Despite a three-day pullback for the S&P 500 last week, the first since early January, year-to-date returns for major indexes remain solidly in the green (except for small-cap stocks).

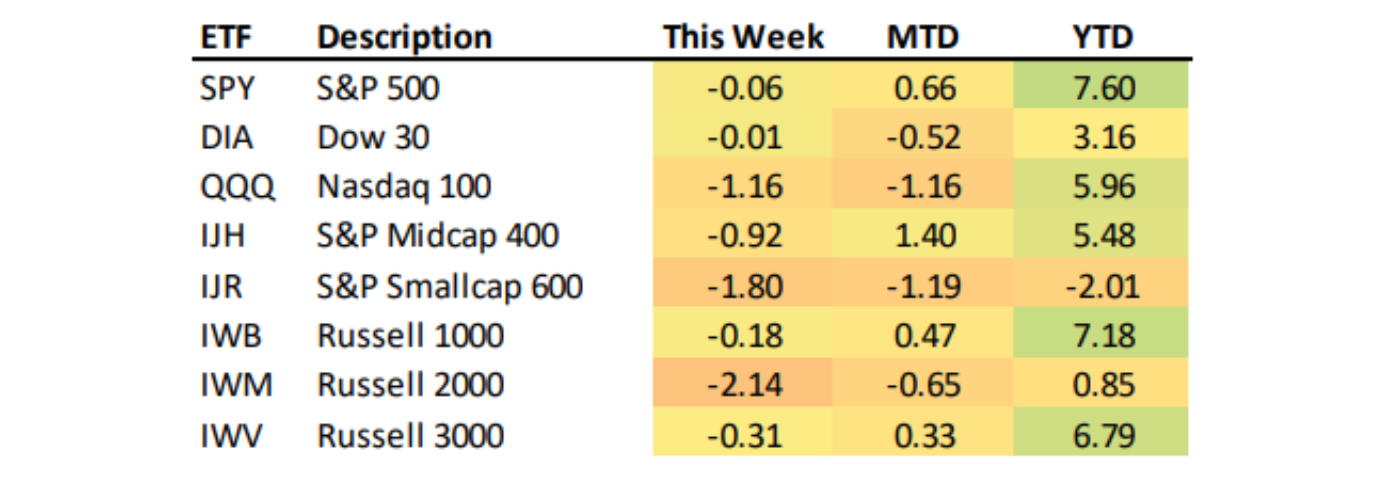

TABLE 1: KEY ETF PERFORMANCE THROUGH 3/15/2024

Source: Bespoke Investment Group

Bespoke Investment Group notes the following on the market’s performance:

“It’s easy to get complacent when the market goes through a stretch like it’s had over the last 5-6 months. As a reminder, markets can still go down!

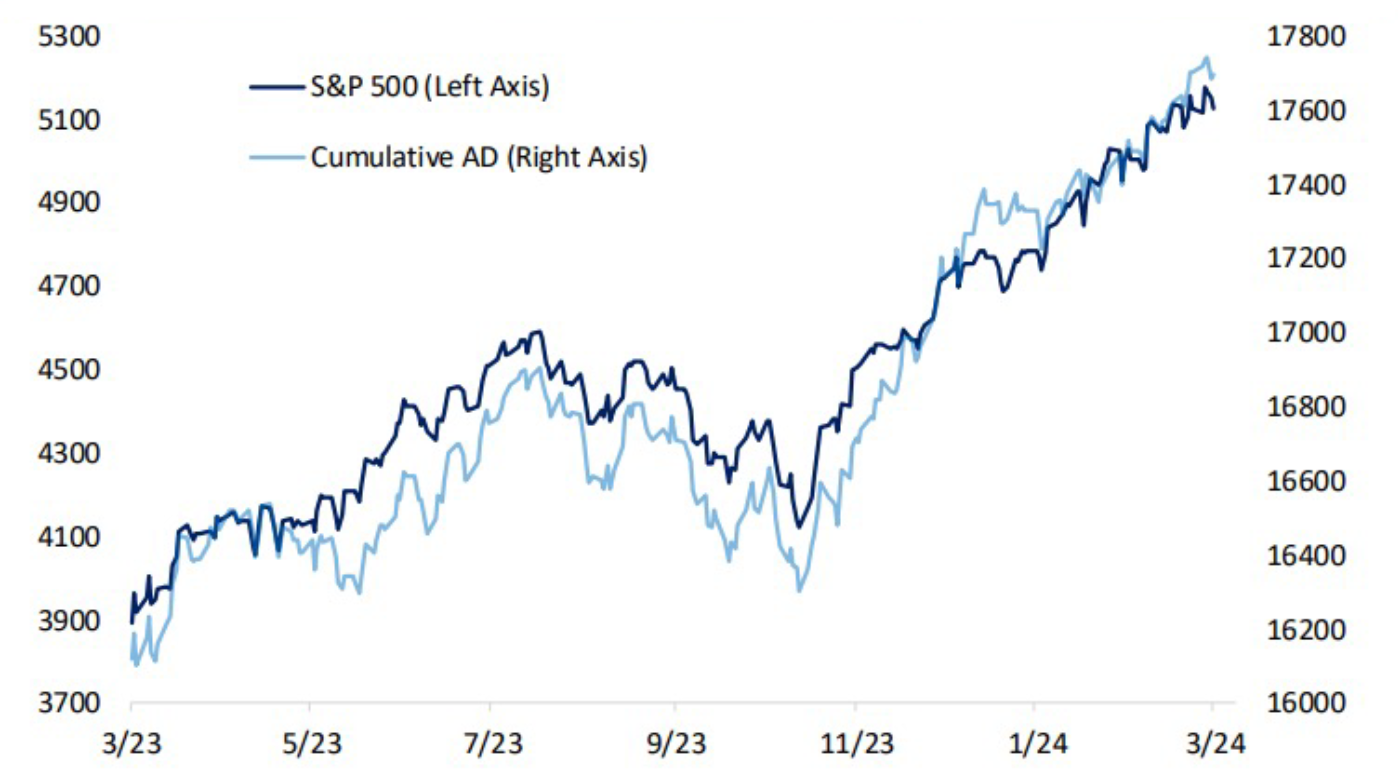

“You’d be hard-pressed to find many six-month periods where both price and the S&P’s cumulative advance/decline line trend this nicely higher. It’s been a steady climb since last October with nary a pullback.”

FIGURE 1: S&P 500 PRICE VS. CUMULATIVE A/D LINE

Source: Bespoke Investment Group

Several major Wall Street firms are raising year-end S&P 500 price targets

Bloomberg reported toward the end of February that both UBS and Goldman Sachs revised estimates for S&P 500 full-year gains:

“UBS Group AG raised its year-end forecast for the S&P 500 Index for the second time since December, as Wall Street strategists struggle to keep pace with the market’s strength to start 2024.

“The bank in a Tuesday note cited the sturdy economy and inflation data that reflects solid demand—which it sees as supporting equity prices. The update comes a few days after Goldman Sachs Group Inc. also boosted its view on US equities for the second time since late last year.

“At UBS, strategists Jonathan Golub and Patrick Palfrey now expect the S&P 500 to end 2024 at the 5,400 level. …”

Regarding Goldman Sachs, its price target now stands at 5,200, according to Bloomberg:

“‘Increased profit estimates are the driver of the revision,’ a team led by David Kostin wrote in a note to clients dated Friday. The 12-month forward earnings expectations are at a record high for the US stock index after forecasts bottomed out a year ago.”

And Business Insider reported at the end of last week that the widely followed strategist Ed Yardeni appears more bullish than ever:

“Ed Yardeni, the renowned economist and market expert, has made a bold prediction for the future of the stock market. He believes that the S&P 500 could surge by a whopping 26% by 2026 to 6,500.

“What Happened: Yardeni, the president of Yardeni Research, has been steadfast in his bullish outlook. He recently reiterated his year-end S&P 500 price target of 5,400, a figure he initially proposed a year ago. However, he now considers this estimate to be conservative.

“‘I think this is a long-term bull market. I got still 5,400 by year-end and that was a pretty bold call a year ago, but right now that’s looking pretty conservative, and why not more?’ Yardeni told CNBC on Wednesday. …

“He attributes this optimism to the market’s improving breadth and the possibility of a broader market.

“Yardeni also noted the high bullish sentiment among investors, suggesting that there may not be enough bears to convert into bulls to sustain the momentum.”

Despite analysts’ bullish outlooks, others see reasons for caution

As might be expected, there is no shortage of market strategists pointing out that significant risks still abound in the current investment environment, including uncertainty over the Fed’s rate policy, geopolitical risks, and the viewpoint that markets have run “too far, too fast” while inflation remains stubborn.

Forbes Advisor cites one strategist concerned over an overextended tech sector:

“David Bahnsen, chief investment officer at The Bahnsen Group, says the recent enthusiasm for tech stocks reminds him of the dot com bubble and investors should tread carefully.

“‘The AI hype is not sustainable because much of the stock gains seen due to AI are about the marketing of AI and the hype, and only one or two companies have actually experienced a specific revenue bump from AI,’ Bahnsen says.

“‘Where there has been AI fever, and there has been a lot of it, it has priced in perfection and then some.’”

Raymond James, while bullish in the long term, sees the potential for short-term weakness in the markets, according to an analysis posted at Financial Advisor IQ:

“The recent run-up in stock prices has pushed valuations to elevated levels. In fact, on a trailing twelve-month basis, the S&P 500’s price-earnings ratio has climbed to 23.0x—its highest level since 2002 (ex-COVID). … The problem: any hint of disappointing news (whether macro or earnings related) could lead to a negative reaction. …

“And with stock prices already reflecting positive developments on the economic and jobs front, any deviations from the soft-landing narrative could lead to a temporary setback. With our economist expecting a growth slowdown, whether it’s the softest of landings or the mildest-of-mild recessions, the market remains vulnerable to any less than stellar macro news.”

J.P. Morgan, which went into 2024 with one of the lowest outlooks for the S&P 500, still cautions about market risk in a recent note, says MarketWatch, despite some bullishness on big tech:

“Investors are pushing into so-called momentum stocks at a rate not seen since the dot-com bubble of the late 1990s, making them increasingly vulnerable to a market event, such as Tuesday’s consumer price inflation (CPI) report.

“That’s according to a team of strategists at JPMorgan led by Dubravko Lakos-Bujas, who offer a fresh warning to clients about potential bubble risk.

“‘Momentum is a dynamic stock factor that changes its exposure depending on macroeconomic and fundamental conditions. As such, it often becomes crowded, followed by an inevitable and often sharp correction (i.e. momentum crash),’ Lakos-Bujas, chief global equity strategist, and his team said in a note dated Sunday. …

“That momentum crowding is credited in part to ‘investors’ insatiable demand for sustainable growth stocks in a challenging macro backdrop.’ JPMorgan says growth stocks, which offer a higher-than-average chance of higher earnings, revenue or cash flow, now have the ‘highest sensitivity’ to the market versus long-term history. …

“In a separate note, JPMorgan analysts led by Mislav Matejka argued that top-performing tech stocks are actually undervalued compared with rival stocks and thus may not be in bubble trouble.”

Is a short-term market pullback inevitable?

Bespoke Investment Group generally takes an even-handed view of market and economic data, and has recently pointed out the various pros and cons of the current environment. But perhaps what stands out the most in its analysis is how vulnerable the market is to a short-term pullback:

“Were yesterday’s [Mar. 14] stronger-than-expected inflation data and weaker retail sales the catalyst to kick off a more significant pullback, or will the dip buyers step back in once again and take us to new highs? …

“Even more remarkable than the fact that we haven’t had a one-day 2%+ drop in more than a year is that we haven’t even seen a 2%+ pullback from a closing high (over any number of days) in 96 trading days dating back to last October.

“You can see the tight upward range that the S&P has been trading in over the last six months with no 2%+ drops at any point. As shown below, there have only been a handful of stretches this long without a 2%+ pullback in the last 70+ years. Rest assured that we will have a 2%+ pullback again at some point!”

FIGURE 2: S&P 500 ETF (SPY)—SUSTAINED RALLY FOR PAST SIX MONTHS

Source: Bespoke Investment Group

RECENT POSTS