We cannot emphasize enough the importance of the generational change in the way the Fed views inflation by fear of lower rather than higher inflation. Last week when Fed Chair Powell was asked what would make him raise interest rates, he responded by suggesting only an outsized rise in inflation.

He followed that up with emphasizing that sustainably low inflation and forward inflation expectations remain below the Fed’s desired 2.0% level and were not transitory. Our translation is that the Fed won’t raise interest rates anytime over the next year and may lower rates again if there is a meaningful change in their assessment of moderate economic activity. That is a clearly defined “Fed put” for the equity market through sustainably higher valuations.

The sustainably low inflation and subsequent Fed reaction highlighted above reinforces our positive core thesis and four main reasons to be bullish:

- The folks printing the money globally continue to tell us they will maintain a highly accommodative stance.

- The corporate credit market remains open and bank lending standards remain easier in the most recent data.

- There is a demographic tailwind with the millennials born in the peak year (1990) turning 30 amid solid employment, good confidence, and low rates.

- There is an inflection in global manufacturing off historically weak levels.

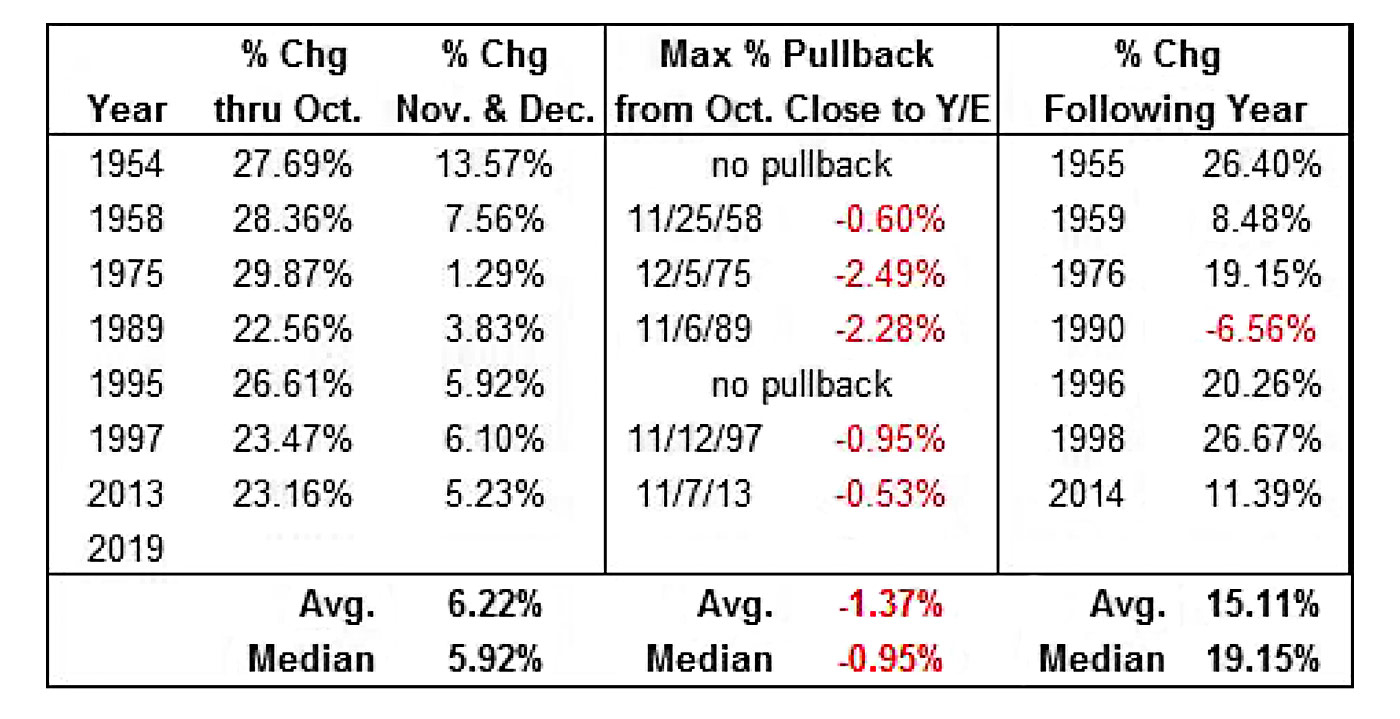

The S&P 500 (SPX) has reached into record territory and is up over 22% year to date and 6% from the early October low, which sets the stage for a bit of choppy consolidation. We can qualify “choppy” using prior instances of >20% SPX gains through October since 1950. We found that any pullback is limited to under 2.5% from the end of October, with a median drop of just 0.95%.

The message is clear: Use any pullback as an opportunity to add exposure given the median gain of 5.92% in the last two months of the year, and 19.15% the next year.

Source: Bloomberg, Canaccord Genuity

Tony Dwyer is the head of the U.S. Macro Group and chief market strategist at Canaccord Genuity. He also sits on the firm’s U.S. operating committee. Mr. Dwyer joined Canaccord Genuity in 2012 and is known for the practical application of macroeconomic and tactical market indicators. Mr. Dwyer was previously equity strategist and director of research at Collins Stewart and a member of the firm's executive committee. Mr. Dwyer is a frequent guest on many financial news networks. canaccordgenuity.com

Tony Dwyer is the head of the U.S. Macro Group and chief market strategist at Canaccord Genuity. He also sits on the firm’s U.S. operating committee. Mr. Dwyer joined Canaccord Genuity in 2012 and is known for the practical application of macroeconomic and tactical market indicators. Mr. Dwyer was previously equity strategist and director of research at Collins Stewart and a member of the firm's executive committee. Mr. Dwyer is a frequent guest on many financial news networks. canaccordgenuity.com