Despite inflation-squeezed household budgets and soaring credit card debt (or perhaps because of it), Americans had no problem packing their bags for a vacation this Fourth of July.

Data provider Statista offered the following perspective:

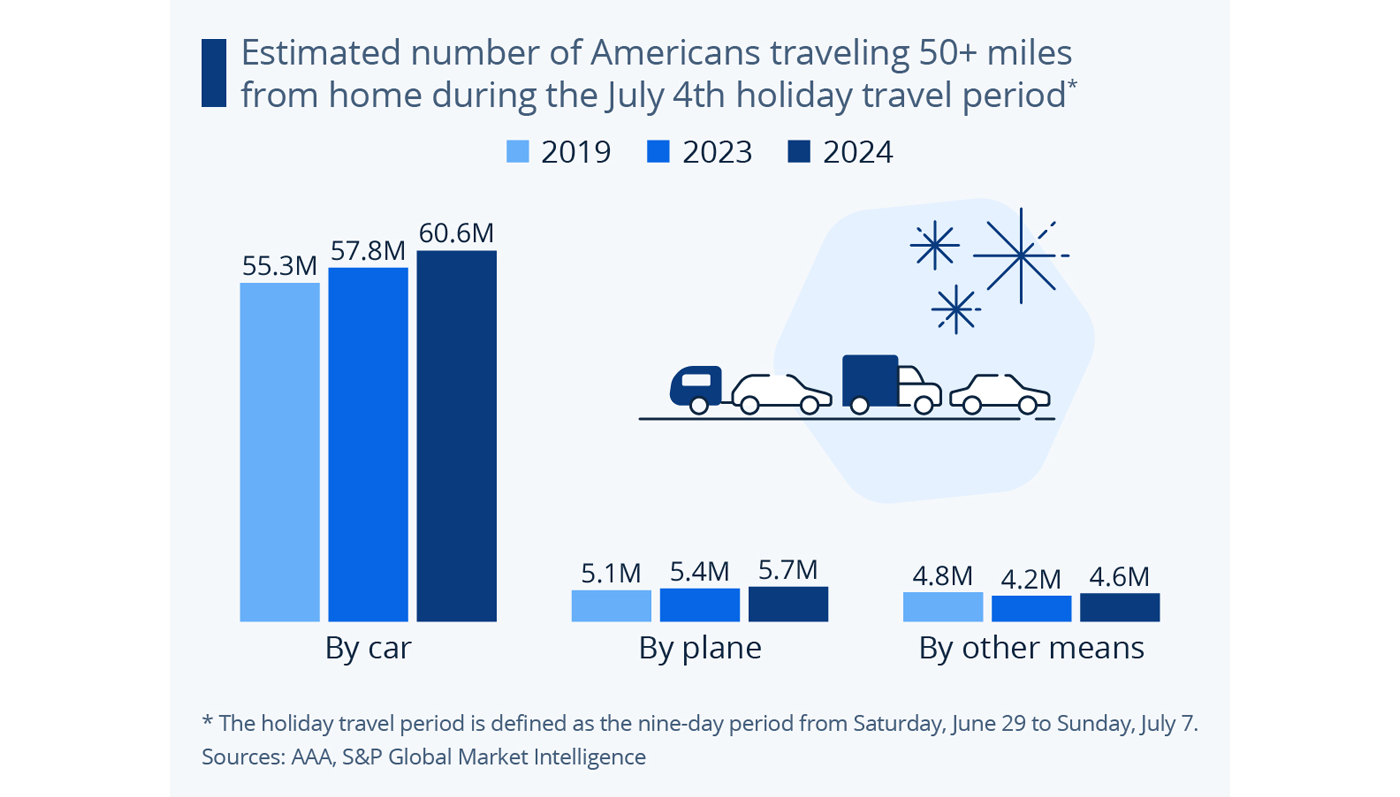

“Fourth of July holiday travel is expected to reach a new record high in 2024, as more than 70 million Americans are forecast to hit the road or the skies to travel more than 50 miles for this year’s celebrations. That’s according to projections from AAA who are predicting that 60.6 million Americans will take to the nation’s roads, while 5.7 million will take a plane and 4.6 million will travel by train or other means for Independence Day. That represents an increase of 5 percent from last year and 8 percent from 2019, as low air fares and gas prices are fueling Americans’ appetite for travel.

“‘With summer vacations in full swing and the flexibility of remote work, more Americans are taking extended trips around Independence Day,’ Paula Twidale, Senior Vice President of AAA Travel said in a statement. ‘We anticipate this July 4th week will be the busiest ever with an additional 5.7 million people traveling compared to 2019.’

“All modes of transport are set to see a noticeable increase this year and road trips will continue to dominate Fourth of July travel. 85 percent of travelers are expected to drive to their holiday destination as gas prices have eased from the historic highs of the past two years. Even though air travel is far less common for Independence Day celebrations, airports are expected to be busier than ever these days. In the weeks leading up to July 4, the TSA reported several new records for performed safety checks at U.S. airports.”

FIGURE 1: AMERICANS SET TO TRAVEL IN RECORD NUMBERS FOR JULY FOURTH

Sources: Statista, AAA, S&P Global Market Intelligence

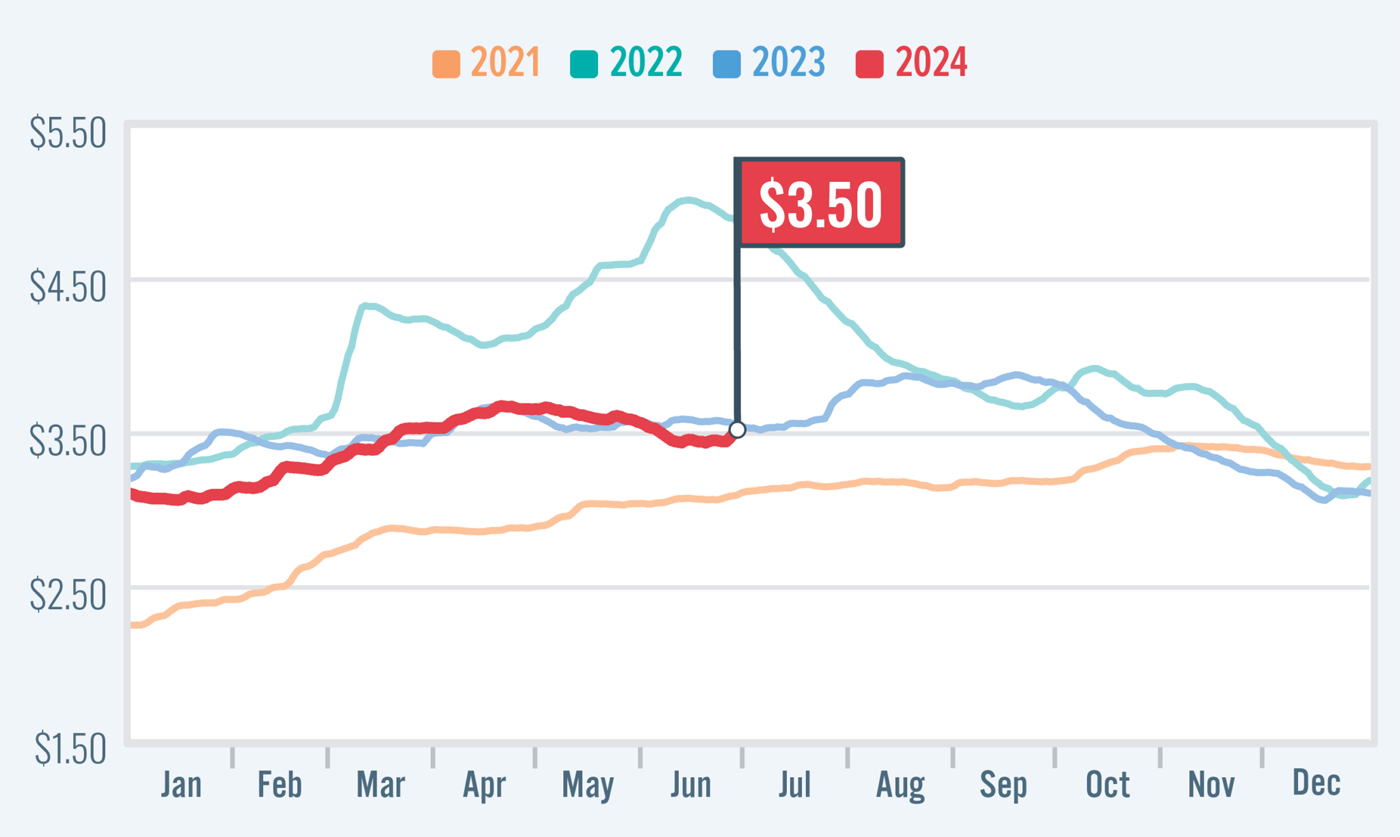

Gas prices are slightly lower than 2023 but still elevated

While Statista cites lower gas prices as an impetus for increased travel, that is open to debate. Prices are down from 2023 but still greatly exceed pre-pandemic levels and even prices in 2021.

AAA reported the following on June 27:

“The national average shook off nearly three weeks of stagnation, moving a nickel higher since last week to hit $3.50. The move came as the cost of oil crossed the $80 per barrel mark, putting upward pressure on pump prices. With oil costs accounting for about 54% of what you pay at the pump, more expensive oil usually leads to more expensive gas.

“‘Summer got off to a slow start last week with low gas demand,’ said Andrew Gross, AAA spokesperson. ‘But with a record 60 million travelers forecast to hit the road for the July 4th holiday, that number could pop over the next ten days. But will oil stay above $80 a barrel, or will it sag again? Stay tuned. …’

“Today’s national average is $3.50, nine cents less than a month ago and six cents less than a year ago.”

FIGURE 2: NATIONAL GAS PRICE COMPARISON (2021–2024)

Note: Prices are per gallon for regular unleaded gasoline, as of June 27, 2024

Source: AAA (GasPrices.AAA.com)

Were Americans driving more electric vehicles (EVs) this summer?

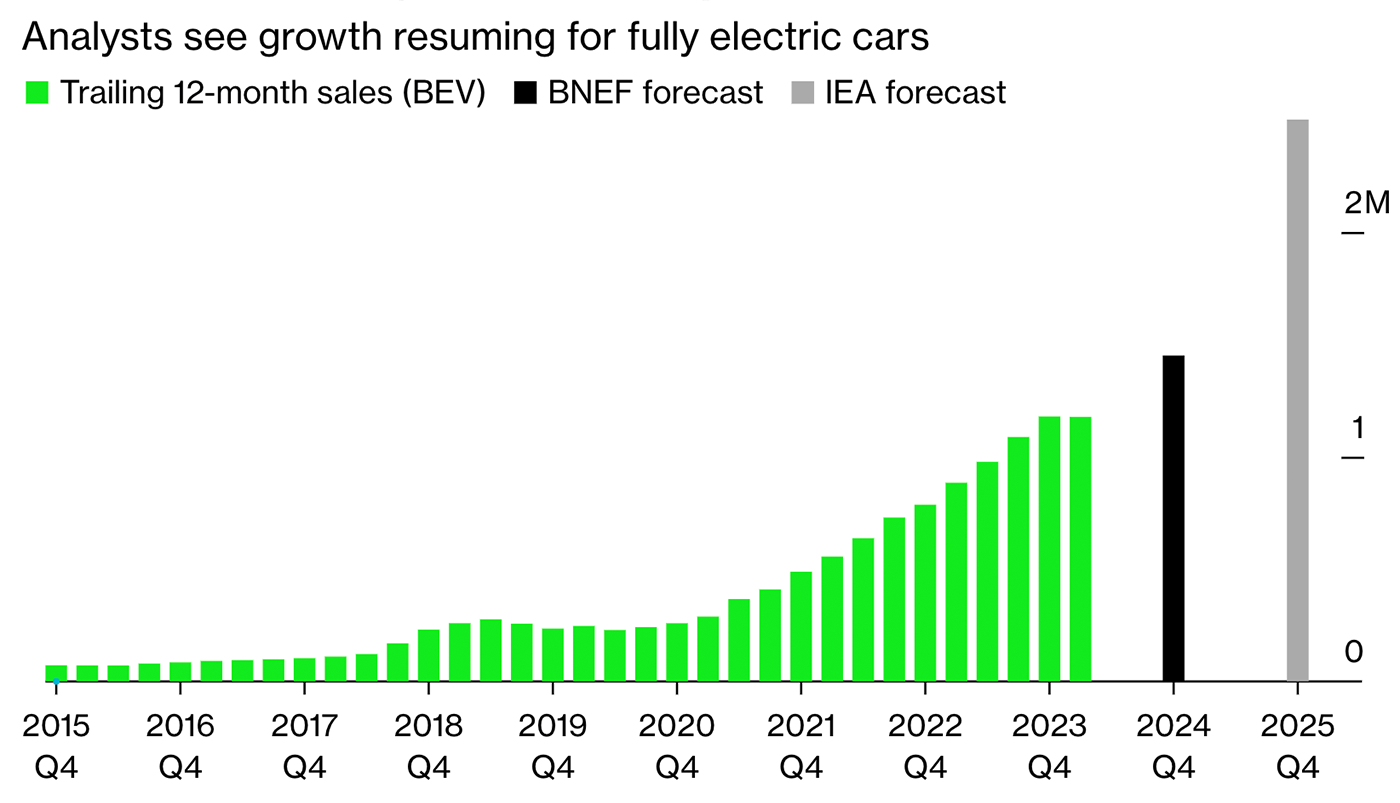

Yes, with some caveats. Bloomberg points to an EV industry in a consolidation phase, with several manufacturers revamping EV model planning for major new rollouts. Meanwhile, other manufacturers are being rewarded with booming sales. For example, GM experienced a sales decline in Q1 but anticipates 300% growth by the end of 2024.

According to Edmunds,

“Looking at a broader perspective, in the first quarter of 2024, 7.9% of all new car registrations were for electric vehicles, according to Experian Automotive’s Market Trends report. This is a slight decrease of 0.3% from the previous quarter. … EVs and PHEVs [plug-in hybrid EVs] combined made up 8.5% of the vehicles sold in May 2024.”

Bloomberg provides further detail on 2024’s EV market:

“After an underwhelming start to the year for US electric-vehicle sales, it might seem easy to conclude that the boom times are over. Sales were flat in the first quarter, Ford dramatically scaled back expansion plans and Tesla laid off 10% of its global workforce. But these dismal indicators only tell part of the story.

“For every sign of an EV slowdown, another suggests an adolescent industry on the verge of its next growth spurt. In fact, for most automakers, even the first quarter was a blockbuster. Six of the 10 biggest EV makers in the US saw sales grow at a scorching pace compared to a year ago—up anywhere from 56% at Hyundai-Kia to 86% at Ford. A sampling of April sales similarly came in hot.

“It’s a tale of two EV markets, where consumers are flocking to some brands in record numbers while turning their backs on those with inferior battery range, slower charging and high prices, said Stephanie Valdez-Streaty, director of industry insights at Cox Automotive. Delays of new vehicles, though temporary, added to the perception of a market running out of steam.

“‘We’re still seeing growth in demand, just not at the same pace for every brand,’ Valdez-Streaty said. ‘Right now Tesla doesn’t have new models, Ford doesn’t have a lot in the pipeline. But Hyundai, BMW, Kia, Cadillac—they’re really moving the needle forward.’ …

“The two companies with the worst start to the year were General Motors and Tesla—both victims, in part, of their own product cycles. This year GM discontinued its most popular EV, the Chevy Bolt, before its replacements were ready, while Tesla Model 3 production was interrupted for a long-planned facelift to the car’s design. Excluding those two models, US EV sales in the first quarter grew a respectable 23% over a year ago, matching pace with global EV sales for the same period.”

FIGURE 3: EV SLOWDOWN MAY BE JUST A BLIP FOR THE U.S.

Sources: Bloomberg Green, IEA (STEPS), BloombergNEF

RECENT POSTS