market assets, like we are experiencing today.

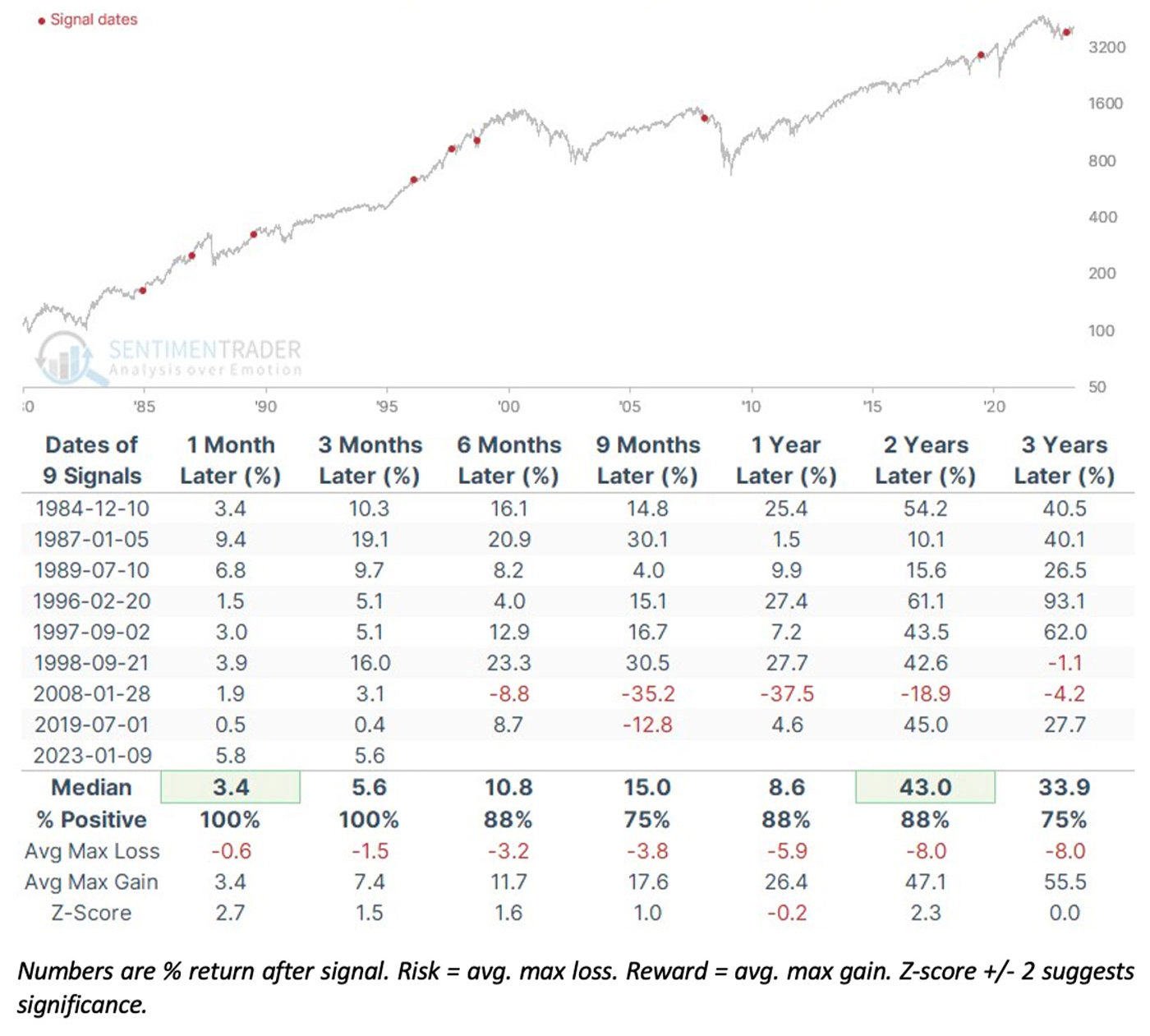

FIGURE 6: S&P 500 AFTER RETAIL MONEY-MARKET ASSETS GROW >20% YEAR OVER YEAR

Source: SentimenTrader

Before you invest, make sure the time and cost are right

In today’s world, we are presented with an incredible array of choices. Whole industries and marketing departments are devoted to making almost anything look tempting. Sometimes it’s even what appears to be the lowest-hanging fruit.

Currently, among the most alluring investments, and easiest to pick, are high-yield fixed-investment vehicles, be they CDs or fixed-rate annuities. We have not seen them in quite a while—so they feel new, while stocks may appear old hat.

Yet, two of the most important questions to ask when investing are (1) “Is the time right?” and (2) “At what cost?” History tells us that right now CDs and fixed-rate annuities carry a substantial hidden cost.

Dynamic risk management is key for investment success

We believe that if an investor wants to manage investment risk, a better solution is to work with a financial advisor who can help build a portfolio of active strategies that can move in and out of different financial markets—without the costly time restrictions and early-withdrawal penalties that come with fixed-term investments.

Our research strongly suggests that advisors and their investor clients should look to strategies that are designed to dynamically manage risk, while also taking advantage of opportunities for growth—ultimately providing a more successful approach than resorting to fixed-duration investments.

The opinions expressed in this article are those of the author and the sources cited and do not necessarily represent the views of Proactive Advisor Magazine. This material is presented for educational purposes only.

Jerry C. Wagner, founder and president of Flexible Plan Investments, Ltd. (FPI), is a leader in the active investment management industry. Since 1981, FPI has focused on preserving and growing capital through a robust active investment approach combined with risk management. FPI is a turnkey asset management program (TAMP), which means advisors can access and combine many risk-managed strategies within a single account. FPI's fee-based separately managed accounts can provide diversified portfolios of actively managed strategies within equity, debt, and alternative asset classes on an array of different platforms. flexibleplan.com

Jerry C. Wagner, founder and president of Flexible Plan Investments, Ltd. (FPI), is a leader in the active investment management industry. Since 1981, FPI has focused on preserving and growing capital through a robust active investment approach combined with risk management. FPI is a turnkey asset management program (TAMP), which means advisors can access and combine many risk-managed strategies within a single account. FPI's fee-based separately managed accounts can provide diversified portfolios of actively managed strategies within equity, debt, and alternative asset classes on an array of different platforms. flexibleplan.com

RECENT POSTS