Find out if bulls or bears are in control with this ‘magic trick’

Find out if bulls or bears are in control with this ‘magic trick’

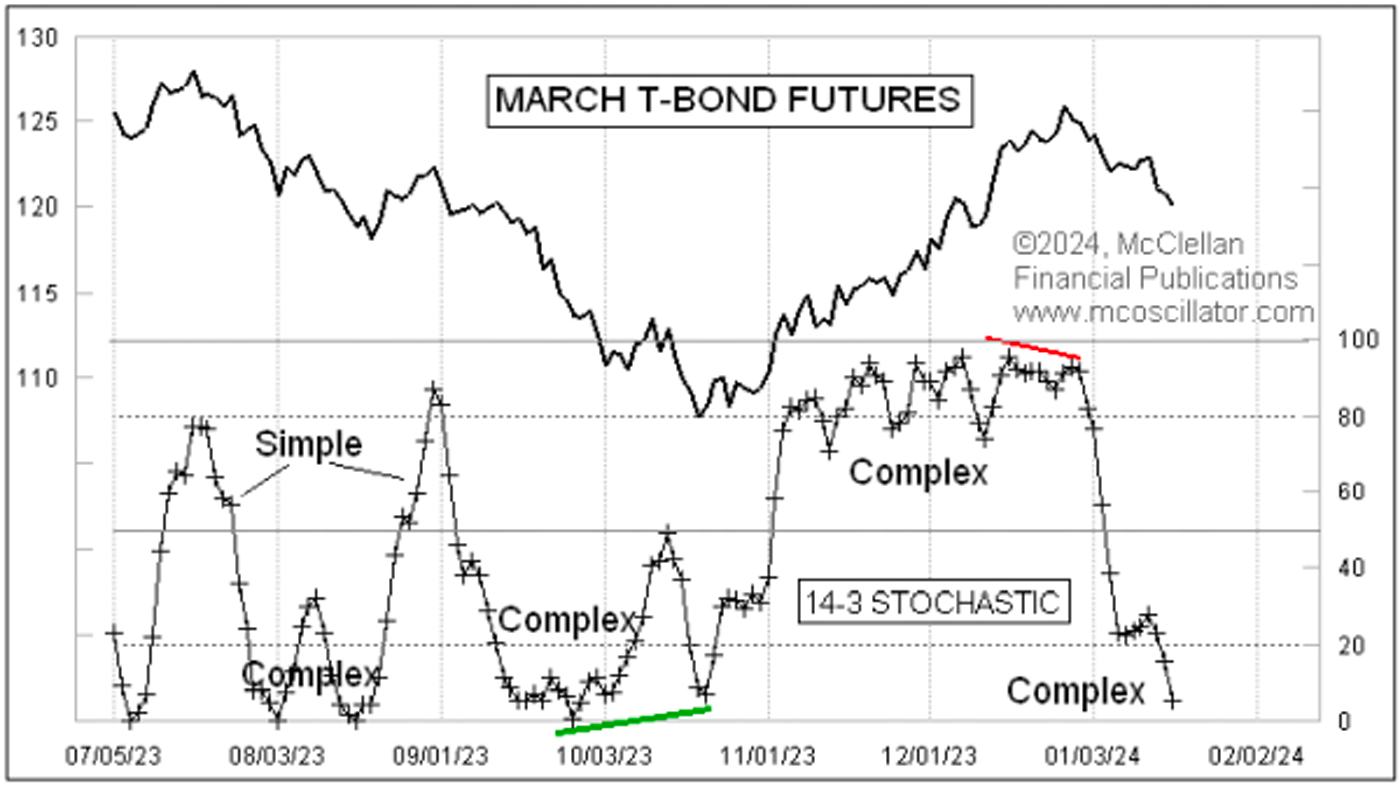

Here is a fun “magic trick” that some technical indicators can do. This week’s chart shows the 14-3 stochastic oscillator for T-bond futures prices, where the “14-3” refers to a 14-trading day look-back period and a three-day simple moving average for smoothing. Right now this indicator is forming a “complex” structure below the neutral level of 50, and that carries a message that the bears are in charge at the moment.

FIGURE 1: 14-3 STOCHASTIC OSCILLATOR FOR T-BOND FUTURES

Source: McClellan Financial Publications

The term “complex” is used here to describe fluctuations that don’t cross over the neutral level. This differs from a “simple” structure, which moves across the neutral level and back without developing any complexity. A simple structure implies weakness for the side (bull or bear) on which it appears.

The message of control from a complex structure persists until there is a divergence versus prices, like the two highlighted in Figure 1. In November and December 2023, a substantial complex structure formed above the neutral level, indicating that the bulls were in charge, and it was a good message. But that message changed at the end of December 2023 with the emergence of a bearish divergence versus prices. This divergence signaled the end of the bulls’ control.

The current structure below the neutral level is a complex one. So far, there has been no divergence versus prices, so the message is that the bears are in control of the bond market until further notice.

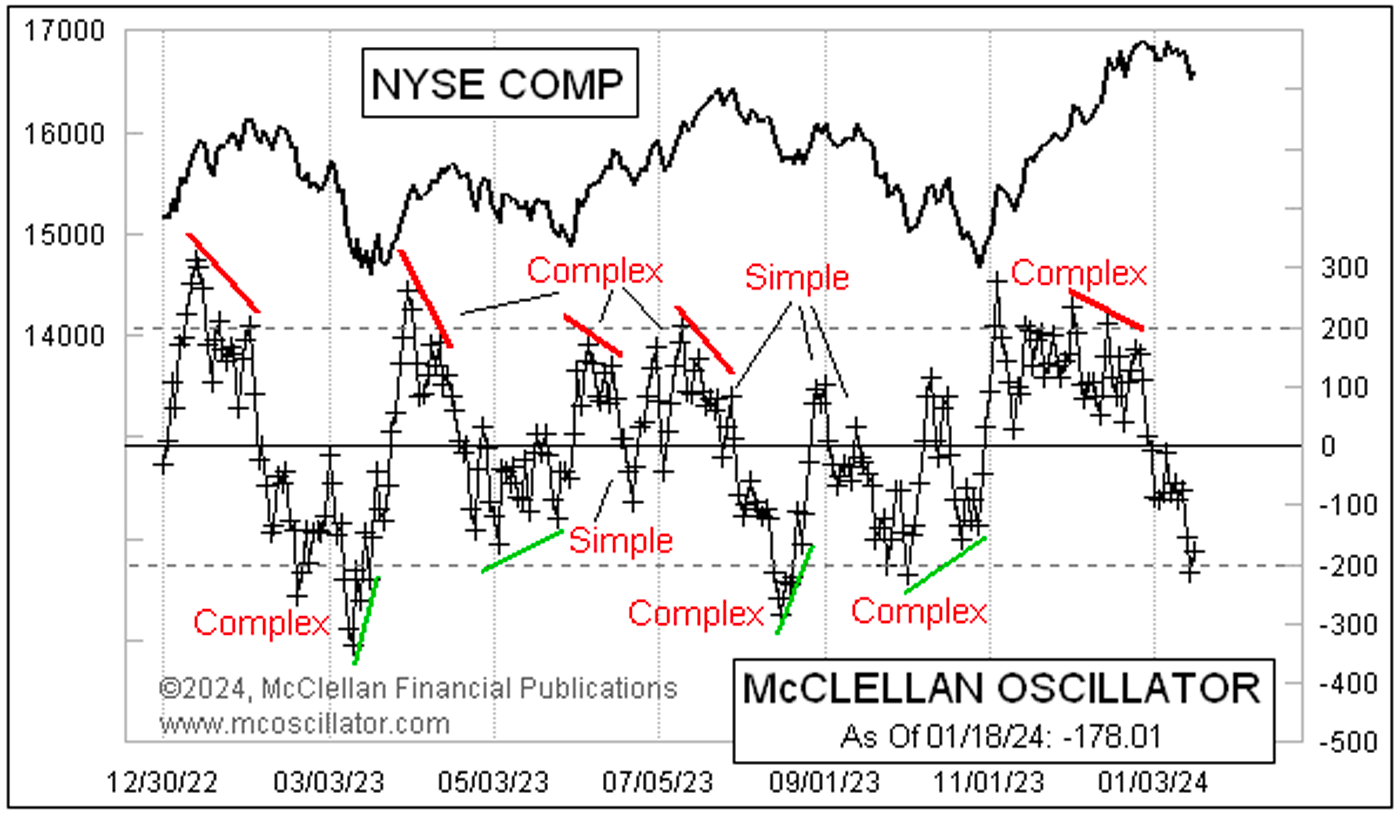

Complex and simple structures for the equity market (NYSE Composite)

This trick of complex or simple structures indicating which side is in control is something the McClellan A-D (Advance-Decline) Oscillator can do as well.

In Figure 2, I have labeled some of the structures as complex or simple to help you get the idea. The most recent structure above the neutral level of zero was complex, signaling that the bulls were in charge of the stock market during November and December 2023. However, that message changed when the Oscillator stopped making higher highs and a bearish divergence versus prices emerged. The current structure, located below the neutral level, is also complex. Despite reaching an oversold level, it has not yet displayed a bullish divergence versus prices. So the message of the bears being in control stands, for now.

FIGURE 2: MCCLELLAN A-D OSCILLATOR—NYSE COMPOSITE

Source: McClellan Financial Publications

Not every technical indicator will perform this magic trick, so the reader should not assume that it is a universal property of all indicators. But discovering it in those indicators where it is applicable can be fun.

The opinions expressed in this article are those of the author and the sources cited and do not necessarily represent the views of Proactive Advisor Magazine. This material is presented for educational purposes only.

This is an edited version of an article that first appeared at McClellan Financial Publications on Jan. 18, 2024.

Tom McClellan is the editor of The McClellan Market Report newsletter and its companion, Daily Edition. He started that publication in 1995 with his father Sherman McClellan, the co-creator of the McClellan Oscillator, and Tom still has the privilege of working with his father. Tom is a 1982 graduate of West Point, and served 11 years as an Army helicopter pilot before moving to his current career. Tom was named by Timer Digest as the #1 Long-Term Stock Market Timer for both 2011 and 2012. mcoscillator.com

Tom McClellan is the editor of The McClellan Market Report newsletter and its companion, Daily Edition. He started that publication in 1995 with his father Sherman McClellan, the co-creator of the McClellan Oscillator, and Tom still has the privilege of working with his father. Tom is a 1982 graduate of West Point, and served 11 years as an Army helicopter pilot before moving to his current career. Tom was named by Timer Digest as the #1 Long-Term Stock Market Timer for both 2011 and 2012. mcoscillator.com

RECENT POSTS