The election outcome has likely neutralized the far-left and far-right tail risk of the political spectrum, which could allow a more centrist view and set of policy initiatives. The Republicans lost the White House but outperformed all expectations by winning seats in the House and holding on to the Senate (pending the Georgia runoff), which suggests there is no major mandate or majority that would go right to work on big policy changes.

That means investors can again focus on the most powerful influence in the world—a historically accommodative Fed and global central banks. This doesn’t mean the market goes straight up; President Trump is unlikely to go easily and we have seen a record number of COVID-19 cases in each of the past four weeks. But it does give a solid amount of conviction during bouts of uncertainty that (1) our core fundamental thesis should remain in place, and (2) we are likely in the beginning of a new economic and market cycle.

At last week’s post-FOMC press conference, the Fed reiterated inflation was too low; they had more ammo if the economy weakens; and that they could change the composition, duration, size, and life cycle of its QE purchases if necessary. Even with a highly unclear election cycle and a much-feared second wave of COVID-19, the market drivers have been sending a very consistent message:

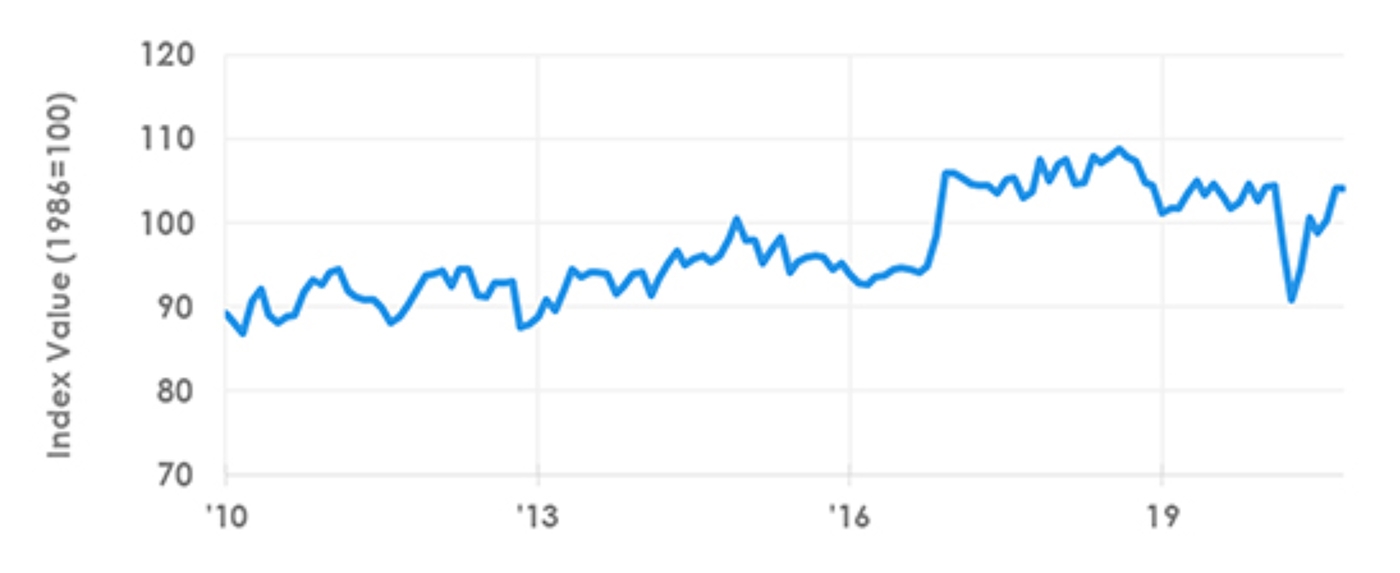

- Inflation and forward inflation expectations allow for easy money until whenever. The combination of sustainably low core inflation and a historically low 10-Year Inflation Breakeven rate allowed the Fed to adopt a new policy framework that suggests a zero-interest-rate policy (ZIRP) for the foreseeable future. While many worry the historic excess liquidity could generate inflation, there is no sign of it with the 10-Year Inflation Breakevens well below the Fed’s desired rate.

Sources: Bloomberg, Canaccord Genuity

- Fed policy drives historic excess liquidity. The availability of credit is driven by Fed policy, and the Fed has made it clear their policies are driven by core inflation reaching an average of 2%. As a result, money supply, excess liquidity, and easing financial conditions should help the economy continue to recover from the COVID-19 recession.

- Historic money availability drives synchronized global recovery. Nearly every economic indicator saw the worst drop followed by the sharpest improvement in history. It is important to remember sustained periods of economic weakness typically occur when businesses and households need money and have limited access to it. That is clearly not the case currently given excess liquidity, a demographic tailwind, improved small-business and manufacturing optimism, and an inflection in the global outlook.

Note: Based on 10 survey indicators, seasonally adjusted, Jan. 2010–Oct. 2020.

Source: NFIB Research Foundation

- Improved global economy should make our 2021 EPS estimate conservative. The direction of earnings should reaccelerate in the second half of 2020, with full recovery by the end of 2021. Clearly, this depends on the progress of a COVID-19 treatment and vaccine. We believe our SPX operating EPS estimate of $165 for 2021 is conservative and that there is significant upside risk to our estimate and the market when there is greater clarity on the current COVID-19 vaccines and antibody therapies in the pipeline.

Our positive fundamental core thesis driven by excess liquidity and a synchronized global recovery doesn’t suggest there won’t be bouts of volatility—especially when our tactical indicators are in neutral. But it does enable us to act on any news-driven sell-offs like the first market speed bump in September, and into the whoosh in late October. We believe the economy and market are in the beginning of a long-duration recovery that should favor the economic recovery theme that favors the broad market with an emphasis on emerging markets, economically sensitive sectors, small-cap stocks, and commodities.

Tony Dwyer is the head of the U.S. Macro Group and chief market strategist at Canaccord Genuity. He also sits on the firm’s U.S. operating committee. Mr. Dwyer joined Canaccord Genuity in 2012 and is known for the practical application of macroeconomic and tactical market indicators. Mr. Dwyer was previously equity strategist and director of research at Collins Stewart and a member of the firm's executive committee. Mr. Dwyer is a frequent guest on many financial news networks. canaccordgenuity.com

Tony Dwyer is the head of the U.S. Macro Group and chief market strategist at Canaccord Genuity. He also sits on the firm’s U.S. operating committee. Mr. Dwyer joined Canaccord Genuity in 2012 and is known for the practical application of macroeconomic and tactical market indicators. Mr. Dwyer was previously equity strategist and director of research at Collins Stewart and a member of the firm's executive committee. Mr. Dwyer is a frequent guest on many financial news networks. canaccordgenuity.com