Guidance, not guesswork: Active management for retirement accounts

Guidance, not guesswork: Active management for retirement accounts

For clients seeking to take advantage of market opportunities—while also looking to avoid large drawdowns—actively managed strategies are an attractive and accessible option for workplace retirement accounts.

There is little doubt that many Americans are underprepared to fund their retirement needs. A recent Newsweek article summed it up clearly:

“More than half of all Americans do not have a plan in place for their retirement, a new study has revealed.

“Allianz Life’s 2024 Annual Retirement Study has found that 56 percent of Americans have no solid financial plan for their post-working years. The survey, which polled 1,000 over 25s in February and March this year, also found that nearly half (48 percent) worry about living too frugally and not enjoying retirement as much as they should.”

These statistics align with the National Institute on Retirement Security’s findings from 2024:

“The ground is shifting when it comes to retirement. Most Americans are experiencing increased financial pressures and low levels of retirement savings. …

“When asked if the nation faces a retirement crisis, 79 percent of Americans agree there indeed is a retirement crisis, up from 67 percent in 2020. More than half of Americans (55 percent) are concerned that they cannot achieve financial security in retirement. When it comes to inflation, 73 percent of respondents said recent inflation has them more concerned about retirement.”

In July 2024, Alicia H. Munnell, senior advisor of the Center for Retirement Research at Boston College, wrote about whether there really is a “retirement crisis”:

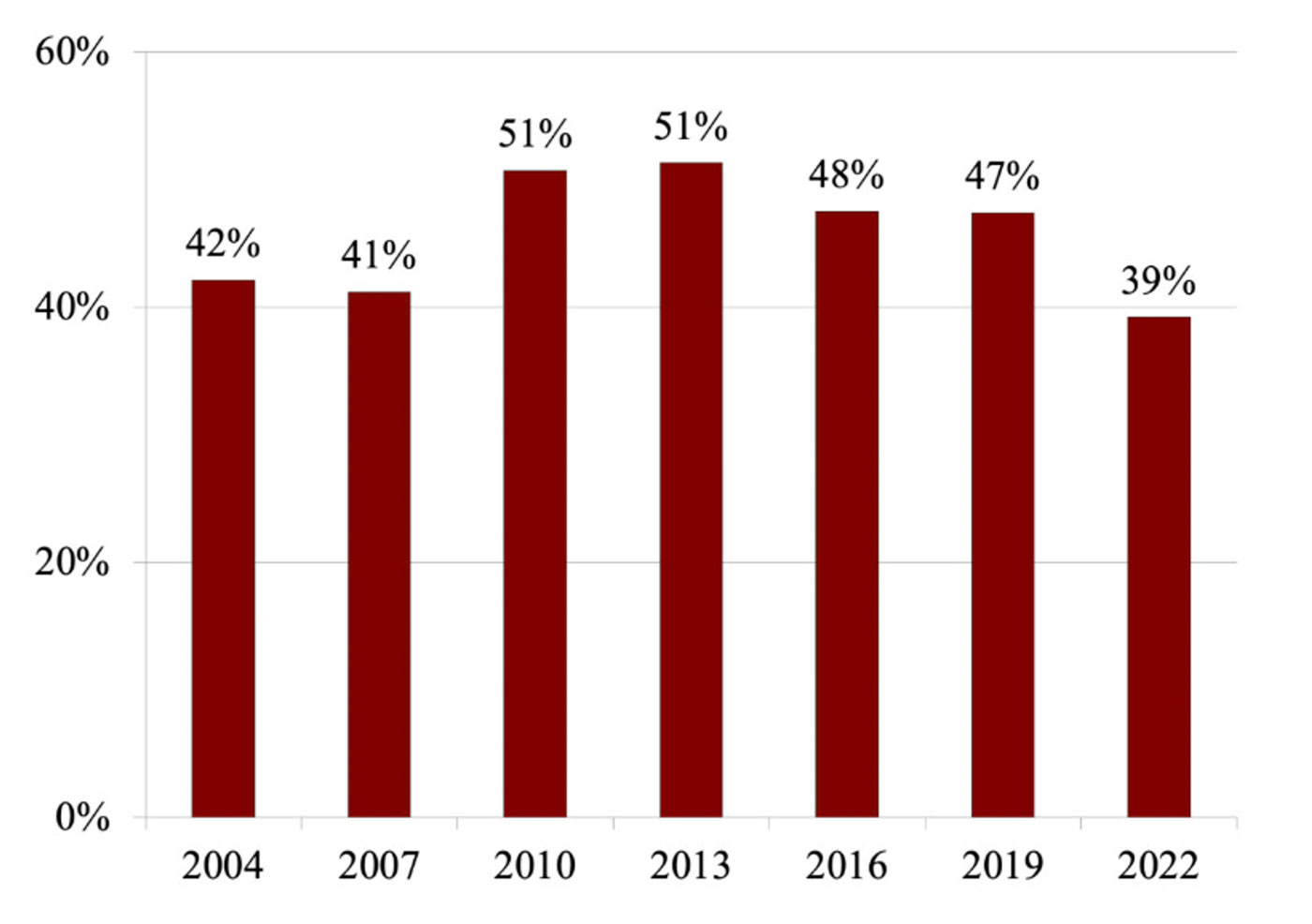

FIGURE 1: THE NATIONAL RETIREMENT RISK INDEX (2004–2022)

% households at risk

Source: Yimeng Yin, Anqi Chen, and Alicia H. Munnel, 2024. “The National Retirement Risk Index: An Update from the 2022 SCF.” Issue Brief 24-5. Center for Retirement Research at Boston College.

How are Americans managing their workplace retirement plans?

Research from Fidelity, Boston College, and others reveals several concerns with how working Americans are contributing to and managing their workplace retirement savings plans, including 401(k)s and other voluntary savings plans such as 403(b)s:

- According to a Fidelity study, age-appropriate equity allocations have declined, particularly among millennials. Only about 59% of those studied have what Fidelity considers to be age-appropriate investment allocations. The study found, “The decline in [retirement] preparedness is being driven by two primary factors: people are saving less and investing more conservatively. … Among those taking a conservative approach, nearly six in ten (57%) respondents expressed concern about losing their savings by investing too aggressively.”

- Factors impacting retirement plan contribution rates include lower household savings rates, inflation, and declining real income.

-

In 2023, Ms. Munnell noted that 401(k) participants were hit hard by the weak 2022 stock market, and that “more importantly, long-run trends show little gains for median balances.”

In an updated look at 401(k) balances last year, Munnell wrote,

“Average balances rose from $112,600 in 2022—a terrible year for the stock market—to $134,100 in 2023, and median balances from $27,400 in 2022 to $35,300 in 2023. The big difference between the median and the average is due to a small number of accounts that have really big balances. Average balances are more typical of long-tenured, more affluent participants, while the median represents the typical participant.

“The good performance of all the indicators in 2023, however, does not mean all is well. Balances are actually pretty puny. Consider the holdings of those approaching retirement—ages 55-64. As one would expect, these balances are much larger than those for the full participant population. But still, the median is only $87,600, which means that half of participants have less than this amount and half have more.”

It’s also worth noting, as Munnell pointed out in 2023, that “households with a 401(k) plan are the lucky ones. Only about half of households in the middle third of the income distribution have such a plan.”

The shift over the past 45 years from defined benefit plans (pensions) to defined contribution plans (401(k)s) has raised important questions:

- Are most American workers too focused on wealth accumulation and not enough on risk management of their investment assets and planning for decumulation—that is, how they will fund a retirement income stream?

- Are they making avoidable mistakes with their 401(k)s? Bankrate cites several of the most common:

- Not contributing enough or consistently

- Failing to increase contributions with income growth

- Being unaware of or not understanding investment choices, fees, or the performance of different investment funds

- Accepting the default investment option

- Being too heavily invested in your employer’s company stock

- Failing to take full advantage of employer matches

- Not understanding vesting schedules (especially important if an employee is leaving their company)

- Taking early withdrawals and incurring penalties and/or fees

- Do most workers have the financial literacy to manage such an important asset on their own? Behavioral tendencies associated with self-directed investing—such as loss aversion, anchoring, or herding—can all impact 401(k) decisions. As one industry observer put it, “You give the burden of planning retirement and place it upon the shoulders of the person who knows the least.”

- Are workers aware of and preparing for sequence-of-returns risk—the potential damage caused by poor market returns just before or after retirement?

Why this information matters for advisors and their clients

Certainly, one of the key themes presented here is that participants in 401(k) and other voluntary retirement plans are being asked to effectively manage their own investment portfolios with limited personal investment knowledge and a tendency to make decisions influenced by behavioral biases. While plan sponsors provide information on administrative details and available investment options, that support falls short of professional guidance in making important investment decisions year after year.

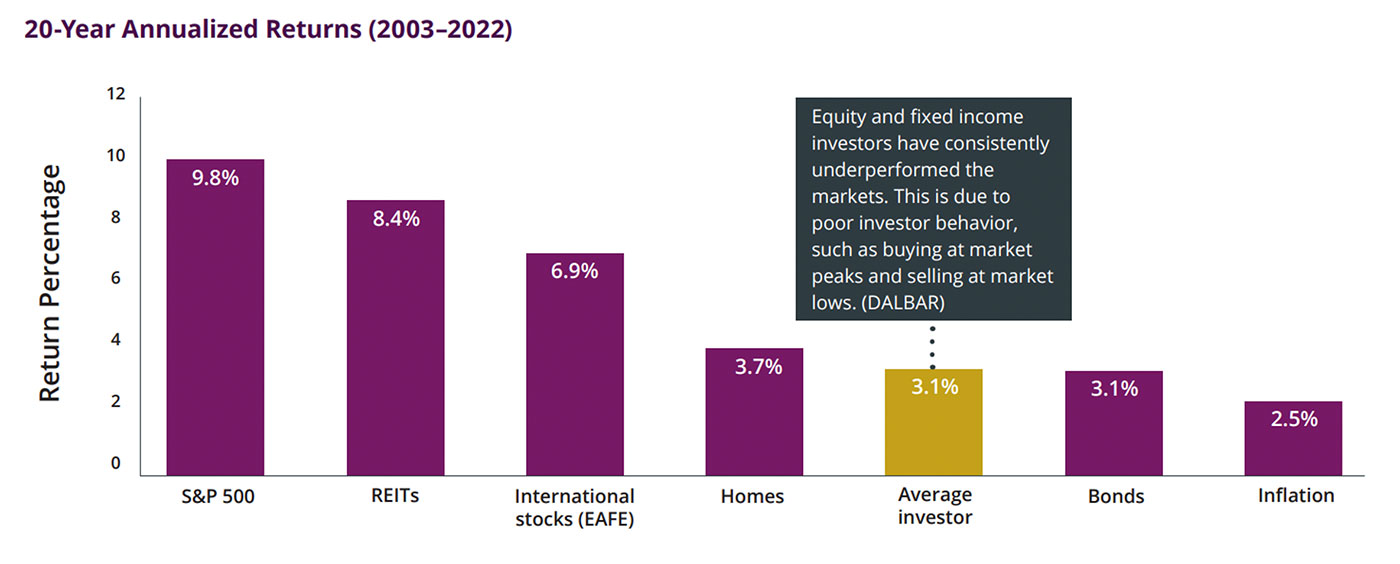

Research from DALBAR and other sources shows how self-directed investors often underperform major benchmarks. In 2024, DALBAR reported,

This trend is not new. As wealth management firm Darnell Sikes Wealth Partners notes,

FIGURE 2: COMPARISON OF SELF-DIRECTED INVESTOR PERFORMANCE TO MAJOR ASSET CLASSES

Sources: Developed by Darnell Sikes Wealth Partners (DSWP), based on data from Morningstar Direct, Bloomberg, and DALBAR

For roughly the past two decades, select third-party investment managers (also known as turnkey asset management platforms, or TAMPs) have offered managed investment solutions for advisors who work with plan participants in 403(b), 401(k), 401(a), or 457 plans.

As noted earlier, a major problem is that the market volatility of the past 20-plus years has led many plan participants to invest their 401(k) accounts far too conservatively.

For clients seeking to take advantage of market opportunities, while also seeking to avoid large drawdowns in turbulent markets, actively managed strategies are an attractive and accessible option for many plan participants. Funds can be used to deliver different risk-managed strategies in separately managed accounts designed to be used within a self-directed brokerage account (SDBA).

Plan participants at many companies or within the public sector can ask their advisor about the ease of using the SBDA option. By doing so, they can add a dynamically risk-managed separate account to their workplace retirement account. This separate account provides a gateway to the same management styles as high-net-worth investors, institutions, and foundations, giving investors more tools, an enhanced risk-management approach, and professional guidance to help them reach their retirement funding goals.

The bottom line

Working with their financial advisor, plan participants can construct a workplace retirement portfolio that reflects their objectives, risk tolerance, time horizon, and personal or family financial situation—in addition to being analyzed and optimized in the context of their overall financial plan.

Having a knowledgeable and professional advocate for retirement investment planning takes away the burden for plan participants of making difficult investment decisions each year on their own. In addition, employing risk-managed strategies that have an active, responsive defense mechanism can help keep a severe bear market from derailing a plan participant’s portfolio and progress toward their goals.

We have interviewed several advisors who guide clients in using the SDBA option.

One advisor told our publication,

“Through our relationships with third-party investment managers, we now provide sophisticated, risk-managed investment strategies to eligible 401(k) plan participants at various companies and professional firms. …

“We help eligible participants take full advantage of their retirement accounts through the benefits of investment strategies using dynamic risk management. We are excited by this opportunity to serve current and future clients by helping them mitigate market volatility in their retirement accounts while seeking growth opportunities through full market cycles.”

Another advisor, who works with many public sector employees, says he has used third-party management for retirement accounts for several years:

The opinions expressed in this article are those of the author and the sources cited and do not necessarily represent the views of Proactive Advisor Magazine. This material is presented for educational purposes only.

David Wismer is editor of Proactive Advisor Magazine. Mr. Wismer has deep experience in the communications field and content/editorial development. He has worked across many financial-services categories, including asset management, banking, insurance, financial media, exchange-traded products, and wealth management.

David Wismer is editor of Proactive Advisor Magazine. Mr. Wismer has deep experience in the communications field and content/editorial development. He has worked across many financial-services categories, including asset management, banking, insurance, financial media, exchange-traded products, and wealth management.

RECENT POSTS