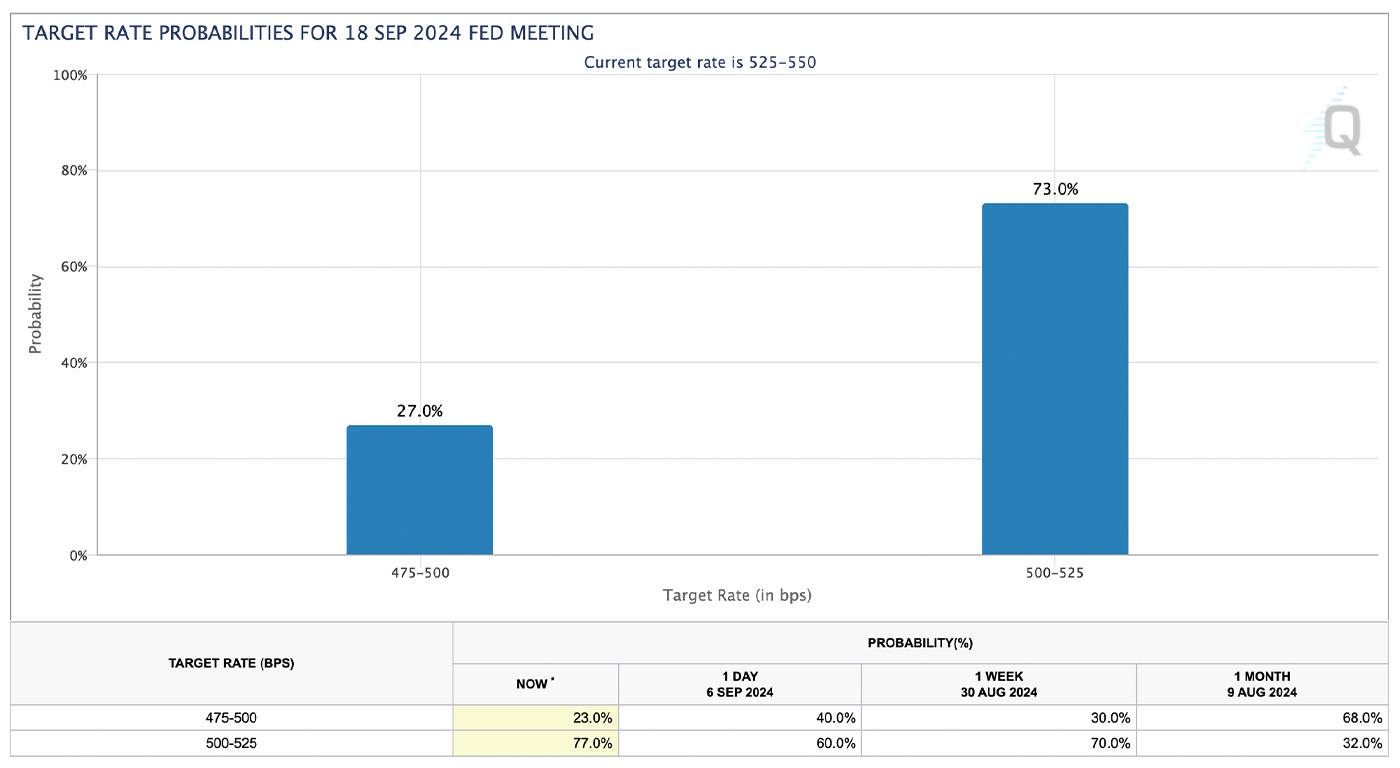

The August payrolls report was described as “down the middle” by several analysts. It showed an addition of 142,000 jobs, less than the anticipated 160,000. However, it also reported a drop in the unemployment rate to 4.2% and a higher-than-expected increase in average hourly wages.

FIGURE 1: AUGUST PAYROLLS REPORT SHOWS MIXED PICTURE

Sources: MarketWatch, Bureau of Labor Statistics

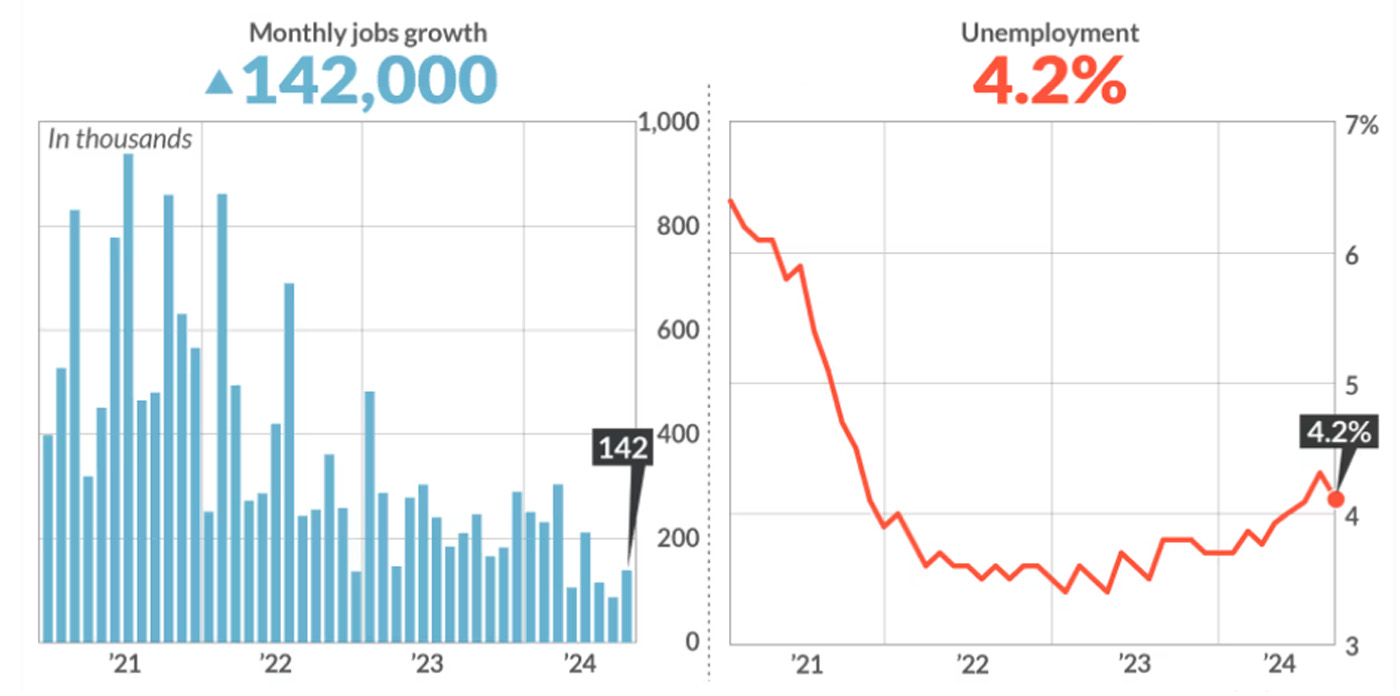

Bespoke Investment Group points out that both the August payroll data and the recent Job Openings and Labor Turnover Survey (JOLTS) report indicate a definite weakening in employment that merits the Federal Reserve’s attention:

“Given falling inflation and indisputably deteriorated labor markets, the FOMC is right to shift their focus away from inflation and towards the labor markets. Slowing hiring and rising unemployment are reasons for major concern. But precautionary easing in response to risks is different from those risks being realized. …

“July data on job openings and labor market turnover (JOLTS) showed a larger-than-expected drop in job openings, which came in 5% lower than estimated with a 3% downward revision to June data. The JOLTS data, alongside unofficial gauges like Indeed job postings, has been very consistent for some time in terms of showing a slowdown in hiring. Hires were over 4.5% of the labor force at the peak in late 2021 but have been trending lower for almost three years now; the same goes for the quits rate.”

FIGURE 2: JOLTS POINTS TO AN ACCELERATING LABOR-MARKET SLOWDOWN

Source: Bespoke Investment Group

All signs point to a September rate cut—but how far will the Fed go?

Barron’s noted remarks by one Fed member:

“It’s time to lower interest rates, Federal Reserve Gov. Christopher Waller said Friday. It’s another Fed official as good as confirming that rates will begin to come down when the central bank concludes its Sept. 17-18 policy meeting.

“In a speech titled ‘The Time Has Come’ at the University of Notre Dame in Notre Dame, Indiana on Friday morning, Waller said that the recent inflation, jobs, and other economic data support a decrease in interest rates, but don’t point to a recession in the near future.

“‘Considering the achieved and continuing progress on inflation and moderation in the labor market, I believe the time has come to lower the target range for the federal funds rate at our upcoming meeting,’ Waller said, according to his prepared remarks. …”

Reuters cited comments from another Fed official that add to the likelihood of a September rate cut:

“‘It is now appropriate to dial down the degree of restrictiveness in the stance of policy by reducing the target range for the federal funds rate,’ New York Fed President John Williams said at a Council on Foreign Relations event, though by how much and at what pace, he added, is still up in the air.”

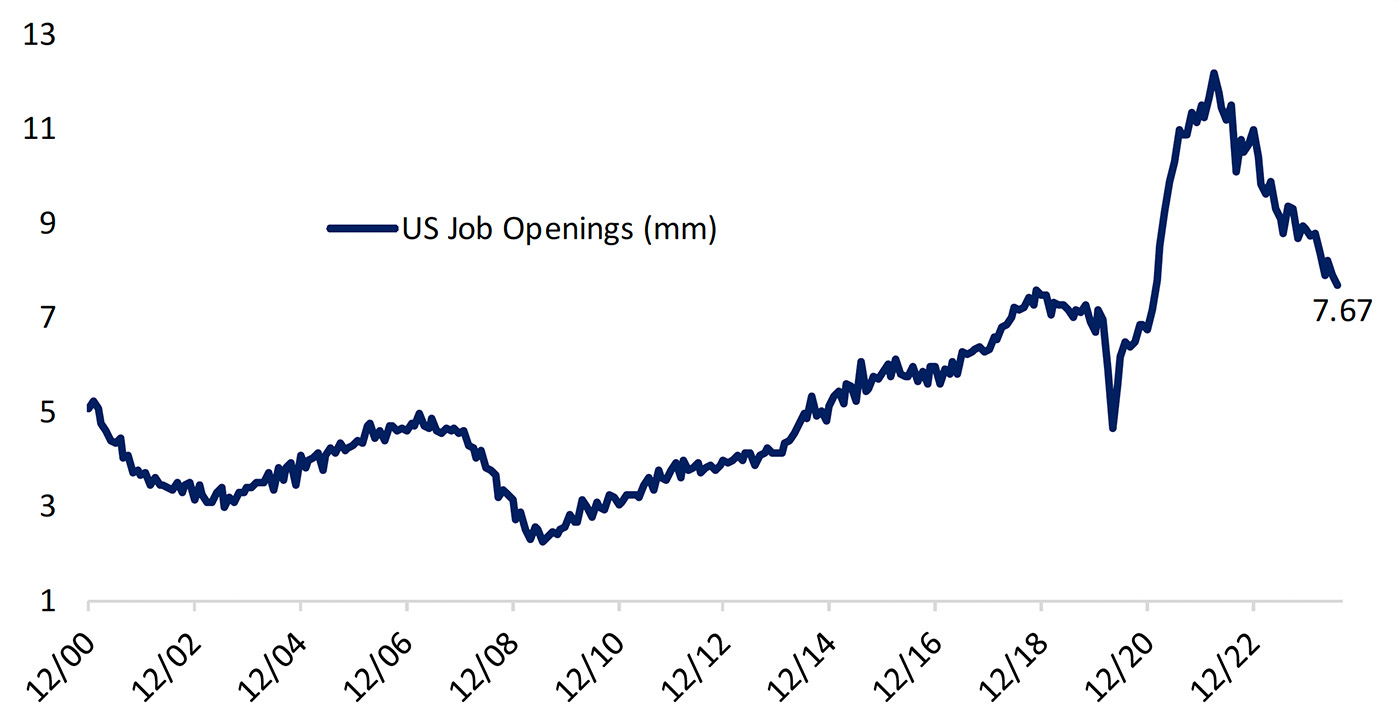

According to the CME’s FedWatch Tool, which tracks the target rate probabilities for the Sept. 18 Fed meeting, as of Sept. 6, there was a 77% chance of a quarter-point rate cut and a 23% chance for a half-point rate cut. The odds of a half-point cut initially increased following the payrolls report, said Reuters, only to fall hard as the jobs data was further digested and more likely seen as an “orderly US labor-market slowdown.”

FIGURE 3: CME’S FED TARGET RATE PROBABILITIES FOR SEPTEMBER FED MEETING

Source: CME Group. Data from Sept. 6, 2024

![]() Related Article: Sunspot cycle signals a big upturn in unemployment

Related Article: Sunspot cycle signals a big upturn in unemployment

Barron’s argues that a quarter-point cut makes sense, given the current employment data and election season:

“Data from the Bureau of Labor Statistics showed a rebound in hiring last month, with little in the report to suggest an imminent recession. … Policymakers likely would have needed to see further deterioration in the labor market to merit a more aggressive half-point cut at their September policy meeting.

“Instead, officials will likely choose to proceed more slowly, beginning with a quarter-point cut in September and making decisions meeting by meeting, depending on the message sent by the incoming data this fall. The Fed’s next meetings are in November and December.”

Barron’s added in another article,

“Investors and central bankers alike should normally ignore politics when it comes to decision-making. But with polls showing an almost dead heat in the race for the White House, the Fed will be keen not to be seen as partisan. That makes a quarter-point cut still the most likely first move in this rate-cutting story.”

RECENT POSTS