A different version of ‘Dogs of the Dow’?

A different version of ‘Dogs of the Dow’?

The standard “Dogs of the Dow” trading/dividend strategy involves buying the five or six worst-performing stocks from the Dow Jones Industrial Average (DJIA) at the end of one year and holding them for one year. Then the process is repeated the next year. The strategy has had some great and not-so-great years.

Personally, I’ve never traded it. That holding period is just too long for me, especially considering that some of those stocks are in steep downtrends. The only reason I bring this up is because, once in a while, Dow Jones decides to boot a stock out of the DJIA and replace it with a shiny new “hot” stock. That is a real “dog” of the Dow, and they want to get rid of it.

That happened earlier this year. Walgreens Boots Alliance (WBA) was dropped from the DJIA at the end of February in favor of Amazon (AMZN). The Dow doesn’t change much over the years. This is only the seventh change since 2015—and the first since August 2020. Ironically, in 2018, General Electric (GE) was dropped and Walgreens was added. Stocks dropped from the Dow often rally shortly thereafter, sometimes significantly.

The portfolio managers who make these decisions often face a great deal of criticism from the investing community, and some of it is clearly justified. They wait too long to jettison a stock or, more often, to add a strong stock.

The worst case was probably IBM. Let’s start at the beginning. IBM was one of eight stocks added to the Dow on May 26, 1932—at almost the exact bottom of the worst bear market in history. So, you’d figure that all eight of those were good “adds.”

Well, I guess the portfolio managers at Dow Jones didn’t feel that way. On March 14, 1939—not quite seven years later—they booted IBM out of the Dow and replaced it with AT&T. (I couldn’t find the exact prices of IBM stock back then, but there are business summaries available. Apparently, Thomas Watson, the founder and CEO at the time, was expanding, building, and hiring. I’m not sure why the stock would have tanked by 1939, but it most likely did. That would be the only reason that it would have been kicked out of the Dow.)

![]() Related Article: An interesting footnote to ‘Sell in May and go away’

Related Article: An interesting footnote to ‘Sell in May and go away’

IBM remained out of the Dow for 40 years. It wasn’t added back until June 29, 1979. During that “time-out,” IBM became the king of the computer manufacturing market, and the stock was a monster winner. Had IBM remained in the Dow, the Index would have broken through 1,000 way before it eventually did—and who knows where it would be today? (If anyone wants a “project,” figure that out).

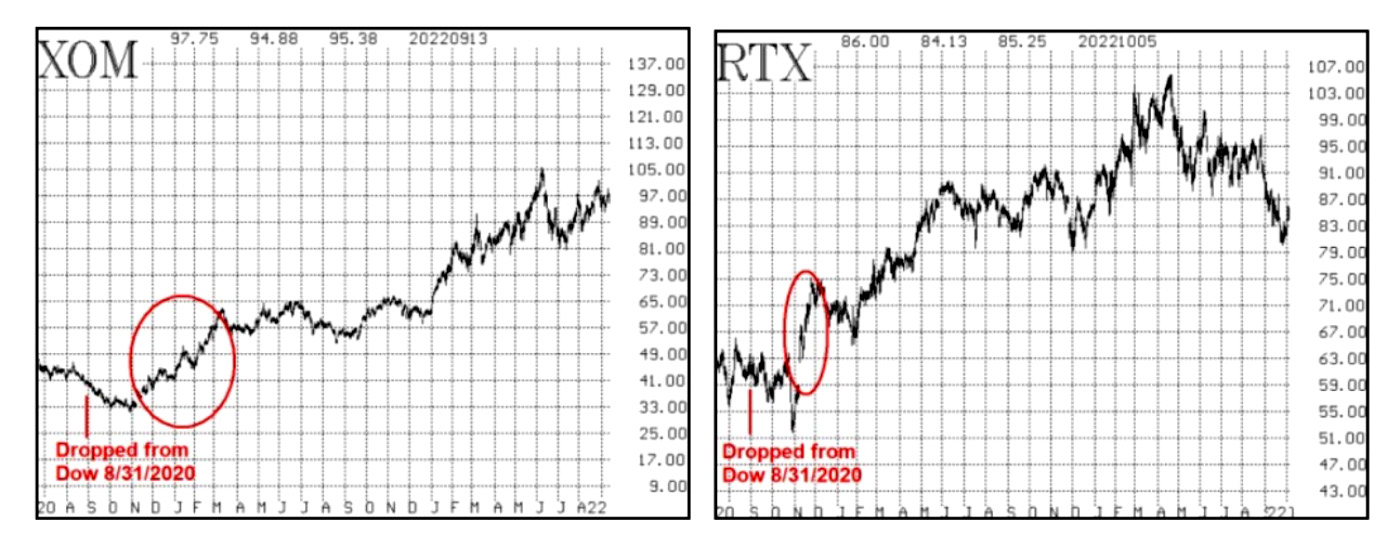

So, back to the present day. I was curious about what happens when stocks are dropped from the DJIA. The following charts show two examples: Exxon Mobil (XOM) and Raytheon (RTX), both of which were dropped on Aug. 31, 2020 (in favor of Salesforce.com and Honeywell, respectively).

Source: McMillan Analysis Corp.

These two stocks edged a little lower over the next couple of months and then put together monster rallies—both in the short and long term. That’s interesting to note.

Pfizer (PFE) (see the chart below), removed on the same day, also rallied strongly, although that had a lot to do with the COVID-19 vaccine. It was dropped during the pre-vaccine part of the pandemic. It didn’t go down much. The stock then rallied late in the year when it was selected as one of the companies to receive government funding for its vaccine research. From there, larger gains followed—although it did pull back to its “dropped from the Dow” price around March 1, 2021, before setting off on a monster rally over the next 10 months.

AT&T (T) has been added to and dropped from the Dow twice, most recently in 2015, when it was jettisoned in favor of Verizon. After being dropped, AT&T rallied for two months. Like PFE, it gave those gains back before setting off on a strong rally in 2016.

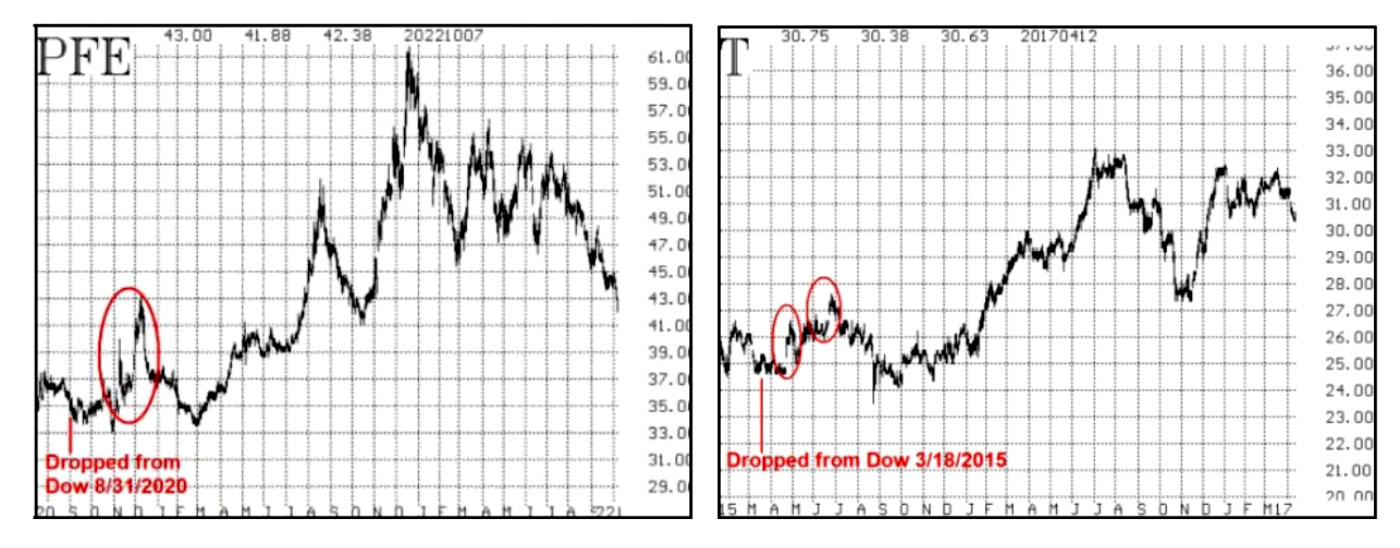

Source: McMillan Analysis Corp.

The only other stocks to be dropped from the Dow since 2015 were General Electric (GE) and DuPont (DD). In contrast with the four stocks previously discussed, these two failed to deliver short-term and long-term rallies after they were dropped in 2018 and 2019, respectively.

Source: McMillan Analysis Corp.

So, the theory isn’t foolproof, but the historical pattern seems to show that most of the stocks rally after being dropped from the DJIA.

(Editor’s note: Mr. McMillan added the following commentary for the article’s first publication in March 2024.)

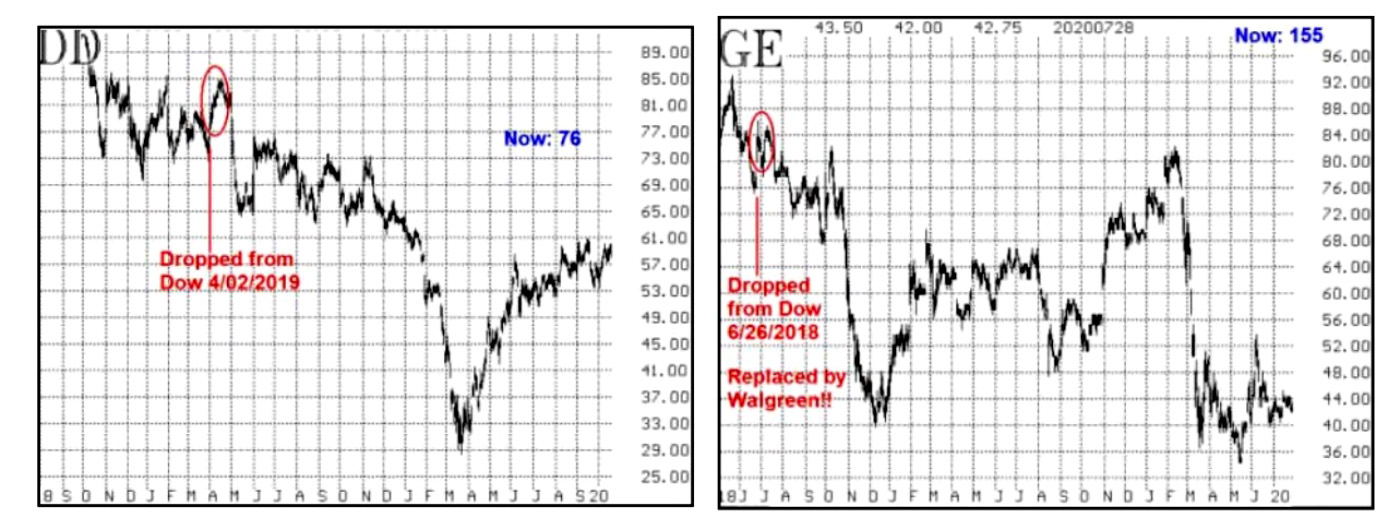

The following chart for Walgreens Boots Alliance (WBA) around the time of its departure from the Dow shows why the portfolio managers at Dow Jones were looking for a replacement. Even so, this could be a viable candidate to prove those portfolio managers wrong once again.

Source: McMillan Analysis Corp.

I’d prefer to see WBA attempt to rally somewhat before buying. This would be an attempt to avoid getting into something like DD or GE, which never rallied above any short-term resistance areas.

Ideally, waiting for WBA to break above its December highs at 27 would probably be best. On the other hand, that’s a long way above the current price, which is near 21. So, a shorter-term approach would be to at least see a rally above the recent resistance near 23.

(Editor’s note: WBA never reached Mr. McMillan’s suggested buy triggers after it was replaced by Amazon, and the stock has gone on to have a dismal 2024.)

The opinions expressed in this article are those of the author and the sources cited and do not necessarily represent the views of Proactive Advisor Magazine. This material is presented for educational purposes only.

This is an edited version of an article that was first published at optionstrategist.com on March 8, 2024.

Professional trader Lawrence G. McMillan is perhaps best known as the author of “Options as a Strategic Investment,” the best-selling work on stock and index options strategies, which has sold over 350,000 copies. An active trader of his own account, he also manages option-oriented accounts for clients. As president of McMillan Analysis Corporation, he edits and does research for the firm’s newsletter publications. optionstrategist.com

Professional trader Lawrence G. McMillan is perhaps best known as the author of “Options as a Strategic Investment,” the best-selling work on stock and index options strategies, which has sold over 350,000 copies. An active trader of his own account, he also manages option-oriented accounts for clients. As president of McMillan Analysis Corporation, he edits and does research for the firm’s newsletter publications. optionstrategist.com

RECENT POSTS