With 97% of S&P 500 companies reporting through Feb. 29, the Q4 2023 earnings season surpassed initial expectations—helped in large part by the earnings of mega-cap tech companies.

FactSet recently reported the following highlights:

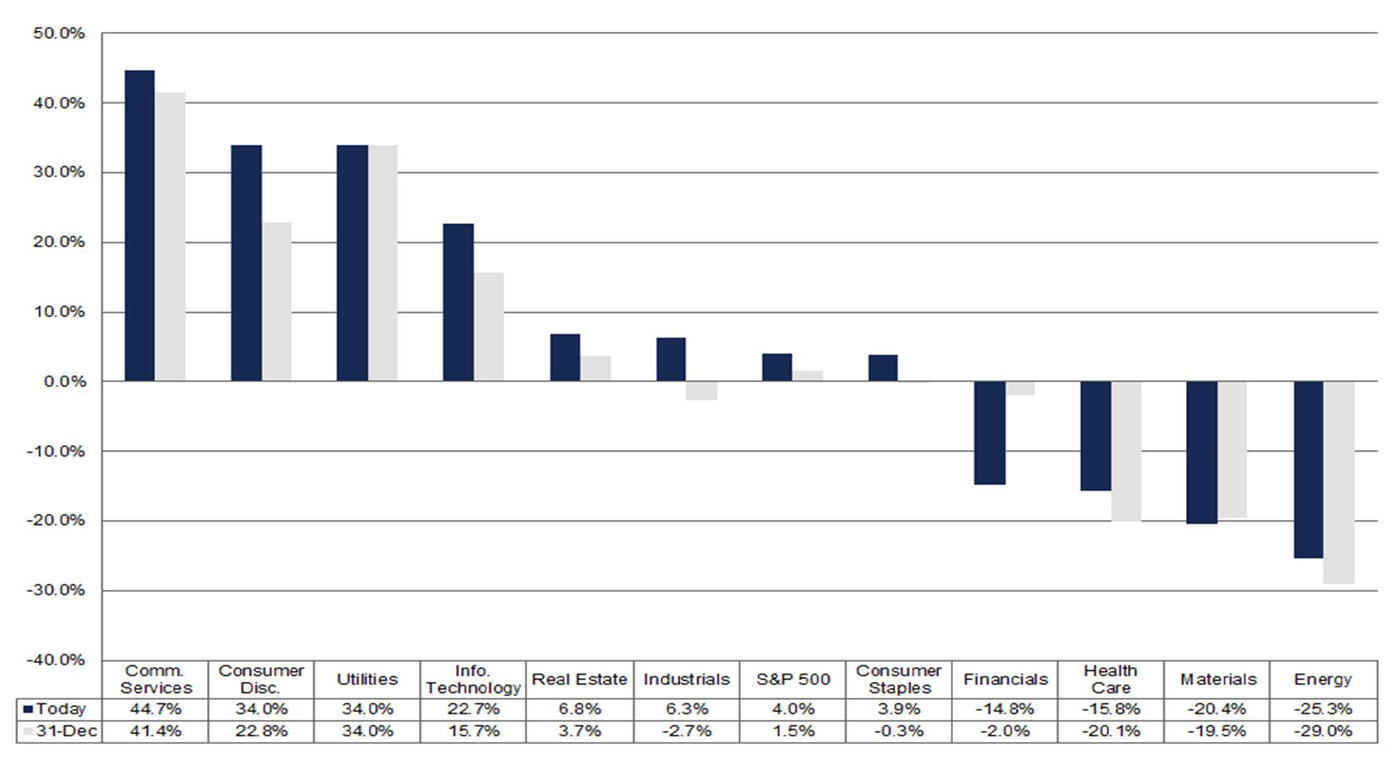

- While expectations in December were for S&P 500 Q4 earnings growth of 1.3%, the projections to date are for growth of 4.0%.

- With earnings growth of 45%, the Communications Services sector easily led all 11 sectors. The Consumer Discretionary, Utilities, and Information Technology sectors all also had strong double-digit Q4 earnings. In Information Technology, Nvidia, Microsoft, and Apple contributed heavily to the sector’s earnings growth.

- Eight sectors reported growth in revenues, led by the Real Estate, Communication Services, and Financials sectors. The Energy sector had the poorest revenue growth of the three sectors reporting revenue declines.

- Inflation was a major topic in earnings calls, with mentions by 254 S&P 500 companies so far.

Detailed findings for Q4 earnings

FactSet compiled the following key metrics for the Q4 2023 earnings season in its most recent Earnings Insight:

- “Earnings Scorecard: For Q4 2023 (with 97% of S&P 500 companies reporting actual results), 73% of S&P 500 companies have reported a positive EPS surprise and 64% of S&P 500 companies have reported a positive revenue surprise.

- “Earnings Growth: For Q4 2023, the blended (year-over-year) earnings growth rate for the S&P 500 is 4.0%. If 4.0% is the actual growth rate for the quarter, it will mark the second-straight quarter that the index has reported earnings growth.

- “Earnings Guidance: For Q1 2024, 71 S&P 500 companies have issued negative EPS guidance and 30 S&P 500 companies have issued positive EPS guidance.

- “Valuation: The forward 12-month P/E ratio for the S&P 500 is 20.4. This P/E ratio is above the 5-year average (19.0) and above the 10-year average (17.7).”

FIGURE 1: S&P 500 EARNINGS GROWTH (Y/Y)—Q4 2023

Source: FactSet

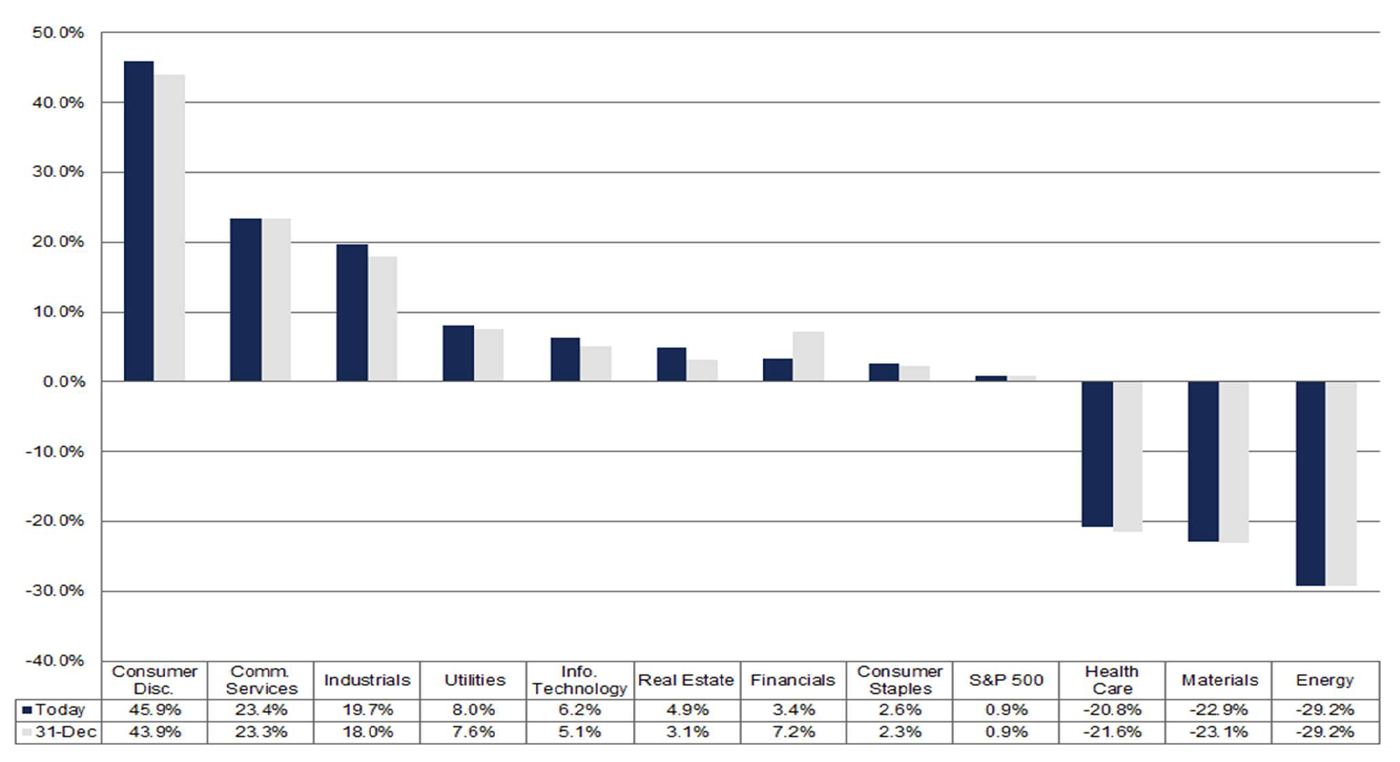

With data for full-year 2023 earnings almost complete, S&P 500 companies are reporting a lackluster 0.9% overall earnings increase.

FIGURE 2: S&P 500 EARNINGS GROWTH (Y/Y)—CALENDAR YEAR 2023

Source: FactSet

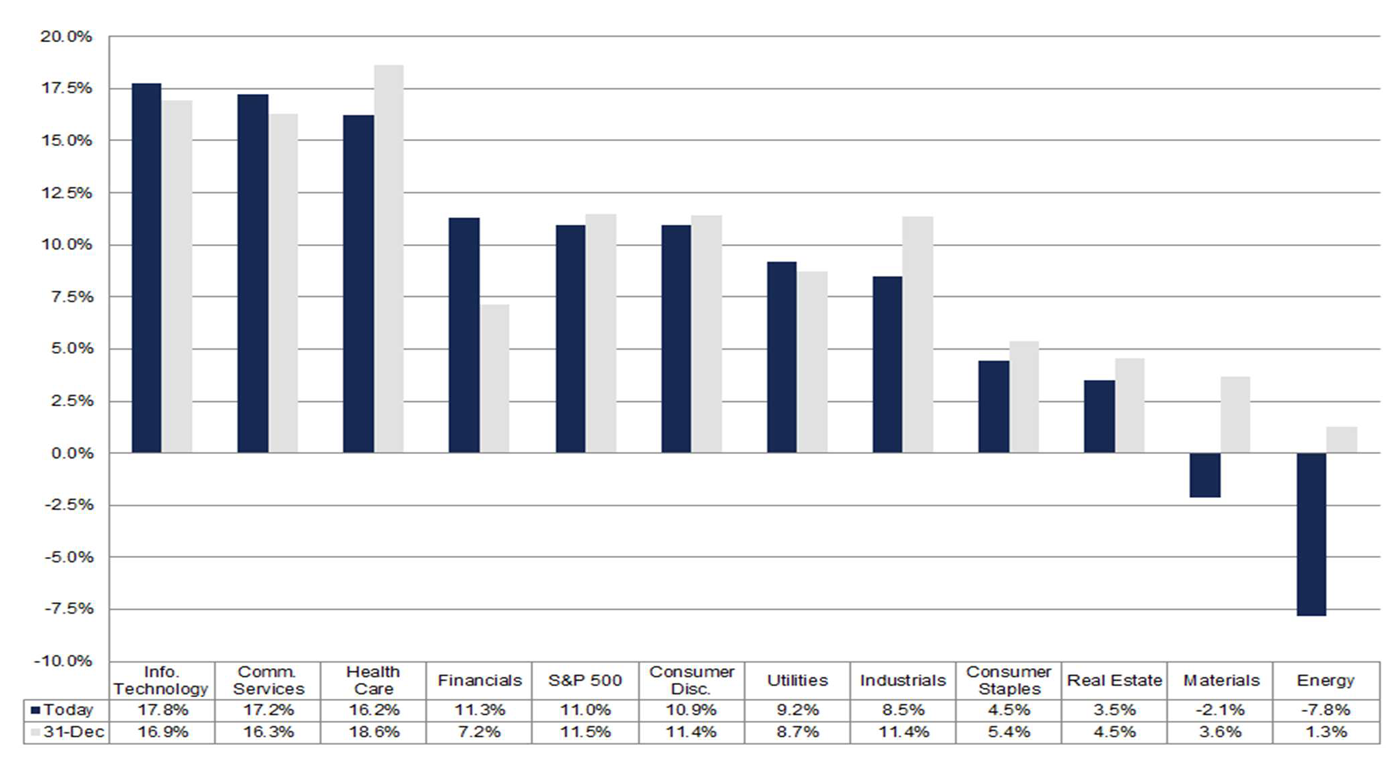

Outlook for 2024 earnings

FactSet notes that the outlook for 2024 earnings is significantly improved versus last year. Compared to 2023’s 0.9% earnings growth for S&P 500 companies, initial analyst projections point to calendar year 2024 earnings growth of 11.0%—accompanied by revenue growth of 5.0%. Earnings growth is expected to pick up throughout 2024, with Q4 topping all quarters at 17.4% growth. Information Technology and Communications Services, not surprisingly, are expected to lead all sectors in earnings growth.

FIGURE 3: EST. S&P 500 EARNINGS GROWTH (Y/Y)—CALENDAR YEAR 2024

Source: FactSet

FIGURE 4: S&P 500 EARNINGS-PER-SHARE BOTTOM-UP ACTUALS AND ESTIMATES BY YEAR

Source: FactSet

RECENT POSTS