Last week’s announcement by the Trump administration to impose sweeping tariffs on virtually all U.S. imports sent shockwaves through global markets. The tariffs, which range from 10% to much higher levels on goods from key trading partners like China, led to a historic plunge in U.S. stock markets. Major stock market indexes experienced their worst single-day drops since the depths of the COVID-19 pandemic.

The selling in U.S. stocks continued into Monday morning before turning choppy with wide swings, and the S&P 500 briefly entered bear market territory. The CBOE Volatility Index (VIX) soared over 50, with most market observers expecting continued volatility. “Headline risk,” both positive and negative, seems certain over the coming weeks and months.

Bespoke Investment Group reported the following observations over the weekend:

“After a decline of just under 5% on Thursday and a nearly 6% decline Friday, the S&P 500 lost over 10% of its value in just two days this week. Since the 5-trading day week started in late 1952, there have only been three other periods where the benchmark index of US stocks declined by double-digit percentages in just two sessions—October 1987, November 2008, and March 2020. Not all three of these periods marked absolute bottoms in the market, but they came very close to long-term lows. That doesn’t mean that this occurrence will end up being some fantastic buying opportunity, but it wouldn’t take much at this point to get the market to experience at least a short-term bounce.”

“For the Nasdaq, two-day declines of 10%+ have been slightly more common although still rare. Besides 1987, late in the Financial Crisis, and during the Covid crash, there were also several occurrences in 2000 and early 2001. Back in the dotcom bust, the ultimate low wasn’t until October 2002, so all of the occurrences during those periods were far from good buying opportunities.

“Whether you look at the S&P 500, the Nasdaq, or the Russell 2000, all three indices experienced major technical breakdowns this week taking out not just the mid-March lows but the lows from October as well. Closing out the week, the S&P 500 and Nasdaq were both back down near their lows from last spring’s pullback, erasing nearly a year’s worth of gains in the process.”

FIGURE 1: S&P 500 AND NASDAQ INDEXES OVER THE PAST YEAR

Source: Bespoke Investment Group; data through the afternoon of April 4, 2025

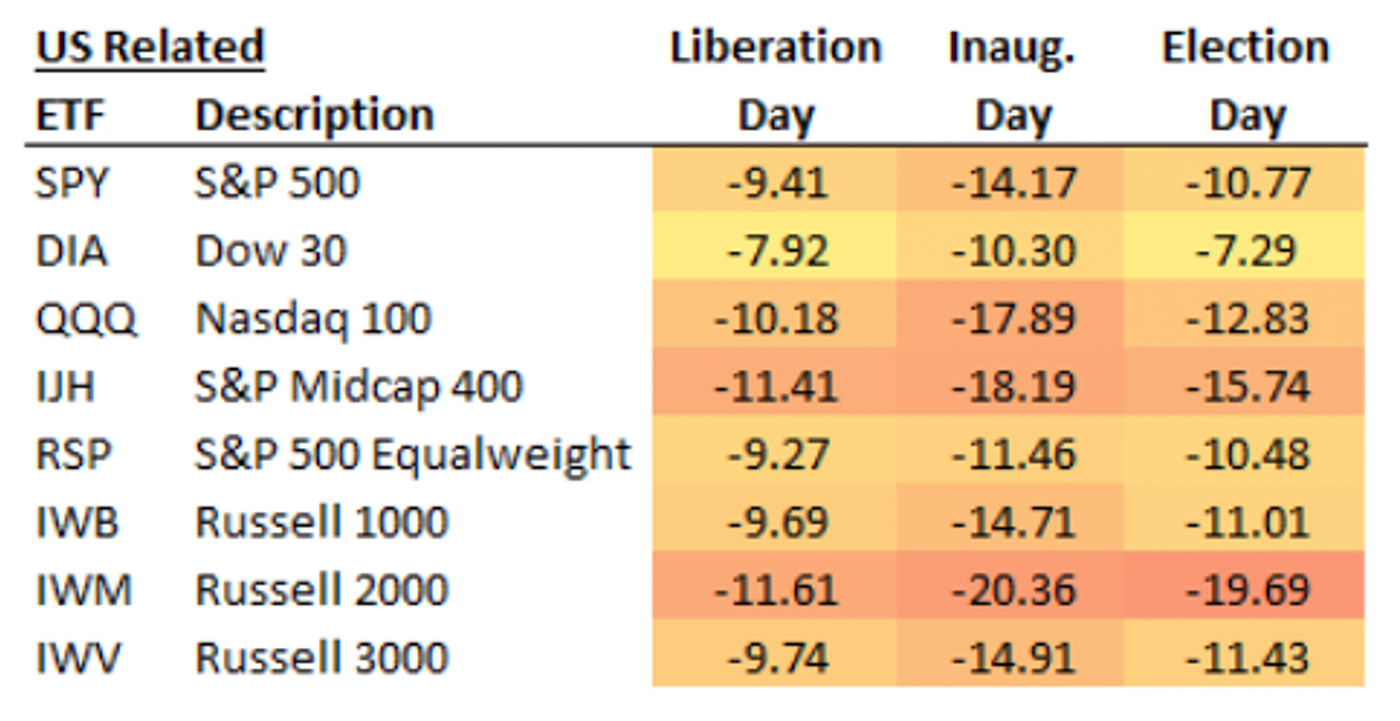

Table 1 shows the performance of key asset classes since April 2, 2025 (“Liberation Day,” when the tariff announcements were made); Jan. 20, 2025 (Inauguration Day); and Nov. 5, 2024 (Election Day).

TABLE 1: ETF PERFORMANCE SINCE KEY DATES (%, TOTAL RETURN)

Source: Bespoke Investment Group; data through the afternoon of April 4, 2025

This market turmoil reflected investor fears that the tariffs would disrupt global trade, increase costs for businesses and consumers, and ultimately slow down both U.S. and global economic growth. The immediate negative reaction from the markets underscored the potential for significant economic fallout from the tariff trade policies.

On the flip side, key figures in the Trump administration emphasized that the short-term “pain” would be well worth the long-term gains for U.S. economic growth, capital markets, and the pocketbooks of average Americans. Some conservative voices, while critical of elements of the tariff announcements, believe that the measures will ultimately lead to trade negotiations favoring U.S. interests and that market shocks should dissipate over the intermediate term.

President Trump remained resolute about the long-term benefits of the tariff policy, stating in remarks reported by the Associated Press, “Sometimes you have to take medicine to fix something.” The full text of the April 2 tariff executive order can be found here.

Recession concerns

Analysts warn that the tariffs could lead to higher prices for imported goods, squeezing consumer spending and business investment. Additionally, the tariffs may provoke retaliatory measures from other countries, further straining international trade relations and economic stability.

The combination of these factors has led to increased calls for a recession, as the economic outlook appears less favorable and the risk of a downturn grows more pronounced. The U.S. economy was already facing challenges—including inflationary pressures, weaker sentiment measures, and signs of slowing growth—making it more vulnerable to the adverse effects of the tariffs.

The financial media provided several reactions, including the following report from the Associated Press on comments from Jerome Powell:

“The Trump administration’s expansive new tariffs will likely lead to higher inflation and slower growth for the U.S. economy, Federal Reserve Chair Jerome Powell said Friday.

“Powell said that the tariffs, and their likely impacts on the economy and inflation, are ‘significantly larger than expected.’ He also said that the import taxes will probably lead to ‘at least a temporary rise in inflation,’ but added that ‘it is also possible that the effects could be more persistent.’ …

“Powell also emphasized that the full impact of the tariffs on the economy aren’t yet clear, and the Fed will stay on the sidelines until it has more clarity about the economy. He acknowledged that many businesses have said they are holding off on new investments until they get a better sense of the tariffs’ impact.”

MarketWatch summarized JPMorgan’s thoughts on the possibility of a recession:

“Jamie Dimon finally has his hurricane. JPMorgan’s economics team has just raised their recession probability to 60% following the aggressive tariff stance announced by U.S. President Donald Trump.

“In a note entitled, ‘there will be blood,’ chief economist Bruce Kasman and his team said this year’s 22-percentage tariff increase amounts to the largest tax hike since 1968.

“‘The effect of this tax hike is likely to be magnified—through retaliation, a slide in U.S. business sentiment, and supply chain disruptions. The shock is likely to be only modestly dampened by the flexibility tariff hikes afford for further fiscal policy easing,’ they say.

They aren’t [making] immediate changes to forecasts as the initial implementation—and possible negotiation—take hold. ‘However, we view the full implementation of announced policies as a substantial macroeconomic shock not currently incorporated in our forecasts. We thus emphasize that these policies, if sustained, would likely push the U.S. and possibly global economy into recession this year,’ they say.

“While any downturn from the current U.S. and global economic expansion is likely to be mild, ‘recessions are inherently unpredictable. Another important concern is that sustained restrictive trade policies and reduced immigration flows may impose lasting supply costs that will lower U.S. growth over the long run,’ they say.”

Reuters reported on Goldman Sachs’ revised economic outlook:

“Goldman Sachs raised the odds of a U.S. recession to 45% from 35%, the second time it has increased its forecast in a week, amid a growing chorus of such predictions by investment banks due to an escalating trade war.

“Goldman raised its estimate from 20% to 35% early last week on fears that U.S. President Donald Trump’s planned tariffs would roil the global economy. Days later, Trump announced steeper-than-expected duties, which have ignited a selloff in global markets.

“Since then, at least seven top investment banks have raised their recession risk forecasts, with J.P. Morgan putting the odds of a U.S. and global recession at 60%, on fears that the tariffs will not only ignite U.S. inflation but also spark retaliatory measures from other countries, as China has already announced.”

Strategist and technical analyst Michael Gayed wrote the following in his newsletter:

Barron’s provided extensive coverage last weekend, including the following observations:

“Capital Economics estimates that the average tariff is set to jump from about 2% last year to just over 20%—drawing comparisons to the Smoot-Hawley tariffs that deepened a recession in the 1930s. The tailspin in stocks, with the S&P 500 index shaving $2.5 trillion in market value in one day, underscored the shock. Economists warned that the tariffs could push the U.S. into stagflation, hitting growth and pushing prices higher.

“Trump’s latest tariff salvos aim to narrow the country’s $1.2 trillion trade deficit in goods, which he describes as a national emergency. He is wielding tariffs as a powerful tool against both friends and foes in hopes of raising billions in revenue and bringing manufacturing jobs and production of critical goods back to the U.S. …

“Over the medium to longer term, Trump’s tariff and trade policy will likely accelerate the move to diversify supply chains, emphasize regionalization over globalization, and invest in becoming more self-reliant. The trend began in Trump’s first term and was kicked into higher gear amid the supply-chain disruptions of Covid 19 and Russia’s attack on Ukraine.

“But given the uncertainty and increasing costs of inputs, companies may rethink where they allocate long-term capital. ‘These tariffs plus associated uncertainties provide more incentives to build around the U.S., not in the U.S.,’ says Mary Lovely, who focuses on U.S.-China relations at the Peterson Institute of International Economics.”

A high-profile ally of the Trump administration’s policies voiced concerns about the tariff issue, according to Fox Business:

“Billionaire investor Bill Ackman called for a 90-day ‘time-out’ on President Donald Trump’s reciprocal tariffs, warning of the United States bringing forth a ‘self-induced, economic nuclear winter.’

“In a lengthy X post on Sunday, the billionaire founder of Pershing Square hedge fund management argued that the U.S. ‘is 100% behind the president on fixing a global system of tariffs that has disadvantaged the country,’ but stressed that business ‘is a confidence game and confidence depends on trust.’

“Ackman, who backed the Republican presidential candidate in July 2024 after previously supporting the Democratic Party, acknowledged that Trump ‘has elevated the tariff issue to the most important geopolitical issue in the world, and he has gotten everyone’s attention.’”

On a more positive note for supporters of the administration’s tariff policy, the Associated Press reported movement on possible negotiations among trading partners:

“Top administration officials said Sunday that more than 50 countries targeted by President Donald Trump’s new tariffs have reached out to begin negotiations over the sweeping import taxes that have sent financial markets reeling, raised fears of a recession and upended the global trading system.

“The higher rates are set to be collected beginning Wednesday, ushering in a new era of economic uncertainty with no clear end in sight. Treasury Secretary Scott Bessent said unfair trade practices are not ‘the kind of thing you can negotiate away in days or weeks.’ The United States, he said, must see ‘what the countries offer and whether it’s believable.’ …

“‘There doesn’t have to be a recession. Who knows how the market is going to react in a day, in a week?’ Bessent said. ‘What we are looking at is building the long-term economic fundamentals for prosperity.’”

RECENT POSTS