Investment lessons from defensive driving

Investment lessons from defensive driving

Defensive driving best practices closely resemble the principles of dynamic, risk-managed investing. This investment approach seeks to ensure the security and growth of client investments through full market cycles.

While summer may be slowly fading away, it still beckons us with open highways and the thrill of new adventures. According to AAA, large numbers of travelers were estimated to have embarked on journeys of over 50 miles over the Fourth of July holiday—and the trend toward more summer travel is expected to continue. Many families across the nation are gearing up for much-awaited August and Labor Day vacations.

This uptick in travel brings the vital role of defensive driving into sharp focus, ensuring safe and secure journeys for all. The National Safety Council (NSC) presents a compelling case for these precautions. It suggests that defensive driving courses can significantly cut the risk of accidents and injuries by up to 50%. This statistic speaks volumes. It demonstrates the power of being prepared and managing potential hazards proactively.

However, more driving usually means more risk. In response, many trusted health and safety organizations have offered up several defensive driving habits, including the 10 tips presented below. The habits mitigate risk and work to ensure safe travels. These practices remarkably parallel the principles of dynamic, risk-managed investing that we adhere to at Flexible Plan Investments, Ltd. (FPI).

Let’s explore these safety tenets and their correlation to our approach to ensuring the security and growth of our clients’ investments.

1. Always wear your seat belt

Fastening your seat belt before starting a journey can help protect you in the case of an accident. This practice parallels our first line of defense in dynamic risk management. FPI’s active, tactical management approach acts like a financial seat belt, providing a safety net against unexpected market downturns. FPI designed this strategic measure to help shield clients’ investments, much like a seat belt helps to protect a driver during unforeseen circumstances.

2. Keep a safe following distance

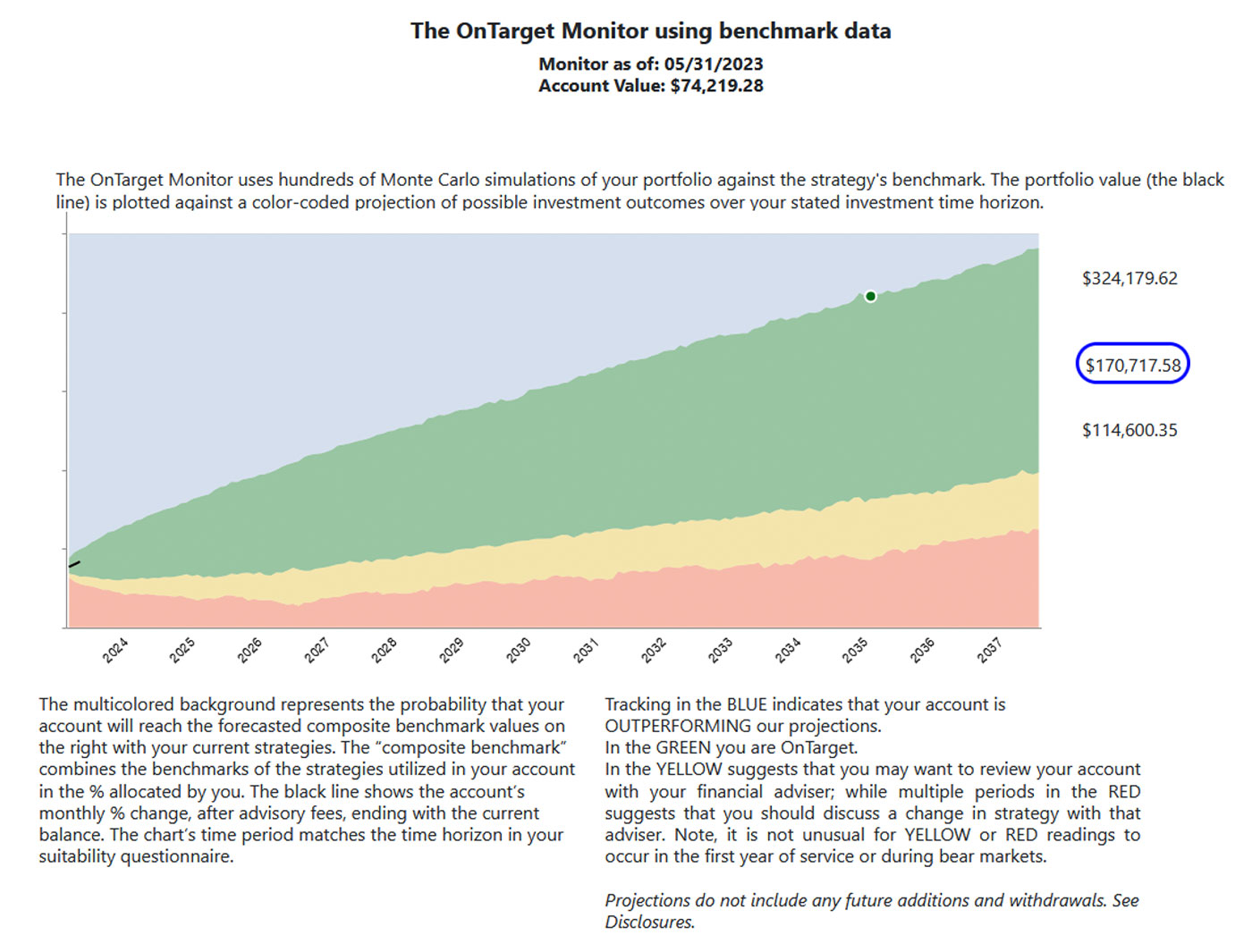

Following at a safe distance from objects and other drivers can give drivers enough time to react and recover in the event of an accident or other dangerous situation. In the investment landscape, FPI created custom benchmarks in our OnTarget Monitor (see sample below) to act as a guide to maintain a safe distance from risk. We believe that before anyone invests, they should have a clear goal and a realistic benchmark that reflects their risk tolerance and time horizon. The OnTarget Monitor helps an investor set and track their progress toward their goal. And by adjusting asset allocation according to market conditions and providing suitability-based strategies, we provide portfolios with space to breathe and recover.

3. Scan the road ahead and behind you

Constant vigilance is critical both on the road and in the financial markets. My father taught me this lesson when I was learning to drive. “Constantly use the rearview mirrors,” he would often say. “You should always know the position of every car around you.” FPI’s strategies are rigorously backtested. They look in the rearview mirror at past market prices to prepare us for future market events. We learn from past market trends while proactively anticipating future investment opportunities and risks, guiding client portfolios.

4. Be aware of your surroundings

Drivers must be mindful of their surroundings to react appropriately. For the same reason, FPI factors the broader economic landscape—including economic indicators, geopolitical events, and sector trends—into our investment decisions. This consideration allows us to optimize the positioning of a portfolio’s investments within the dynamic global market.

5. Avoid distractions

On the road and in investing, distractions can lead to costly mistakes. “Hot” investment trends or panic-inducing news can distract investors from their long-term goals. Our dynamic, risk-managed strategies and turnkey, multi-strategy portfolios can help both financial advisors and their clients to maintain focus on long-term investment goals, helping avoid such pitfalls.

6. Never drive under the influence

In investing, as in driving, it is important to make decisions with a clear head. Investors under the influence of extreme emotions, such as fear and greed, may make hasty and regrettable decisions. FPI’s active investment approach includes systems and strategies that remove these emotional biases, ensuring lucid, data-driven decisions.

7. Follow traffic laws

Just as traffic laws are designed to keep drivers safe, investment regulations and financial principles (the traffic laws of the financial world) are created to keep investors safe. At FPI, we adhere strictly to these regulations and principles. Our goal is to continuously manage our clients’ investments with the highest legal and ethical standards in alignment with market norms and regulations.

8. Stay focused

Staying focused allows drivers to assess conditions and act accordingly. Similarly, our Illustration Generator (available to financial professionals only) helps a client and their financial advisor explore the right portfolio strategies for the client’s individual situation. It emphasizes multi-strategy diversification and tactical adjustments according to market conditions and is designed to make sure a client’s financial journey aligns with their personal and financial objectives. And for those advisors and clients who want additional guidance in portfolio construction, we offer turnkey, multi-strategy portfolios that are suitability-based and goal-centered.

9. Stay alert

In driving, this means constantly scanning near and far for signs of trouble. For investments, it means regularly reviewing portfolios and keeping an eye on emerging trends and potential investment opportunities. Our tools and strategies are designed to facilitate ongoing market analysis, aided by daily account monitoring and weekly strategy updates available on the Flexible Plan Investments and OnTarget Investing websites. Furthermore, in this era of artificial intelligence, the majority of our strategies already automatically adapt as market conditions change.

10. Anticipate possible risk

As I often say, “Risk is always with us.” Our Crash Test Analyzer (available to financial professionals only) plays a crucial role in watching out for risk. Just as drivers anticipate potential road hazards, we stress-test portfolios for various scenarios, continually evaluating potential market risks. This proactive identification and mitigation of risk aids in minimizing losses and maximizing returns.

Just as defensive driving habits are designed to keep drivers safe on the road, dynamic, risk-managed investing at FPI aims to safeguard our clients’ financial future. Our principles mirror these driving habits, seeking to protect wealth, provide stability, and navigate the intricate investment landscape with agility and foresight. We believe that following these 10 defensive habits can help investors both enjoy a safe and pleasant journey this summer and a successful and rewarding trip on the investment highway.

The opinions expressed in this article are those of the author and the sources cited and do not necessarily represent the views of Proactive Advisor Magazine. This material is presented for educational purposes only.

Jerry C. Wagner, founder and president of Flexible Plan Investments, Ltd. (FPI), is a leader in the active investment management industry. Since 1981, FPI has focused on preserving and growing capital through a robust active investment approach combined with risk management. FPI is a turnkey asset management program (TAMP), which means advisors can access and combine many risk-managed strategies within a single account. FPI's fee-based separately managed accounts can provide diversified portfolios of actively managed strategies within equity, debt, and alternative asset classes on an array of different platforms. flexibleplan.com

Jerry C. Wagner, founder and president of Flexible Plan Investments, Ltd. (FPI), is a leader in the active investment management industry. Since 1981, FPI has focused on preserving and growing capital through a robust active investment approach combined with risk management. FPI is a turnkey asset management program (TAMP), which means advisors can access and combine many risk-managed strategies within a single account. FPI's fee-based separately managed accounts can provide diversified portfolios of actively managed strategies within equity, debt, and alternative asset classes on an array of different platforms. flexibleplan.com

RECENT POSTS