According to FactSet, there is some optimism for Q3 earnings based on results from the companies that have reported so far:

“As of today [Oct. 13], the S&P 500 is reporting year-over-year earnings growth of 0.4% for the third quarter, which would mark the first quarter of year-over-year earnings growth reported by the index since Q3 2022. … At this very early stage of the earnings season for Q3, both the number of companies reporting positive EPS surprises and the magnitude of these EPS surprises are trending above the 5-year averages. Will this strong performance continue for the rest of the earnings season?”

Last week saw the most significant earnings of the season to date, with several major banks reporting. Barron’s noted last Friday,

“Higher interest rates have been a mixed bag for the nation’s banks. Today’s bank results, the kickoff to third-quarter earnings season, demonstrated the good part of the equation—the ability to make more money on higher-rate loans. Earnings from JPMorgan Chase, Wells Fargo, and Citigroup all came in well above Wall Street estimates.

“To be sure, it’s still early. There’s no guarantee the good news will continue next week with more bank reports on the way, most notably from Charles Schwab, Bank of America, and Goldman Sachs. Each of those banks have unique issues that have proven challenging to their bottom lines.”

On the negative side of the equation, another Barron’s article speaks about the interest-rate problems facing banks:

“Bank stocks have been punished this year as rapidly rising interest rates have caused many problems for lenders. At first, banks could delight in the fact that higher rates allowed them to earn more interest on the loans they issue. But high rates also have the tendency to keep potential borrowers on the sidelines and pressure current borrowers into delinquencies. The jump in rates has also meant savers now have more options for where to park their nest eggs and earn yield, putting pressure on banks’ funding costs.”

The poor performance of the banking sector this year can be seen in the significant drop in the KBW Nasdaq Bank Index, which includes 24 banking stocks representing the large U.S. national money centers, regional banks, and thrift institutions.

FIGURE 1: ONE-YEAR TREND FOR KBW NASDAQ BANK INDEX

Source: NASDAQ

Expectations for Q3 earnings

FactSet compiled the following key metrics about the Q3 2023 earnings season in its most recent Earnings Insight:

- “Earnings Scorecard: For Q3 2023 (with 6% of S&P 500 companies reporting actual results), 84% of S&P 500 companies have reported a positive EPS surprise and 66% of S&P 500 companies have reported a positive revenue surprise.

- “Earnings Growth: For Q3 2023, the blended (year-over-year) earnings growth rate for the S&P 500 is 0.4%. If 0.4% is the actual growth rate for the quarter, it will mark the first quarter of year-over-year earnings growth for the index since Q3 2022.

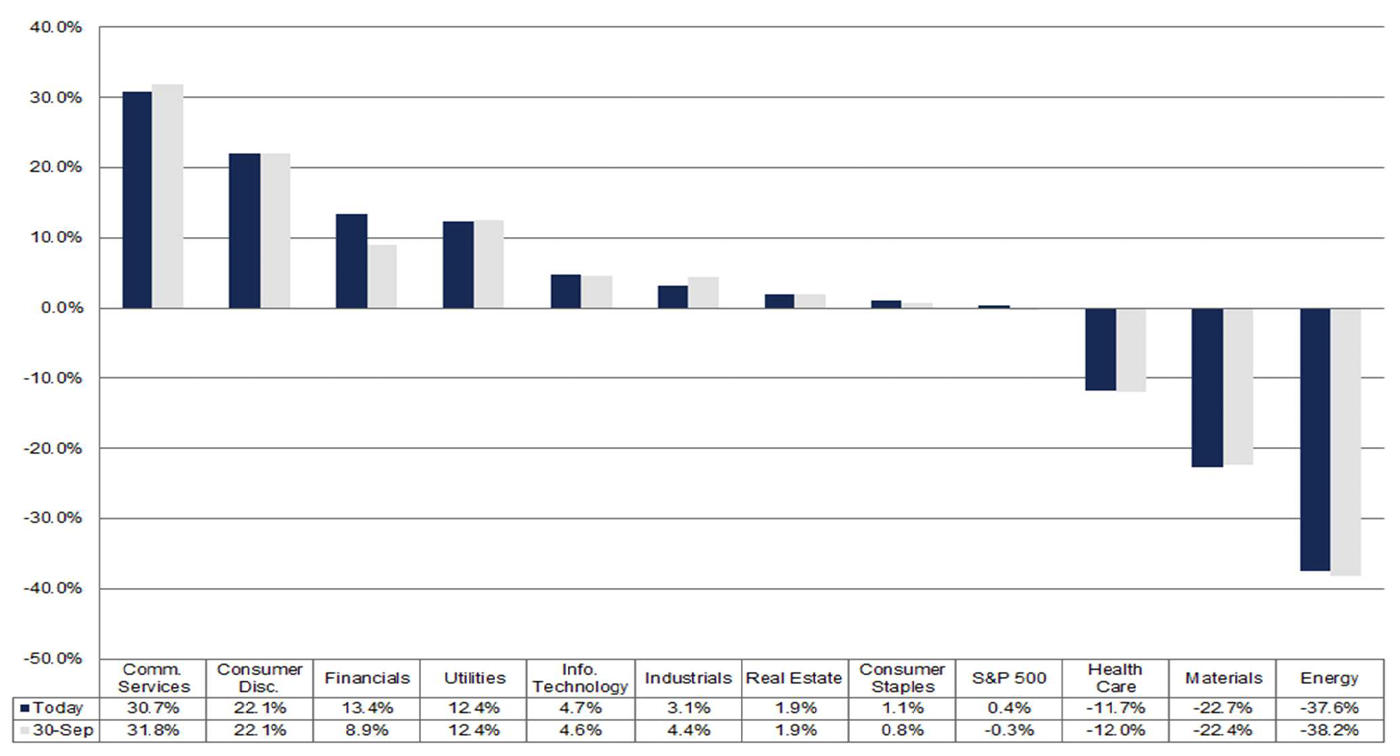

- “Earnings Revisions: On September 30, the estimated (year-over-year) earnings decline for the S&P 500 for Q3 2023 was -0.3%. Five sectors are reporting (or are expected to report) higher earnings today compared to September 30 due to positive EPS surprises and upward revisions to EPS estimates.

- “Earnings Guidance: For Q4 2023, 4 S&P 500 companies have issued negative EPS guidance and 5 S&P 500 companies have issued positive EPS guidance.

- “Valuation: The forward 12-month P/E ratio for the S&P 500 is 18.1. This P/E ratio is below the 5-year average (18.7) but above the 10-year average (17.5).”

Looking at specific sectors, FactSet notes,

“Eight of the eleven sectors are reporting (or are expected to report) year-over-year earnings growth, led by the Communication Services and Consumer Discretionary sectors. On the other hand, three sectors are reporting (or are expected to report) a year-over-year decline in earnings, led by the Energy and Materials sectors.”

As can be seen in Figure 2, the Financials sector is estimated to have a healthy 13.4% earnings growth rate in Q3 2023.

FIGURE 2: S&P 500 PROJECTED EARNINGS GROWTH BY SECTOR (Q3 2023)

Source: FactSet

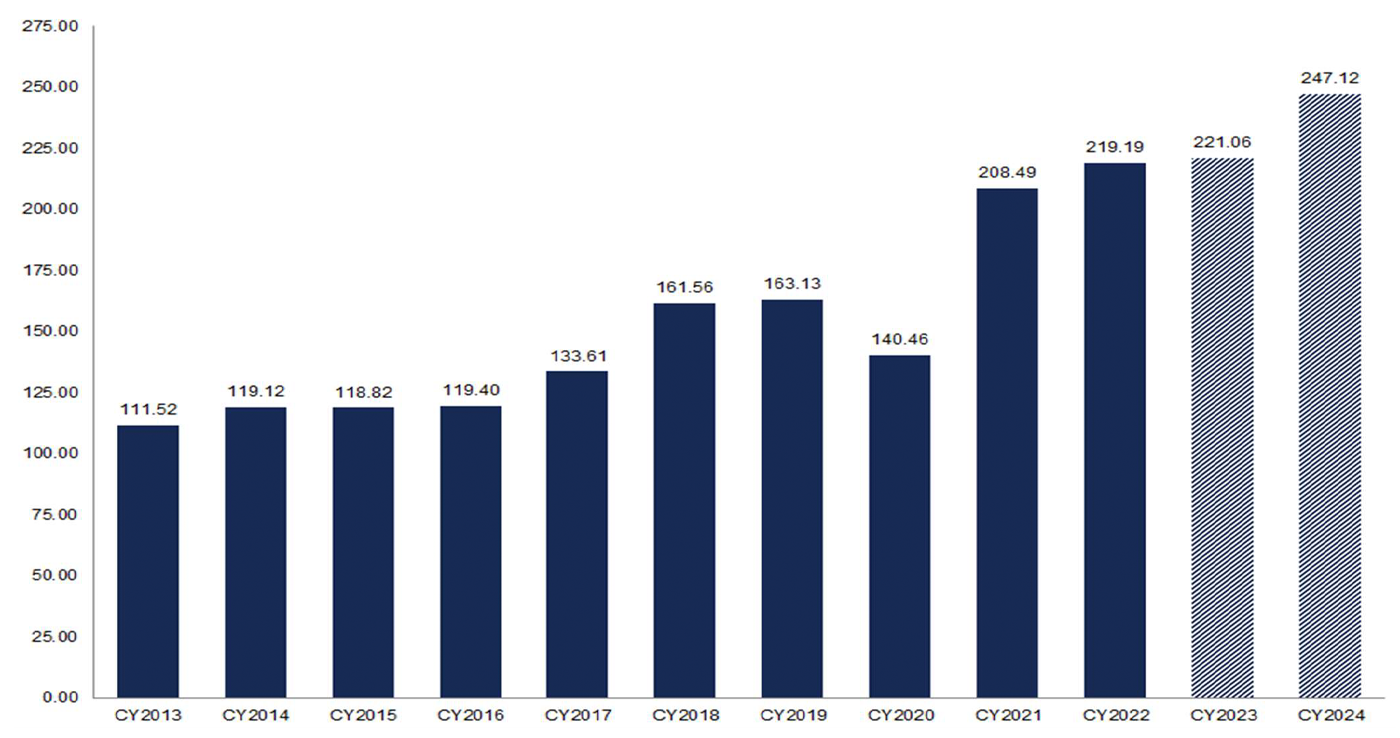

FactSet also provides a forward-looking outlook for the next several quarters, with generally upbeat forecasts—especially for the last three quarters of 2024:

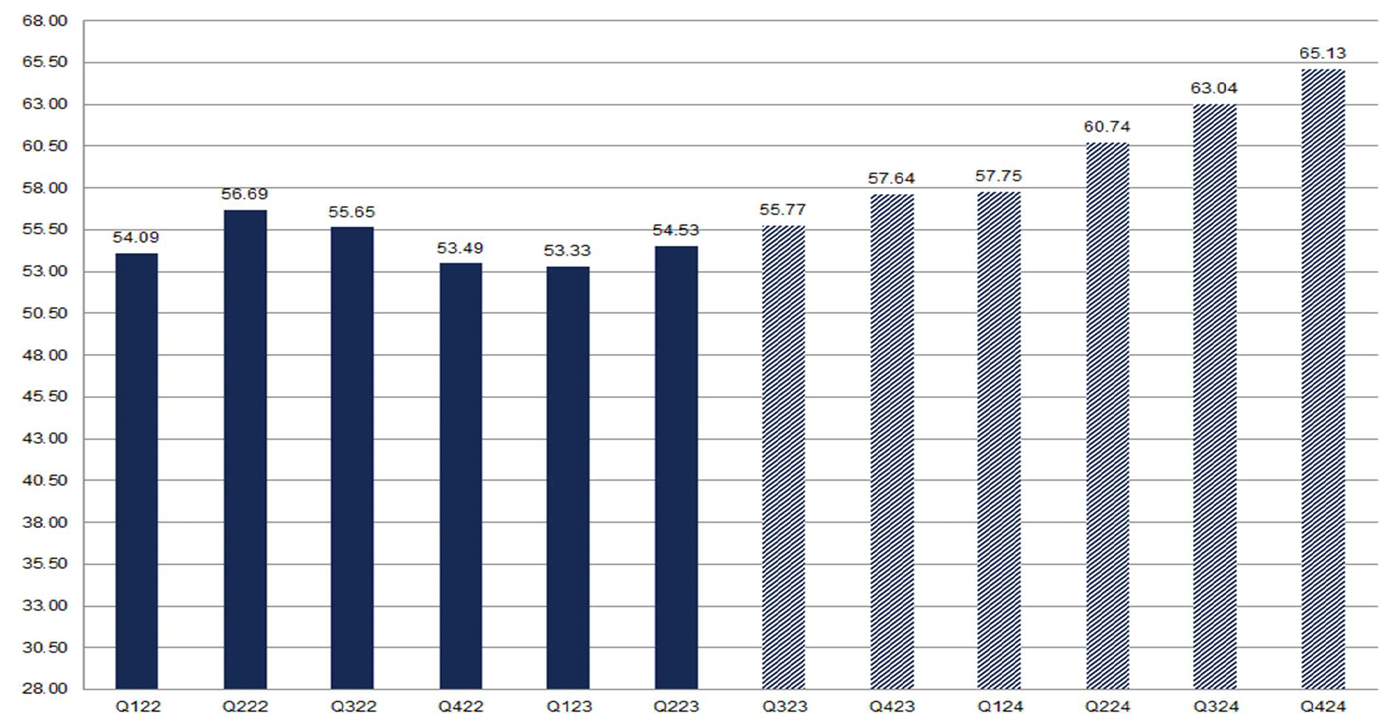

- “For the third quarter, S&P 500 companies are reporting year-over-year growth in earnings of 0.4% and year-over-year growth in revenues of 1.9%.

- “For Q4 2023, analysts are projecting earnings growth of 7.6% and revenue growth of 4.0%.

- “For CY 2023, analysts are projecting earnings growth of 0.9% and revenue growth of 2.4%.

- “For Q1 2024, analysts are projecting earnings growth of 8.1% and revenue growth of 4.7%.

- “For Q2 2024, analysts are projecting earnings growth of 11.7% and revenue growth of 5.4%.

- “For CY 2024, analysts are projecting earnings growth of 12.2% and revenue growth of 5.6%.”

FIGURE 3: S&P 500 CALENDAR YEAR BOTTOM-UP EPS ACTUALS AND ESTIMATES

Source: FactSet

FIGURE 4: S&P 500 QUARTERLY BOTTOM-UP EPS ACTUALS AND ESTIMATES

Source: FactSet

Bespoke Investment Group provided the following perspective in its comprehensive outlook for the Q3 earnings season on Oct. 9:

“Given the economic and monetary headwinds both here in the US and around the world, it shouldn’t be a surprise that analyst sentiment has been negative heading into the Q3 reporting period, and while sentiment heading into the Q2 reporting period was almost positive on a net basis, sentiment is once again decidedly negative heading into this earnings season. …

“This will mark the seventh straight quarter that analysts were leaning bearish heading into earnings season, and in four of the six prior periods, the market managed to rally during earnings season. The largest of the two declines came during the Q1 2022 reporting period when the S&P 500 tumbled 13.08%. While earnings likely contributed to some of that weakness, that was also during a period when Russia had just invaded Ukraine and inflation was surging.”

The opinions expressed in this article are those of the author and the sources cited and do not necessarily represent the views of Proactive Advisor Magazine. This material is presented for educational purposes only.

RECENT POSTS