How financial advisors manage real (and perceived) market volatility

How financial advisors manage real (and perceived) market volatility

While 2019 has not been atypically volatile, the market has had wild swings based on headlines surrounding trade policy, interest rates, and geopolitical events. How do advisors help guide clients through volatile markets—whether real or perceived?

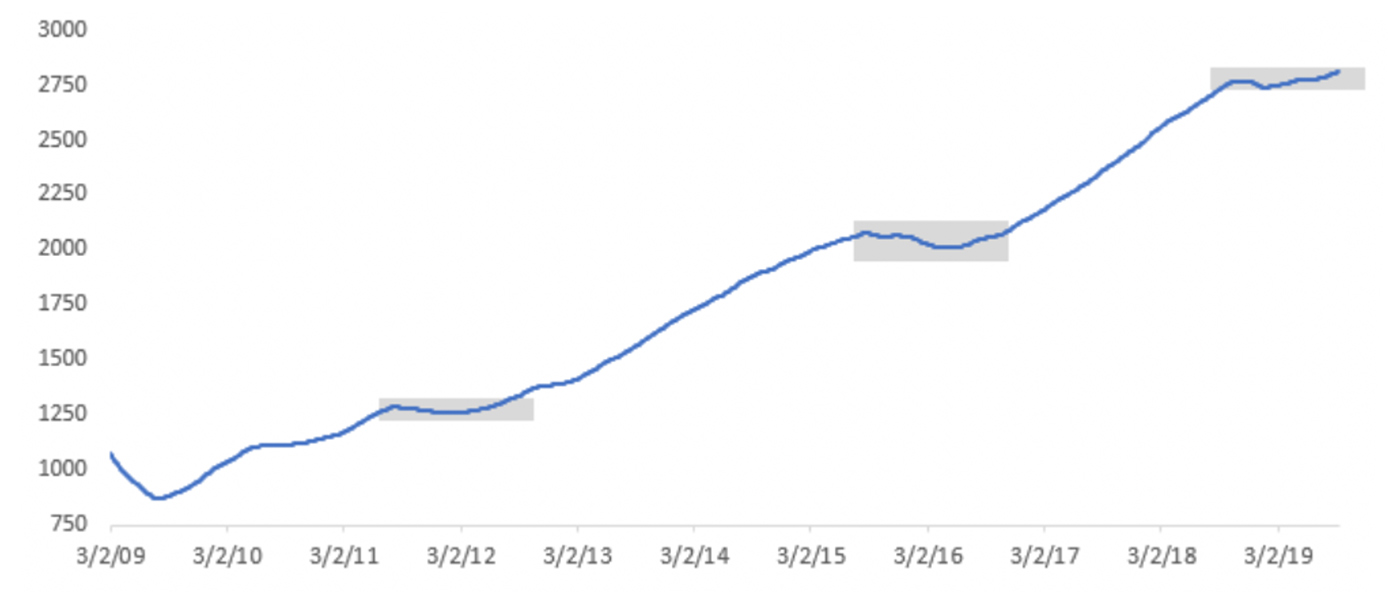

Over the last 12 months, investors may have felt like they have seen remarkable bouts of market volatility, despite the fact that the CBOE VIX Volatility Index has experienced relatively few serious spikes. The most notable VIX event over this period was in December 2018, as the S&P 500 declined close to 20% from its prior highs.

Source: Yahoo Finance, CBOE

Bespoke Investment Group has recently noted that the market’s many gyrations have been within a relatively narrow range for several months, similar to some past market periods:

“In the chart (Figure 2), we strip away the daily price action of the S&P 500 and only show the index’s 200-day moving average (DMA). Looking at things this way shows how despite the wide swings we have seen over the last year or more, the S&P 500’s 200-DMA has been in a tight range for well over a year. Not only that, but the current consolidation period looks awfully similar to prior consolidation periods that we saw back in 2011/2012 and 2015/2016.

“What’s notable about this period and the prior two is that each time, the spread between the S&P 500’s 200-DMA 52-week high and low has been less than 3%. … While there have now been three periods in the last ten years where the one-year range of the S&P 500’s 200-DMA was less than 3%, prior to that there were only four other periods going all the way back to the late 1920s.”

Source: Bespoke Investment Group

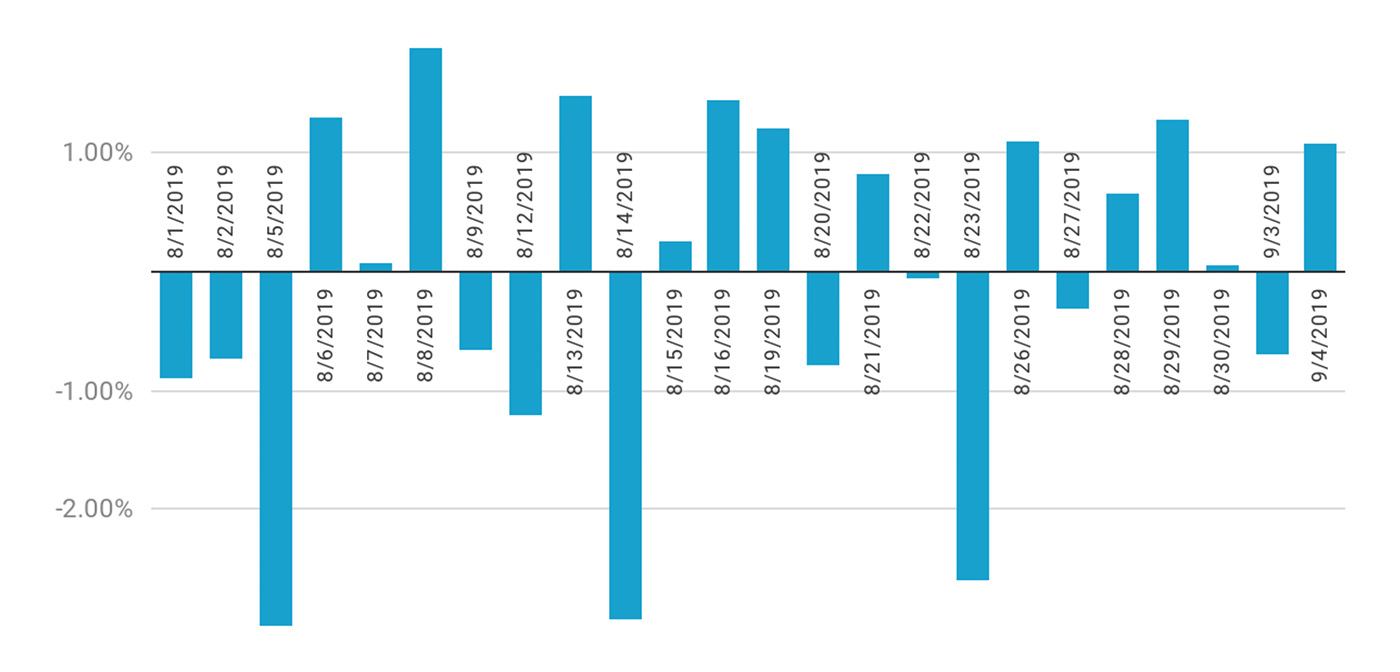

That said, there is no doubt that intraday and weekly moves for the market have rattled many investors, and we have seen numerous daily headlines of “Dow soars” and “Dow tumbles.”

Bespoke said in early September, as quoted by CNBC, “Ever since early August, investors are being whipped around by a series of contradictory tweets, headlines, and ‘reports.’ One day the trade war with China is at the point of no return. The next day the two sides are talking.”

CNBC added, “This back-and-forth has led to a slew of volatile moves in stocks. Over the past 24 trading sessions through Wednesday’s close (9/4), the S&P 500 has posted 12 moves of at least 1%.”

Source: CNBC, using FactSet data and created with Datawrapper

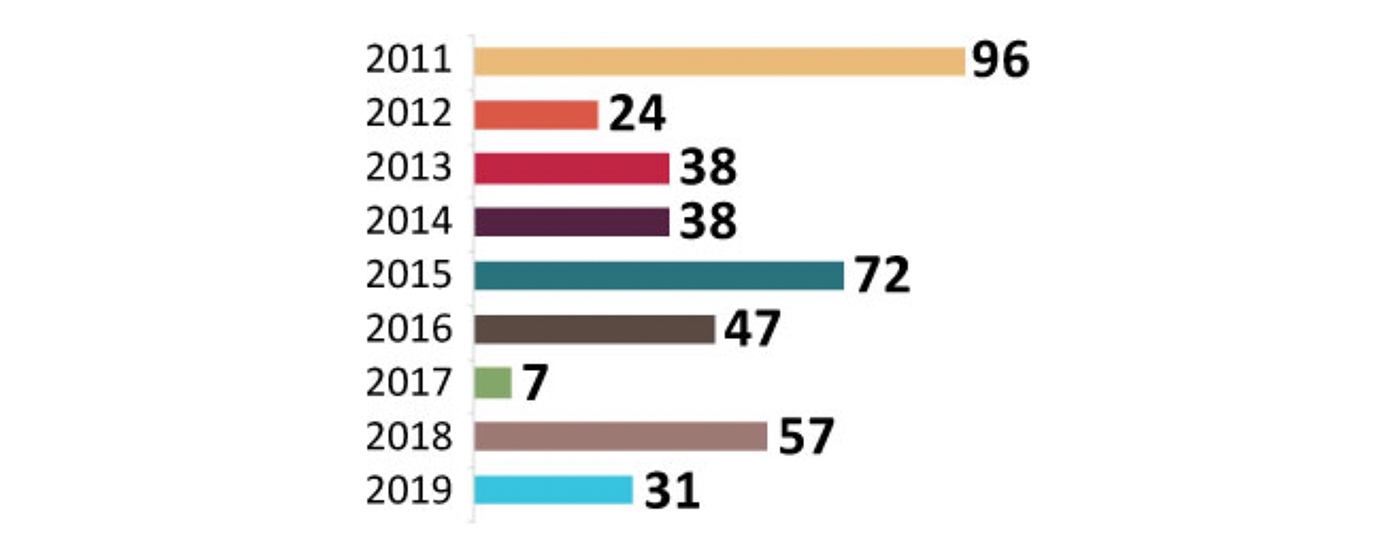

The American Association of Individual Investors (AAII) had an interesting perspective on volatility in mid-September, and the media and public’s perception of it this year:

“This week’s relative calm in the markets is likely a welcome change. It follows an approximate six-week period where the S&P 500 index swung in a 186-point range. The point range equates to an approximate 6% move in both directions.

“If it felt like the market was even more volatile, it’s likely because you’re paying attention to intraday moves and focusing on point changes instead of percentage changes. … These percentile moves equate to larger absolute point moves with major indexes at current levels relative to what we’ve seen in the past. … A 200-point move in the Dow is no longer significant.”

The AAII also noted that compared to the last eight years, 2019 has actually seen a rather average number of days where the S&P 500 moved up or down by 1% or more (so far, at least). The point being that volatility tends to arise in a concentrated time period, giving the impression this year has been more volatile than most.

Source: American Association of Individual Investors (AAII), data through 9/12/19

Nonetheless, financial advisors, particularly following the steep decline in the S&P 500 in late 2018, have had to field questions and concerns from some nervous clients regarding their portfolios—and the preservation of their capital.

Three-quarters of advisors surveyed this spring by Eaton Vance said “fear” was the “primary current motivator” for their clients. Nearly 90% of advisors said the political environment was becoming a “factor in client conversations about the market.”

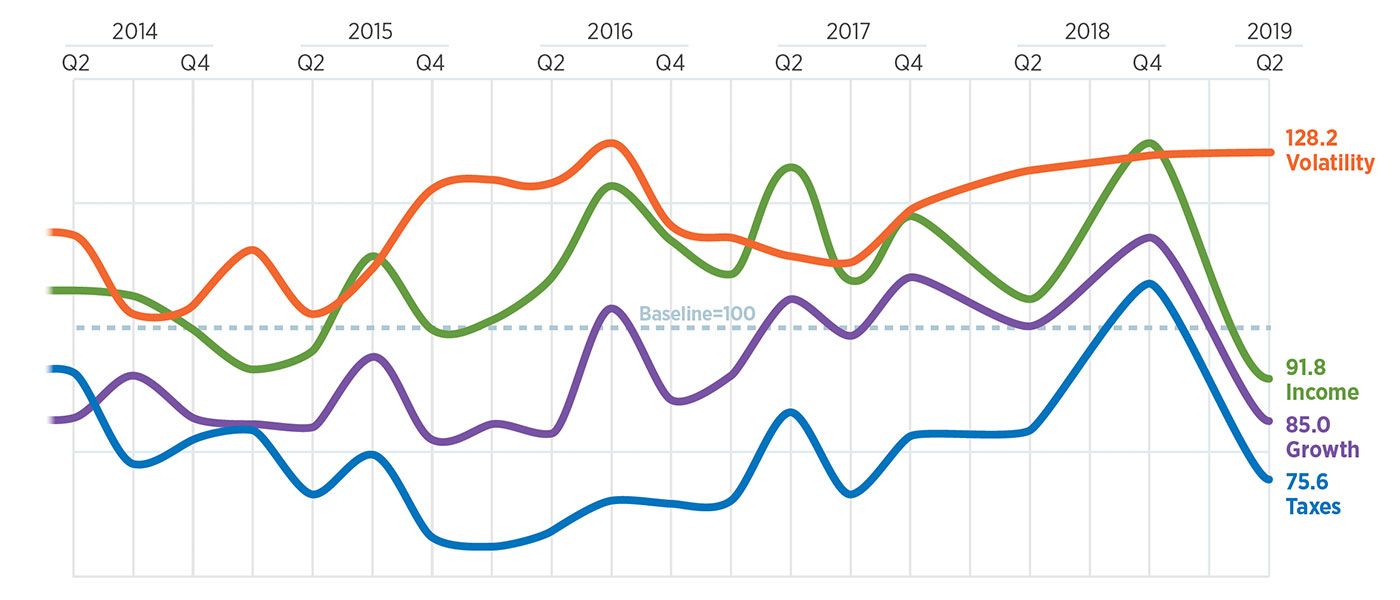

While sentiment has improved markedly since the beginning of the year, advisors expect volatility to remain a primary concern for the financial markets. Generating income, growing capital, and managing tax exposure remain important objectives as advisors guide their clients, but fell below the importance of “managing volatility” earlier this year.

FIGURE 5: RELATIVE IMPORTANCE OF 4 FACTORS FOR CLIENTS’

FINANCIAL/INVESTMENT PLANNING

Source: Eaton Vance Advisor Top-of-Mind Index (ATOMIX), spring 2019

Ideally, when a client and his or her financial advisor have jointly developed a goals-based financial plan, and created an investment plan that strives to reach those customized goals, questions from clients around volatile markets will be minimized.

Unfortunately, that is not always the case.

In Proactive Advisor Magazine’s article “Clients understand volatility—except when it happens,” Richard Lehman, a professor of behavioral science, wrote,

“Human brains are riddled with pesky emotional and cognitive biases that can overpower even the most well-considered plans. … The reasons are rooted in psychology and are as inevitable as the closing bell at the end of each trading day.”

“Review again with the client their financial plan objectives and how they relate to their overall life goals. Ask them the critical question point-blank: ‘Are you still on track to meeting your long-term financial and investment objectives?’ With a well-constructed financial and investment plan that was developed with the client’s risk tolerance at the forefront, the answer should undoubtedly be a calming ‘yes.’

“Have a frank discussion about the trade-offs of different types of portfolio allocations, the depth of exposure to equity markets, and the use of buy-and-hold passive strategies versus more active, risk-managed strategies. Would this client be more comfortable with a less-volatile portfolio construction, understanding that the consequence might be some ‘underperformance’ versus the major market benchmarks in times of roaring bull markets? However, they must understand this is importantly counterbalanced through the use of strategies meant to mitigate the worst effects of bear markets.”

This is sound advice from an expert who not only is an authority in the field of behavioral finance, but also has had decades of hands-on experience in the financial markets working for major Wall Street firms, banks, and financial-data companies.

For this article, we looked at how several advisors apply their own unique practice philosophies in addressing these issues.

Advisor and portfolio strategist Steve Deppe, of San Diego, California, says his goal is to help clients “meet the minimum annual return necessary to achieve their stated financial objectives with a sustainable level of risk or volatility in their portfolio.”

Advisor and portfolio strategist Steve Deppe, of San Diego, California, says his goal is to help clients “meet the minimum annual return necessary to achieve their stated financial objectives with a sustainable level of risk or volatility in their portfolio.”

“Risk management is a vital component of our process since it helps encourage behavioral adherence to the underlying strategy. Everyone wants the S&P 500’s current trailing 10-year annualized returns, but few can behave through the hard times—the 10 years before this period—in a way that would have allowed their portfolio to prosper. Prudent risk management optimizes the likelihood of behavioral adherence, which, in turn, optimizes the likelihood of investing for success over the long term.”

Diana Avery, who has over 20 years of experience in the financial-services industry, says her firm is “committed to excellence” in its process of working with clients. She says this includes seeking out experienced third-party investment managers who can provide portfolio strategies that the firm thinks are appropriate for its clients.

Diana Avery, who has over 20 years of experience in the financial-services industry, says her firm is “committed to excellence” in its process of working with clients. She says this includes seeking out experienced third-party investment managers who can provide portfolio strategies that the firm thinks are appropriate for its clients.

“I believe the managers that we work with provide several benefits for our firm and our clients. They can provide sophisticated, rules-based investment strategies based on their proprietary models. In building client portfolios, we are looking for strong diversification and risk management. I do not believe that most of our clients, especially those near or in retirement, should be simply invested in passive mutual funds that are fully exposed to market risk.

“Managed accounts can take advantage of tactical or active portfolio strategies that can respond in real time to different market conditions, which I think is a huge plus for our clients. Also, it is relatively easy with managed accounts to modify a client’s portfolio allocations if their objectives or their life circumstances change. The managers can provide a variety of portfolio options that are appropriate for clients across many different risk profiles, which is also a benefit in addressing the specific needs of a diverse client base.”

Mike Kuczinski, whose firm is located in Millstone Township, New Jersey, told our publication this year, “Client education is a very important part of the process. I like to stay away from jargon but still communicate critical concepts such as the sequence of returns, effective ways to think about risk tolerance, and what risk management really means.”

Mike Kuczinski, whose firm is located in Millstone Township, New Jersey, told our publication this year, “Client education is a very important part of the process. I like to stay away from jargon but still communicate critical concepts such as the sequence of returns, effective ways to think about risk tolerance, and what risk management really means.”

“With changing economic conditions and two decades of severe market swings, we advocate that clients invest for the long run, using widely diversified portfolios that can perform suitably through full market cycles. For many clients, I use the services of third-party investment managers who place an emphasis on risk management and have a variety of strategic and tactical approaches, many of which can be responsive to current market conditions.

“Taking a risk-managed approach can be challenging at times in a lengthy bull market that has had some volatile swings and periods of uncertain direction. Risk-managed strategies under those circumstances can at times become too conservative. But I feel certain that when investors are faced with another severe bear market period, they will greatly appreciate having a high degree of risk management in place for their portfolios. That is a lesson from market history that I emphasize often with my clients.”

William Curry, of Wilmington, Delaware, says that his firm provides financial guidance grounded in “intellectual capital amassed over 40 years of serving clients.”

William Curry, of Wilmington, Delaware, says that his firm provides financial guidance grounded in “intellectual capital amassed over 40 years of serving clients.”

“A few years ago, I found a third-party manager that emphasized active, risk-managed strategies that demonstrated the ability to deliver competitive returns while mitigating drawdowns. This approach provides a very good investment solution for clients on several fronts. It can minimize the impact of the sequence of returns through seeking to avoid steep drawdowns.

“At the same time, client portfolios, if properly constructed, can take advantage of periods of overall market growth—allowing for a more aggressive stance in the market if conditions warrant with the flexibility for portfolio strategies to adjust if market conditions deteriorate. I explain that to clients in terms of the efficient frontier: Would they prefer a portfolio approach that has the potential for returns that are competitive with the overall market while taking on less risk exposure and experiencing lower volatility? That makes a lot of sense to me and to the vast majority of our clients.”

David Wismer is editor of Proactive Advisor Magazine. Mr. Wismer has deep experience in the communications field and content/editorial development. He has worked across many financial-services categories, including asset management, banking, insurance, financial media, exchange-traded products, and wealth management.

David Wismer is editor of Proactive Advisor Magazine. Mr. Wismer has deep experience in the communications field and content/editorial development. He has worked across many financial-services categories, including asset management, banking, insurance, financial media, exchange-traded products, and wealth management.