This summer has brought plenty to stir up investors’ emotions. The Federal Reserve raised their short-term interest-rate target, political tensions between global powers were elevated, and the U.S. unemployment rate matched its lowest level in over a decade.

The latest developing news story to keep investors on edge is the potential for a government shutdown, which could potentially lead the government to default on its debt and send tens of thousands of federal workers on furlough. Though the much-publicized “deal” between President Trump and senior Democrats could delay the shutdown threat until mid-December, anything is still possible. Despite recent index gains, this issue brought some fear back into the markets over the past several weeks, and investors may still be wondering if they should position themselves defensively in case a shutdown ultimately occurs.

Here we’ll explore whether the threat of government shutdown should warrant scaling back on equity exposure. The result may help investors focus on the real driver of stock market returns.

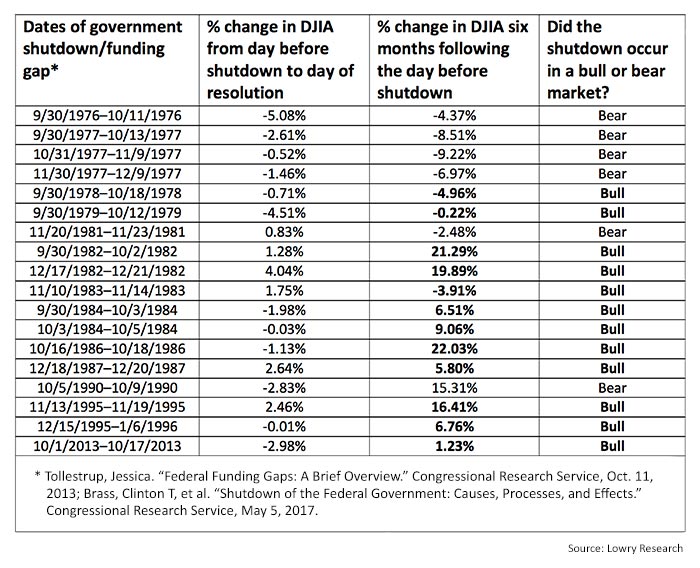

As is readily apparent in the following table, the stock market returns following the past 18 government shutdowns/funding gaps have been erratic. Specifically, 67% of returns from the day before the government shutdown until the day of its resolution have been negative, giving those wishing to trade such news by reducing stock exposure moderately better odds than a coin flip. Several of the negative returns were also only nominal in magnitude. This suggests that making short-term trades and portfolio adjustments based on the speculation of whether a government shutdown will occur may not be the best investment strategy.

PAST GOVERNMENT SHUTDOWNS AND

PERFORMANCE OF DOW JONES INDUSTRIAL AVERAGE (DJIA)

What carries much more importance for the majority of investors and portfolio managers is to not get caught up in short-term market gyrations and instead focus on whether a specific news event might impact longer-term returns. In the two right-hand columns of the table, one can see the six-month return in the DJIA following a government shutdown and if the overall equity market was in a longer-term bull or bear market.

We find the worst losses following a government shutdown occurred when the established longer-term trend of the stock market was bearish. Furthermore, we can see that out of the 12 shutdowns that occurred during a bull market, the DJIA was at a higher level, and often a significantly higher level, six months after the shutdown 75% of the time.

This might suggest to an investor that government shutdowns are good for stocks during a bull market. However, it is a bull market that is positive for stock prices, regardless of what news story may be developing. Bull markets develop because of the long-term interplay between the market forces of supply and demand. During bull markets, demand is the dominant market force versus supply in the stock market, and according to the law of supply and demand, this should result in higher stock prices. The balance between supply and demand takes precedence in determining stock market trends over any developing news story, whether it’s a government shutdown, an election, or any other political turmoil.

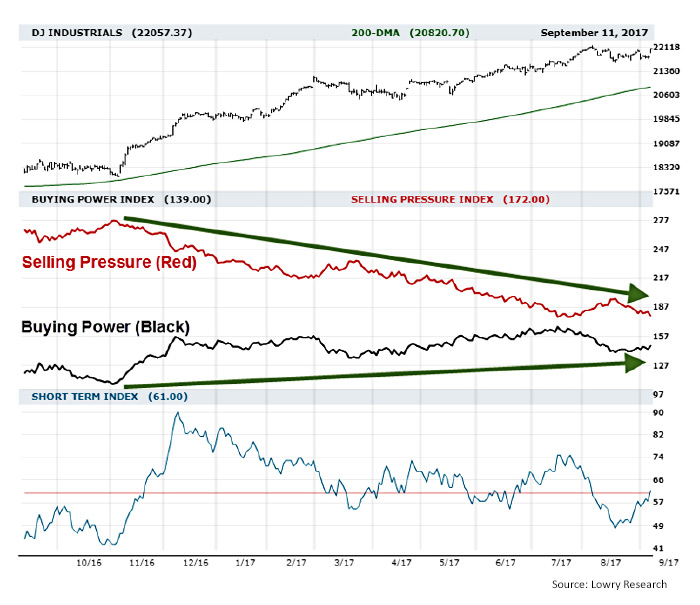

With this understanding in mind, what does the current balance between supply and demand suggest for the market, even if a government shutdown occurs? Since 1938, Lowry Research has used its proprietary Selling Pressure and Buying Power Indexes to measure trends in supply and demand, and these Indexes have guided thousands of investors through bull markets, bear markets, major news stories, and even wars.

As it stands today, the Indexes indicate a favorable environment for stock price appreciation over the intermediate term and little sign that the bull market beginning in 2009 is in danger of ending. As shown in the following chart, the trends of the Indexes reflect a long-term contraction in supply, as evident by Selling Pressure’s nearly one-year downtrend, and expanding demand. These positive conditions suggest that despite today’s uncertain political environment, investors will likely be looking back months from now with the DJIA at a higher level than it is today.

NYSE BUYING POWER VS. SELLING PRESSURE

The opinions expressed in this article are those of the author and do not necessarily represent the views of Proactive Advisor Magazine. These opinions are presented for educational purposes only.

Christopher Diodato, CMT, is a market analyst with Lowry Research, where he uses Lowry’s proprietary research methods and presents actionable findings to clients. Before joining Lowry Research, Mr. Diodato was a financial advisor with Morgan Stanley and a member of the portfolio management team at Cetera Retirement Services. In addition to holding the Chartered Market Technician (CMT) designation, he is a Level III candidate for the Chartered Financial Analyst (CFA) program. https://www.lowryresearch.com

Christopher Diodato, CMT, is a market analyst with Lowry Research, where he uses Lowry’s proprietary research methods and presents actionable findings to clients. Before joining Lowry Research, Mr. Diodato was a financial advisor with Morgan Stanley and a member of the portfolio management team at Cetera Retirement Services. In addition to holding the Chartered Market Technician (CMT) designation, he is a Level III candidate for the Chartered Financial Analyst (CFA) program. https://www.lowryresearch.com