Outsourcing active management: A competitive advantage for advisors

Outsourcing active management: A competitive advantage for advisors

Outsourcing investment management offers financial advisors access to sophisticated active investment strategies, resources for risk mitigation, and more time for clients and business building.

Outsourced investment management has transformed the way financial advisors serve their clients, providing numerous benefits that help them excel in a competitive environment. As advisors adopt a more comprehensive approach to their clients’ financial planning, balancing client engagement with investment management has become increasingly important. The shift toward fee-based practices and the rising use of turnkey asset management platforms (TAMPs) have driven the trend of outsourcing investment management, and many back-office functions, to third-party money managers.

Several studies and articles highlight why outsourcing can be advantageous for financial advisors:

- Time savings: Delegating investment management frees advisors to focus on client relationships and other core activities.

- Access to expertise: Advisors have access to specialized investment knowledge and multiple providers and strategic options.

- Cost efficiency: Outsourcing can be more cost-effective than maintaining an in-house team, especially for smaller firms.

- Scalability: Advisors can more easily scale operations to meet changing demands.

- Risk management: Third-party managers can help mitigate market risk through their expertise and dedicated resources.

- Enhanced service offerings: Advisors can offer clients a broader range of services, including more sophisticated investment strategies.

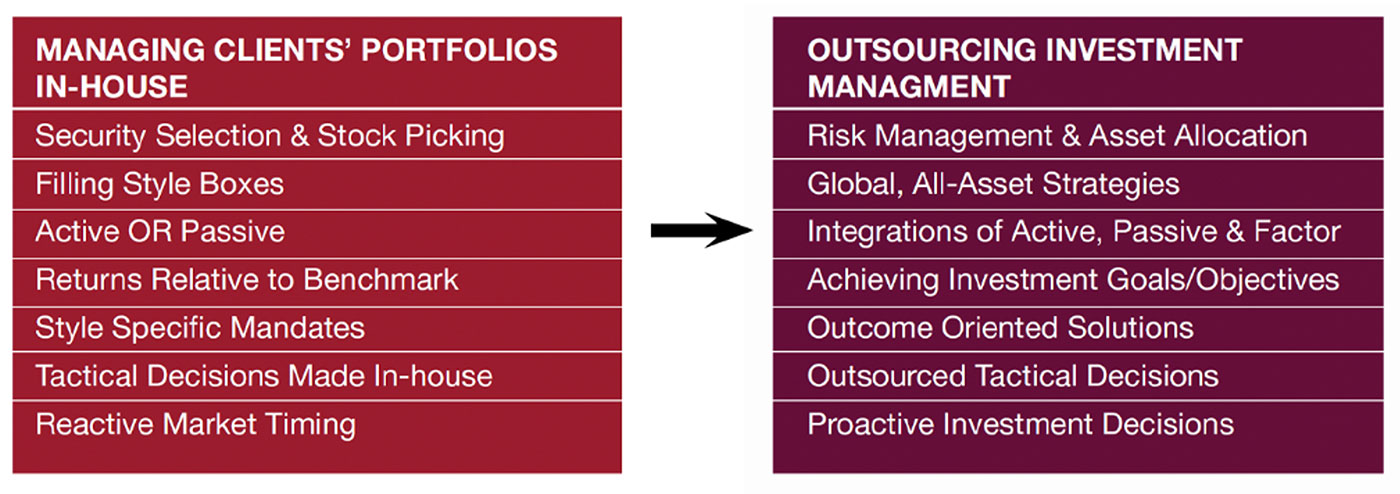

A guide from The Wealth Advisor illustrates how outsourcing can enhance a financial advisor’s or wealth manager’s value proposition for clients and prospects.

FIGURE 1: OUTSOURCING ELEVATES YOUR INVESTMENT VALUE PROPOSITION

Sources: Wealth Advisor: 2023 Model Portfolio & SMA Strategists, Envestnet

While estimates vary on how many financial advisors outsource investment management—whether for all clients or some—the consensus is that the trend is accelerating. The 2024 Impact of Outsourcing study, conducted by independent research firm 8 Acre Perspective, builds on research conducted in prior studies. Key findings include the following:

- The use of TAMPs continued to grow in 2024, with 60% of outsourcing advisors using a TAMP exclusively or in combination with another provider. This increased from 44% in 2021.

- 98% of financial advisors surveyed report that they are delivering better investment solutions to their clients since they began outsourcing.

- Advisors who outsource say they reclaim about nine hours each work week, and 72% say they are able to apply that time to building relationships with clients.

- Advisors who outsource report seeing a variety of financial benefits for their practices, including asset growth, lower operating costs, higher personal incomes, and higher business valuations.

- About 90% of outsourcing advisors report that their client relationships have become stronger since they began outsourcing, and more than 80% say client retention has improved.

- More than 90% of outsourcing advisors report that the results of outsourcing investment management have met or exceeded their expectations.

Outsourced investment management and active strategies

Given the uncertainty of investment environments, advisors have consistently shared with our publication the desire to find financial-planning and investment solutions for their clients that will stand the test of time—through multiple market cycles.

This means employing strategic approaches that can generate competitive returns in both bull and bear markets through the use of strong risk-management techniques. It also means adopting a planning and investment philosophy that can accommodate investors with varying risk tolerances and levels of financial sophistication. For this, advisors have consistently turned, in whole or part, to active investment management.

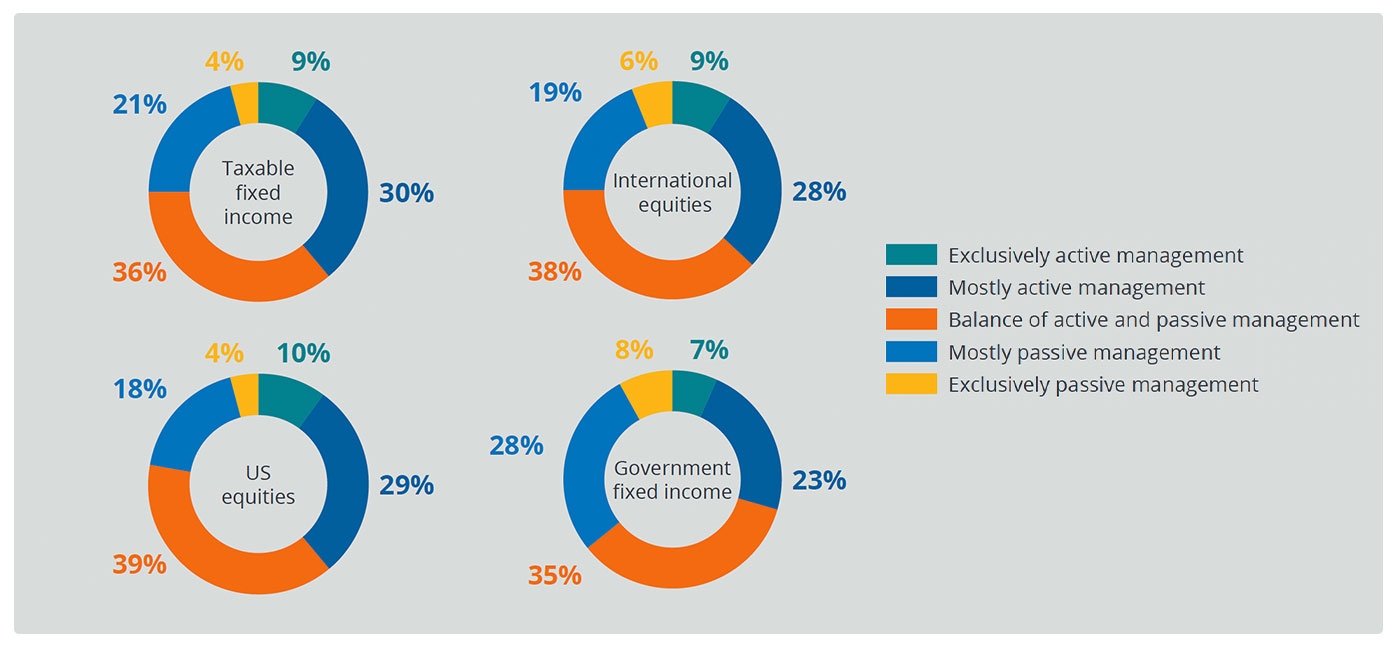

Recent research by Wealth Management IQ (sponsored by Envestnet) found the following:

- 72% of respondents use third-party managed models for at least some clients.

- 78% incorporate active products and strategies in their clients’ equity portfolios.

- 39% maintain a balance of active and passive strategies.

- 29% mostly use active strategies.

- 10% exclusively use active management for U.S. equity allocations.

The study concludes, “The active/passive wars are over and both sides have won. Most advisors use a variety of actively managed and passively managed products, depending on their clients and client objectives.”

FIGURE 2: INVESTMENT MANAGEMENT PREFERENCES—ACTIVE VS. PASSIVE

Source: Wealth Management IQ and Envestnet research study, “Active & Passive Investments in Portfolio Construction.”

For this issue, Proactive Advisor Magazine asked several experienced financial advisors:

What are the benefits of using third-party managers for active investment management?

Kevin Gotts • Alpha & Omega Financial Solutions • Whittier, CA

Kevin Gotts • Alpha & Omega Financial Solutions • Whittier, CA

Read full article

“A client’s investment strategy is tailored to their risk profile, financial objectives, and time horizons. Many of our clients are at the stage where retirement planning is a priority. Their investment goals typically focus on two key objectives: achieving risk-managed portfolio growth and developing predictable income streams—while factoring in the impact of inflation and tax exposure. …

“I believe in using investment specialists for clients’ managed portfolios. It wouldn’t be possible for me to duplicate the research capabilities, market monitoring, and strategic and risk-management expertise of these professionals. I work closely with one third-party manager that offers actively managed strategies that are suitable for clients of various risk profiles. These strategies are based on rules-based algorithms, providing an unemotional, sophisticated approach to the markets. Their risk-management approach is impressive and aligns well with my philosophy of seeking less volatile upside growth while mitigating steep portfolio drawdowns through active portfolio adjustments. I also believe in portfolio diversification, so clients may have a mix of active and passive strategies, as well as exposure to asset classes beyond traditional equities.

“The asset manager I use also has capabilities in the areas of self-directed 401(k) programs and faith-based investments. This can include actively managed strategies in those areas and a focus on risk management. That appeals to many of our clients. They also appreciate this manager’s ability to create an ongoing, customized benchmark that tracks long-term portfolio progress against their specific investment goals.”

Diana Avery • Avery Financial Services • Atlanta, GA

Diana Avery • Avery Financial Services • Atlanta, GA

Read full article

“I believe the managers that we work with provide several benefits for our firm and our clients. They can provide sophisticated, rules-based investment strategies based on their models. In building client portfolios, we are looking for strong diversification and risk management. I do not believe that most of our clients, especially those near or in retirement, should be simply invested in passive mutual funds that are fully exposed to market risk.

“Managed accounts can take advantage of tactical or active portfolio strategies that can respond to different market conditions, which I think is a huge plus for our clients. Also, it is relatively easy with managed accounts to modify a client’s portfolio allocations if their objectives or their life circumstances change. The managers can provide a variety of portfolio options that are appropriate for clients across many different risk profiles, which is also a benefit in addressing the specific needs of a diverse client base.

“Finally, working with third-party managers provides a highly professional investment resource that few advisors could provide to clients on their own. Having this resource allows me to focus on what I do best: in-depth financial planning, dedicated client service, and maintaining strong client relationships.”

Sean Reading • The North Star Financial Group LLC • Palmyra, PA

Sean Reading • The North Star Financial Group LLC • Palmyra, PA

Read full article

“In the early part of my career, the focus was on internally managing client portfolios using a fairly traditional approach to asset allocation, strategy, diversification, and portfolio construction. However, after the market turmoil of 2008 through 2009, I started to rethink that approach. Traditional asset-class relationships did not work as we have seen previously in the market. When I opened our firm, I started to make a transition to third-party money management, incorporating a more active approach with robust risk management.

“Today, we work with several third-party managers on behalf of our clients, and we conduct a thorough due diligence process when selecting those managers. We consider several criteria. First, does their overall investment philosophy align well with ours—specifically, do they prioritize risk mitigation? Second, do they have a track record of verifiable investment results that we believe are competitive given the strategic approaches being used? Third, can we establish a personal comfort level with the firm’s management and staff? We often conduct on-site due diligence visits to build that relationship. Last, will they provide excellent service to both our firm and our clients? That covers many areas, including timely reporting and having staff available to resolve any issues that may come up.

“A major objective of our firm is to communicate clearly with clients about investment expectations. Our actively managed strategic approach and strong risk management are designed to help clients meet their long-term, goals-based return objectives. We are more interested in risk-adjusted returns than ‘beating the market.’ In strong or choppy markets, risk-managed strategies may not capture all of the market’s returns. But, in return, we expect to mitigate losses during poor market conditions. We explain concepts such as the sequence of returns and the mathematics of recovering from steep portfolio losses. We believe these factors make a strong case for a well-diversified, risk-managed portfolio that seeks to mitigate volatility over the long term.”

Shannon LaRosse • WellSpring Financial • Birdsboro, PA

Shannon LaRosse • WellSpring Financial • Birdsboro, PA

Read full article

“While risk management can be beneficial to an accumulation plan, it becomes essential in retirement distribution planning. It ties back into the sequence-of-returns risk—and knowing that a client will be able to pull their income, regardless of how the stock market performs. …

“We use the services of third-party investment managers for active, risk-managed strategies. These managers have been carefully vetted and have robust strategy, research, and management teams. Their sole responsibility is the daily management of their firm’s investment strategies. We carefully examine their performance in different types of market environments. We look to see if they can produce competitive returns in positive markets and—importantly—strive to mitigate losses in poor market conditions.

“We believe in approaches that take advantage of market trends, not ‘market timing.’ And, even in volatile markets, we believe our managers can find growth opportunities. From the point of view of a client’s long-term portfolio growth, we believe it is not always about trying to outperform an index. It is also about mitigating losses. Many people erroneously think that taking on more risk will lead to higher returns. Occasionally, that is true. But for less volatile, long-term portfolio growth, we think actively risk-managed strategies can play an important role.

“Our investment managers can provide risk-managed strategies that should be suitable for any of our clients, from those with conservative risk profiles to clients who want a fairly aggressive approach. Another benefit is that several of the active strategies we use can go inverse the market, use leverage, actively rotate to stronger-performing sectors, or simply reduce or increase market exposure—if the market situation is appropriate for any of those approaches. Those are things that a passive, buy-and-hold strategy will just not offer.”

The opinions expressed in this article are those of the author and the sources cited and do not necessarily represent the views of Proactive Advisor Magazine. This material is presented for educational purposes only.

David Wismer is editor of Proactive Advisor Magazine. Mr. Wismer has deep experience in the communications field and content/editorial development. He has worked across many financial-services categories, including asset management, banking, insurance, financial media, exchange-traded products, and wealth management.

David Wismer is editor of Proactive Advisor Magazine. Mr. Wismer has deep experience in the communications field and content/editorial development. He has worked across many financial-services categories, including asset management, banking, insurance, financial media, exchange-traded products, and wealth management.

RECENT POSTS