Revolutionizing investment risk management through the power of AI

Revolutionizing investment risk management through the power of AI

Could a computer make better investment decisions than a group of investment professionals? It’s an age-old question that developments in AI-enabled investment management may soon answer.

Artificial intelligence (AI) is proving itself to be the answer to accurate, faster, and more informed investment decisions. 2023 will be looked on as the inflection point in AI technology, both broadly speaking and specific to investment management. From new AI-enabled ETFs for retail investors to institutional-grade cash-management strategies based on predictive analytics, we’re seeing tangible use cases play out in positive ways. And while we still haven’t hit the five-year mark on investment performance for true AI-driven funds, the past few years have shown promise.

The data-driven financial world is an exceptional playground for researchers and developers to refine their technology. As we venture further into the realm of AI-powered risk management, the following key areas continue to be refined with the ultimate goal of delivering a better outcome for investors.

Predictive capabilities continue to excel

One of the most significant advantages of AI is its ability to analyze expansive amounts of data, identify possible outcomes, and make a decision on how to allocate assets based on the mandate of the fund and risk level. Humans will forever remain hindered by our inability to process information quickly and make decisions without bias when compared to AI.

What is most important with predictive analytics and AI, however, is that the AI’s outcome is dependent on the input data. That is to say, AI can only make a prediction based on the data input into the system. This produces limitations that are quickly becoming addressed by enhanced machine learning, natural language processing, and expanding AI’s data input capabilities.

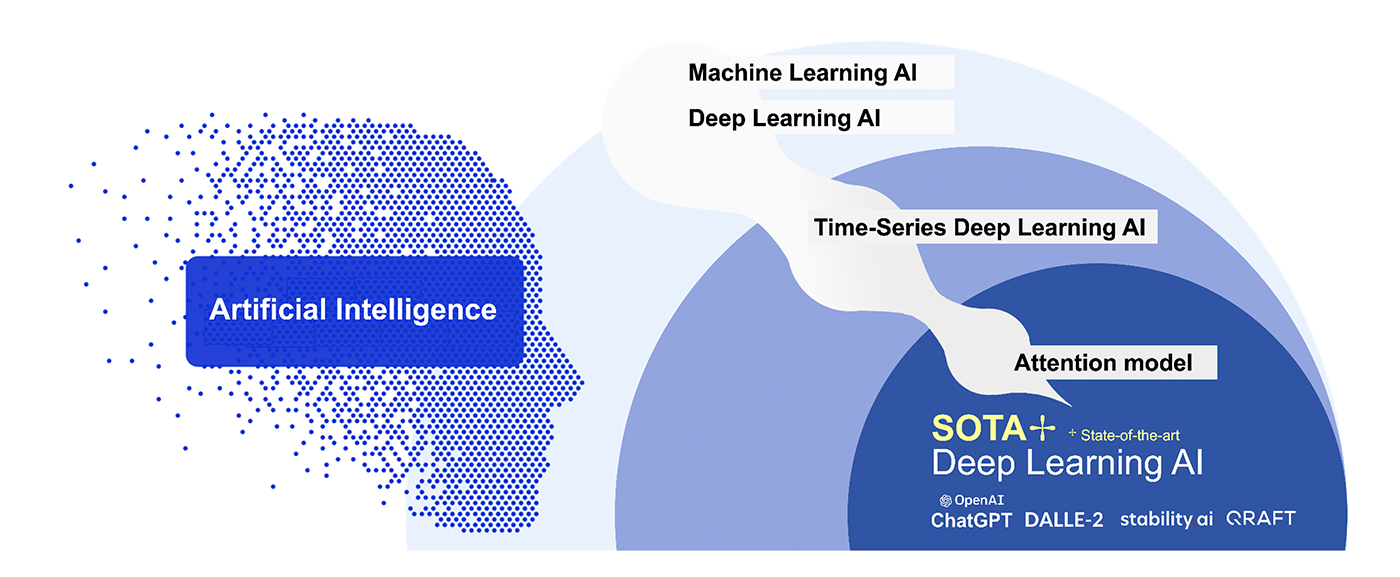

This illustration breaks down artificial intelligence into its more specific implementations. Notably highlighted is the attention model, a mechanism in deep learning that allows the system to focus on specific parts of the input data that are of greater importance with regards to the broader framework.

Humans and the regression models we typically lean on for investment forecasting tend to work in a linear fashion. AI works in a nonlinear fashion—AI can connect dots humans cannot even comprehend within seconds. An AI model’s nonlinear approach can lead to greater risk management in investment portfolios compared to traditional linear approaches by enabling firms to manage new and unfamiliar risks, systematically remove bias from the decision-making process, and coordinate risk management across multiple control areas. Traditional approaches to risk management may not be sufficient in today’s complex and fast-moving financial market environment.

Refinement of input variables to create better outcomes

As mentioned, AI is only as powerful as the data it has to work with. If you give AI only the financials of a specific company and ask it to evaluate the stock based purely on that, it will not factor in the macroeconomic forces at play, among other things. Limited scope creates significant outcome risk. Fortunately, AI has expanded well past this more rudimentary analysis over the past several years.

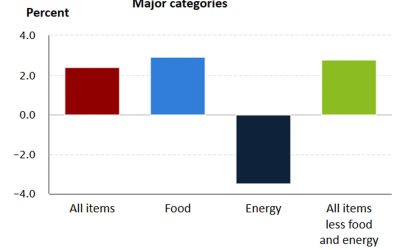

In 2022, the Qraft Technologies AI Risk Indicator tool (which evaluates risks in U.S. equity markets similar to more traditional fear/greed indexes) utilized more than 70 different variables each week to gauge market risk. The most heavily weighted input in the weekly score was the U.S. Short-Term Equity Momentum. The other top four variables that the AI weighted were U.S. Short-Term Treasurys Medium-Term Volatility, U.S. Long-Term Treasurys and Short-Term Treasurys One-Year Correlation, Commodities One-Year Volatility, and Commodities Short-Term Momentum. In a year driven by Federal Reserve policy, supply-chain constraints, and commodity volatility spurred by geopolitical risk, the emphasis on these variables can be rationalized.

What matters most is that the AI is not married to these variables. Should the AI determine other variables are driving risk in the markets, it will immediately emphasize those variables. Thanks to expanding machine learning capabilities and AI’s nonlinear approach to predicting certain outcomes, AI will continue to improve its ability to focus on the variables that matter most faster and more accurately than ever before.

Why the future is bright for risk management and AI

The future of investment risk management will be shaped by the transformative potential of AI, especially to cope with changes in the current complex and fast-moving financial market environment. As we continue to venture further into the realm of AI-powered risk management, we can expect to see more refined technology that delivers better outcomes for investors.

One of the key benefits of AI is its ability to learn from itself and create a cycle of testing and learning to produce more optimal outcomes. There are many variables when it comes to risk in the markets. It is impossible to predict which variables matter most and when, but through predictive analytics and a continuing refinement of providing models with clean and relevant data, it is possible that risk management will become nearly fully automated at the portfolio level based on the tolerance of the investor.

The opinions expressed in this article are those of the author and the sources cited and do not necessarily represent the views of Proactive Advisor Magazine. This material is presented for educational purposes only.

Francis Geeseok Oh is the APAC CEO of Qraft Technologies. Since its founding in 2016, Qraft has been transforming conventional asset management with innovations in artificial intelligence and investments. In addition to actively managed AI-enhanced ETFs traded at the NYSE, Qraft develops AI-enabled investment solutions designed to generate alpha and manage risk that have been adopted by major financial institutions around the world. Francis has nearly 20 years of investment industry experience, with prior roles at Vanguard, Direxion, and Mirae Asset.

Francis Geeseok Oh is the APAC CEO of Qraft Technologies. Since its founding in 2016, Qraft has been transforming conventional asset management with innovations in artificial intelligence and investments. In addition to actively managed AI-enhanced ETFs traded at the NYSE, Qraft develops AI-enabled investment solutions designed to generate alpha and manage risk that have been adopted by major financial institutions around the world. Francis has nearly 20 years of investment industry experience, with prior roles at Vanguard, Direxion, and Mirae Asset.

RECENT POSTS