Could crypto be an effective on-ramp for advisors cultivating younger clients?

Could crypto be an effective on-ramp for advisors cultivating younger clients?

A FINRA study shows that recent crypto investing didn’t reduce the number of new stock investors but added to it. This should be very good news for advisors looking to cultivate younger investors.

Until this year, bitcoin and crypto presented advisors with more of a headache than an opportunity. The absence of an equity vehicle for trading crypto not only prevented advisors from satisfying the demand for digital assets but also from expanding their client base with new investors who simply started investing with digitals instead of stocks.

Moreover, many advisors had a difficult time warming to cryptos to begin with, given the stark distinctions from corporate equities, the absence of business fundamentals, the volatility, and the security issues. On top of that, many broker-dealers didn’t have the means to include bitcoin on their platforms, and compliance departments shunned cryptos due to the lack of regulation.

Meanwhile, according to Morning Consult, approximately 13% of U.S. adults currently owned bitcoin as of April 2024. That’s upwards of 30 million Americans, with a disproportionate number coming from Gen Z and Millennial investors. So, while advisors were handcuffed, millions of Americans formed relationships with crypto exchanges outside the regulated securities industry in order to own crypto. One exception was Robinhood, which was able to serve both needs from different parts of its operation.

For registered advisors affiliated with regulated broker-dealers, cryptos therefore represented a major conundrum—a groundbreaking innovation with enormous popularity that was essentially unavailable to them. That also meant that clients or prospects who came to them looking for cryptos had to be turned away, something that no doubt left many advisors with a bad taste in their mouths for the whole crypto affair.

The picture, of course, is very different now. As of their introduction in January 2024, regulated bitcoin ETFs can now satisfy the demand for bitcoin, providing advisors with a vehicle that can fit right alongside stocks and equity ETFs in a regulated brokerage account. That doesn’t remove the questions about its merits as an investment or its volatility, but it does open the regulated investment world to many new investors and exposes advisors to a sizable new audience. The challenge for advisors is how to successfully take advantage of that opportunity.

That means not only understanding the investment needs and wants of a predominantly younger audience but also recognizing the differences between first-time investors who buy stocks or mutual funds in taxable or retirement accounts and those who buy crypto from nonregulated sources.

A study in 2023 by FINRA and NORC (an opinion research firm affiliated with the University of Chicago) looked into exactly that and offers some valuable insights as a result. The study looked at how people began investing in the pandemic era (2020) and then compared that to the post-pandemic era (2023). The results offer advisors valuable insights into the differences between people who entered the markets through conventional brokerage products (taxable accounts) and those for whom bitcoin was their initial foray into investing.

FINRA/NORC study insights

The study set out to build on previous information regarding the surge in new investors that occurred in 2020—an increase attributed to mobile trading platforms, lower barriers to investing, and various pandemic-related factors, including the distribution of stimulus checks from the U.S. government. Essentially it was trying to determine whether 2020 was a one-time blip. It concluded, “Two years later, our research suggests that the expansion of the investing population continued unabated and was supplemented by new investors entering the markets by purchasing cryptocurrency.”

In fact, the study showed that more of the people who began investing in 2022 started by purchasing cryptocurrency (4.9% of adults) as opposed to beginning with a taxable brokerage account (4.2%). This tells us that first-time investors in 2023 were actually more likely to be starting with crypto than stocks, and that for every new securities investor, there was also a (separate) new crypto investor.

At the time this was occurring, it was unclear whether crypto investing was cannibalizing the number of new stock investors or adding new ones via a different path. The result above clearly showed that crypto investors added to first-time stock investors, a revelation that has a strong impact regarding early investing by younger generations.

This is also a key finding for advisors. It means crypto investing didn’t siphon off possible stock investors; it added to them. And at some point, many of these new crypto investors will likely broaden out into conventional securities. In other words, there has been a considerable increase in the number of new investors in recent years, and the markets can thank both the pandemic and crypto for that.

The bottom line is that more new investors are entering the markets these days, and at least half of them are starting with crypto rather than securities products. For advisors looking to cultivate younger clients, that should represent very good news. The challenge is to understand the differences between those entering through securities and those entering through crypto. And the study provides valuable insights on that.

One place to look for those insights was in the respondents’ reasons for investing. Responding to a question about the reasons why they started investing, the two groups of investors compared as follows:

Taxable account holders

- Able to invest a small amount (24%)

- Invest for retirement (12%)

Crypto account holders

- A friend mentioned (31%)

- Able to invest a small amount (25%)

Interestingly, the ability to invest a small amount was important to both groups and the single most important reason motivating new equity account holders. Retirement savings followed for this group, cited by just 12%. For crypto investors, while the ability to invest a small amount was important, more said recommendations from friends were a greater factor.

This is a prime distinction of crypto investors. They didn’t start investing because they decided it would be advantageous to begin building wealth or saving for retirement. They were swayed by friends and family members. That means that the herding instinct and the fear of missing out combined to compel their actions.

That also means that while they may indeed be somewhat more risk-tolerant than new stock investors, they are not citing the higher risk-reward of crypto as a reason for investing in it. Instead, they are choosing crypto despite its risks. Advisors seeking to develop relationships with these investors may find that many are just as interested in diversifying those risks as they broaden into equities, rather than necessarily looking for equities that are just as risky.

Looking at sources of information between the two groups, the study found the following distinctions:

Taxable account holders

- Friends and family (34%)

- Personal research (30%)

- Finance professionals (29%)

- Company websites (28%)

- Financial services companies (20%)

- Social media (12%)

Crypto account holders

- Friends and family (48%)

- Social media (25%)

- Personal research (25%)

- News media (13%)

- Financial services companies (12%)

- Financial professionals (9%)

Nearly half of crypto investors cite friends and family as their primary information source. But more than a third of securities investors do also. And almost as many crypto investors are doing their own research to gather additional information. The biggest difference between the two groups was in the use of finance professionals (only 9% of crypto investors mentioned that as a source). But since finance professionals couldn’t really address crypto needs, that shouldn’t be at all surprising. In fact, it could be viewed now as a big opportunity for advisors to fill.

When asked about their investing goals, the responses were as follows:

Taxable account holders

- Saving for retirement (56%)

- Learn about investing (29%)

- Speculate (24%)

- Saving for an expense (22%)

Crypto account holders

- Learn (39%)

- Speculate (29%)

- Save for retirement (25%)

- Spare time (21%)

While more than half of the taxable investors had an eye on retirement, only a quarter of crypto investors did. Surprisingly, more crypto investors than securities investors cited learning about investments as a top goal, and speculating was only slightly more important to crypto investors.

Finally, when the crypto investors were asked whether crypto investing made them more interested in stocks, the answers were as follows:

Crypto account holders

- Became more interested (36%)

- Became less interested (16%)

This might be the best news for advisors of anything in the study.

Takeaways

While the study didn’t appear to delve too deeply into personal characteristics, it gave important clues about crypto novices versus securities novices.

Perhaps most importantly, new investors in 2023 were as likely to begin with crypto as with securities—a telling statistic about current times. But the numbers of both groups who claim to be speculating were not that far apart (29% for crypto investors versus 24% for taxable accounts). Both groups indicated (a) a willingness to learn about investments, (b) recognition of the importance of saving for retirement, and (c) their need/desire for a vehicle that allowed for small investments.

This suggests that investment novices of both types have more in common than not. The portrayal of crypto investors as seekers of higher risk is not supported by this data. Despite a slightly higher reliance on social media by the crypto novices, both groups rely heavily on friends and family for guidance and conduct their own research.

A younger investor’s preference for stocks versus crypto may largely stem from their parent and friend affiliations. Households where the parents invest in stocks often see their children follow suit. Those who don’t or don’t encourage their offspring to do so may leave their children more open to outside influences like friends and social media.

The fact that more than one-third of crypto novices indicated that the experience makes them more likely to invest in securities is encouraging. If crypto is increasing the number of younger investors, it is simply providing a different on-ramp into investing in more traditional securities. This means they may be just as likely to form relationships with advisors as securities investors.

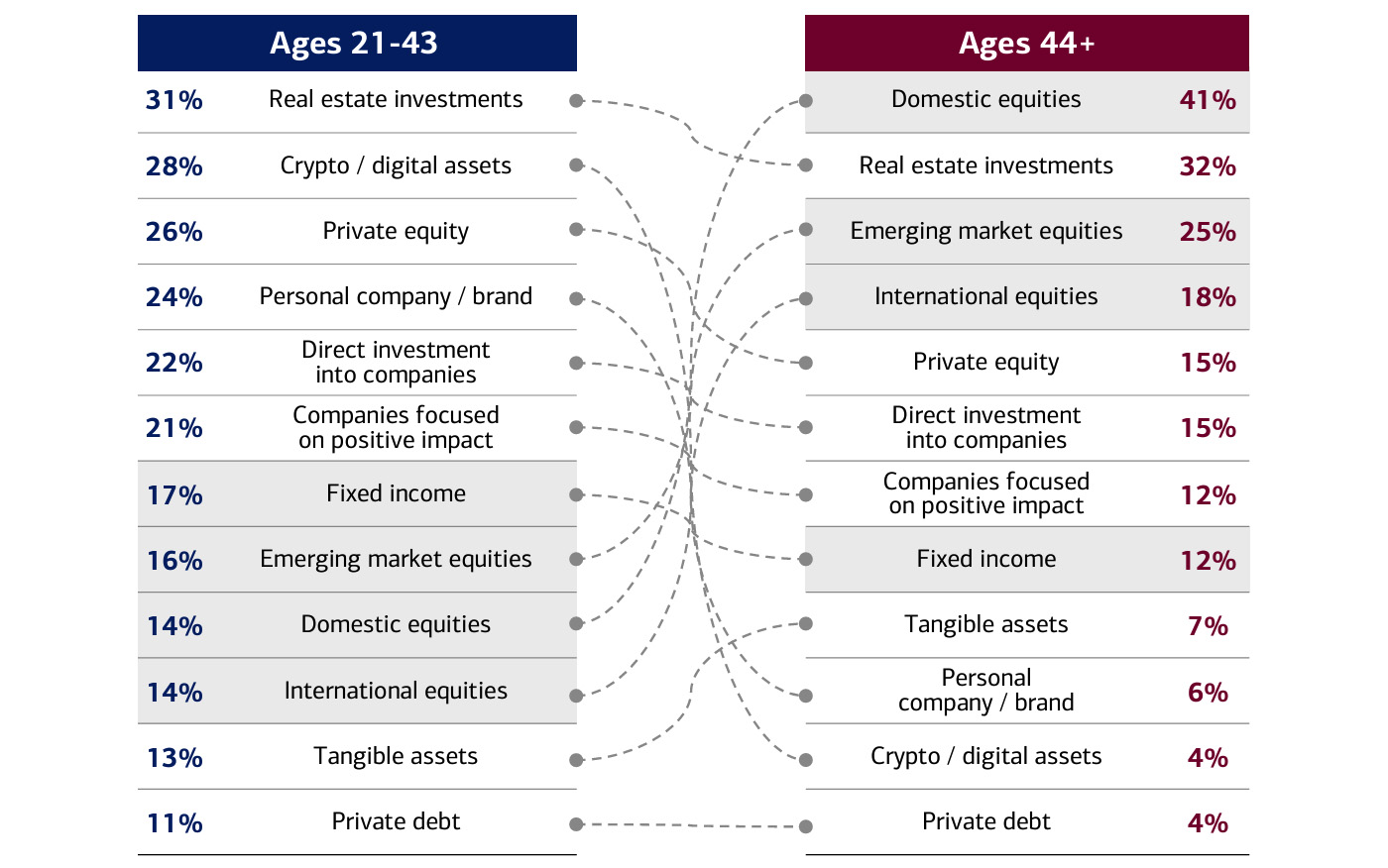

A Bank of America study offers an interesting perspective on how the portfolios of younger investors (ages 21–43) differ from older ones. More affluent younger investors are challenging traditional investment preferences and perceived opportunities. Even as they diversify, it is fair to assume that crypto investing will remain important to them.

TOP RANKINGS FOR PERCEIVED GROWTH OPPORTUNITIES AMONG AFFLUENT INVESTORS

Six options outrank traditional investments among younger investors

Source: Bank of America 2024 Study of Wealthy Americans

Crypto investors, while more inclined to use social and news media for information, are not necessarily less likely to develop a relationship with an advisor once they feel ready to expand their investment horizons. In fact, they might be more likely to seek professional help when diversifying, as they may feel less knowledgeable about equities.

Here is where financial advisors can add real value.

A FINRA study shows that “investor knowledge is low” across all age groups, with an average score of 4.7 out of 10 on an investing quiz. For example, 44% of respondents mistakenly think that the past performance of an investment is a good indicator of future results. Knowledge levels are even lower among “investors under 35 and those with less than two years’ experience.”

Advisors have an educational opportunity, especially with younger investors, including children of current clients. They can fill the gap in financial education that this group desires and clearly needs, according to the research.

The most immediate task for advisors is to address some important concepts for a new crypto investor:

- The risk/reward, fundamentals, and long-term rationale for digital assets versus equities and other asset classes

- The advantages of asset-class diversification and sound portfolio allocation theory

- The relevance of crypto in taxable versus retirement accounts

Over the long term, advisors can begin to educate newer investors about the following important financial themes, among others:

- The significance of understanding their relationship with money from a behavioral finance perspective

- The importance of goals-based financial and investment planning

- Why understanding diversification, market cycles, and investment risk management is crucial, especially for those looking to fund a long-term retirement-income plan

- The “power of compounding” and how it relates to (a) building wealth in the long run, and (b) the mathematics of bear market portfolio losses and subsequent recoveries

Importantly, to connect with crypto investors, advisors will need to demonstrate that they can speak their language and demonstrate a willingness to accept bitcoin as a component of a broader asset mix. With that, advisors could reap the benefits of a larger investing audience, no matter how an investor first became involved with the financial markets.

The opinions expressed in this article are those of the author and the sources cited and do not necessarily represent the views of Proactive Advisor Magazine. This material is presented for educational purposes only.

Richard Lehman is the founder/CEO of Alt Investing 2.0 and an adjunct finance professor at both UC Berkeley Extension and UCLA Extension. He specializes in behavioral finance and alternative investments, and has authored three books. He has more than 30 years of experience in financial services, working for major Wall Street firms, banks, and financial-data companies.

Richard Lehman is the founder/CEO of Alt Investing 2.0 and an adjunct finance professor at both UC Berkeley Extension and UCLA Extension. He specializes in behavioral finance and alternative investments, and has authored three books. He has more than 30 years of experience in financial services, working for major Wall Street firms, banks, and financial-data companies.

RECENT POSTS