Part of the reason the market has been rallying recently is the indication that an interest-rate cut is likely coming as soon as the next Fed meeting at the end of July.

It is interesting timing for the Fed to begin cutting interest rates since its quantitative tightening (QT) program still remains in place (though it is winding down). By reducing the System Open Market Account (SOMA) at the same time it cuts rates, the Fed is basically going to be driving with one foot on each pedal.

The Fed will be instituting both a contractionary policy and a stimulative policy at the same time. While curious, that is not unprecedented.

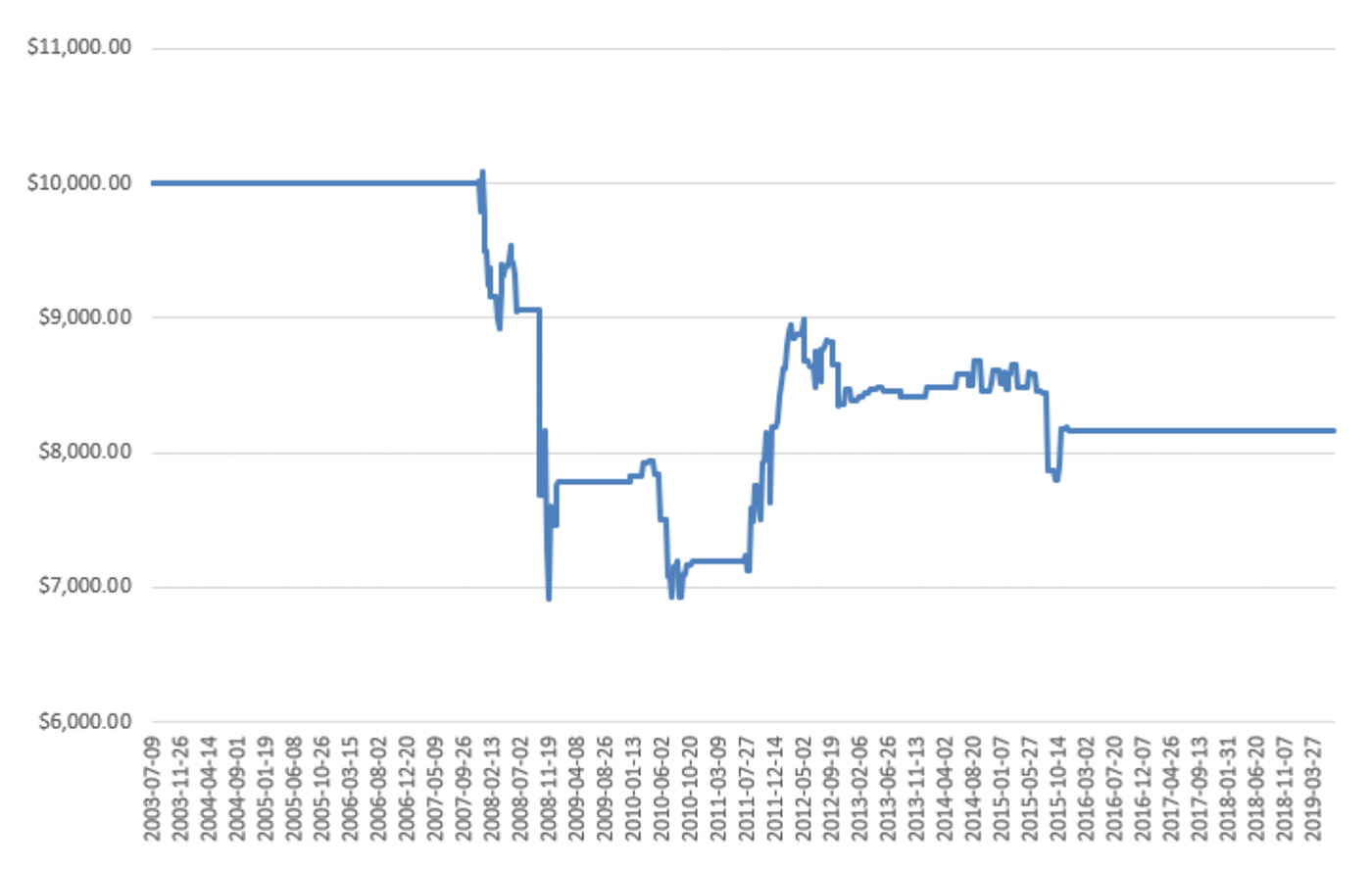

I decided to examine SPX performance since 2003 during weeks when (1) the most recent interest-rate move was lower and (2) the SOMA contracted. Results of starting with a $10,000 portfolio invested in an SPX index fund or ETF, and not including any trading costs, can be seen in Figure 1.

Source: quantifiableedges.com

The overall results for a trade based on these factors have been fairly poor and very inconsistent.

Not terribly encouraging.

Of course, rates were already at zero for many of the past instances. Moreover, the SOMA decreases occurred during policies such as Operation Twist, when week-to-week oscillations rather than an overall reduction in the SOMA actually occurred. So past comparisons like those in Figure 1 are not perfect.

If the Fed does cut rates, it would also be very unusual because the market is currently at new highs. Looking back to 1990, the only other instance I could find where the Fed began a rate-cutting cycle while the SPX was within 1% of a 200-day high was in July 1995. That rate cut was followed by seven months of continued rallying for the market.

The bottom line is that I see mixed messages using comparable instances with regard to the Fed. Anticipating market reaction in such an environment can be difficult. I will likely be relying more on some of my other indicators in the coming months to help set my market bias.

Rob Hanna has worked in the investment industry since 2001. He is the founder and publisher of Quantifiable Edges, a quant-based website where he also publishes a newsletter. After managing a private investment fund through Hanna Capital Management LLC from 2001 to 2019, Rob joined Capital Advisors 360, where he now serves as a registered investment advisor and focuses on short-term and quantitative strategies. quantifiableedges.com

Rob Hanna has worked in the investment industry since 2001. He is the founder and publisher of Quantifiable Edges, a quant-based website where he also publishes a newsletter. After managing a private investment fund through Hanna Capital Management LLC from 2001 to 2019, Rob joined Capital Advisors 360, where he now serves as a registered investment advisor and focuses on short-term and quantitative strategies. quantifiableedges.com