Behavioral adherence: Sticking with the plan in volatile markets

Behavioral adherence: Sticking with the plan in volatile markets

The keys to keeping clients calm in times of economic uncertainty and market volatility are communication, education, and a consistently risk-managed investment approach.

When markets are particularly volatile, financial advisors must encourage their clients not to react emotionally and abandon their carefully constructed investment plans.

Such was the case in the first few months of 2025. The markets entered a period of heightened volatility in March and April, with the S&P 500 falling into a correction and briefly touching bear market territory.

Investing News Network reported in early March, “Fear is gripping the financial markets in 2025. CNN’s Fear and Greed Index, a widely followed gauge of investor sentiment, has plunged into the ‘Extreme Fear’ zone.”

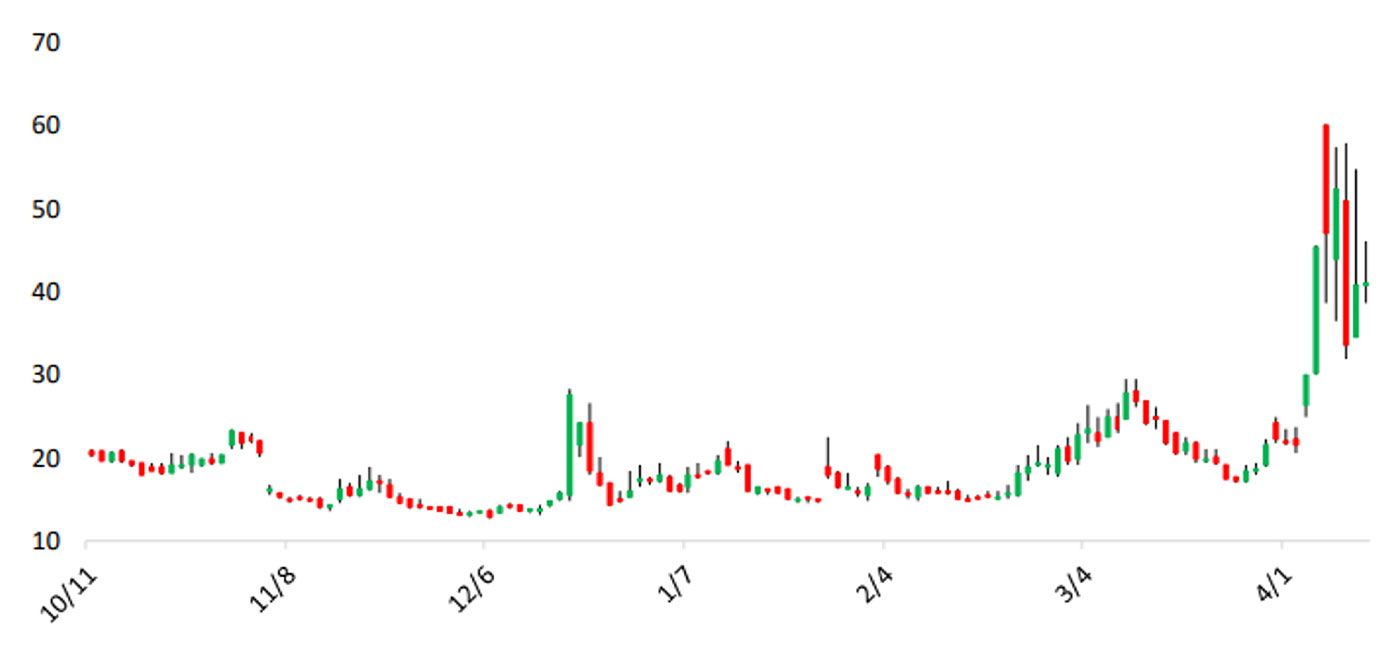

The CBOE Volatility Index (VIX) climbed from about 15 to the mid-20s during the first half of March before soaring over 50 at the height of the market’s initial reaction to the announcement of sweeping tariffs on April 2, 2025. Market moves of historic magnitude have occurred both to the downside and upside.

FIGURE 1: CBOE VOLATILITY INDEX (VIX) REFLECTS LARGE MARKET SWINGS AMID UNCERTAINTY

Source: Bespoke Investment Group

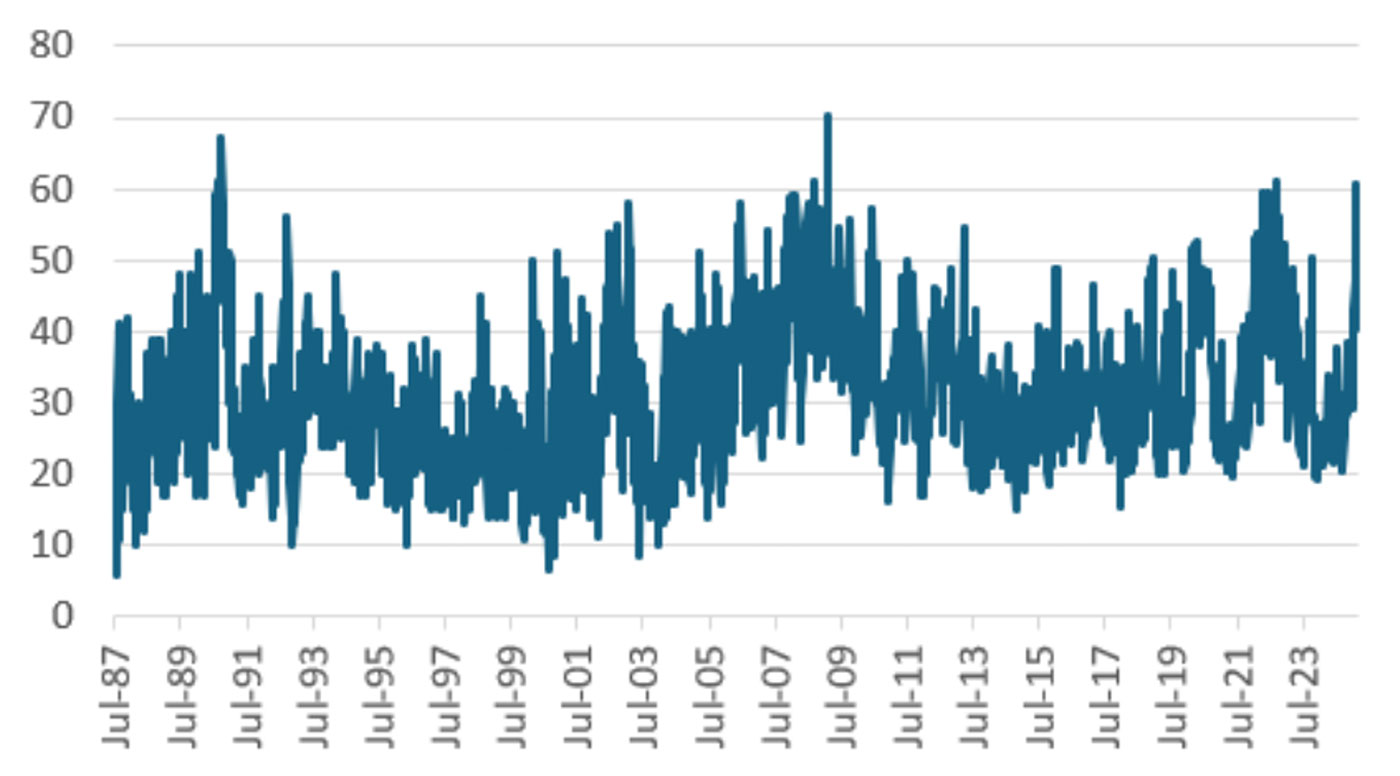

And even well before the formal tariff executive order, Bespoke Investment Group had posted on social media in late February, “Retail investors have been spooked to a historic degree!!! AAII Bearish sentiment ticked above 60% for just the sixth time in its history dating back to 1987. The 5-week change in Bearish sentiment is the 3rd highest in history behind only Dec. 2000 and Aug 1990.”

FIGURE 2: AAII BEARISH SENTIMENT: WEEKLY SINCE 1987

Sources: American Association of Individual Investors, Bespoke Investment Group

For advisors, the importance of understanding financial psychology is never more apparent than during market volatility, says Joe Buhrmann, an advisory financial planning practice management consultant for eMoney.

“The key for financial professionals is to work with clients to ensure they don’t reach the point of feeling threatened,” Buhrmann writes. “Prepare your clients by educating them about market dynamics and how the work you do for them will help position their investments for the long term.”

Instead of focusing exclusively on portfolio and individual security performance, advisors should remind their clients about the metrics and longer-term planning techniques they employ, writes Joshua Belfiore, a senior product manager for advanced planning for eMoney. These include Monte Carlo analysis, decision modeling, goal funding, and end-of-analysis metrics.

“Bouts of volatility present an opportunity to reframe the conversation by placing ‘performance’ in context, and remind clients that their objectives, which they came to you to address in the first place, may still be very much on track,” Belfiore writes.

“As wealth managers, we best speak to market volatility by helping clients connect the dots between portfolio activity, articulated client objectives, and the financial plan you’ve already created with them,” he adds.

Advisors provide perspective on guiding clients in difficult markets

Several advisors spoke with Proactive Advisor Magazine about what they believe causes clients to want to deviate from their plans—and how they help them keep on track.

Behavioral issues behind those impulses almost always stem from the constant tug-of-war between fear and greed, says Steve Deppe, CMT, managing member and chief investment officer at Nerad + Deppe Wealth Management in La Jolla, California.

“There are moments when their biases will infiltrate their decision-making, and the emotional state of fear or greed will lead them to abandon any long-term investment strategy,” Deppe says. “They will then want to rebalance their portfolios in alignment with whatever bias they are experiencing at that time.”

Indeed, the current public policy climate in the U.S. is creating “a lot of bifurcation” in client opinions, worries, and fears, says Adam Koos, CFP, CMT, president and portfolio manager at Libertas Wealth Management Group, based in Columbus, Ohio.

“The behavioral psychology is all across the board, depending on political opinions, how conservative each client is, and how much fear they’ve soaked up in whatever their chosen medium is for news consumption,” Koos says. “There is clearly a direct correlation between how much someone pays attention to political news and how many poor investment decisions they make.”

On the flip side, not making changes when prudence dictates can also impact long-term strategy, he says. Some investors hold on to certain investments due to a behavioral bias known as cognitive dissonance—they may know intellectually that a change is required, but they’re attached to a reason not to make it.

“Their reasons are all over the place … from ‘My uncle gave me the stock,’ to ‘My previous financial advisor really liked it,’ or ‘I used to work for them,” Koos says. “Personal opinions, how much you like a stock, whether it’s your favorite company—and especially political bias—none of these things have any place in investing your hard-earned retirement savings.”

Clients also may be tempted by the latest investment craze without putting much thought into it, says James Kraatz, co-founder and president of Faith Investment Services, an advisory firm located in Shelby Township, Michigan.

“I believe the number one reason is all the noise they hear in the media. You establish a plan with the client, but all of a sudden they’re hearing about the latest and greatest thing they should be investing in or chasing, and they want to know why they’re not in that—for example, cryptocurrency,” Kraatz says. “They don’t understand the inherent risk that comes with modifying their stated plan to chase the new thing on the block.”

Another challenge is short-term thinking, says Elaine King, CFP, founder of Family and Money Matters Institute in Miami, Florida.

“It’s hard for people to prioritize retirement when there are bills, vacations, and everyday expenses now,” King says. “Some clients at the beginning tell me, ‘I’ll save more next month,’ but it takes a plan to stay focused, and that is something I provide.”

King first sets up plans to make saving automatic and with clear targets—small increases over time, to make it easier for clients. For example, bumping up savings by just 10% a year makes a huge difference without feeling painful.

“Second, I help reframe risk,” she says. “Instead of focusing just on performance, I show what that actually means for their long-term goals. I remind them: If they had stayed invested during 2008, they’d be way ahead now. That usually helps ease fears.”

The importance of articulating a strong risk-management process

When clients react out of fear or greed to market conditions, Deppe focuses on helping them avoid emotional decisions driven by bias—especially personal beliefs on what may happen in the future.

“You have to understand that these concerns are real to the client,” he says. “You have to embrace them, and then you have to use history to provide factual evidence to dispel the bias. You want to try to help people recenter themselves away from the emotion that is infiltrating the decision-making process.”

Reminding clients of the long-term strategy is critical. When building portfolio allocations or investment policy for clients, Deppe typically relies on some form of backtesting. This can be a strategic asset-allocation model assessing the long-term risk and reward characteristics of uncorrelated asset classes, or a tactical allocation model that relies on the continued success of its historical rotational signals.

These backtests form the foundation of portfolio expectations for the client and the advisor from both a risk and reward perspective, he says. But clients often overemphasize the results of the backtest and underemphasize the process they need to follow to have any chance of realizing those historical results.

“This is where the conversation should take a sharp U-turn,” Deppe says. “We need to help our clients first fall in love with the process, or investment policy, embracing the good, the bad, and the ugly. This is important because exercising strict discipline in adhering to the process is the only way for the past performance of any portfolio to actually become future results.”

“I call this ‘behavioral adherence,’ and it is critical to investing successfully over the full market cycle,” he says.

Deppe also reminds clients about his philosophy around active investment management. He reiterates that the investment managers that he chooses employ specific risk-management techniques in strategies that seek market opportunity while mitigating portfolio drawdowns in unfavorable market environments.

“Our job after we’ve established that is to make sure the investment team is actually achieving what we set out for the client as the benchmarks,” Deppe says. “If they’re not, why aren’t they? Sometimes there’s a very good reason why they’re not achieving the returns that we stated we needed in this portfolio. But if it’s a continued trend that they’re underperforming, then we find another money manager. We are very transparent about this with our clients.”

The solutions to keeping clients calm in times of uncertainty and market volatility are communication, education, and a consistently risk-managed investment approach, Koos says. Protecting wealth is most important, and clients who are afraid of the market need to understand this crucial rule in the game of retirement planning.

“When we have the ball, we need to be cautious,” he says. “And when we lose the ball—which will inevitably happen as the market starts to crash—we need to put different players—investments—on the field than the ones we had playing on the offensive side of the ball. Risk management always comes first at our firm, or, to continue the analogy, ‘Defense wins ball games.’”

The beauty of active portfolio management is that advisors don’t have to know the future to produce successful results in their clients’ portfolios, Koos says. However, advisors do have to pay attention, follow rules, and stick to their strategy when the trends start to break down.

“With today’s advances in technology, successful active strategies can be effectively implemented through mechanical, quantitative approaches that are computer-driven,” he says. “We believe maintaining a non-emotional, rules-based, technical approach to money management can outperform ‘buy-and-hope’ portfolios over the course of a full market cycle.”

The markets may continue to be volatile for some time. But advisors can help steer their clients through this turbulence by reminding them about the process and reiterating the principles of active management so they can better meet their long-term financial goals.

The opinions expressed in this article are those of the author and the sources cited and do not necessarily represent the views of Proactive Advisor Magazine. This material is presented for educational purposes only.

CMT and Chartered Market Technician are registered trademarks owned by CMT Association. CFP is a registered trademark of the Certified Financial Planner Board of Standards Inc. (CFP Board).

RECENT POSTS