Editor’s Note: Tony Dwyer, U.S. portfolio strategist for Canaccord Genuity, and his colleagues author a widely respected monthly overview of market conditions, technical factors, and future market outlook called the “Strategy Picture Book.” The following provides an excerpt from their July 11, 2018, report on the macro market outlook.

Our EPS and core thesis suggest adding exposure on volatility

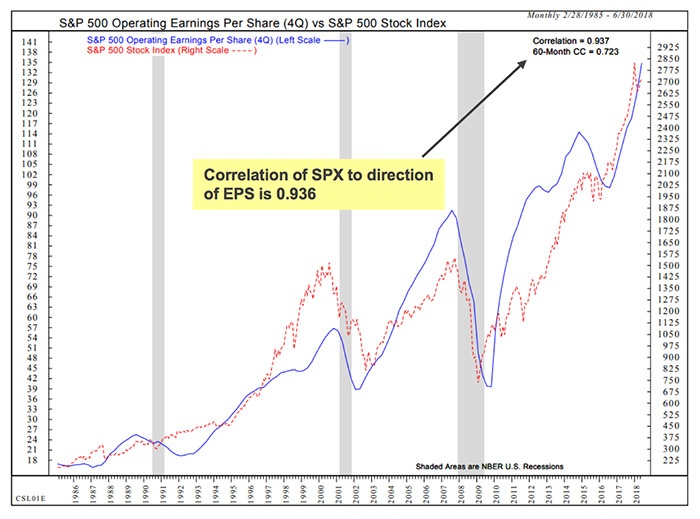

Earlier in the year, we were much more nervous about a meaningful correction because sentiment was at an optimistic extreme, the CBOE Volatility Index (VIX) was historically low for an extended period without any meaningful drawdowns, and the S&P 500 (SPX) was up 7.5% in the first three weeks of the year. As we enter the second half, the extreme economic and market optimism has been relieved, and, according to Thomson Reuters I/B/E/S estimates, we are about to enter what should prove to be a very solid Q2 2018 EPS reporting season. We are not suggesting there won’t be corrections and volatility, but ultimately the SPX correlates with the direction of earnings per share (EPS), which should stay positive through 2019.

FIGURE 1: S&P 500 OUTLOOK TRENDS WITH THE DIRECTION OF EARNINGS

Sources: Canaccord Genuity, ndr.com

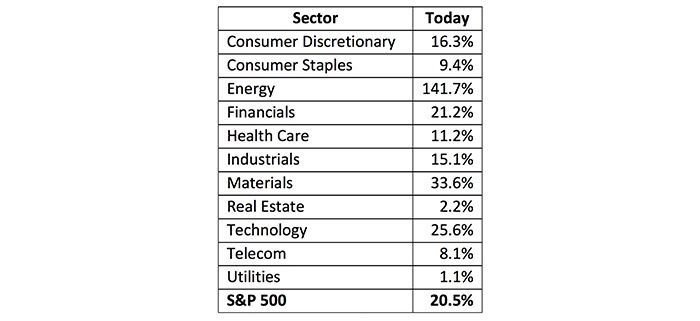

- Q2 2018 EPS growth is estimated to be 20.5%, driven by the more cyclical sectors such as Energy, Materials, Info Tech, and Financials. Clearly, the 2017 tax cut legislation and more business-friendly regulatory backdrop opened the door for accelerated domestic economic growth and the 20%-plus jump in SPX EPS.

- History shows the current estimate should be too low. Throughout this cycle, EPS estimates have been revised up a median 3.4% from the beginning of reporting season to the last report. This suggests Q2 2018 growth should be over 24% when all is said and done. As a reminder, Q1 2018 consensus going into reporting season was to be up 18.5%, and it ended up rising 26.6%.

Our core thesis is still in place

- The equity market is most closely correlated to the direction of earnings. SPX Operating EPS should end the year with over 20% growth.

TABLE 1: ESTIMATED EARNINGS GROWTH FOR Q2 2018

Sources: Canaccord Genuity, Thomson Reuters I/B/E/S

- The direction of earnings is driven by economic activity, which remains in an uptrend, and is accelerating. Business and consumer confidence all remain near a historic high. NFIB Small Business confidence hit a cycle high in May, and the median lead from cycle peak to recession is 41 months.

- Positive economic activity is driven by the positive yield curve and availability of money. Over the past seven cycles, a recession did not begin for a median 19 months after the initial date of inversion of the U.S. Treasury curve.

- The slope of the yield curve and availability of credit is driven by Fed policy, which is neutral. The real fed funds rate using the Core PCE is roughly at zero, which is well below any other period that drove recession. Our checks and balances in case it might be different this time for credit are the NFCI stress indexes, which show historically low stress.

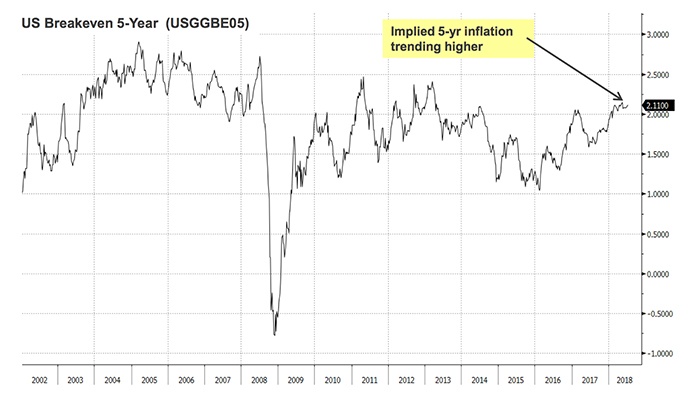

- Fed policy is driven by core inflation, which should remain in the range of the past 20 years. Though the current implied five-year inflation rate is higher, it is still below this and prior cycle peak levels.

FIGURE 2: 5-YEAR INFLATION RATE HIGHER BUT BELOW PRIOR PEAK LEVELS

Sources: Canaccord Genuity, Bloomberg

The opinions expressed in this article are those of the author and do not necessarily represent the views of Proactive Advisor Magazine. These opinions are presented for educational purposes only.

Tony Dwyer is the head of the U.S. Macro Group and chief market strategist at Canaccord Genuity. He also sits on the firm’s U.S. operating committee. Mr. Dwyer joined Canaccord Genuity in 2012 and is known for the practical application of macroeconomic and tactical market indicators. Mr. Dwyer was previously equity strategist and director of research at Collins Stewart and a member of the firm's executive committee. Mr. Dwyer is a frequent guest on many financial news networks. canaccordgenuity.com

Tony Dwyer is the head of the U.S. Macro Group and chief market strategist at Canaccord Genuity. He also sits on the firm’s U.S. operating committee. Mr. Dwyer joined Canaccord Genuity in 2012 and is known for the practical application of macroeconomic and tactical market indicators. Mr. Dwyer was previously equity strategist and director of research at Collins Stewart and a member of the firm's executive committee. Mr. Dwyer is a frequent guest on many financial news networks. canaccordgenuity.com

Recent Posts: