How advisors successfully grow with next-generation clients

How advisors successfully grow with next-generation clients

While younger individuals are still in the accumulation phase of their lives, it is well worth building relationships now. “Next-generation clients” will grow faster, give advisors a more diverse book of business, and use advisor services for decades to come.

According to Nielsen research, nearly two-thirds of the U.S. population was born after 1964, yet many advisors continue a practice focus on baby boomers who are nearing or already in retirement.

There is no doubt that the strategy has had merit since individuals close to retirement are generally most interested in obtaining financial guidance and have significant assets to fund their retirement. Data from a 2019 study indicates that baby boomers—those born from 1946 to 1964—possess 54% of total U.S. household net worth.

However, according to the same research, from 2010 to 2019, millennials/Gen Y (1977–1995) have increased their net worth by 500%, and members of Generation X (1965–1976) by 181%.

Additionally, it is estimated over $60 trillion in wealth will be transferred from more than 90 million American estates from 2007 to 2061, according to the Center on Wealth and Philanthropy at Boston College.

Various studies have shown different results, but they all indicate that it is likely that children will move on from their parents’ advisors once they receive an inheritance. Estimates range from a 65% to 95% likelihood that a child will not maintain assets with their parents’ current financial advisor. Enhancing the probabilities of retaining those client assets obviously makes sound business sense for any advisor’s practice.

In its 2018 study, “The State of Retail Wealth Management,” research and data analytics firm PriceMetrix says it sees “the emergence of both ‘Next Gen’ clients and ‘Next Gen’ advisors as catalysts for growth” within the advisory field.

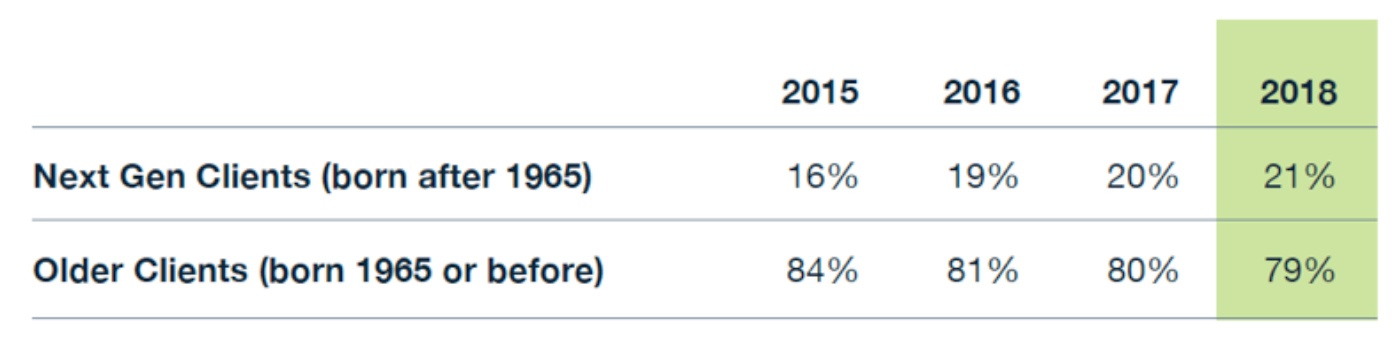

PriceMetrix has also identified a quantifiable opportunity for advisors who are actively seeking to add younger individuals and families as clients of their firms. The study notes that next-generation clients (those born after 1965) are slowly becoming a bigger piece of advisors’ practices, now accounting for 21% of relationships (Table 1). Further, assets under management for next-generation clients have grown by 6.1% since 2015, compared to 3.5% asset growth over the same period for older clients.

Source: PriceMetrix, “The State of Retail Wealth Management 2018,” April 2019

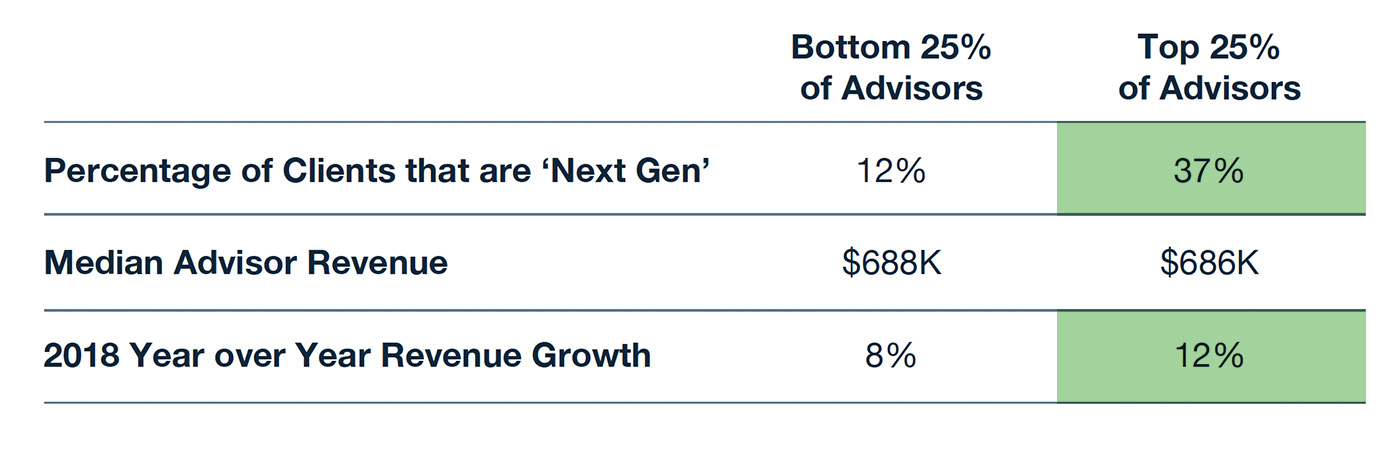

PriceMetrix found that those advisors who have a higher percentage of younger clients are more likely to be “higher-growth” advisors:

“Advisors vary in their willingness (and/or ability) to attract Next Gen clients. Advisors in the top-quartile have 37% of their clients born after 1965. For bottom-quartile advisors, the figure is 12%. Interestingly, the two advisor groups have similar revenues on average, but the advisors with younger books are growing at a faster rate than those with older books, reinforcing the impact that Next Gen clients can have on growth.

“Wealth management leaders will need to deeply understand the product and service preferences of Next Gen clients, to adapt and ensure they can continue to attract these important clients in the years to come.”

Source: PriceMetrix, “The State of Retail Wealth Management 2018,” April 2019

For this issue, we looked at how several advisors apply their own unique practice philosophies in addressing the following question:

Kevin Brennan • Hartland, MI

Kevin Brennan • Hartland, MI

Read full article

“When I first started out as a financial advisor, I saw that other advisors placed great emphasis on clients who were about to enter or already in retirement. Many advisors were using seminar marketing programs to develop prospects who fit this profile. That made sense from a business perspective, as retirement clients have a strong need for financial guidance in many areas.

“But I also saw an opportunity that I thought could work well for my own practice. I asked myself, ‘Who in my area is actively targeting younger clients?’ I thought it was an underserved area to explore, and it has since become the primary focus of our practice. Our ideal prospective clients are married couples with young children, approximately 30 to 45 years old, with a relatively high income. They may not necessarily have a large net worth, but they are decades from retirement and have many financial needs other than pure retirement-income planning.

“As I develop clients of this type, I feel confident they will be working with our firm for many years to come. We have found that sponsoring family-oriented events that are targeted at both children and their parents has been a very effective way to get our name out into the community and build our network of potential prospects.”

Michael Pennica • Colorado Springs, CO

Michael Pennica • Colorado Springs, CO

Read full article

“My practice, based in Colorado Springs, has grown organically through many of the contacts and networking groups that have been part of my entire life, particularly my 23 years in the Air Force. This area has a high concentration of active and retired military, defense-related contractors, and many small businesses related to the military and the bases located here.

“But I try to take that a step further by cultivating multi-generational relationships within family circles. The needs of various generations are very different and not one-size-fits-all. People expect information that is tailored to their age group, mindset, and life stage. It is not just about the numbers of accumulation and distribution.

“I ask clients, especially those in their 50s and 60s, to bring in their parents and their children for a group discussion. Many are receptive to it—a small minority throws up a wall. But those who take advantage of these kinds of sessions find them very productive. Whether it is a young family just starting their financial plan, a middle generation concerned about making the retirement transition, or an older generation wanting to transfer wealth, the needs can be intertwined. Such sessions not only help me find better solutions for the initial client, but can also help keep growing those circles and lead to new relationships.”

Linda Persechino • New Hartford, CT

Linda Persechino • New Hartford, CT

Read full article

“When I started my advisory firm, one of the goals was to keep it manageable in terms of number of clients. I work with a more limited client base that I can really get to know. I want to understand what is driving their financial objectives and continue the advisor-client relationship for years with their family.

“The realization that this was the perfect career for me came once I understood that people want their financial advisor to care about them, understand them, and help them to connect their money to their unique dreams. Money is simply a tool that allows people to do the things that are important to them. Helping them to invest their money and plan for their future is only one part of our advisor-client relationship. There are many non-investment-related things I do for my clients, such as making homemade soup for elderly clients, visiting clients in the hospital, helping technology-challenged clients find vacations and cars online, and—sadly—sometimes attending their funerals. I believe in being there for my clients through all stages of life.

“Paying so much attention to the big picture with my clients has had an unexpected and welcome benefit. As I learn more about my clients and their lives, they also learn more about me and my life. They realize that I want to help them financially and that I also care about them personally! My clients understand this, and because they do, they are happy and willing to refer me to their friends and family. It is hugely rewarding to know that my approach to the financial advisory world has so far been a successful one.”

Scott Harris • Tampa, FL

Scott Harris • Tampa, FL

Read full article

“You really have to take the time to get to know who you are working with, and then be able to understand all facets of their financial lives and their personal goals and needs. This is paramount in developing a good solid strategy for their future. I always tell people who are new to the business that this is foremost a relationship business. Until that is understood, you’re not going to be successful.

“As our practice matured, we have followed more of an intentional referral-based strategy. We host educational meetings for small groups at a nice restaurant and ask clients to invite a friend or associate they think might be interested in our message. This is pretty low-key but has paid off in some very solid prospect introductions.

“I think, however, that the real key to keeping our business growing is staying in tune with the life stages of our current clients and their extended families. Many of our clients are boomers who are fast approaching or already in retirement. They have children, and many have grandchildren. We encourage our clients to bring their adult children to meetings, both to understand the family finances firsthand and also to explore their own financial-planning needs. This has to be handled carefully, but I think it is a win-win situation for everyone if the chemistry is right and relationships develop.”

Robert Kinnun • Midland, MI

Robert Kinnun • Midland, MI

Read full article

“My focus is on high-net-worth (HNW) families and their unique and complicated needs, including the planning for the transfer of wealth across generations, charitable giving, business succession or sale, and managing their substantial and varied assets.

“In working with HNW families, I am increasingly seeing the need for ramping up my use of technology to address the needs of the future generations of my current clients.

“Sons and daughters, or grandchildren—now in their teens or 20s—have obviously grown up with a far greater exposure to technology than prior generations. They also have a different mindset, seeming to be less patient and looking for fast, technologically enabled answers for just about every aspect of their lives.

“They are used to instant gratification and instantaneous response. The challenge will not only be in the mechanics of communicating with them, but also in explaining and reinforcing long-term investment strategies for a generation that thinks in real time.

“I cannot claim to have all of the answers, but it is something that I think my generation of advisors needs to address. There are several areas where technology can come into play. An obvious one is in having the most client-friendly access to account information, presented in a clear, concise, and intelligent fashion.”

The opinions expressed in this article are those of the author and do not necessarily represent the views of Proactive Advisor Magazine. These opinions are presented for educational purposes only.

This article first published in Proactive Advisor Magazine on Oct. 31, 2019, Volume 24, Issue 5.

New this week:

David Wismer is editor of Proactive Advisor Magazine. Mr. Wismer has deep experience in the communications field and content/editorial development. He has worked across many financial-services categories, including asset management, banking, insurance, financial media, exchange-traded products, and wealth management.

David Wismer is editor of Proactive Advisor Magazine. Mr. Wismer has deep experience in the communications field and content/editorial development. He has worked across many financial-services categories, including asset management, banking, insurance, financial media, exchange-traded products, and wealth management.