Despite the continued fear of a trade war, flat yield curve, slower global and domestic growth, and the coming election, the positive influences that drive our core thesis still exist:

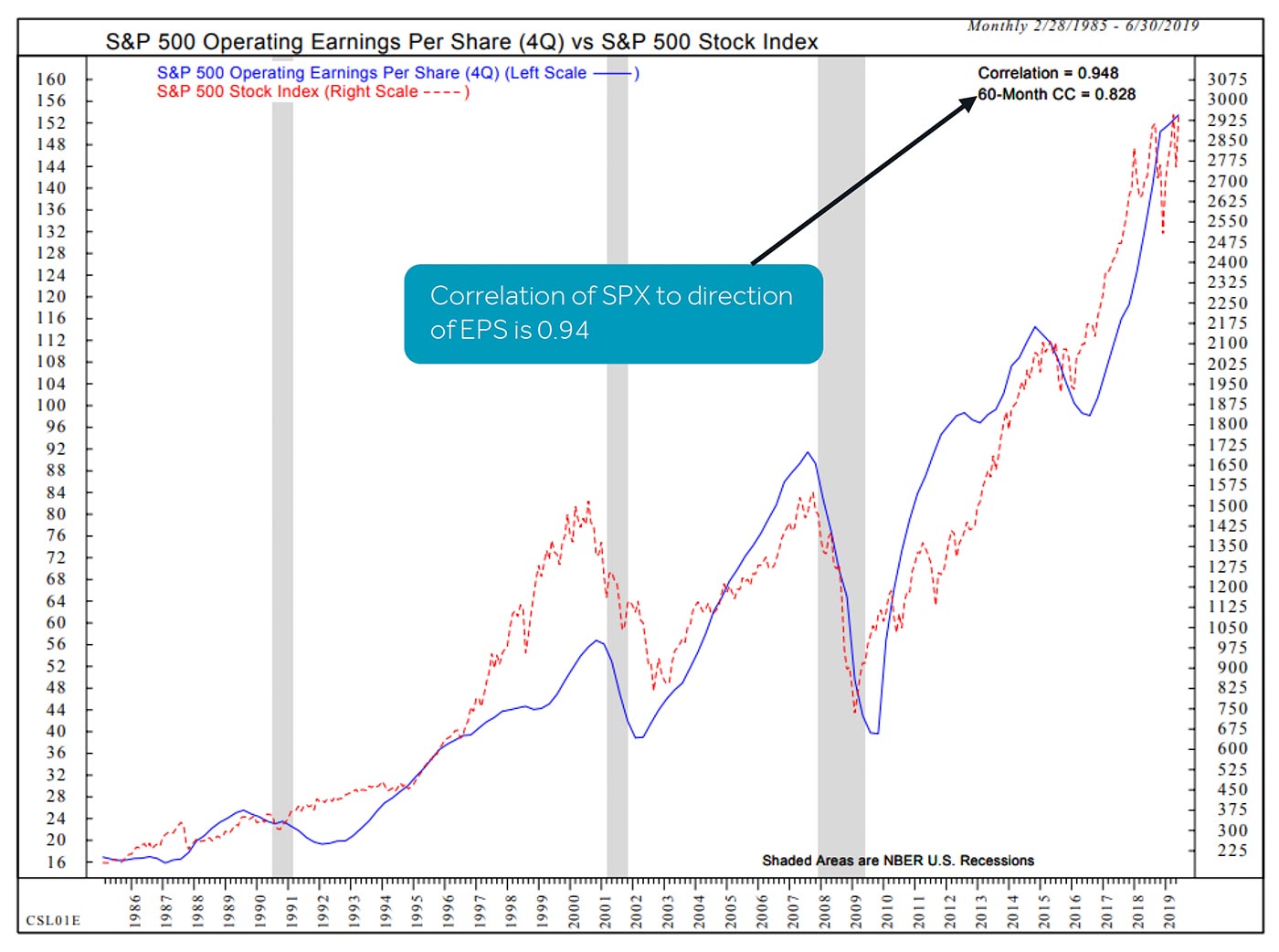

1. The equity market is most closely correlated to the direction of earnings. SPX (S&P 500) operating earnings per share (EPS) should end the year with growth over the mid single digits, which is in line with our year-old 2019 EPS estimate of $168 per share. Similar to prior nonrecession market crashes, the SPX should catch up to EPS direction.

Source: Canaccord Genuity, ndr.com

2. The direction of earnings is driven by economic activity, and, while slow, should reaccelerate given a drop in rates and no sign of stress in various non-Treasury metrics. We would typically be much more concerned regarding forward growth estimates if the drop in U.S. Treasury yields were accompanied by significant pressure in corporate debt spreads, tightening bank lending standards, and signs of stress in the Chicago Fed NFCI subindexes.

3. Positive economic activity is driven by the positive yield curve and the availability of money. Over the past seven cycles, the median time frame to recession has been 19 months after the initial date of inversion of the 2-10 year U.S. Treasury curve that drives nontraditional bank lending. Over the past three cycles, the lead time to recession has been 25 months, with a market gain of 32% first.

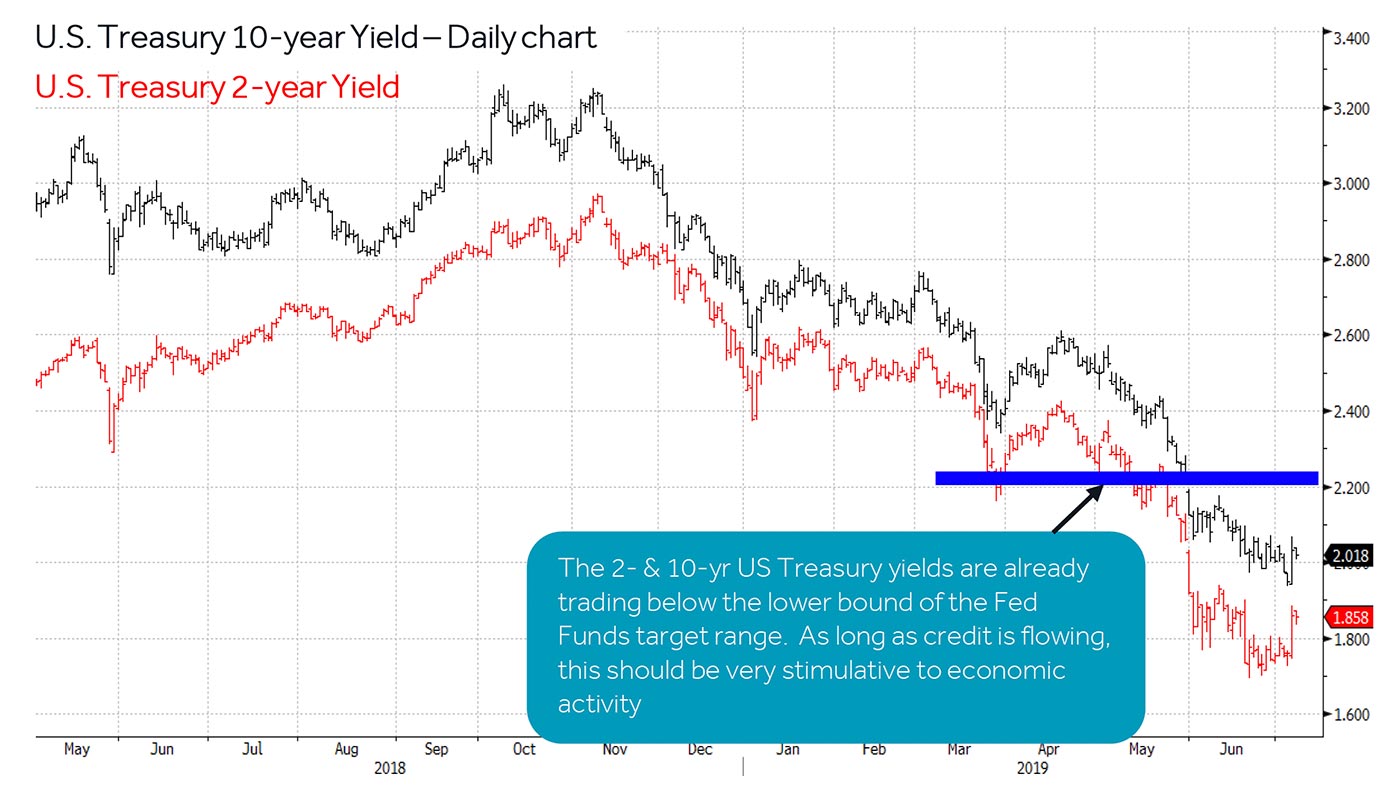

4. The slope of the yield curve and availability of credit are driven by Fed policy, which is likely becoming more dovish. The 2-year and 10-year U.S. Treasury yields have already seen a significant decline given the softer outlook for inflation.

Source: Canaccord Genuity, Bloomberg

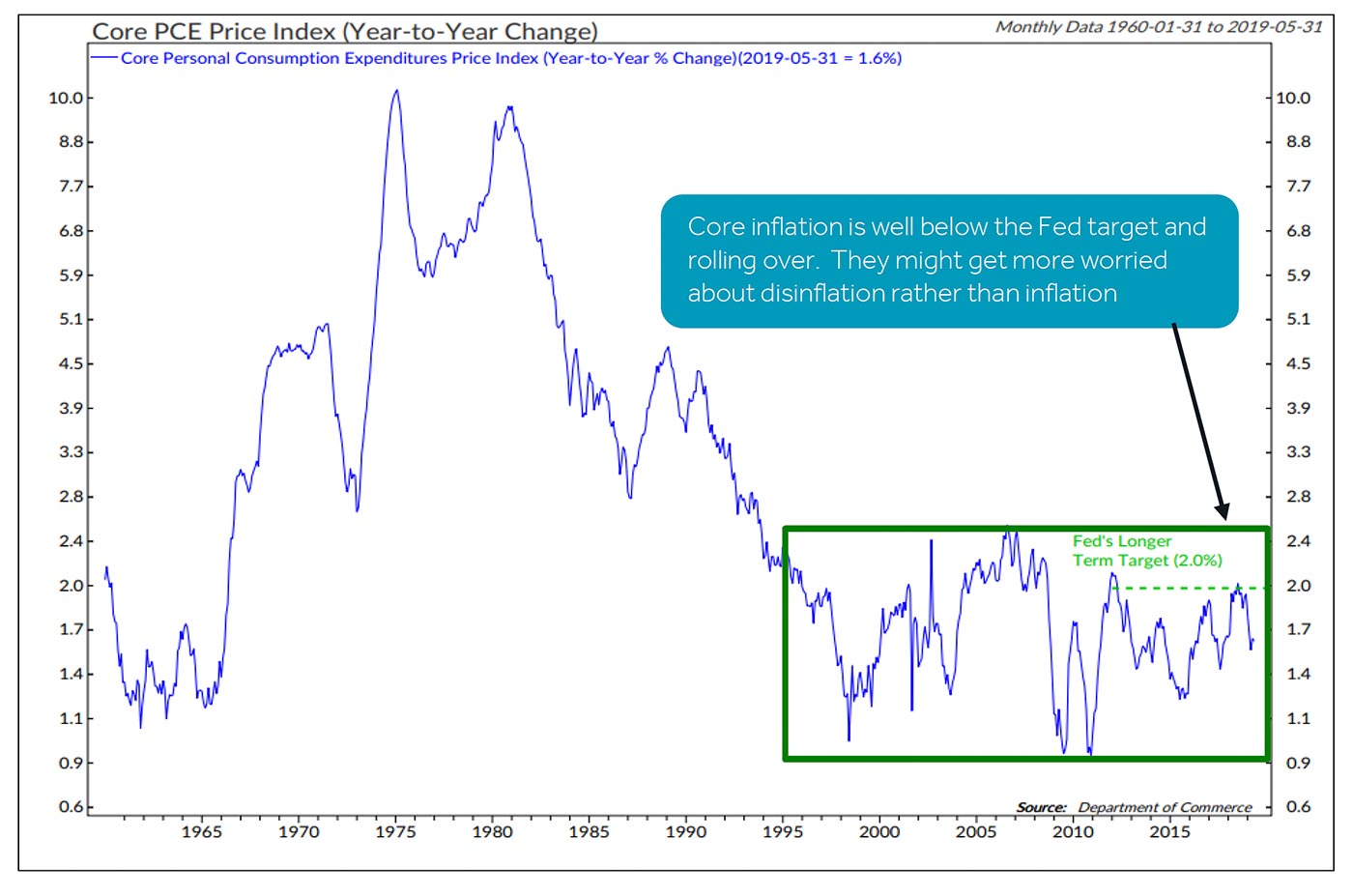

5. Fed policy is driven by core inflation, which should remain in the range of the past 20 years. The Fed’s favored inflation measures, the Core PCE and inflation breakevens, are currently well below their 2% average goal. Core PCE appears to have stalled, giving the Fed room to remain “dovish” even if growth is solid.

Source: Canaccord Genuity, ndr.com

The S&P 500 has reached into overbought territory and has exceeded our 2019 target of 2,950, which suggests a period of consolidation and increased volatility may lie directly ahead. That said, our positive fundamental thesis, current valuation level, and intermediate-term tactical backdrop suggest any weakness should prove limited and temporary, and we would add exposure into any coming weakness. We remain focused on our 2020 SPX target of 3,350.

Tony Dwyer is the head of the U.S. Macro Group and chief market strategist at Canaccord Genuity. He also sits on the firm’s U.S. operating committee. Mr. Dwyer joined Canaccord Genuity in 2012 and is known for the practical application of macroeconomic and tactical market indicators. Mr. Dwyer was previously equity strategist and director of research at Collins Stewart and a member of the firm's executive committee. Mr. Dwyer is a frequent guest on many financial news networks. canaccordgenuity.com

Tony Dwyer is the head of the U.S. Macro Group and chief market strategist at Canaccord Genuity. He also sits on the firm’s U.S. operating committee. Mr. Dwyer joined Canaccord Genuity in 2012 and is known for the practical application of macroeconomic and tactical market indicators. Mr. Dwyer was previously equity strategist and director of research at Collins Stewart and a member of the firm's executive committee. Mr. Dwyer is a frequent guest on many financial news networks. canaccordgenuity.com