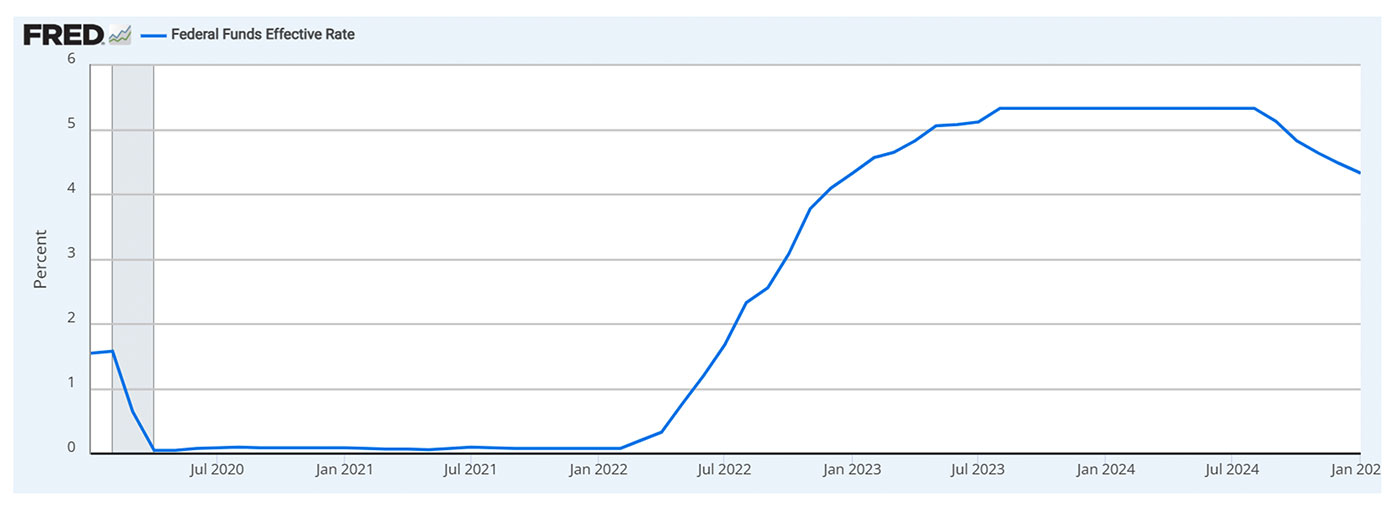

The Federal Reserve’s January meeting minutes, released last week, highlighted a cautious approach to future interest-rate decisions due to heightened economic uncertainty.

The Fed emphasized the need to “proceed carefully” in deciding whether to raise their benchmark interest rate further. This stance reflects the balance the Fed is trying to maintain between curbing inflation and avoiding harm to the economy.

MarketWatch reported,

“Business leaders across the country told Federal Reserve officials that they will try to pass along to consumers any higher costs resulting from potential Trump tariffs, according to minutes of the central bank’s January meeting, which were released Wednesday.

“At the meeting, Fed officials expressed concerns that tariffs and other Trump policies could slow progress on getting inflation back to their 2% target.

“The central bank is having a tough time gauging the impact of President Donald Trump’s plans relating to the economy.

“Fed staff noted ‘elevated uncertainty regarding the scope, timing and potential economic effects of possible changes to trade, immigration, fiscal and regulatory policies.’ …

“Their forecast projects that the Fed won’t make much progress on inflation this year, ‘with inflation expected to be similar to 2024’s rate.’ That assumes that trade policy puts upward pressure on inflation this year.

“In their discussions, Fed officials made clear they want to see further progress on inflation before making any more cuts to interest rates.”

FIGURE 1: FEDERAL FUNDS EFFECTIVE RATE—PAST FIVE YEARS

Shaded areas indicate U.S. recessions.

Source: Board of Governors of the Federal Reserve System (U.S.) via FRED

Fortune added recently,

“According to the Fed’s minutes, officials see inflation gradually moving toward the central bank’s 2% target, but ongoing economic uncertainties may factor into future decisions on interest rates.

“Contributing factors include slowing wage growth, stable long-term inflation expectations, weakening business pricing power, and the Fed’s restrictive policy stance.”

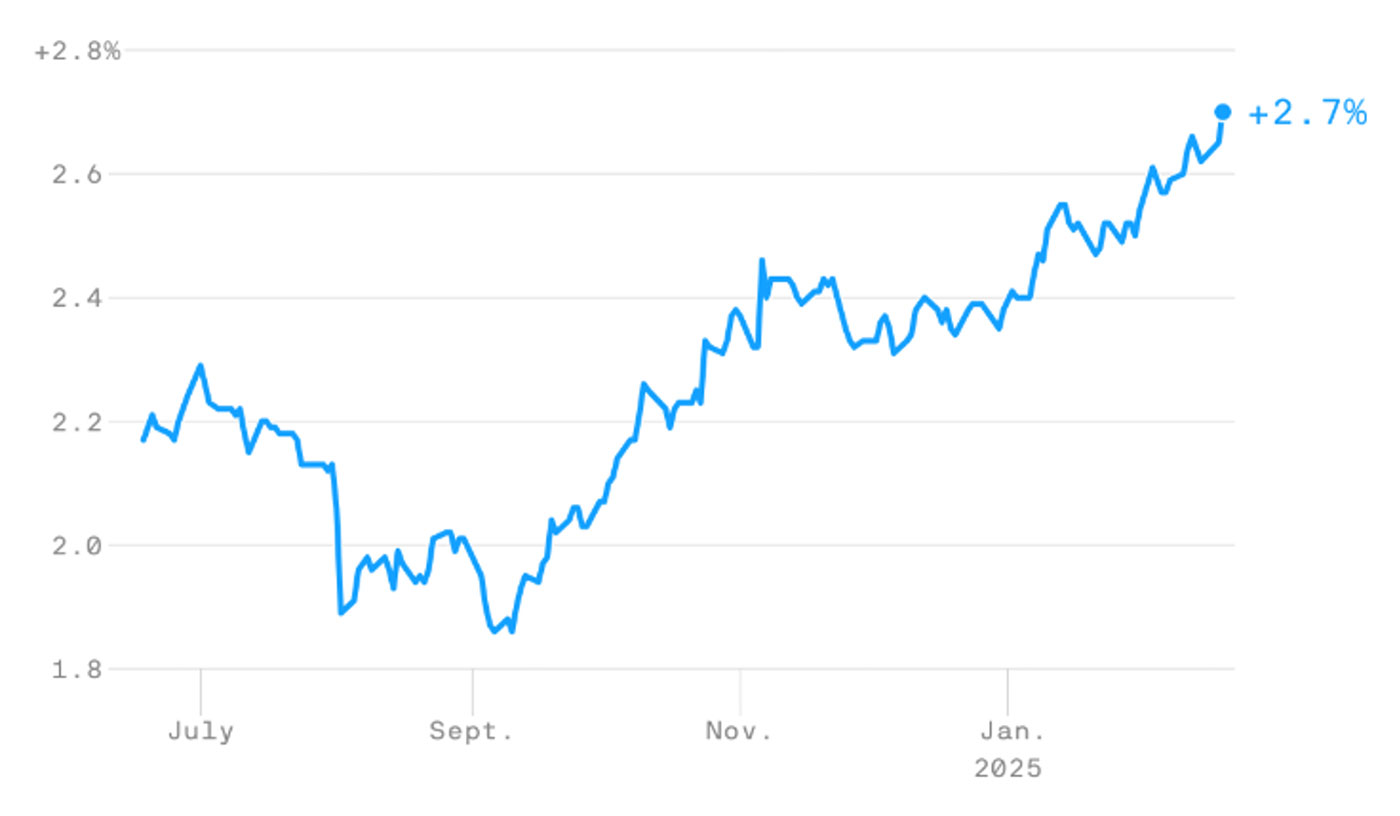

Axios agrees that the outlook for intermediate progress on inflation is looking less likely, stating,

“Bond markets are betting that inflation will stay elevated in the years ahead, and some evidence from business surveys and forecasters points in the same direction.”

FIGURE 2: ANNUAL INFLATION RATE EXPECTED OVER THE NEXT FIVE YEARS

Spread between inflation-protected and nominal Treasury yields (daily)

Sources: Axios, Federal Reserve; data through 2/19/2025

Sentiment measures weaken as CEO confidence strengthens

Consumers, small businesses, homebuilders, and retail investors have all mirrored some of the Fed’s concerns, reflecting uncertainty about the current and future economic environment.

In contrast, CEO confidence presents a more optimistic picture. The Conference Board’s Measure of CEO Confidence for Q1 2025, based on data collected from Jan. 27 to Feb. 10, indicates that CEOs are generally positive about their industries and the overall economy.

However, some concerns remain. FactSet reported that “the term ‘tariff’ or ‘tariffs’ was cited by half of the S&P 500 index companies that reported earnings between December 15, 2024, and February 6, 2025.”

Despite this, CEO sentiment has strengthened. According to a Feb. 20 press release from The Conference Board,

“The Conference Board Measure of CEO Confidence in collaboration with The Business Council increased by 9 points in the first quarter of 2025 to 60, the highest level in three years. For the first time since early 2022, the Measure was well above 50 in Q1 2025, indicating that CEOs have shifted from the cautious optimism that prevailed in 2024 to a more confident optimism.”

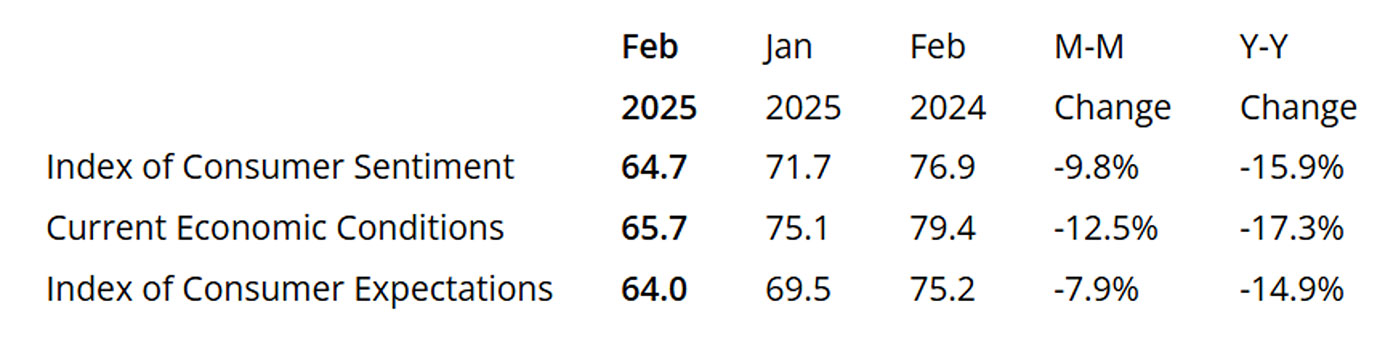

University of Michigan Consumer Sentiment Index

The most recent University of Michigan consumer sentiment report indicates a significant decline in consumer confidence.

The Consumer Sentiment Index fell to 64.7 in February 2025, down from 71.7 in January and 76.9 in February 2024. Concerns about inflation contributed to the decline, with year-ahead inflation expectations rising from 3.3% to 4.3%. Additionally, the Current Economic Conditions Index and the Index of Consumer Expectations both saw notable decreases.

The University of Michigan noted,

Responses were heavily skewed to political affiliations, with the analysis of the report stating,

“While sentiment fell for both Democrats and Independents, it was unchanged for Republicans, reflecting continued disagreements on the consequences of new economic policies.”

TABLE 1: FINAL SURVEY RESULTS FOR FEBRUARY 2025

Source: University of Michigan Surveys of Consumers

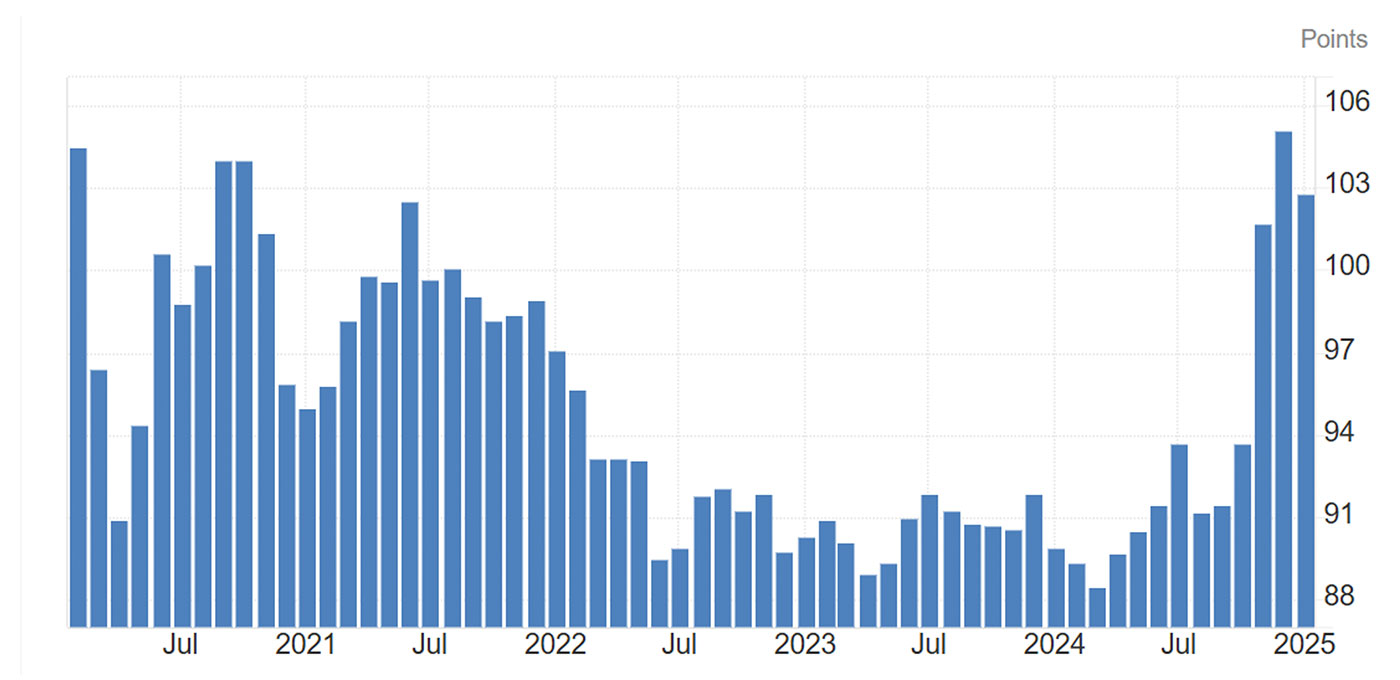

National Federation of Independent Business (NFIB) Small Business Optimism Index

The NFIB Small Business Optimism Index for January 2025 declined from 105.1 to 102.8. Despite this drop, the index remains above its historical average, indicating continued optimism among small-business owners, according to the NFIB. However, concerns about the economic outlook are on the rise, with the Uncertainty Index increasing by 14 points to 100. The net percentage of owners expecting the economy to improve fell five points to 47%.

Hiring difficulties remain a major challenge, with 35% of small-business owners reporting unfilled job openings. Additionally, fewer owners plan to make capital investments in the coming months, reflecting caution about future economic conditions.

Bloomberg reported,

“American companies of all sizes are on edge over President Donald Trump’s tariffs, but it’s arguably small business that is most exposed.

“Many smaller firms say they’re having to hike prices, freeze expansion plans or absorb a hit to already-thin profit margins as import bills climb. Such businesses employ half the US workforce, so how they cope with Trump’s ramped-up trade war will be crucial to the wider economic impact.”

FIGURE 3: U.S. NFIB BUSINESS OPTIMISM INDEX

Sources: Trading Economics, NFIB

National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI)

The NAHB recently published the results from the February survey of homebuilders, saying,

“Builder sentiment fell sharply in February over concerns on tariffs, elevated mortgage rates and high housing costs.

“Builder confidence in the market for newly built single-family homes was 42 in February, down five points from January and the lowest level in five months, according to the National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI) released today.

“‘While builders hold out hope for pro-development policies, particularly for regulatory reform, policy uncertainty and cost factors created a reset for 2025 expectations in the most recent HMI,’ said NAHB Chairman Carl Harris, a custom home builder from Wichita, Kan. ‘Uncertainty on the tariff front helped push builders’ expectations for future sales volume down to the lowest level since December 2023. Incentive use may also be weakening as a sales strategy as elevated interest rates reduce the pool of eligible home buyers.”

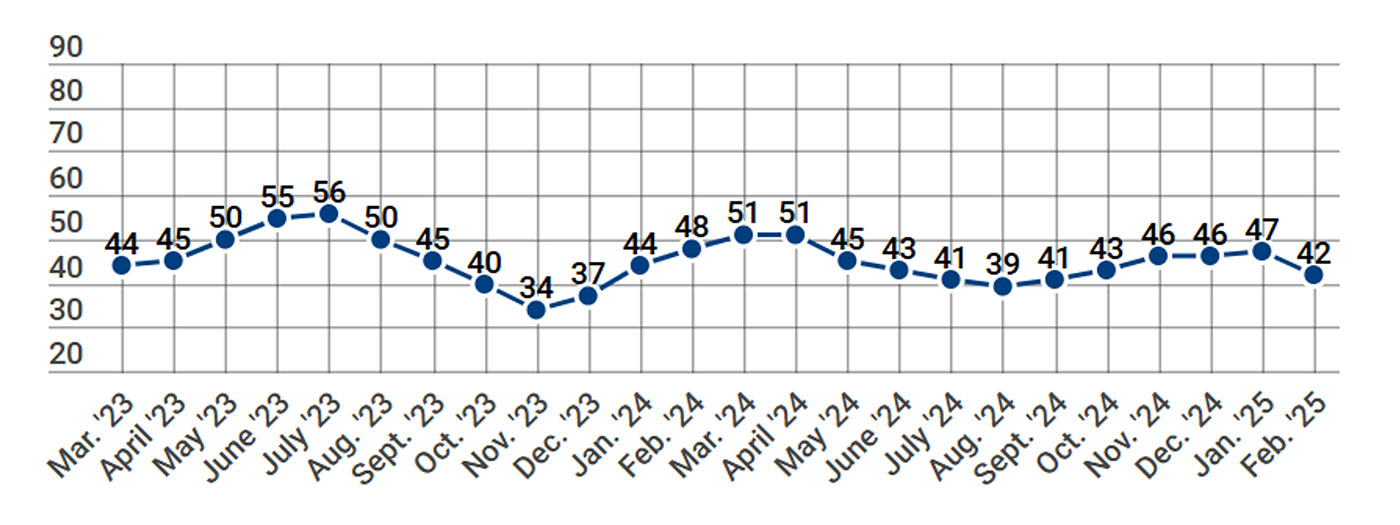

FIGURE 4: NAHB/WELLS FARGO HOUSING MARKET INDEX (HMI) TREND

Sources: NAHB/Wells Fargo Housing Market Index (HMI)

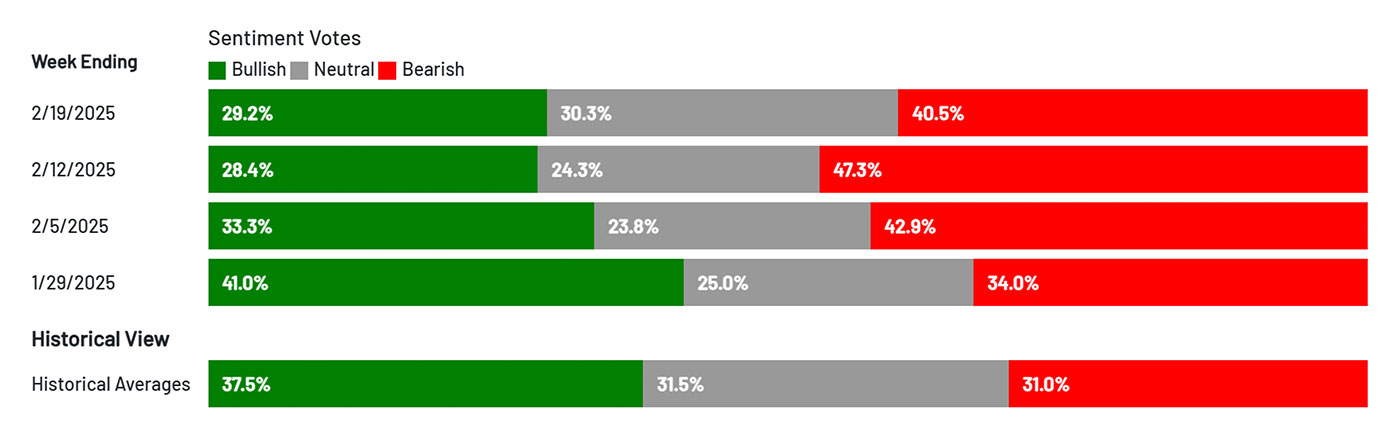

American Association of Individual Investors (AAII) Survey

While individual investor sentiment held fairly steady over the past few weeks, current bullish sentiment shows a sharp drop since the end of January and is now below its historical average. However, retail investor sentiment is often viewed as a contrarian indicator.

The AAII posted this remark on February 20:

FIGURE 5: AMERICAN ASSOCIATION OF INDIVIDUAL INVESTORS SURVEY

Source: American Association of Individual Investors

RECENT POSTS