Why risk management matters for all investors

Why risk management matters for all investors

Goals-based investment planning benefits from recognizing the many types of risks that investors face. It is also served well by incorporating modern portfolio strategies that can help provide portfolio growth, while proactively managing risk.

Proactive Advisor Magazine has explored the topic of risk management in some detail over the years, addressing several questions:

-

Are the retail investor and financial advisor underserved by the buy-and-hold philosophy?

-

What is the potential role of dynamic, risk-managed strategies in investors’ portfolios?

-

How might modern risk-managed portfolios be best constructed on a conceptual level?

In three articles, the focus has been on a related question: What risks, common to virtually all investors, do such strategies help mitigate?

-

“Why ‘timing’ is critical for investment returns” looked at the very real risks of the sequence of returns—especially pronounced for recent retirees.

-

“Risk is always with us” examined three distinct categories of investment risk: “unavoidable” risk, “improbable” risk, and “probable” risk.

-

“Would your client portfolios benefit from ‘just in case’ risk management?” reinforced the notion that investors must be cognizant of risk in good market times and bad—and the value of multiple proactive approaches to portfolio risk management.

Risk management: Not just for retirees

This article offers a quick look at another risk factor.

The sequence-of-returns issue is most commonly written about for retirees who are making withdrawals from their investment portfolios. How investment returns are “sequenced” can have a profound impact on whether a retiree’s income-distribution plan will survive throughout a lengthy retirement. A portfolio consisting of dynamic, risk-managed strategies can help smooth out market volatility and seeks to avoid the worst drawdowns of bear markets. This can help minimize the impact of the sequence of returns for retirees.

But what about those individuals who are not yet in retirement, are still in investment accumulation mode, and are not taking any withdrawals from their investment accounts?

You might have guessed it. There is a specific category of risk they face also—retirement date risk.

For investors who are within five to 10 years of retirement, the sequence of returns for their investment portfolio is as important to them as it is for recent retirees. For passive, buy-and-hold investors, a singular market event (such as that experienced in 2008–2009), or a less dramatic series of negative investment return years, can erode a portfolio’s value to the point where a planned retirement date might have to be postponed.

If the portfolio drawdown is significant enough, and takes a lengthy period to overcome, this postponement could last a long time.

Postponing retirement may be a viable option for those who are in a stable job situation, but it will be difficult for those who have lost jobs or are experiencing declining health. Alternatively, older workers could still follow through with a planned retirement date but will probably have to make a significant adjustment to their retirement income expectations. Retirement date risk affected many individuals after 2008–2009, as they had to deal with the triple negative impact of a loss of investment wealth, high unemployment for older workers, and a hit to housing values.

A paper written in 2012 for The Russell Sage Foundation and The Stanford Center on Poverty and Inequality, “Older Workers, Retirement, and the Great Recession,” said,

“The increase in unemployment among older adults was nonetheless far more prominent than in prior recessions. Older adults also spent more time out of work when laid off. In the early stages of the recession, older workers were more likely to postpone retirement and remain in the labor force, presumably in an effort to counter losses in retirement wealth.”

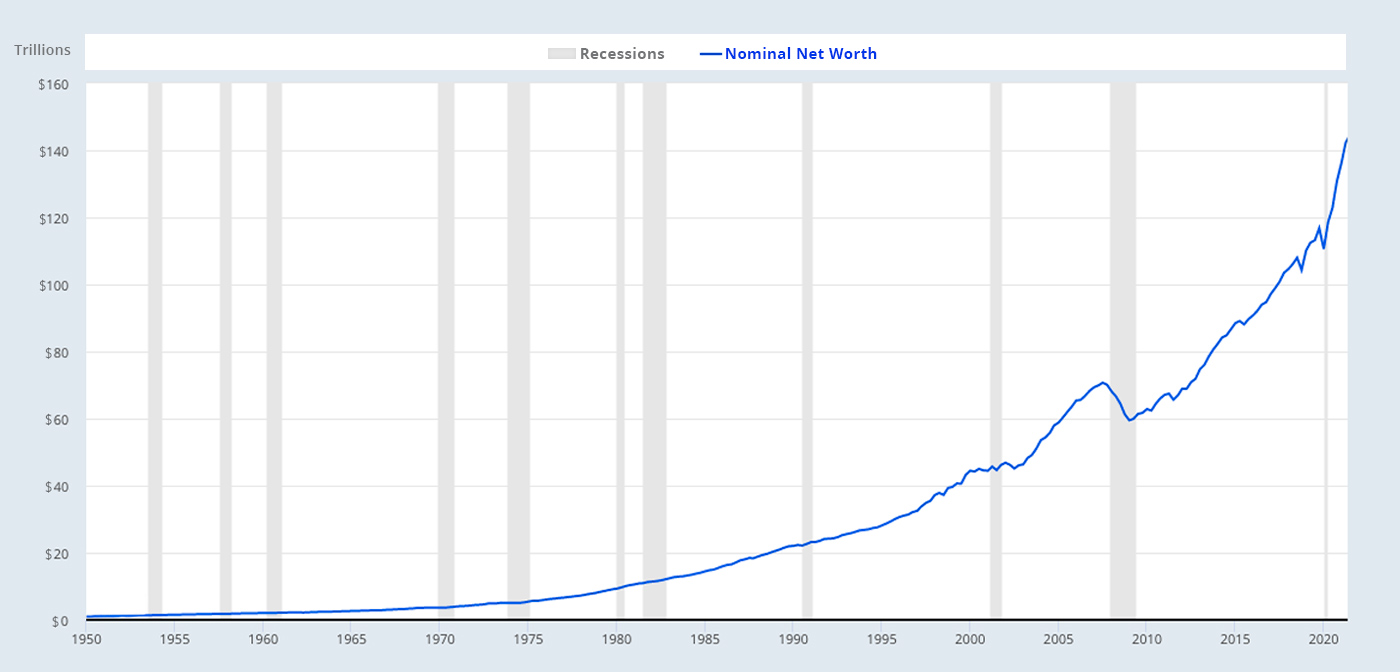

According to The Federal Reserve Bank of St. Louis, the net worth of U.S. households and nonprofit organizations rose from $44.2 trillion in 2000 to a pre-recession peak of $67.7 trillion in the third quarter of 2007. It then fell $13.1 trillion to $54.6 trillion in the first quarter of 2009, about a 20% decline.

FIGURE 1: TREND IN U.S. NOMINAL NET WORTH (1950–Q3 2021)

Note: This chart is in nominal terms, not inflation-adjusted, and includes nonprofit data.

Sources: Federal Reserve Bank of St. Louis, Board of Governors of the Federal Reserve System (U.S.)

The good news is that household wealth has rebounded impressively from the depths of 2009. But, the breakeven period for statistical household net worth recovery still took four to five years—critical years for those approaching retirement.

In the real world, many people have still not recovered, for a variety of reasons. And now many U.S. households are facing another significant challenge to their long-term financial situation, brought on by the COVID-19 pandemic.

Michael Kitces, a well-known blogger and speaker, has written about retirement date risk and says in part,

“The reality is that sequence of return risk is equally relevant for accumulators in the years leading up to retirement as well. The only difference is the problematic sequence is reversed—for retirees, the dangerous sequence is to get bad returns at the beginning (of retirement), while for accumulators it’s getting bad returns at the end (of the accumulation phase) that causes the problem. … Accordingly, accumulators in the final years leading up to retirement may wish to proactively manage risk and reduce the volatility of the portfolio, specifically as a means to reduce the retirement date risk they face.”

Goals-based investing, enhanced with active risk management

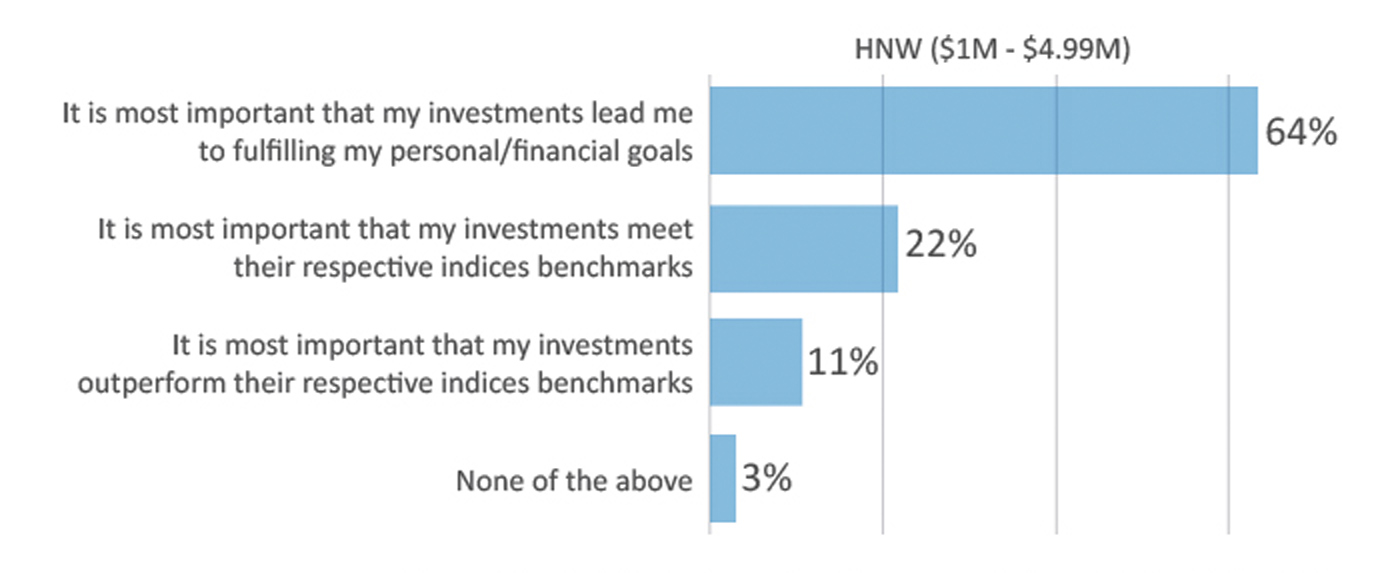

While investment theory is important, and statistics can provide many insights, what is truly most relevant for individuals, couples, and families is how their financial and investment plan addresses their specific situation and their long-term objectives or goals. Higher-net-worth investors, among other categories of investors, tend to agree with this assessment (Figure 2).

FIGURE 2: HIGH-NET-WORTH INVESTORS’ PERCEPTIONS OF INVESTMENT OBJECTIVES

Source: Phoenix Marketing International Survey, commissioned by SEI, July–Nov. 2016.

As articulated in a recent article, Proactive Advisor Magazine believes goals-based investment planning benefits from recognizing the many types of risks that investors may face. It is also served well by incorporating modern portfolio strategies that can help provide portfolio growth, while proactively managing risk for all types of investors—through different market environments.

Financial advisors cite many benefits for employing third-party actively managed strategies for their client portfolios. These include the following:

-

Access to modern analytical strategies in portfolio allocations.

-

Emphasis on risk mitigation and dampening volatility.

-

The ability to be responsive to current market conditions.

-

Generating competitive returns in both bull and bear markets.

-

Helping to remove “emotion” from investment decision-making.

-

Client satisfaction over full market cycles.

One experienced financial advisor articulated this point of view well in an interview with our publication:

“Our fee-based asset-management platform provides a variety of risk-managed investment choices to help retirees in their efforts to secure a better retirement. We believe in tactical asset management, where strategies can go ‘risk-off’ to cash, taking advantage of trends in the equities market. …We are moving more of our client money to one third-party investment manager. Their ‘risk management first’ philosophy aligns well with the objectives of most of our clients.”

New this week:

David Wismer is editor of Proactive Advisor Magazine. Mr. Wismer has deep experience in the communications field and content/editorial development. He has worked across many financial-services categories, including asset management, banking, insurance, financial media, exchange-traded products, and wealth management.

David Wismer is editor of Proactive Advisor Magazine. Mr. Wismer has deep experience in the communications field and content/editorial development. He has worked across many financial-services categories, including asset management, banking, insurance, financial media, exchange-traded products, and wealth management.