The Q1 2024 earnings season is almost at a close, and the results have exceeded going-in expectations.

Barron’s reported in a May 30 article,

“Wall Street estimates that S&P 500 companies’ aggregate first-quarter earnings will grow 7.1% versus a year ago, outpacing the 6.7% growth predicted at the start of the year, FactSet data show. Estimates have climbed as investors have seen nearly eight out of every 10 companies beat consensus earnings forecasts—with very few firms left to report this season.

“It’s common for corporate profits to surpass estimates, as analysts typically make conservative guesses. But this quarter has been unusually good: The percentage of companies reporting higher-than-expected earnings has exceeded even the long-term average rate of 74%, FactSet data through Friday shows.”

On the other hand, Barron’s joins other commentators in noting that Q1 earnings growth has been weighted toward a relatively small number of mega-cap companies, and market gains are borderline “exuberant”:

“While companies certainly have done well this earnings season, there’s a disconnect between those results and stock market gains. The S&P 500 has raced far too ahead of earnings expectations for this year, according to Rosenberg Research’s David Rosenberg. …

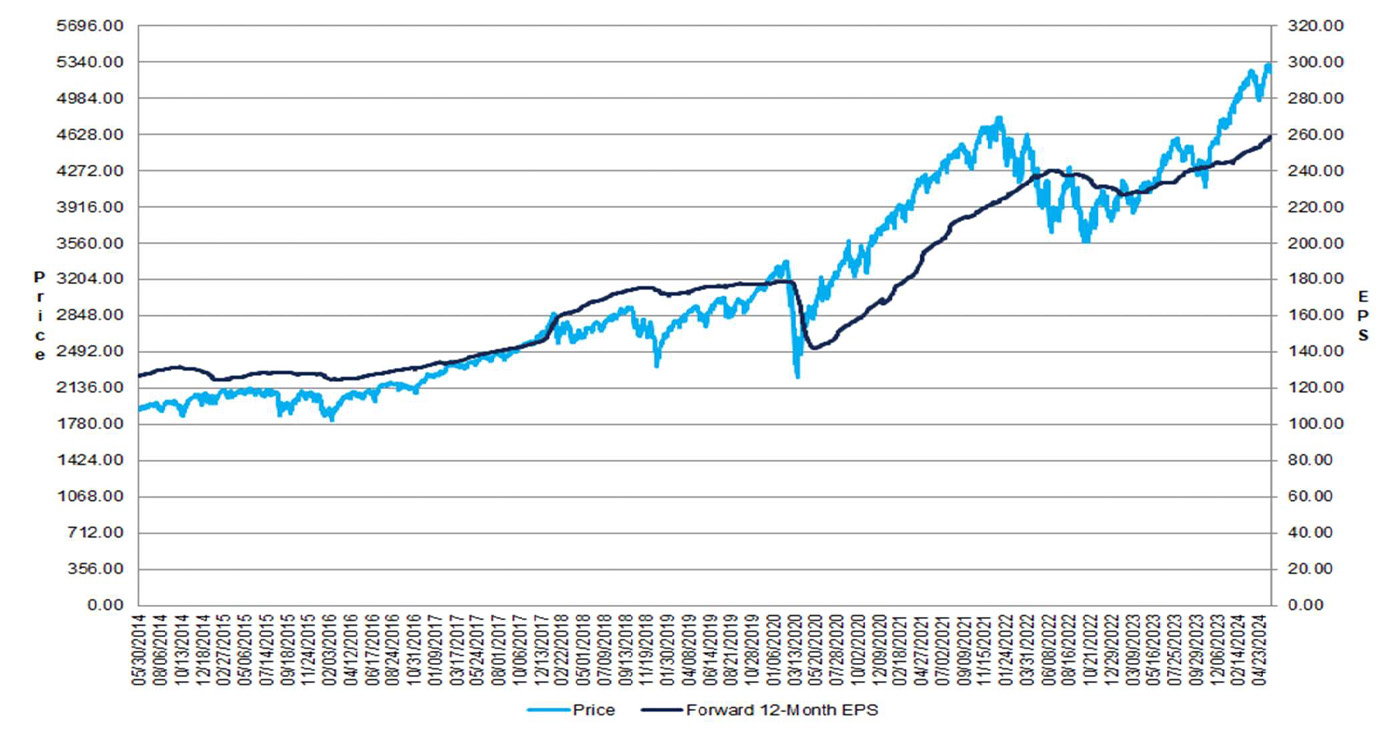

“Investors are now paying 21 times for each dollar of the S&P 500’s projected profits over the next year, compared with 17 times during October’s market low. The multiple surpasses historical averages going back 25 years.

“Investors’ willingness to buy in on the expensive valuation signals an expectation of even bigger gains in the future—even though the S&P 500 has already climbed 28% since an October low point.

“And that’s where the disconnect lies. Profit growth for the first quarter has only been about one-fourth of the market’s monstrous gain since October, while 2024 earnings estimates have seen minimal change.”

Bespoke Investment Group adds,

“One of the more notable divergences this week occurred earlier this week [w/o 5/27] when the S&P 500 was less than 0.3% from its 52-week high, but only 42% of the index’s components were above their 50-DMAs. Divergences of this magnitude come along very infrequently, and since 1990 there have been just seven other periods when the S&P 500 was within 1% of a 52-week high and less than half of its components were above their 50-DMAs.”

Highlights for Q1 earnings to date: S&P 500 companies

FactSet compiled the following key metrics about the Q1 2024 earnings season in its latest Earnings Insight (FactSet’s estimate for S&P 500 Q1 earnings growth is lower than the estimate cited by Barron’s):

- “Earnings Scorecard: For Q1 2024 (with 98% of S&P 500 companies reporting actual results), 78% of S&P 500 companies have reported a positive EPS surprise and 61% of S&P 500 companies have reported a positive revenue surprise.

- “Earnings Growth: For Q1 2024, the blended (year-over-year) earnings growth rate for the S&P 500 is 5.9%. If 5.9% is the actual growth rate for the quarter, it will mark the highest year-over-year earnings growth rate reported by the index since Q1 2022 (9.4%).

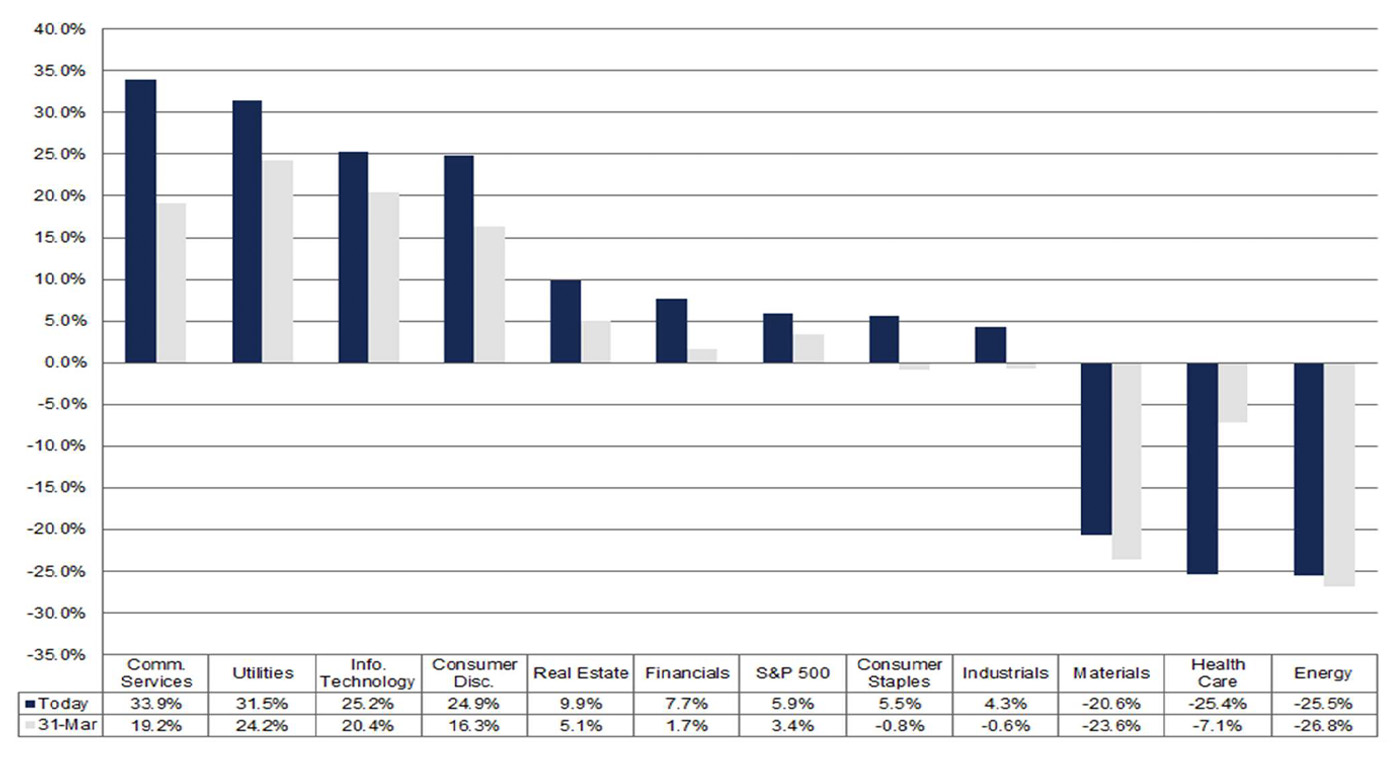

- “Earnings Revisions: On March 31, the estimated (year-over-year) earnings growth rate for the S&P 500 for Q1 2024 was 3.4%. Ten sectors are reporting (or have reported) higher earnings today (compared to March 31) due to positive EPS surprises.

- “Earnings Guidance: For Q2 2024, 64 S&P 500 companies have issued negative EPS guidance and 42 S&P 500 companies have issued positive EPS guidance.

- “Valuation: The forward 12-month P/E ratio for the S&P 500 is 20.3. This P/E ratio is above the 5-year average (19.2) and above the 10-year average (17.8).”

FIGURE 1: S&P 500 CHANGE IN FORWARD 12-MONTH EPS VS.

CHANGE IN PRICE—10 YRS.

Source: FactSet

FactSet indicates that eight of the 11 S&P 500 sectors should report year-over-year earnings growth, with the following top sectors: Communication Services, Utilities, Information Technology, and Consumer Discretionary. Three sectors are expected to report a year-over-year decline in earnings: Energy, Health Care, and Materials.

FIGURE 2: S&P 500 EARNINGS GROWTH BY SECTOR (Y/Y)—Q1 2024

Source: FactSet

Q2 2024 earnings outlook, balance of 2024, and 2025 estimates

FactSet says,

“The percentage of companies issuing negative EPS guidance for Q2 2024 is 60% (64 out of 106), which is above the 5-year average of 59% but below the 10-year average of 63%. … At this point in time, 269 companies in the index have issued EPS guidance for the current fiscal year (FY 2024 or FY 2025). Of these 269 companies, 127 have issued negative EPS guidance and 142 have issued positive EPS guidance.”

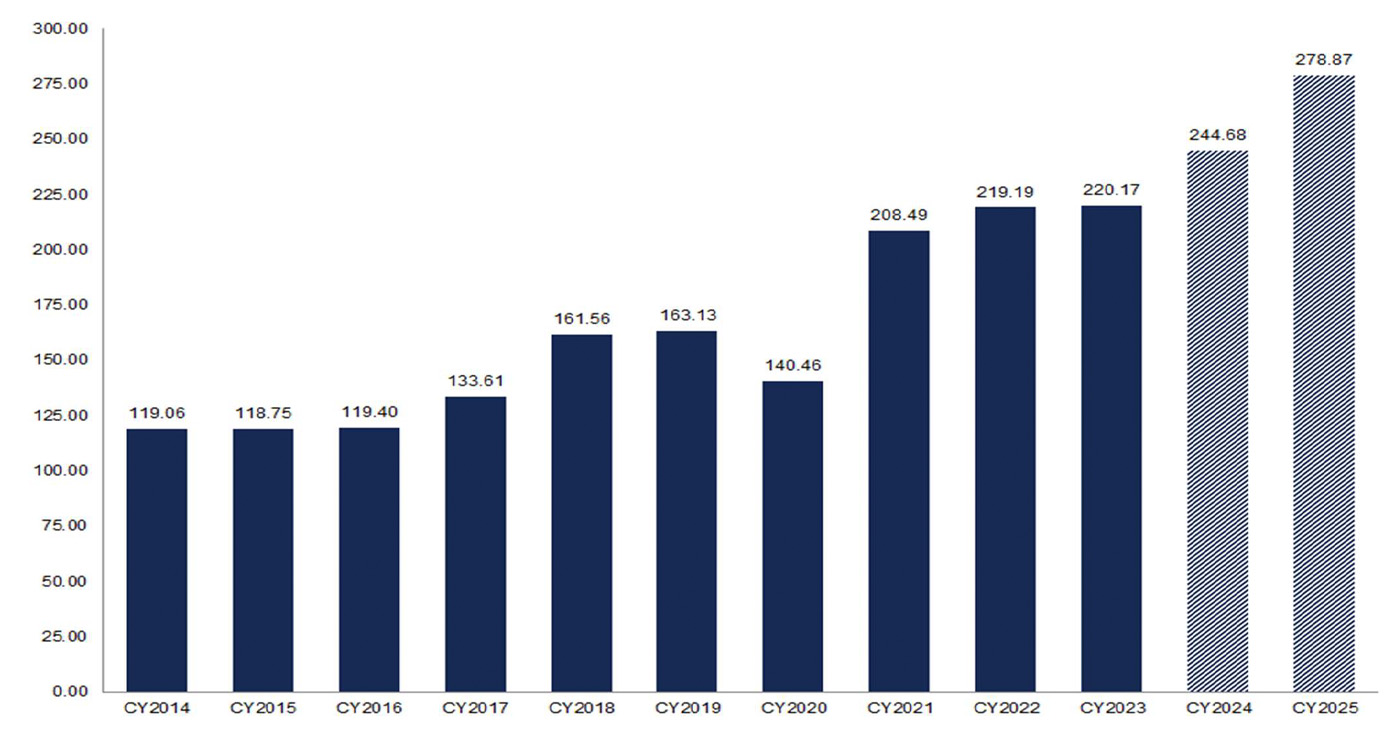

Overall, S&P 500 companies are expected to report earnings growth of 11.3% for the calendar year 2024, broken down in the following projections by FactSet:

- Q1 2024: earnings growth of 5.9% and revenue growth of 4.2%.

- Q2 2024: earnings growth of 9.2% and revenue growth of 4.7%.

- Q3 2024: earnings growth of 8.3% and revenue growth of 4.9%.

- Q4 2024: earnings growth of 17.5% and revenue growth of 5.5%.

Moving forward into 2025, significant earnings growth (+13.9%) is currently expected, as seen in Figure 3.

FIGURE 3: S&P 500 CALENDAR YEAR BOTTOM-UP EPS ACTUALS AND ESTIMATES

Source: FactSet

RECENT POSTS