As the 2020 election draws near, investors might want to know how the Lowry Analysis viewed market conditions ahead of the last election in 2016. No doubt, aside from the political components of who is running and what policies they might pursue, there are numerous similarities in the market itself in terms of price trends, supply and demand, and the overall Lowry view. Of course, there are many differences, as well, so this article will examine both, not to forecast a political outcome but to illustrate how the market is behaving now versus then.

To set the stage for the comparison, there were important price bottoms in February 2016 (cyclical bear market) and March 2020 (pandemic). The market surged off both, with a pair of “good” overbought conditions in terms of the percentage of stocks above various moving averages, and price above the top of its price envelopes for extended periods of time.

Moving closer to the two elections, there were other similarities, including negative divergences in the same indicators measuring the percentage of stocks above various moving averages. There were also persistent declines in the Short Term Index in the weeks ahead of the election in 2016, as well as through late September in 2020. And finally, major price indexes were once again trading above their price envelopes for extended periods of time. This time, however, the rallies were more mature, making these the “bad” type of overbought conditions in stretched markets.

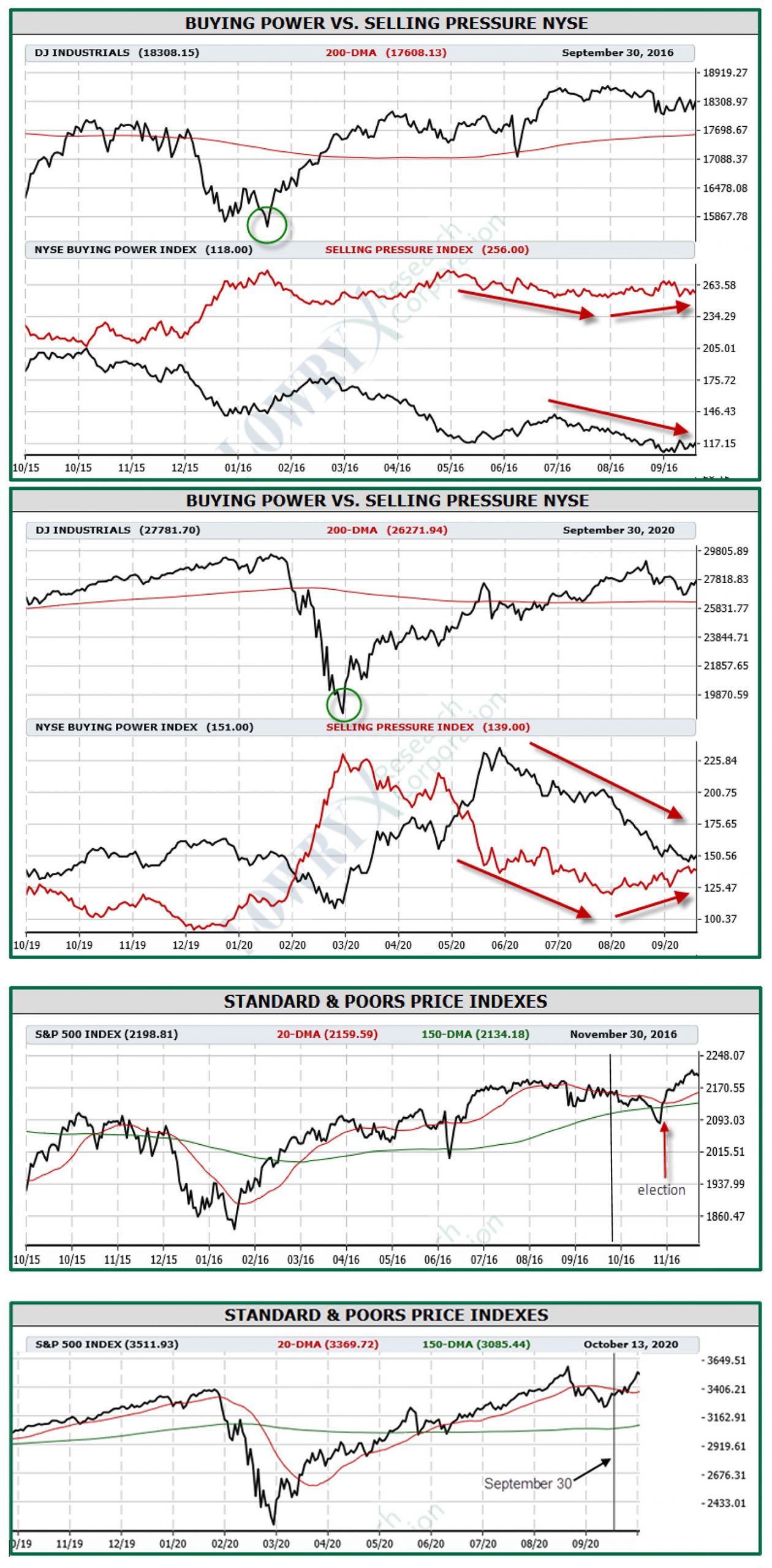

The Lowry commentary for September in both years are remarkably similar. They discussed short-term divergences with little supply increase that only suggested short-term tops in September, along with the suggestion to cull weak stocks. Among the most important differences in the commentaries were the concentration of big technology stocks leading the way in 2020 and the fact that Selling Pressure was dominant in 2016 while Buying Power has been dominant in 2020. (These statistics inform Lowry’s proprietary measures of the intermediate-term trends of investor supply and demand: Buying Power and Selling Pressure.)

With September 2020 having more similarities than differences to September 2016, probabilities seem to favor a similar market outcome (strong intermediate-term rally lasting several months) once postelection volatility eases. However, with more than a month to go before the election itself, there is time for significant change to occur.

The following charts compare indicators and price action in September 2016 with 2020. Please read the Lowry Special Report: Impacts of Presidential Elections on the U.S. Equity Market, published Nov. 3, 2016, for further election analysis throughout Lowry’s 93-year history.

Whereas September 2016 and 2020 were remarkably similar in terms of supply and demand, breadth, and price action, conditions diverged in October. For example, in 2016, Buying Power continued to contract while Selling Pressure continued to expand. In 2020, the opposite occurred, and demand once again became robust.

Starting at the Sept. 23, 2020, market low, this resurgence in demand took many forms, including the percentage of stocks above their 10-day moving averages surging from fully oversold to the “good” kind of overbought. The % of Operating Company Only (OCO) Stocks within 2% of 52-week highs, as well as most “percentage above” various moving averages, all surged to relieve either weak or divergent conditions.

In 2016, the correction continued into the election. In 2020, the correction appears to have ended. Does this mean the start of the next leg higher has already begun? It is possible, but as investors know, history never repeats exactly. At the time of this writing, short-term conditions, from the S&P trading above its 3% envelope to extended traditional technical indicators, are now overbought. Perhaps that will turn out to be the wrinkle 2020 offers ahead of the cloud of uncertainty being lifted after the election, no matter who wins.

Source: All charts via Lowry Research using market data

Michael N. Kahn, CMT, is a senior market analyst at Lowry Research. He has more than 30 years of professional experience as an analyst, writer, educator, and product manager. Before joining Lowry’s, Mr. Kahn wrote a twice-weekly column on technical analysis for Barron’s, as well as articles for MarketWatch, Kiplinger, and other publications. He is active in the CMT Association as a member of the Board of Directors and other roles. For more information on Lowry Research, please visit lowryresearch.com.

Michael N. Kahn, CMT, is a senior market analyst at Lowry Research. He has more than 30 years of professional experience as an analyst, writer, educator, and product manager. Before joining Lowry’s, Mr. Kahn wrote a twice-weekly column on technical analysis for Barron’s, as well as articles for MarketWatch, Kiplinger, and other publications. He is active in the CMT Association as a member of the Board of Directors and other roles. For more information on Lowry Research, please visit lowryresearch.com.