History suggests that the market has either already seen its low for 2018 or is within easy striking distance of it. Now is a great buying opportunity before the market begins to climb again. Buying opportunities in bull markets don’t come very often, and we have one now.

How did we get to this conclusion?

Normally, major corrections occur sometime in the first or second years following a presidential election.

In the last 14 midterm election years, bear markets began or were in progress nine times. Going back over 100 years, the average decline for the Dow Jones Industrial Average (DJIA) has been 20.4% from the post-election-year high to the midterm-year low.

Scary statistics, but, to my way of thinking, it is bad data. And it may be undermining an attractive buying opportunity.

The analogy in play here is this: “Never forget the 6-foot-tall man who drowned crossing the stream that was 5 feet deep on average.” The bad data includes averages from both secular bear and bull markets. (Secular market movements typically span decades.) I think the more proper analysis should instead focus on the data only during secular bull markets, which is the market’s current status.

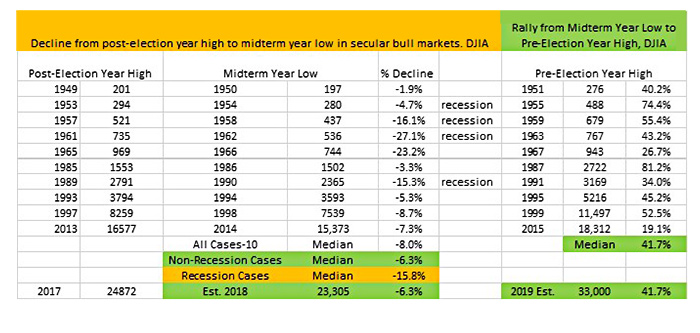

By separating the data, the picture is very different. Going back 59 years and looking at all of the cases of market drops from the post-election-year highs to the midterm-year low that occurred only during secular bull markets, the median decline is just 8%, not 20%.

But take it one step further and add economic recessions to the analysis. Again, the picture and the data shift dramatically. In periods when a recession is taking place, the average market decline almost doubles to 15.8%. And in non-recession periods, the decline is just over 6%.

TABLE 1: COMPARISON OF LOSSES AND GAINS IN ELECTION CYCLES

Source: STIR Research

No one is expecting or predicting a recession in 2018. In fact, it’s just the opposite: The forecast is for accelerating economic growth with an estimated 3.0% gain in GDP this year, up from 2.2% in 2017. To repeat, in non-recession cases, the Dow falls on average just 6.3% from its post-election-year high to its midterm-year low.

The 2017 post-election high was 24,872. Factoring in a median 6.3% decline to the midterm-year low leaves an objective of 23,300 on the downside for the Dow. The intraday low for the Dow on April 2, 2018, was 23,344. Will that be the low for this pullback? No one knows. Predicting exact bottoms is always impossible and a fool’s game.

What is important is the market is probably near its lows for the year, giving investors a tremendous buying opportunity before the bull market resumes. And the opportunity is big.

Corporate earnings are expected to post double-digit gains in 2018. Going back to 1991, on 11 prior occasions when S&P earnings hit double-digit gains, the year ended with a gain every single time.

Since 1914, the Dow has gained 47.4% on average from its midterm-election-year low to its subsequent high in the following pre-election year.

Focusing on results only in secular bull markets, since 1950, the Dow has staged a powerful 41.7% rally from the midterm-year lows to the pre-election year highs. If the lows for 2018 are close to the 23,300 level, then a 40%-plus rally into 2019 produces a goal of 33,000 for the Dow!

With STIR Research’s 2018 Outlook forecasting a 20% gain, with more gains to follow in 2019—and with the S&P 500 trading in negative territory for the year—I believe that the bull market is offering a rare buying opportunity.

The opinions expressed in this article are those of the author and do not necessarily represent the views of Proactive Advisor Magazine. These opinions are presented for educational purposes only.

Marshall Schield is the chief strategist for STIR Research LLC, a publisher of active allocation indexes and asset class/sector research for financial advisors and institutional investors. Mr. Schield has been an active strategist for four decades and his accomplishments have achieved national recognition from a variety of sources, including Barron's and Lipper Analytical Services. stirresearch.com

Marshall Schield is the chief strategist for STIR Research LLC, a publisher of active allocation indexes and asset class/sector research for financial advisors and institutional investors. Mr. Schield has been an active strategist for four decades and his accomplishments have achieved national recognition from a variety of sources, including Barron's and Lipper Analytical Services. stirresearch.com