Significant and sustainable periods of weakness in the economy and markets typically come from a corporate need for money to fund growth, but with limited or no access to it.

Despite the recent move up in the 10-year U.S. Treasury yield to 1.10%, our favored corporate credit indicators point to historic money availability that allows for easing financial conditions:

- The yield spread between investment-grade and high-yield debt to the 10-year U.S. Treasury yield has dropped to the best levels of the pandemic recovery.

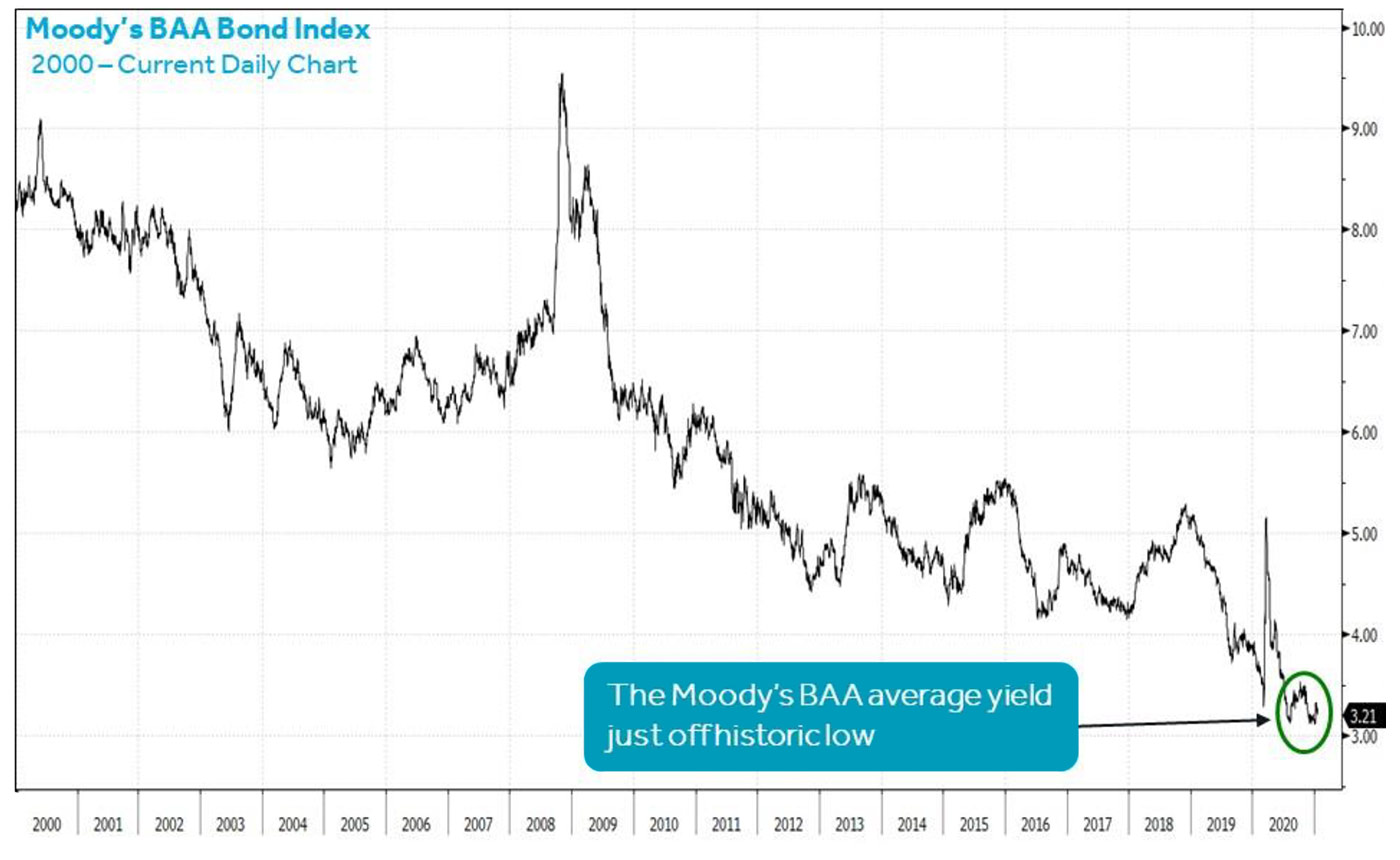

- The Moody’s BAA Bond Index that measures the highest risk area of investment-grade corporate credit is just off the lowest level in history (Figure 1).

Source: Bloomberg, Canaccord Genuity

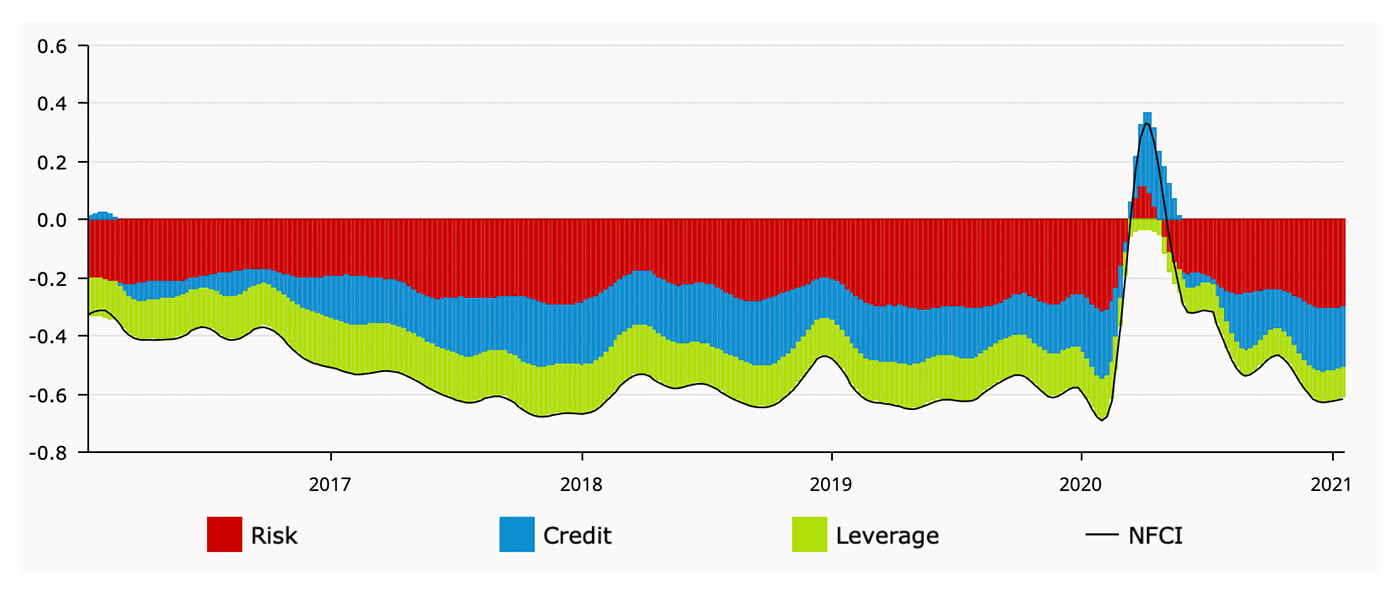

- The Chicago Fed National Financial Conditions (NFCI) subindexes that monitor 105 credit stress indicators continue to trend lower from crisis levels early in the pandemic, and are still suggesting further room for meaningful improvement (Figure 2).

Source: Federal Reserve Bank of Chicago

We believe that these credit metrics reinforce easing financial conditions. The historic money availability should continue fueling the synchronized global economic recovery and supports our game plan of adding exposure to equities on any meaningful pullbacks.

We continue to follow the Fed’s lead, and last week Federal Reserve Vice Chair Richard Clarida reiterated that the U.S. central bank won’t raise interest rates until inflation reaches 2% for a year. With the core PCE price index at just 1.4%, we have a long runway before we should expect rate hikes.

While fear of less quantitative easing may enter the marketplace and cause periods of corrective action in equities, ultimately it is higher short-term interest rates and tighter financial conditions that generate increased risk of recession and sustainable drops in the market.

The opinions expressed in this article are those of the author and do not necessarily represent the views of Proactive Advisor Magazine. These opinions are presented for educational purposes only.

This is an edited version of an article first published by Canaccord Genuity U.S. Equity Research on Jan. 21, 2021.

Tony Dwyer is the head of the U.S. Macro Group and chief market strategist at Canaccord Genuity. He also sits on the firm’s U.S. operating committee. Mr. Dwyer joined Canaccord Genuity in 2012 and is known for the practical application of macroeconomic and tactical market indicators. Mr. Dwyer was previously equity strategist and director of research at Collins Stewart and a member of the firm's executive committee. Mr. Dwyer is a frequent guest on many financial news networks. canaccordgenuity.com

Tony Dwyer is the head of the U.S. Macro Group and chief market strategist at Canaccord Genuity. He also sits on the firm’s U.S. operating committee. Mr. Dwyer joined Canaccord Genuity in 2012 and is known for the practical application of macroeconomic and tactical market indicators. Mr. Dwyer was previously equity strategist and director of research at Collins Stewart and a member of the firm's executive committee. Mr. Dwyer is a frequent guest on many financial news networks. canaccordgenuity.com