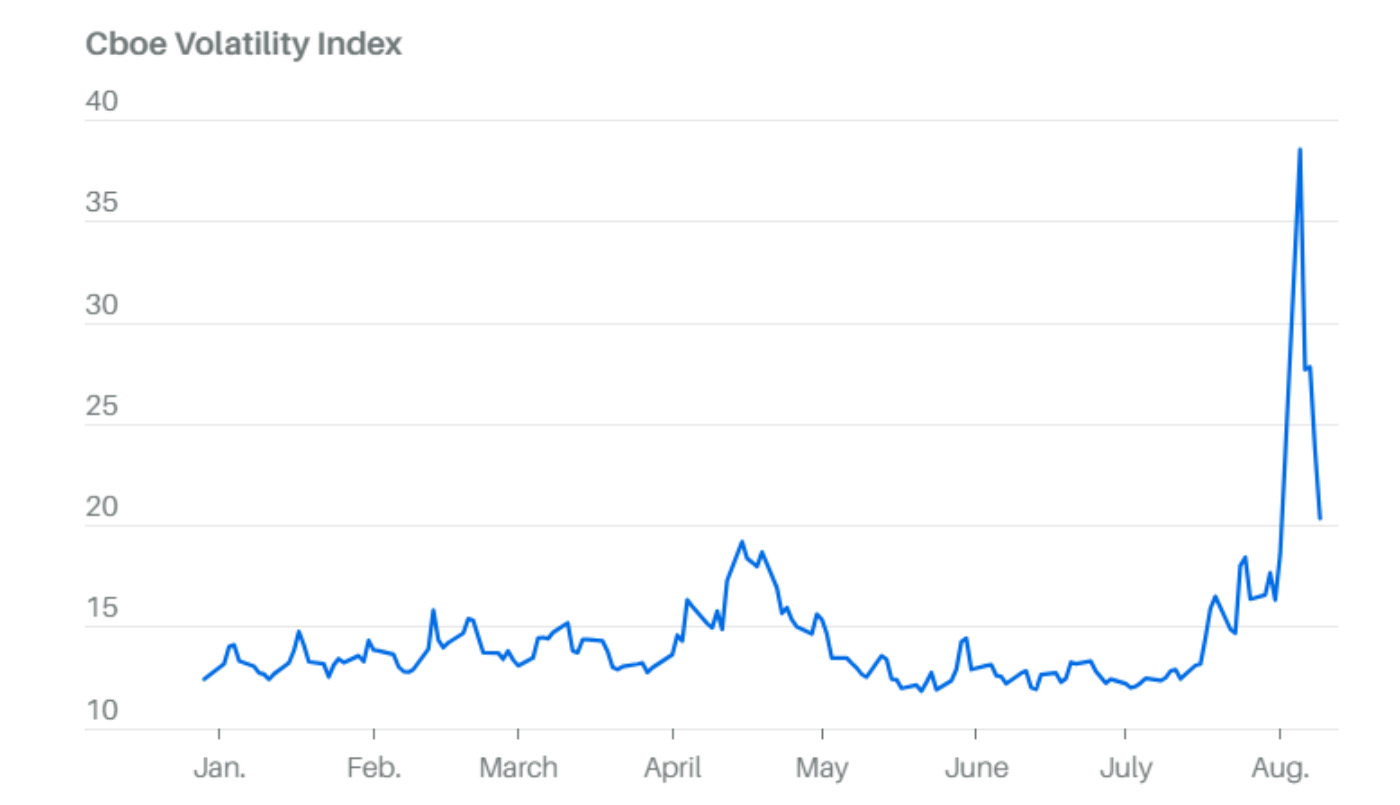

Last week, volatility shot up to levels last seen during the 2020 COVID crisis as markets plunged early in the week.

FIGURE 1: VOLATILITY SPIKED THE WEEK OF AUG. 5, 2024

Sources: Barron’s, Bloomberg

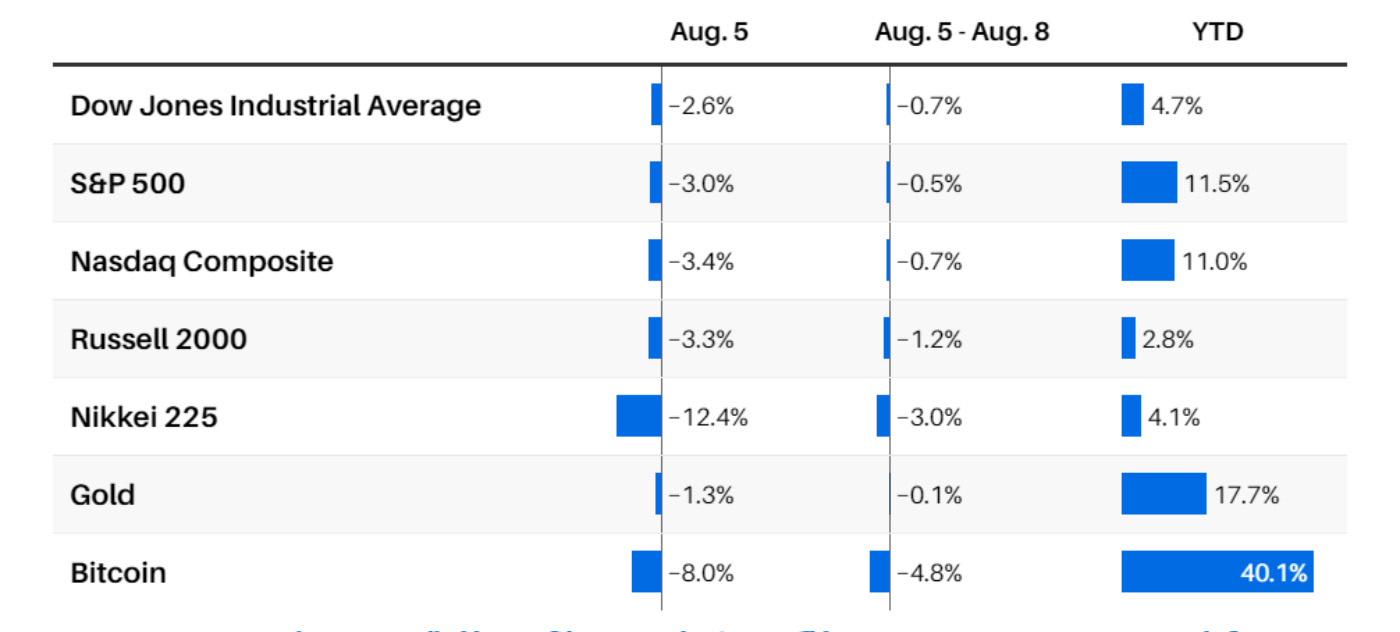

Analysts cited several factors, including a 12% fall in Japan’s Nikkei 225 Index due to the collapse of “the yen carry trade,” signs of a softer U.S. economy, a weaker employment outlook, and a report that Warren Buffett’s Berkshire Hathaway had significantly reduced its Apple holdings.

Commenting on last week’s big market drop and subsequent recovery, MarketWatch noted, “After the worst day and the best day in nearly two years for the S&P 500, the Wall Street stock barometer finished last week barely changed.”

FIGURE 2: MARKETS RECOVER AFTER LARGE LOSSES ON AUG. 5, 2024

Sources: Barron’s, Bloomberg

Barron’s added this weekend,

“Also, skeptics have begun to question whether artificial intelligence will deliver on the promise implied by the near-vertical rise of the market’s largest technology stocks this year. And a contentious U.S. election season and heightened global turmoil could pose more worries for the markets. …

“So, has anything changed for investors? No, and yes. Long-term investors shouldn’t be spooked by a one-day rout or the market’s churning. The S&P 500 and Nasdaq are still up more than 11% on the year, and recent news confirmed certain trends already in place, in particular a cooling labor market and a modest transition under way from the most expensive technology stocks to more cyclical sectors such as energy, financials, and industrials, and dividend-paying bond proxies such as utility stocks and consumer staples. That trend might accelerate, which would be something to welcome, not dread.”

![]() Related Article: S&P 500’s impressive first half dominated by the ‘Magnificent Seven’

Related Article: S&P 500’s impressive first half dominated by the ‘Magnificent Seven’

Highlights for Q2 earnings to date: S&P 500 companies

Against this backdrop of heightened volatility and market uncertainty, over 90% of S&P 500 companies have reported earnings for Q2 2024.

While questions remain as to forward-looking outlooks, several mega-cap tech companies have reported healthy year-over-year revenue gains: Microsoft +15%, Meta +22%, Amazon +10%, and Apple +5%.

FactSet offered the following commentary about the Q2 2024 earnings season in its latest Earnings Insight:

“At this late stage of the second quarter earnings season, the performance of S&P 500 companies relative to expectations continues to be mixed. On the one hand, the percentage of S&P 500 companies reporting positive earnings surprises is above average levels. On the other hand, the magnitude of earnings surprises is below average levels. However, the index is still reporting higher earnings today relative to the end of the quarter. Overall, the index is reporting its highest (year-over-year) earnings growth rate since Q4 2021.”

The Earnings Insight also highlighted the following key metrics for Q2 2024:

- “Earnings Scorecard: For Q2 2024 (with 91% of S&P 500 companies reporting actual results), 78% of S&P 500 companies have reported a positive EPS surprise and 59% of S&P 500 companies have reported a positive revenue surprise.

- “Earnings Growth: For Q2 2024, the blended (year-over-year) earnings growth rate for the S&P 500 is 10.8%. If 10.8% is the actual growth rate for the quarter, it will mark the highest year-over-year earnings growth rate reported by the index since Q4 2021 (31.4%).

- “Earnings Revisions: On June 30, the estimated (year-over-year) earnings growth rate for the S&P 500 for Q2 2024 was 8.9%. Nine sectors are reporting higher earnings today (compared to June 30) due to upward revisions to EPS estimates and positive EPS surprises.

- “Earnings Guidance: For Q3 2024, 47 S&P 500 companies have issued negative EPS guidance and 39 S&P 500 companies have issued positive EPS guidance.

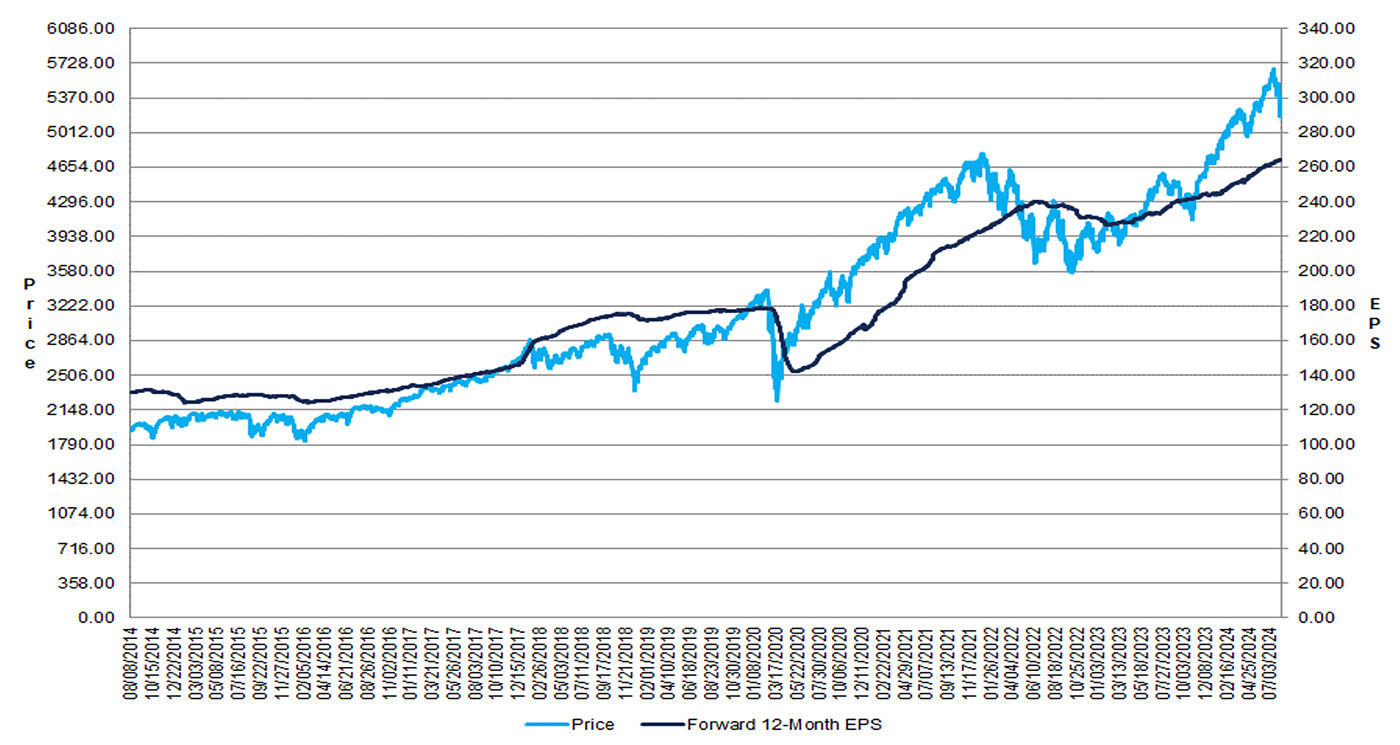

- “Valuation: The forward 12-month P/E ratio for the S&P 500 is 20.2. This P/E ratio is above the 5-year average (19.4) and above the 10-year average (17.9).”

FIGURE 3: S&P 500 CHANGE IN FORWARD 12-MONTH EPS VS. CHANGE IN PRICE—10 YRS.

Source: FactSet

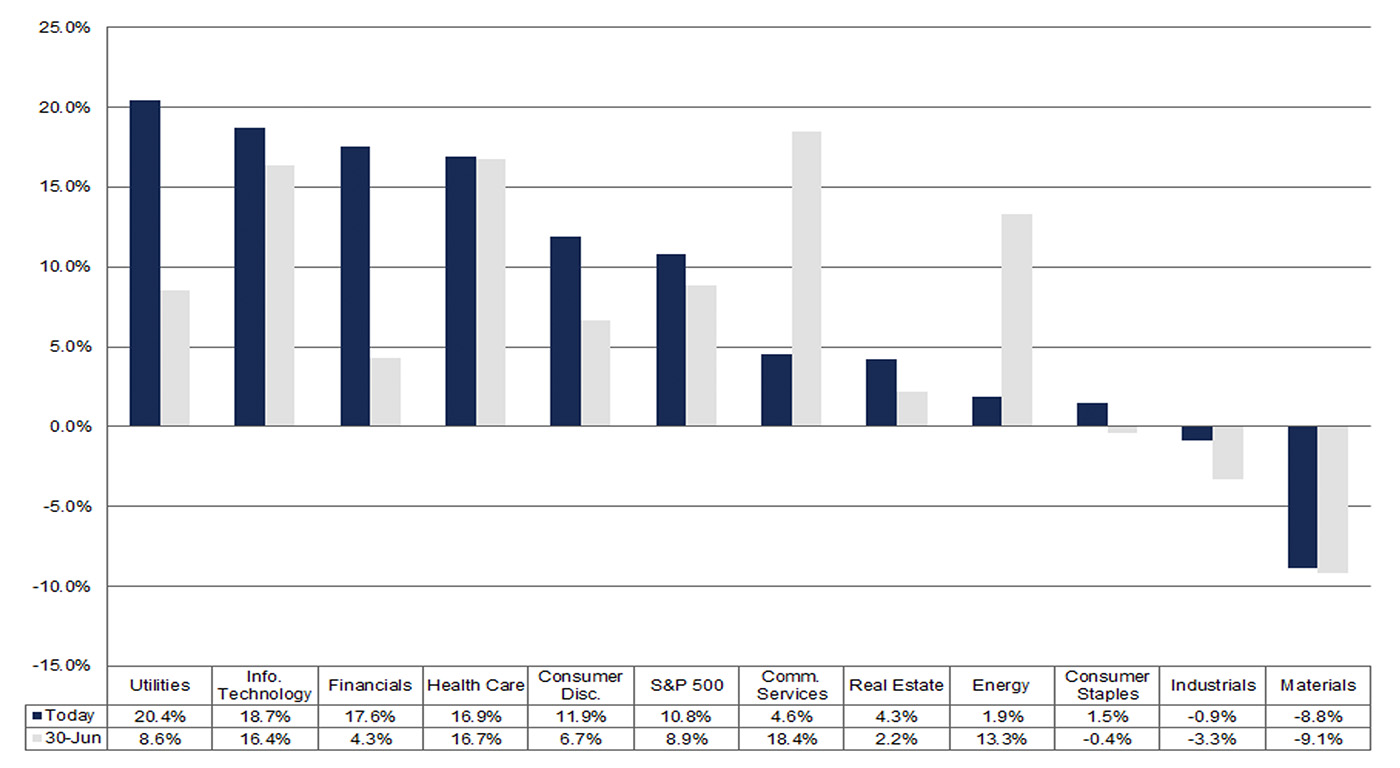

FactSet indicates that 9 of the 11 S&P 500 sectors are reporting year-over-year earnings growth, with the following top sectors: Utilities, Information Technology, and Financials. Two sectors are expected to report a year-over-year decline in earnings: Industrials and Materials.

FactSet says of the Information Technology sector,

“At the company level, NVIDIA ($0.64 vs. $0.27) is the largest contributor to earnings growth for the sector. If this company were excluded, the blended (year-over-year) earnings growth rate for the Information Technology sector would fall to 9.3% from 18.7%.”

FIGURE 4: S&P 500 EARNINGS GROWTH BY SECTOR (Y/Y)—Q2 2024

Source: FactSet

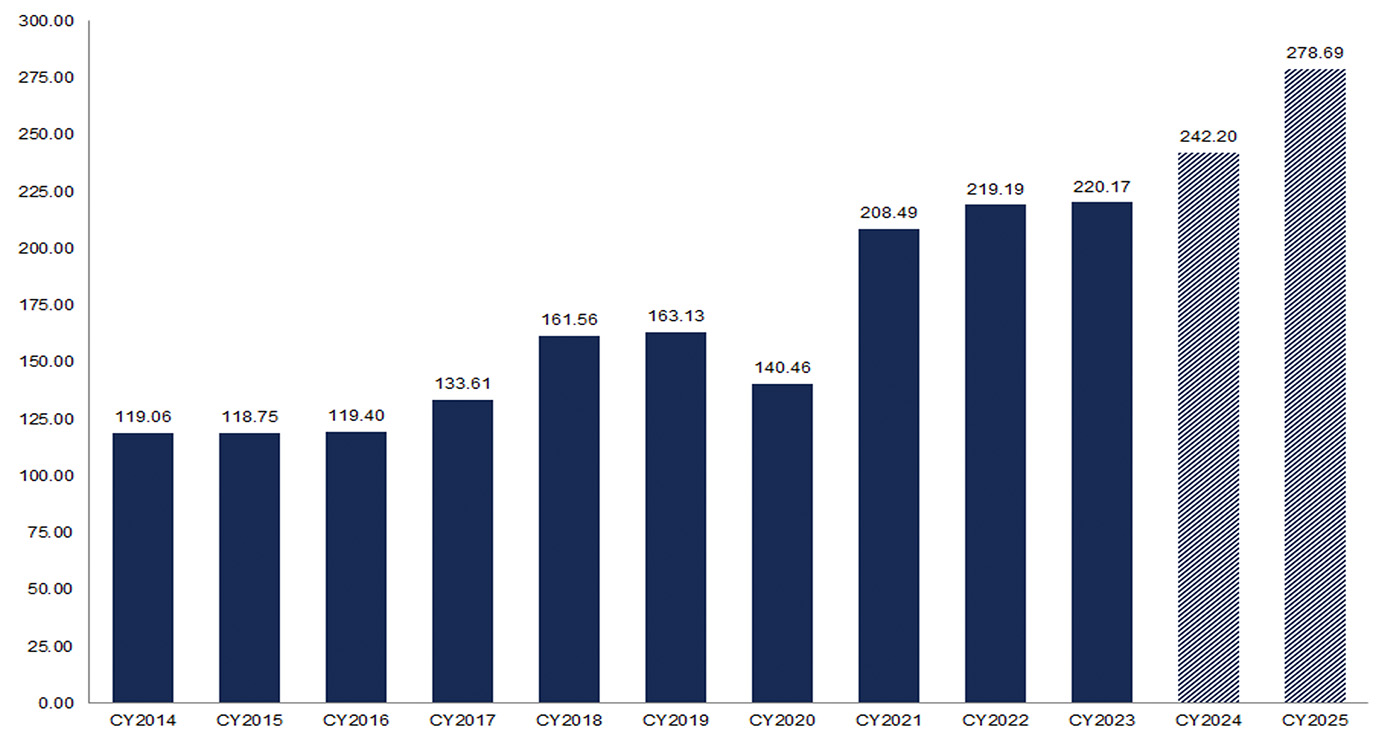

Overall, S&P 500 companies are expected to report earnings growth just over 10% for the calendar year 2024, broken down in the following projections by FactSet for the rest of the year:

- “For the second quarter, S&P 500 companies are reporting year-over-year growth in earnings of 10.8% and year-over-year growth in revenues of 5.2%.

- “For Q3 2024, analysts are projecting earnings growth of 5.4% and revenue growth of 4.9%.

- “For Q4 2024, analysts are projecting earnings growth of 15.7% and revenue growth of 5.4%.

- “For CY 2024, analysts are projecting earnings growth of 10.2% and revenue growth of 5.1%.”

FIGURE 5: S&P 500 CALENDAR YEAR BOTTOM-UP EPS ACTUALS AND ESTIMATES

Source: FactSet

RECENT POSTS