What is the real key to retirement fulfillment?

What is the real key to retirement fulfillment?

Retirement planning isn’t just about income—it’s also about helping clients design the lifestyle they want for the years ahead.

We have interviewed dozens of financial advisors and wealth managers across the U.S. over the past 11 years. Unsurprisingly, retirement planning—and its investment implications—is a topic we frequently discuss.

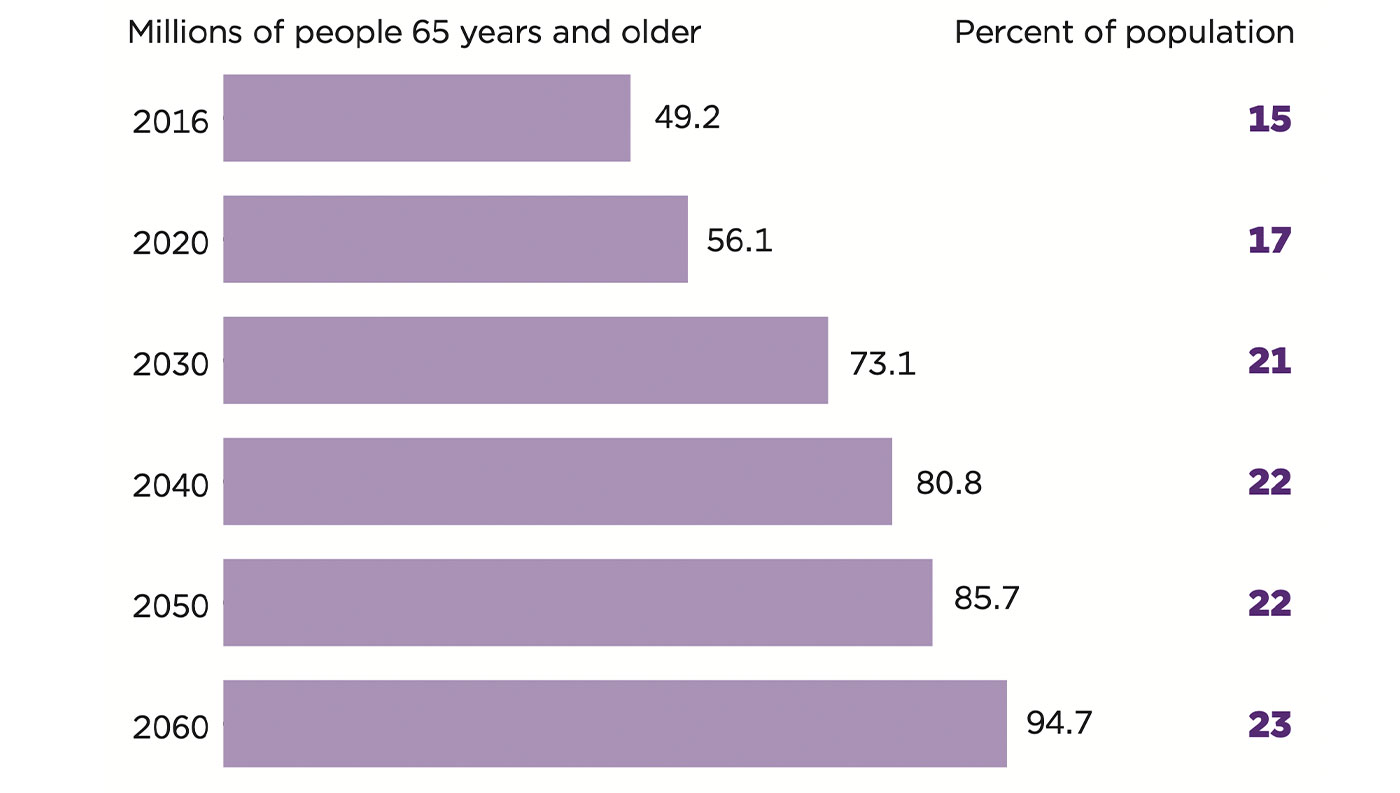

More than 50 million Americans are estimated to be in retirement today, based on the number of Social Security recipients. With tens of millions more expected to join them in the coming years, retirement-related research has expanded into a major field. Americans aged 65 and older are projected to be the fastest-growing age group over the next 40 years.

PROJECTIONS OF THE OLDER ADULT POPULATION: 2030 TO 2060

By 2060, nearly one in four Americans is projected to be an older adult.

Source: U.S. Census Bureau

Research on retirement spans a wide range of disciplines—from scientific and sociological studies to quantitative fields. Within the financial-services industry, key focus areas include the following:

- The impact of increasing longevity

- The roles of life, health, disability, and long-term care insurance

- The optimization and risk management of tax-efficient retirement-income streams

- The sustainability of government programs such as Medicare, Medicaid, Social Security, and Supplemental Security Income (SSI)

- Administration and funding of defined benefit and defined contribution (DC) retirement savings plans

- Strategies and tax implications for wealth transfer and estate planning

- Elder health care and wellness programs

- Senior living options

Together, these challenges create a complex retirement landscape for individuals and society alike.

A 2025 report by BlackRock outlines five major trends shaping the retirement outlook for retirees and the institutions that support them:

- “Americans are living longer—but with constraints.” Life expectancy in the U.S. rose by about 30 years during the 20th century—a dramatic shift that means many Americans will spend far more time in retirement than previous generations. However, life expectancy varies: Women tend to live longer, while Black Americans and people in lower-income groups often fall below the national average. Across all demographics, savings and retirement income strategies must evolve to meet the demands of longer retirements.

- “The first generation of ‘DC retirees’ is here.” The profile of retiring Americans has reached a pivotal point. The generation born in the 1960s is now retiring in significant numbers. It is the first that has relied chiefly on defined contribution plans, rather than traditional pensions (defined benefit plans).

- “Making retirement plans work in retirement.” In a defined contribution plan, building up and investing assets during one’s career is just the beginning. New and different approaches to lifetime income solutions may provide greater long-term financial stability for many retirees, helping alleviate their concerns about outliving their savings.

- “Access is powerful—when offered.” Access to resources—especially a workplace retirement plan—heavily influences American’s retirement readiness. Data shows that Americans are 15 times more likely to save for retirement when they can do so through their employer.

- “Gaps in retirement outcomes persist.” Retirement outcomes are shaped by a range of social dynamics—including gender, race, income level, and family status. This impact can be observed through various metrics, such as access to retirement plans, participation rates, and retirement savings.

Financial advisors can help clients navigate these challenges by educating them on key concepts and strategies. Among the many important themes, top advisors often focus on the following core principles:

- How your mindset and behaviors around money can influence financial decisions

- Why goals-based, holistic financial and investment planning helps tie financial strategies to real-life priorities

- What diversification, market cycles, and investment risk management mean—especially for clients nearing or in retirement

- How the power of compounding works—and how it relates to the mathematics of bear market portfolio losses and subsequent recoveries

- Why the sequence of returns matters when planning for retirement income—and how well-diversified and risk-managed portfolios can help reduce its impact

More advisors are also helping clients take advantage of professional investment management within defined contribution plans. For clients seeking to participate in market opportunities while managing downside risk in turbulent markets, actively managed strategies are an attractive and accessible option for many plan participants. Funds can be used to deliver different risk-managed strategies in separately managed accounts designed for use within a self-directed brokerage account (SDBA). Plan participants at many companies or within the public sector can ask their advisor about the ease of using the SBDA option. (See our article here for further discussion of the SBDA option.)

What defines a fulfilling retirement?

Beyond financial planning, a growing number of professionals are helping clients build a retirement that’s not only secure but also fulfilling.

Financial Advisor magazine’s article “The Science Side of Retirement” states,

“Overall, we know that people want to get retirement right. They want to retire at the right time and for the right reasons. So having tools and strategies for making a good retirement decision is important.

“Additionally, we know that people generally want to be happy, healthy, and connected. They want to thrive and not just survive … living their best life now. In the process they also want to build a legacy that will have a positive impact on future generations. …

“The only issue is that people are left to figure out how to achieve all of these factors on their own. …”

“Thankfully, there are existing, science-based models that we can apply to the retirement planning process to alleviate this problem. Specifically, we can use fresh insights from emerging sciences like Behavioral Economics and Positive Psychology, as well as rely on older models such as Maslow’s Hierarchy of Needs to add value and perspective to the retirement planning process.”

Financial advisors play an increasingly significant role in helping their clients look beyond the important financial mechanics of funding retirement income needs to first envision, and then build, a path to their ideal retirement lifestyle.

Advisors we have interviewed use various terms to describe their firm’s retirement-planning process in this context, including holistic planning, life planning/life transition planning, financial therapy, behavioral life coaching, values-based planning, and personal economic analysis. Regardless of the name, the objective is the same: helping clients make informed decisions on how they can best optimize their assets to achieve a retirement lifestyle that reflects their personal goals, values, important relationships, and aspirations.

I particularly like one Connecticut-based advisor’s explanation:

And a Minnesota-based advisor describes his process in this way:

“… We believe that ‘retirement’ is an outdated term. We prefer to refer to people reaching the point in their lives where working becomes optional, opening up many different possibilities for their continued personal growth and the active lifestyle of their choice.

“… The discovery process is very important, both in a qualitative and quantitative sense. We spend a lot of time early on just asking questions intended to draw clients out on what their lives are all about, their dreams and aspirations, and what will be most important to them in the financial-planning process. We use excellent software that facilitates a collaborative process and allows us to build a goals-based financial plan, develop a thorough retirement-income blueprint, and examine various real-life ‘what if’ scenarios customized for each client.”

Life lessons from Harvard’s landmark study

The Wall Street Journal, CNBC, and other media outlets covered the 85th anniversary of the Harvard Study of Adult Development in 2023. This unique research project, which began in 1938, has tracked participants across different socioeconomic groups for generations. As an essay in The Wall Street Journal described it, the study followed “an original group of 724 men and more than 1,300 of their male and female descendants over three generations, asking thousands of questions and taking hundreds of measurements to find out what really keeps people healthy and happy.”

Coincidentally, my father-in-law was one of the study’s original participants and faithfully complied with its requirements his entire adult life until his passing at age 94—as do a remarkable 84% of the participants.

While the ongoing study has uncovered many important and interesting insights, Director Dr. Robert Waldinger and Associate Director Dr. Marc Schulz emphasized one key finding for The Wall Street Journal:

“Through all the years of studying these lives, one crucial factor stands out for the consistency and power of its ties to physical health, mental health and longevity. Contrary to what many people might think, it’s not career achievement, or exercise, or a healthy diet. Don’t get us wrong; these things matter. But one thing continuously demonstrates its broad and enduring importance: good relationships. …

“Over and over again, when the participants in the Harvard Study reached their 70s and 80s, they would make a point of saying that what they valued most were their relationships with friends and family. If we accept the wisdom—and, more recently, the scientific evidence—that our relationships are among our most valuable tools for sustaining health and happiness, then choosing to invest time and energy in them today becomes vitally important. It is an investment that will affect everything about how we live in the future.”

A Colorado-based advisor who incorporates behavioral coaching into his practice commented on the Harvard study conclusion:

“This simple, yet profound truth is often missing for our everyday interactions. Who are the people you know, like, and trust who are adding a positive impact on your everyday life? These are the voices speaking into your life when you’re establishing a budget, preparing for a major purchase, changing jobs, moving to a new home, planning for college, or preparing for retirement or any other significant event.”

“Financially successful people have someone they can turn to for feedback, pushback, or affirmation. … The people who know you the best also know your values and habits. Remember, people leave patterns, including yourself. Getting trustworthy insight from those closest to you can be a great investment for your financial future.”

The opinions expressed in this article are those of the author and the sources cited and do not necessarily represent the views of Proactive Advisor Magazine. This material is presented for educational purposes only.

David Wismer is editor of Proactive Advisor Magazine. Mr. Wismer has deep experience in the communications field and content/editorial development. He has worked across many financial-services categories, including asset management, banking, insurance, financial media, exchange-traded products, and wealth management.

David Wismer is editor of Proactive Advisor Magazine. Mr. Wismer has deep experience in the communications field and content/editorial development. He has worked across many financial-services categories, including asset management, banking, insurance, financial media, exchange-traded products, and wealth management.

RECENT POSTS