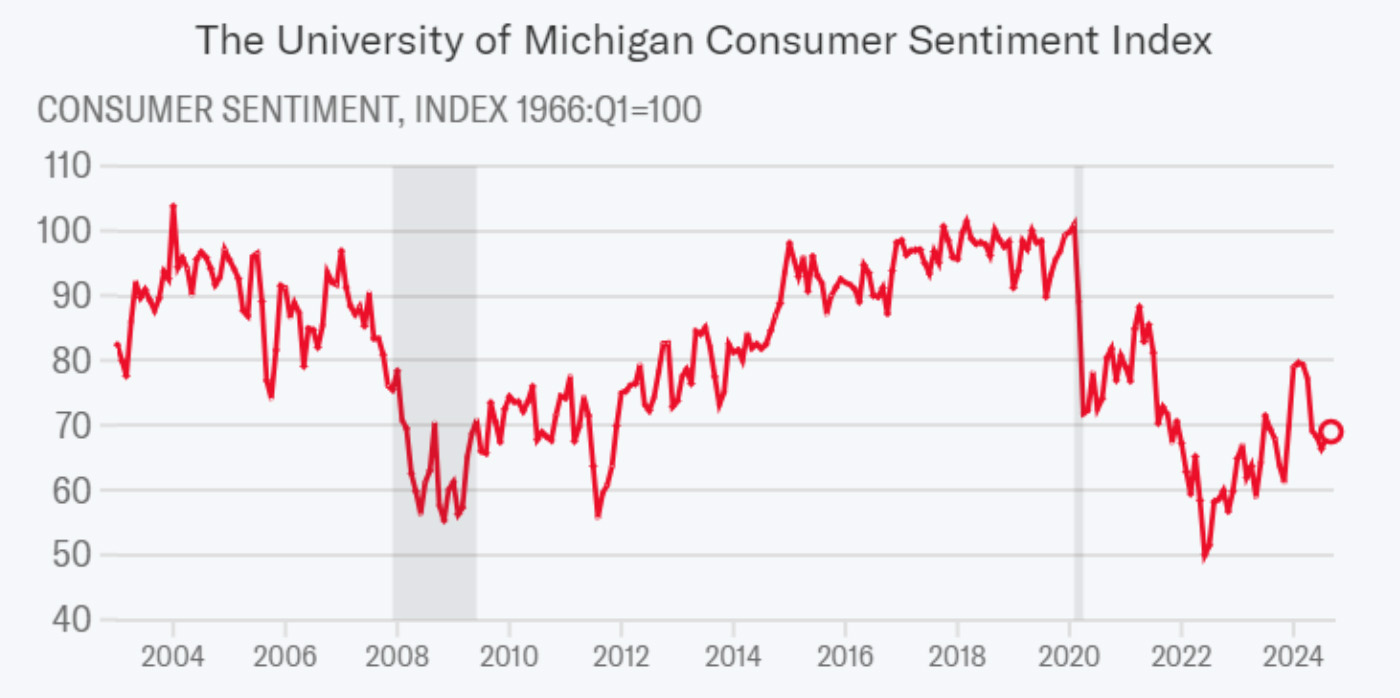

U.S. consumer sentiment improved in September as inflation eased, but Americans are still cautious about the path of inflation and the upcoming November presidential election.

According to a survey released on Sept. 13, the University of Michigan’s preliminary consumer sentiment index rose to 69.0, up from 67.9 in August. This exceeded economists’ expectations of 68.5. However, sentiment readings remain significantly below the levels seen before the pandemic.

Reuters reported,

“The survey was conducted before Tuesday’s debate where Republican candidate Donald Trump squared off against Vice President Kamala Harris, the Democratic Party’s nominee for the Nov. 5 election.

“The survey’s reading of one-year inflation expectations fell for the fourth straight month to 2.7%. That was the lowest reading since December 2020 and compared to 2.8% in August.

“Its five-year inflation outlook edged up to 3.1% from 3.0% in the prior month.”

FIGURE 1: U.S. CONSUMER SENTIMENT RISES MODESTLY IN SEPTEMBER

Note: Shaded areas indicate U.S. recessions.

Sources: Yahoo Finance, University of Michigan

The University of Michigan Surveys of Consumers Director Joanne Hsu commented on the report’s findings:

“Consumer sentiment rose to its highest reading since May 2024, increasing for the second consecutive month and lifting about 2% above August. The gain was led by an improvement in buying conditions for durables, driven by more favorable prices as perceived by consumers. Year-ahead expectations for personal finances and the economy both improved as well, despite a modest weakening in views of labor markets.

“Sentiment is now about 40% above its June 2022 low, though consumers remain guarded as the looming election continues to generate substantial uncertainty. …

“Year-ahead inflation expectations fell for the fourth straight month, coming in at 2.7%. The current reading is the lowest since December 2020 and is well within the 2.3-3.0% range seen in the two years prior to the pandemic. Long-run inflation expectations were little changed, edging up from 3.0% last month to 3.1% this month. Long-run inflation expectations remain modestly elevated relative to the range of readings seen in the two years pre-pandemic.”

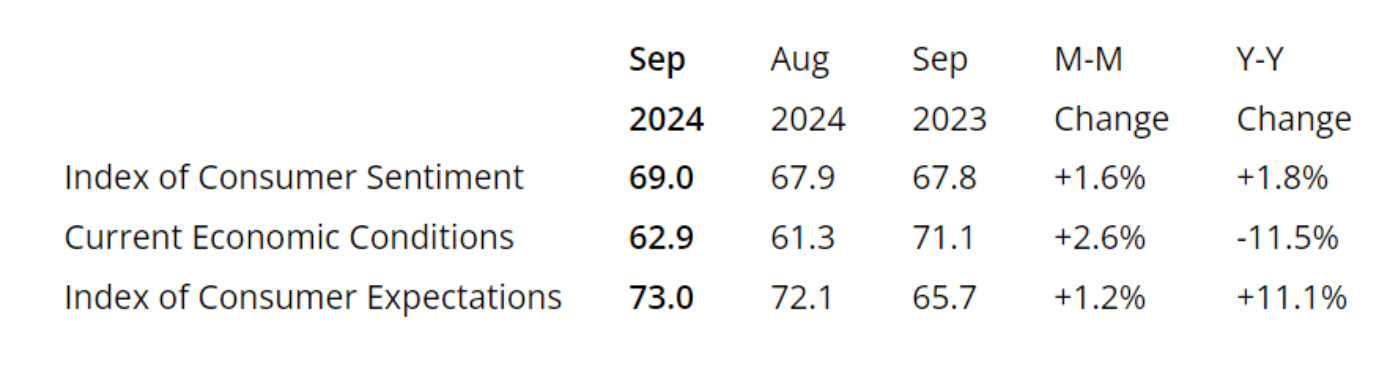

TABLE 1: PRELIMINARY SURVEY RESULTS FOR SEPTEMBER 2024

Source: University of Michigan

Why are sentiment readings still at relatively depressed levels?

One answer might be found in how most Americans continue to struggle with the impact of higher prices in their daily lives.

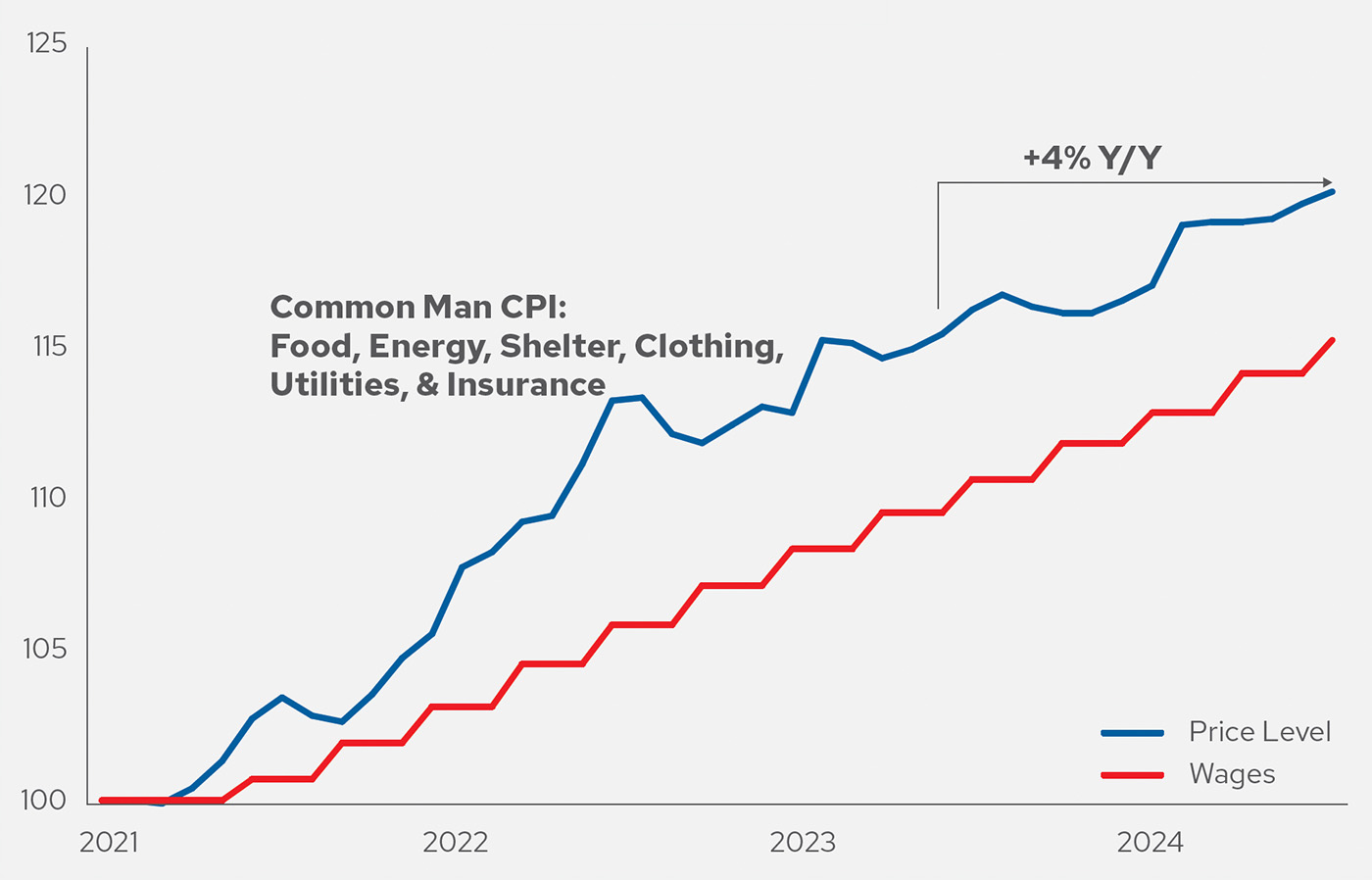

Strategas Research created an alternative look at the financial health of American households called the Common Man CPI (consumer price index).

Unlike “core inflation” measures, which exclude the impact of energy and food prices, the Common Man CPI comprises “items people must buy each day, week, or month,” for example, food, energy, shelter, children’s clothing, utilities, and insurance.

In an August report, Strategas pointed to the following relationship between the Common Man CPI and the headline CPI rate from the Bureau of Labor Statistics (BLS) and core inflation measures:

“Case in point: Strategas ‘Common Man’ CPI, a subset of the headline basket, which focusses on have-to-have staples, e.g., food, energy, shelter, clothing, etc., is up +4% Y/Y, +100 bps above the BLS headline CPI (+3% Y/Y) and +70 bps above the ‘Core’ ex. Food and Energy (+3.3% Y/Y). This suggests inflationary pressures remain tough on households.”

Figure 2 looks at the “Common Man” CPI versus the trend in American wages, showing a significant gap.

FIGURE 2: STRATEGAS’ COMMON MAN CPI VS. WAGES

Index = 100, Dec. 2020

Sources: Strategas, BLS, Haver

![]() Related Article: The yield curve’s 15-month lag

Related Article: The yield curve’s 15-month lag

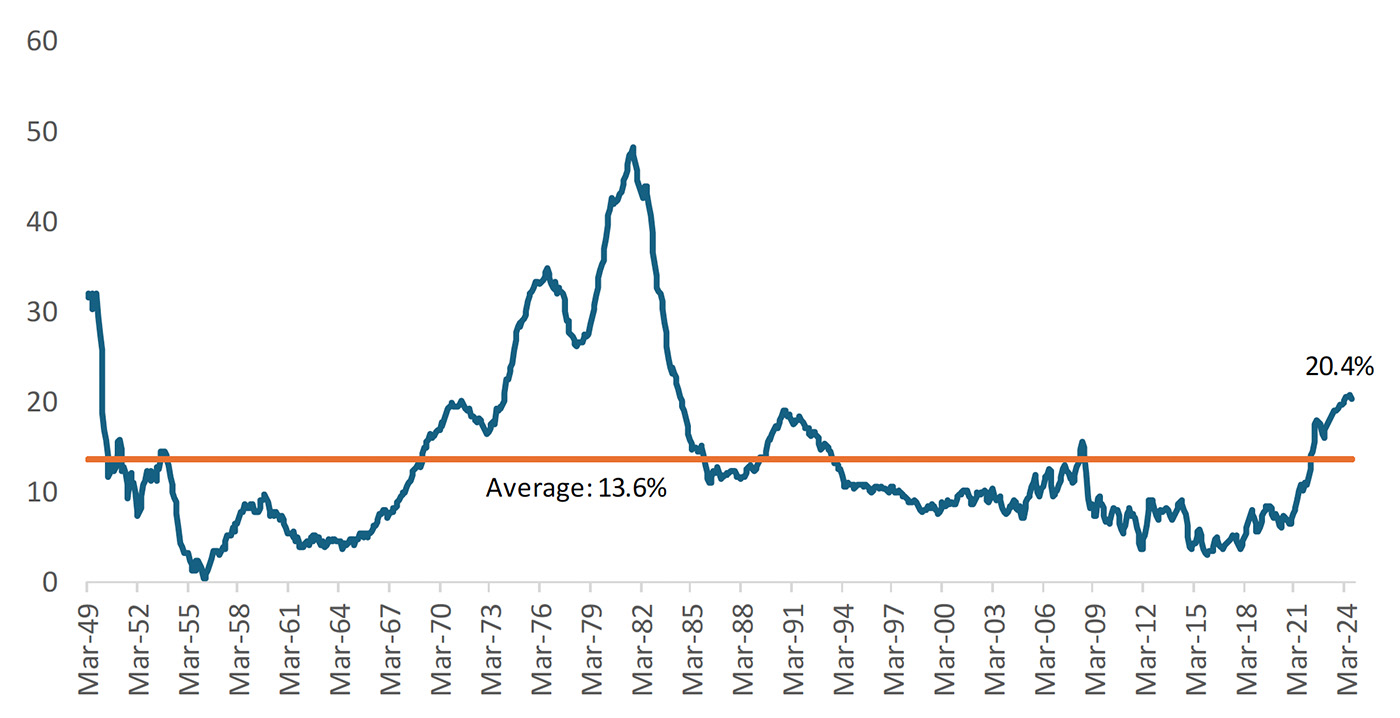

Bespoke Investment Group points out that while the headline inflation rate, expected to come in at 2.3% in September, continues to “tick lower and lower” toward the Fed’s target, the cumulative effect of inflationary growth post-pandemic remains significant.

Bespoke says, “… The 20.4% increase in CPI during Biden’s term so far is certainly much higher than anything we’ve seen since the 1970s and early 1980s, but we did get much, much higher back then.”

FIGURE 3: U.S. CPI 44-MONTH % CHANGE—POST-WWII

Source: Bespoke Investment Group

RECENT POSTS