The University of Michigan’s January survey of consumer sentiment shows longer-term inflation expectations reached the highest level since 2008, according to MarketWatch:

“Expectations for overall inflation over the next year jumped to 3.3% in January from 2.8% in the prior month. It is the highest rate since May.

“Expectations for inflation over the next five years surged to 3.3% this month from 3% in December. That’s the highest since June 2008.

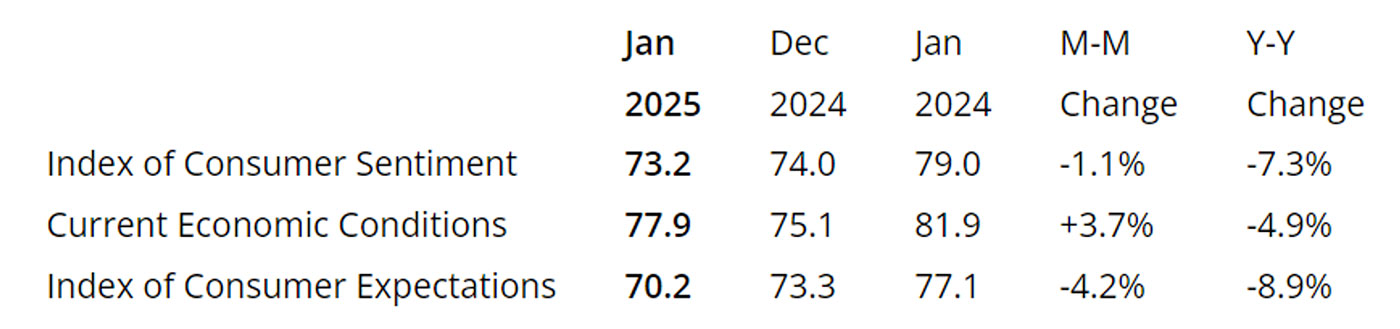

“According to the survey, overall consumer sentiment dipped to 73.2 in a preliminary January reading, down from 74 in the prior month.

“Economists polled by the Wall Street Journal had expected a January reading of 74.

“… Economists noted that there were higher prices for gasoline and food in the last month.”

TABLE 1: UNIVERSITY OF MICHIGAN PRELIMINARY

JANUARY 2025 SURVEY RESULTS

Source: University of Michigan Surveys of Consumers

Surveys of Consumers Director Joanne Hsu provided the following observations on the January preliminary report:

“Consumer sentiment was essentially unchanged in January, inching down less than one index point from December, well within the margin of error. Assessments of personal finances improved about 5%, while the economic outlook fell back 7% for the short run and 5% for the long run. January’s divergence in views of the present and the future reflects easing concerns over the current cost of living this month, but surging worries over the future path of inflation. Overall, this month’s deterioration in the expectations index was seen across political affiliations, including declines of about 3% for Independents and 1.5% for Republicans.

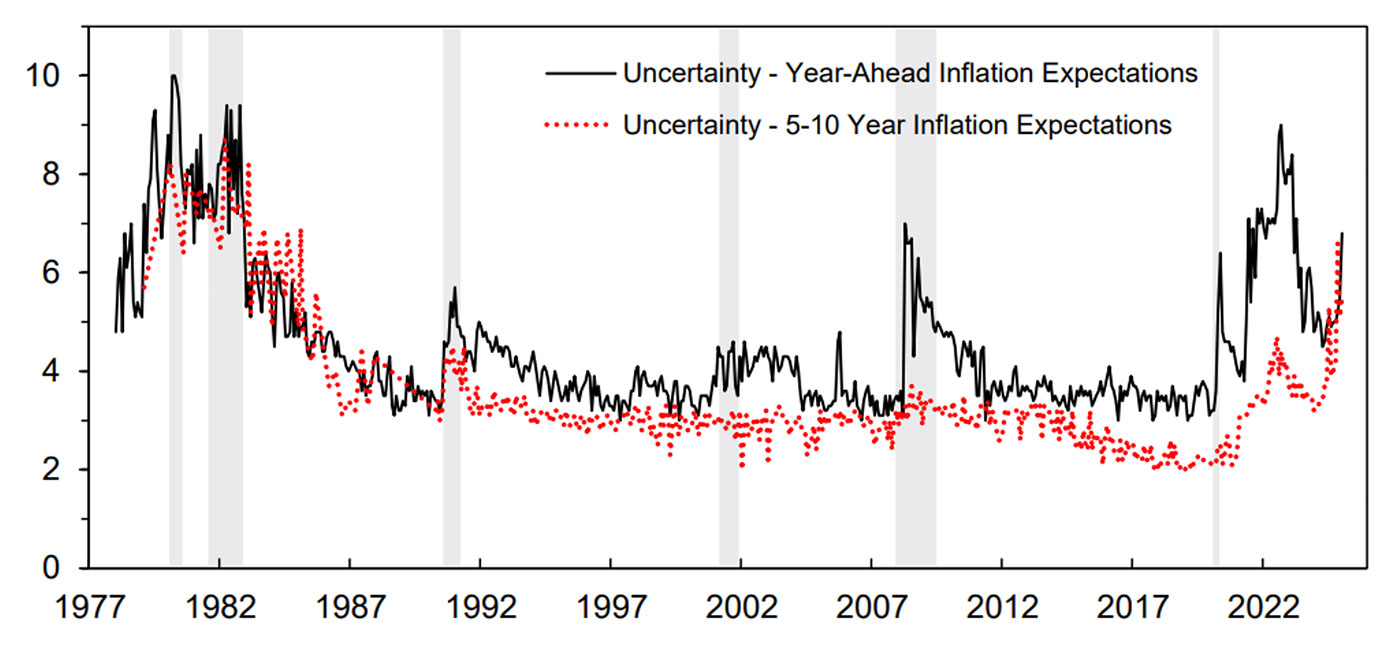

“Year-ahead inflation expectations soared from 2.8% last month to 3.3% this month. The current reading is the highest since May 2024 and is above the 2.3-3.0% range seen in the two years prior to the pandemic. Long-run inflation expectations rose from 3.0% last month to 3.3% this month. This is only the third time in the last four years that long-run expectations have exhibited such a large one-month change. For both the short and long run, inflation expectations rose across multiple demographic groups, with particularly strong increases among lower-income consumers and Independents. Note that inflation uncertainty—as estimated using the interquartile range in inflation expectations—has climbed considerably over the past year, though it remains well below levels seen in the 1970s [Figure 1].”

FIGURE 1: CONSUMERS EXPRESS RISING UNCERTAINTY OVER PATH OF INFLATION

Note: Uncertainty estimated by 75th percentile–25th percentile of expectations; three-month moving averages

Source: University of Michigan

Housing affordability is expected to remain a major issue for consumers

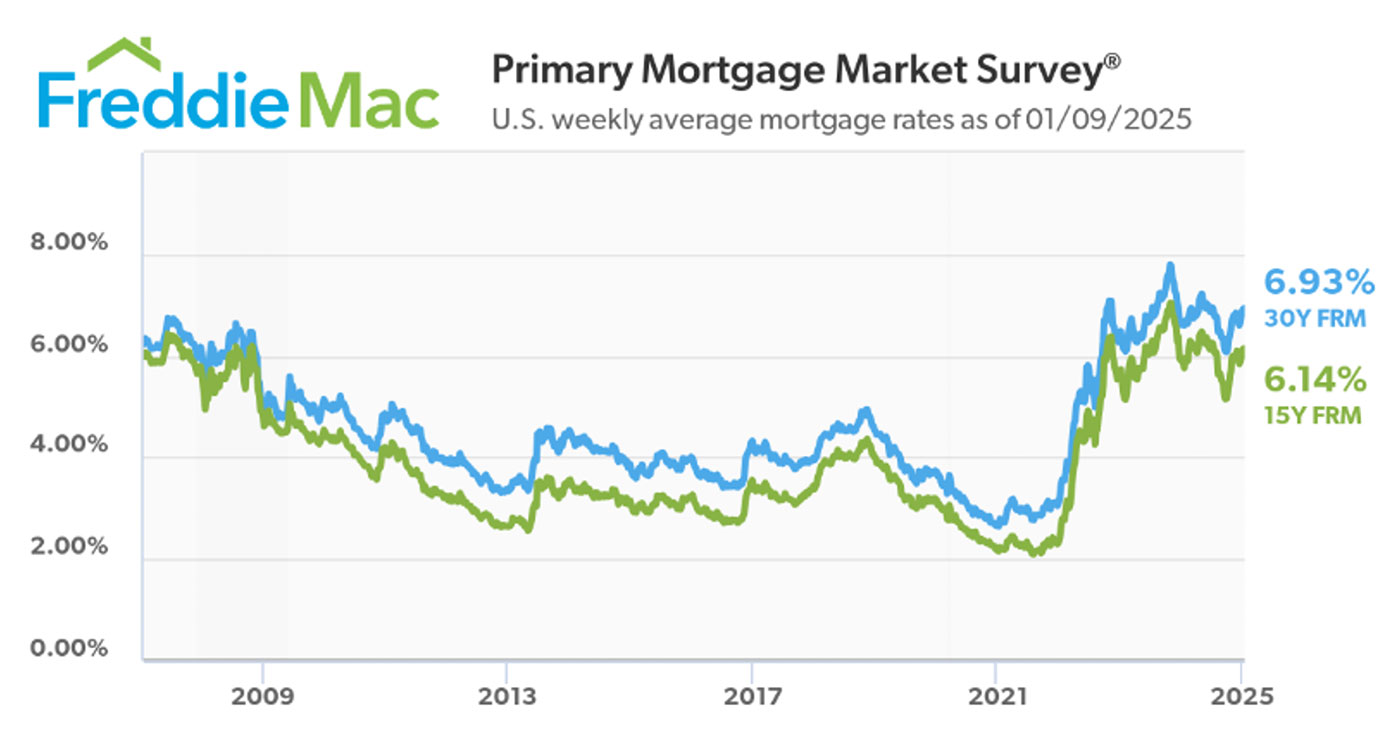

Somewhat ironically, recent improvements in economic data have likely slowed the pace of the Federal Reserve’s interest-rate cuts, leading to higher bond yields (Figure 2) and stubbornly high mortgage rates (Figure 3).

FIGURE 2: 10-YEAR TREASURY YIELD (%)—LAST 12 MONTHS

Source: Bespoke Investment Group

FIGURE 3: TREND IN AVERAGE 15-YEAR AND 30-YEAR MORTGAGE RATES

Sources: Sam Ro, Freddie Mac

Bespoke Investment Group noted last Friday that the pace of rate cuts is “dramatically pushed back,” with “some strategists even suggesting that the current easing cycle could be done already.”

The cost of home financing remains high, with elevated mortgage rates expected to coincide with rising home values in 2025. These factors will likely continue to influence consumer perceptions about inflation over the next few years—adding to the concerns over the costs of energy and food.

First Trust recently wrote,

Sam Ro, in a detailed analysis, notes the substantial impact of higher mortgage rates:

“To better understand what this means for homebuyers, Bloomberg’s Michael McDonough charted the trajectory of monthly mortgage payments based on reported mortgage rates. For a $500,000 home, a new homebuyer is paying about $2,100 a month today versus about $980 at the 2020 low.”

Strategist Charlie Bilello adds,

“The exact same issues plaguing the US housing market at the start of 2024 were there at the end. Which is to say that the combination of high prices and high mortgage rates have frozen the housing market in time, with record lows in affordability constraining both supply and demand.

“The average home price in the US continued to hit record highs throughout 2024 and is up over 50% in just the last 5 years. That’s more than double the increase in average US wages.”

RECENT POSTS